|

市場調查報告書

商品編碼

1755375

髖關節置換市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Hip Replacement Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

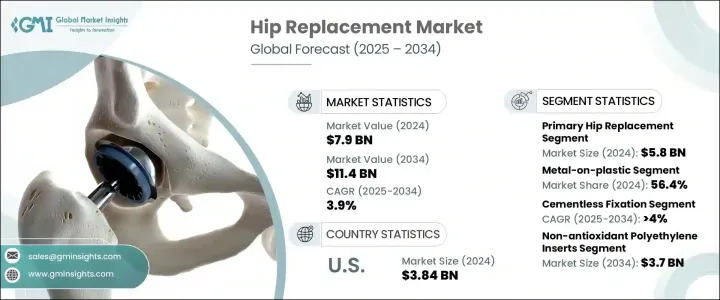

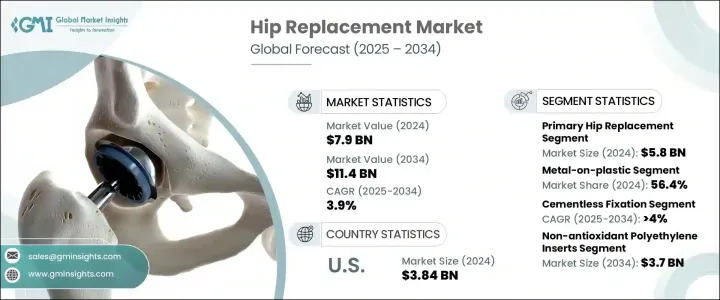

2024年,全球髖關節置換市場規模達79億美元,預計到2034年將以3.9%的複合年成長率成長,達到114億美元。技術創新、手術量增加以及關節相關疾病發病率上升等因素共同推動了市場的成長。老年人口不斷成長,尤其是患有退化性關節疾病的老年人,仍然是接受髖關節置換手術的主要人群。此外,機器人技術與微創手術方法的結合顯著改善了臨床療效。這些進步縮短了住院時間,縮短了復原期,提高了病患滿意度,最終推動了全球髖關節置換手術的普及率。

在關節功能逐漸衰退的老年人中,植入手術越來越普遍。由於手術技術和材料的不斷發展,這類手術如今取得了更高的成功率,並被廣泛接受。此外,醫療基礎設施的改善以及患者對治療結果的教育也促進了市場擴張。創傷病例和骨科損傷數量的增加,以及醫療報銷政策的優惠,也提高了髖關節置換手術的實施頻率。植入物設計、相容性和耐用性的創新,進一步使骨科醫生能夠提供有效的、針對患者的具體解決方案。隨著活躍老化人群對增強型活動解決方案和長期表現的需求不斷成長,市場也在不斷發展。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 79億美元 |

| 預測值 | 114億美元 |

| 複合年成長率 | 3.9% |

從產品細分來看,2024年,初級髖關節置換器材佔據全球市場主導地位,市值達58億美元。由於廣泛應用於各種外科手術,這類器械仍是最常使用的植入物。其廣泛應用歸因於其與多種髖關節疾病的兼容性以及能夠提供可靠的長期療效。受骨折和老化相關關節磨損等因素驅動,髖關節植入手術數量的不斷增加確保了該產品類別的持續成長。

按材料類型分類,金屬對塑膠植入物在2024年佔據56.4%的市場佔有率,佔據市場主導地位。這種材料組合因其優異的耐磨性、經濟性和機械穩定性,仍是首選。金屬零件可有效吸收壓力,而塑膠內襯可減少關節摩擦,從而提高活動能力並減少長期磨損。由於其有效性、外科醫生熟悉度和較低的翻修率,這些植入物在世界各地廣泛使用,使其成為醫護人員和患者的首選。

以固定方式分析,非骨水泥固定系統在2024年成為領先類別,預計到2034年將以4%的複合年成長率成長。該領域因其提供的長期生物穩定性而備受青睞。與依賴合成黏合劑的骨水泥固定不同,非骨水泥植入物可促進植入物表面周圍的自然骨生長。這種生物整合可延長植入物的使用壽命,並降低植入物隨時間推移鬆動的可能性。由於其長期成功率較高,年輕患者尤其受益於這種固定方法。改進的表面設計和材料塗層進一步推動了對這種方法的需求,尤其是在微創和門診手術領域。

植入物市場也呈現顯著的趨勢。非抗氧化聚乙烯植入物正日益受到關注,預計到2034年其市場規模將達37億美元。這些植入物以減少氧化磨損而聞名,有助於延長植入物的使用壽命——這對於更活躍、更年輕的個體來說至關重要。其可靠的臨床性能、更廣泛的可用性和簡化的製造流程使其使用量不斷成長。醫療保健專業人士青睞這些植入物,因為它們在手術中取得了持續的成功,並且擁有強力的歷史資料,證明了其長期有效性。

在終端用途類別中,醫院和診所在2024年佔據了主要收入佔有率,預計未來幾年將大幅成長。這些機構配備了處理複雜骨科手術(包括髖關節置換術)的設備,並提供從術前諮詢到術後復健的一體化護理。它們還受益於擴大使用先進的外科技術,包括機器人輔助和成像系統,從而提高了手術的準確性。在這些臨床環境中進行的微創手術數量不斷增加,進一步支持了市場的成長。

2024年,北美佔據了全球50.6%的市場佔有率,這主要得益於其完善的醫療基礎設施和日益成長的老齡人口。在北美地區,美國在2024年的市值達到38.4億美元。骨質疏鬆症、關節炎和肥胖症的發生率上升,增加了髖關節置換手術的需求。公眾意識宣傳活動和手術選擇機會的增加也促進了手術量的上升。

產業參與者持續投資新一代植入物和數位技術,不斷增強其產品線。策略合作和技術創新(包括3D列印植入物和機器人手術系統)正在幫助製造商保持競爭力,並更好地滿足不斷變化的患者需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 創傷病例數上升

- 髖關節炎和骨質疏鬆症的盛行率不斷上升

- 最近的技術進步

- 個性化髖關節植入物的需求不斷成長

- 產業陷阱與挑戰

- 植入物和手術費用高昂

- 嚴格的監管準則

- 成長動力

- 成長潛力分析

- 監管格局

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 報銷場景

- 報銷政策對市場成長的影響

- 專利格局

- 管道分析

- 消費者行為分析

- 主要國家髖關節置換手術數量

- 髖關節置換治療案例

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 全球的

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 主要髖關節置換裝置

- 部分髖關節置換裝置

- 髖關節置換翻修裝置

- 髖關節置換裝置

第6章:市場估計與預測:按材料,2021 - 2034 年

- 主要趨勢

- 金屬與塑膠

- 陶瓷-金屬

- 陶瓷-塑膠

- 陶瓷對陶瓷

第7章:市場估計與預測:按固定材料,2021 - 2034 年

- 主要趨勢

- 非骨水泥固定

- 混合固定

- 骨水泥固定

第 8 章:市場估計與預測:按插入件,2021 年至 2034 年

- 主要趨勢

- 非抗氧化聚乙烯插入件

- 交聯聚乙烯插入件

- 抗氧化聚乙烯內襯

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院和診所

- 門診手術中心

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- B Braun

- CONFIRMIS

- Corin

- DePuy Synthes (Johnson & Johnson)

- enovis

- ExaTech Inc

- KyOCERA

- Link

- Medacta International

- MicroPort Orthopedics

- ORTHO DEVELOPMENT

- Smith+Nephew

- stryker

- ZIMMER BIOMET

The Global Hip Replacement Market was valued at USD 7.9 billion in 2024 and is estimated to grow at a CAGR of 3.9% to reach USD 11.4 billion by 2034. The market is experiencing growth due to a combination of technological innovation, increased surgical volume, and rising incidences of joint-related disorders. A growing elderly population, particularly those affected by degenerative joint diseases, continues to be a primary demographic undergoing hip replacement procedures. Moreover, the integration of robotics and minimally invasive surgical methods has significantly enhanced clinical outcomes. These advancements have led to shorter hospital stays, reduced recovery periods, and improved patient satisfaction, ultimately contributing to a higher adoption rate of hip replacement procedures globally.

Implant surgeries are increasingly common among older adults experiencing progressive joint deterioration. These procedures are more successful and widely accepted today, thanks to ongoing developments in surgical techniques and materials. In addition, improved healthcare infrastructure and better patient education regarding treatment outcomes have supported market expansion. The rising number of trauma cases and orthopedic injuries, along with favorable healthcare reimbursement, has also boosted the frequency of hip replacement surgeries. Innovations in implant design, compatibility, and durability further enable orthopedic surgeons to deliver effective, patient-specific solutions. The market continues to evolve with the increasing demand for enhanced mobility solutions and long-term performance among active aging populations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.9 Billion |

| Forecast Value | $11.4 Billion |

| CAGR | 3.9% |

In terms of product segmentation, primary hip replacement devices dominated the global market in 2024, with a recorded value of USD 5.8 billion. These devices remain the most commonly used implants due to their broad application across various surgical procedures. Their widespread use is attributed to their compatibility with multiple hip disorders and their ability to provide reliable, long-term results. An increasing number of hip implant procedures-driven by factors such as bone fractures and aging-related joint wear-has ensured continued growth for this product category.

Based on material type, metal-on-plastic implants led the market with a 56.4% share in 2024. This material combination remains a preferred choice due to its excellent wear resistance, affordability, and mechanical stability. The metal component effectively absorbs pressure, while the plastic liner reduces joint friction, leading to improved mobility and reduced wear over time. These implants are commonly used worldwide due to their effectiveness, surgeon familiarity, and lower revision rates, making them a go-to choice for both healthcare professionals and patients.

When analyzed by fixation method, cementless fixation systems emerged as the leading category in 2024 and are forecasted to grow at a CAGR of 4% through 2034. This segment has gained traction due to the long-term biological stability it offers. Unlike cemented fixation, which relies on synthetic adhesives, cementless implants promote natural bone growth around the implant surface. This biological integration offers increased longevity and reduces the chances of implant loosening over time. Younger patients, in particular, benefit from this fixation method due to its higher success rate over extended periods. Improved surface designs and material coatings have further driven demand for this approach, especially in minimally invasive and outpatient surgical settings.

The inserts segment of the market is also experiencing notable trends. Non-antioxidant polyethylene inserts are gaining attention and are projected to reach USD 3.7 billion by 2034. These inserts are known to reduce oxidative wear, which helps enhance implant longevity-a vital consideration for more active and younger individuals. Their growing usage is supported by their reliable clinical performance, broader availability, and simplified manufacturing processes. Healthcare professionals favor these inserts due to consistent procedural success and strong historical data supporting their long-term effectiveness.

Among end-use categories, hospitals and clinics held the dominant revenue share in 2024 and are anticipated to witness substantial growth over the coming years. These facilities are equipped to handle complex orthopedic surgeries, including hip replacements, and offer integrated care that spans pre-surgical consultation through post-surgical rehabilitation. They also benefit from increased access to advanced surgical technologies, including robotic assistance and imaging systems, which enhance procedural accuracy. The rising number of minimally invasive surgeries performed in these clinical environments further supports market growth.

North America accounted for 50.6% of the global market share in 2024, largely due to the presence of well-established healthcare infrastructure and a growing elderly population. Within the region, the United States registered a market value of USD 3.84 billion in 2024. Higher rates of osteoporosis, arthritis, and obesity are increasing the demand for hip replacement procedures. Public awareness campaigns and improved access to surgical options have also contributed to rising procedure volumes.

Industry players continue to enhance their product lines by investing in next-generation implants and digital technologies. Strategic collaborations and technological innovations, including 3D-printed implants and robotic surgical systems, are helping manufacturers stay competitive and better serve evolving patient needs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Forecast model

- 1.6 Primary research and validation

- 1.6.1 Primary sources

- 1.7 Forecast model

- 1.8 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Material

- 2.2.4 Fixation material

- 2.2.5 Inserts

- 2.2.6 End use

- 2.3 CXO Perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in number of trauma cases

- 3.2.1.2 Increasing prevalence of hip arthritis and osteoporosis

- 3.2.1.3 Recent technological advancements

- 3.2.1.4 Growing demand for personalized hip implants

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with implants and surgery

- 3.2.2.2 Stringent regulatory guidelines

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Future market trends

- 3.8 Reimbursement scenario

- 3.8.1 Impact of reimbursement policies on market growth

- 3.9 Patent landscape

- 3.10 Pipeline analysis

- 3.11 Consumer behaviour analysis

- 3.12 Number of hip replacement procedures for key countries

- 3.13 Hip replacement treatment scenario

- 3.14 Porter's analysis

- 3.15 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 MEA

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn and Units)

- 5.1 Key trends

- 5.2 Primary hip replacement devices

- 5.3 Partial hip replacement devices

- 5.4 Revision hip replacement devices

- 5.5 Hip resurfacing devices

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn and Units)

- 6.1 Key trends

- 6.2 Metal-on-plastic

- 6.3 Ceramic-on-metal

- 6.4 Ceramic-on-plastic

- 6.5 Ceramic-on-ceramic

Chapter 7 Market Estimates and Forecast, By Fixation Material, 2021 - 2034 ($ Mn and Units)

- 7.1 Key trends

- 7.2 Cementless fixation

- 7.3 Hybrid fixation

- 7.4 Cemented fixation

Chapter 8 Market Estimates and Forecast, By Inserts, 2021 - 2034 ($ Mn and Units)

- 8.1 Key trends

- 8.2 Non-antioxidant polyethylene inserts

- 8.3 Cross-linked polyethylene inserts

- 8.4 Antioxidant polyethylene inserts

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals and clinics

- 9.3 Ambulatory surgical centers

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn and Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 B Braun

- 11.2 CONFIRMIS

- 11.3 Corin

- 11.4 DePuy Synthes (Johnson & Johnson)

- 11.5 enovis

- 11.6 ExaTech Inc

- 11.7 KyOCERA

- 11.8 Link

- 11.9 Medacta International

- 11.10 MicroPort Orthopedics

- 11.11 ORTHO DEVELOPMENT

- 11.12 Smith+Nephew

- 11.13 stryker

- 11.14 ZIMMER BIOMET