|

市場調查報告書

商品編碼

1755369

聚合物砂市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Polymeric Sand Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

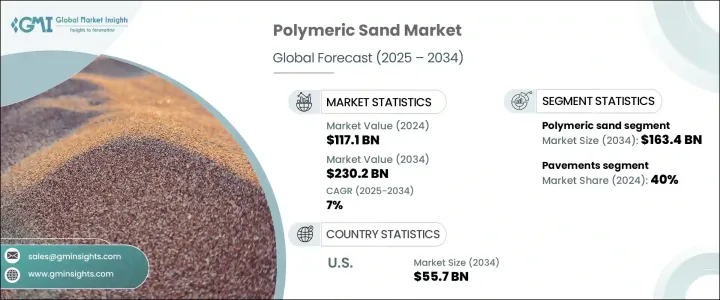

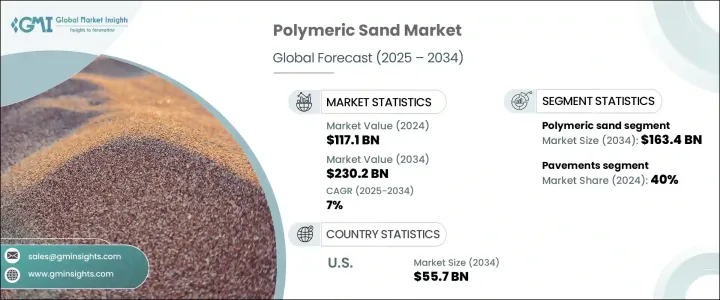

2024年,全球聚合物砂市場規模達1,171億美元,預計到2034年將以7%的複合年成長率成長,達到2,302億美元。推動這一成長的因素包括:建築項目數量增加、城市發展持續推進以及消費者對耐用、低維護景觀材料的偏好。聚合物砂因其能有效固定鋪路磚、減少雜草生長、抵抗侵蝕和蟲害等特性,已成為住宅和商業硬質景觀的首選材料。其配方-細砂與聚合物添加劑結合-遇水硬化,增強了表面穩定性與耐用性。業主、承包商和市政當局在露台、車道、人行道和泳池甲板上使用聚合物砂,欣賞其卓越的性能和視覺吸引力。此外,聚合物砂擁有多種顏色可選,非常適合進行美學客製化。

隨著發展中經濟體優先考慮現代化和基礎設施升級,而富裕地區則持續改善其公共和私人戶外環境,聚合物砂日益被視為一種首選材料。其實實用優勢——例如易於施工、耐侵蝕以及與各種氣候環境的兼容性——使其成為不同地區的理想解決方案。專業景觀設計師依賴其強度和效率,而屋主則重視其減少維護和提升房屋吸引力的能力。此外,聚合物砂擁有多種顏色選擇,使用戶能夠在鋪路項目中實現功能性和美觀性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1171億美元 |

| 預測值 | 2302億美元 |

| 複合年成長率 | 7% |

2024年,聚合物砂市場規模達822億美元。它能夠有效穩定鋪路磚(石材、混凝土或磚塊)之間的接縫,使其成為露台、車道和商業景觀的首選。聚合物砂中的水活化黏合劑能夠形成堅固而靈活的接縫,抵禦環境磨損,幫助鋪設路面保持多年。它特別適用於1/8至4英吋的接縫寬度,這在大多數鋪路應用中都是標準寬度。住宅和商業領域繼續推動成長,其長期性能和易於應用是其受歡迎的核心。

2024年,路面應用領域佔40%的市場佔有率,預期複合年成長率為6.8%。包括城市人行道、花園小徑和步行區在內的路面,依賴能夠承受交通和天氣影響的互鎖式鋪路磚和接縫材料。聚合物砂能夠確保路面的長期耐用性,控制雜草生長,並保持路面表面的完整性,這對於人流量大的公共區域和注重美觀的住宅環境至關重要。東南亞、北美和歐洲等地區的城市正在將聚合物砂應用於以美化和永續發展為重點的城市發展中,重視其排水效率、視覺凝聚力和維護效益。

2024年,美國聚合物砂市場規模達272億美元,預計2034年將達557億美元。戶外生活日益普及,包括對露臺、泳池平台和人行道的投資,使得聚合物砂成為屋主和專業人士的首選解決方案。它能夠抵禦各種氣候條件——從嚴酷的冬季到潮濕的夏季——使其在廣泛的地域範圍內具有吸引力。零售通路的暢通以及消費者對聚合物砂安裝的教育,尤其是透過DIY門市進行的培訓,進一步支撐了市場的成長。公共部門對綠地和基礎設施升級的投資也增加了商業需求,確保了該產品在該地區市場的地位。

推動全球聚合物砂市場發展的關鍵參與者包括 Gator Base、Euro Quarz、Pavestone Company、Quikrete、Alliance Designer Products、Sakrete、TCC Materials、Silpro Corporation、CEMEX、Techniseal、Polybind、Romex、SEK Surebond、SPEC MIX、Sable Marco、Ash GroveB.al.、Romex、SEK Surebond.為了鞏固其在競爭激烈的聚合物砂市場中的地位,各公司將創新、永續性和客戶教育放在首位。關鍵策略包括改進產品配方以提高耐候性和耐用性,提供環保產品以滿足日益成長的環保期望,以及擴展產品線以提供多種顏色和紋理選擇。許多公司利用數位平台透過視訊教學和行動工具與承包商和 DIY 消費者建立聯繫。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 原料分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 快速城市化

- 增加基礎建設投資

- 日益增強的長期成本效益意識

- 城市美化和景觀美化的趨勢日益成長

- 產業陷阱與挑戰

- 市場飽和

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 聚合物砂

- 聚合物粉塵

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 人行道

- 停車位

- 泳池甲板

- 輔助建築空間

- 露臺

- 其他

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 住宅

- 商業的

- 工業的

- 市政

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 直接的

- 間接

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地區

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- MEA 其餘地區

第10章:公司簡介

- Alliance Designer Products

- Ash Grove Cement Company

- Basalite Concrete Products

- CEMEX

- Euro Quarz

- Gator Base

- Pavestone Company

- Polybind

- Quikrete

- Romex

- Sable Marco

- Sakrete

- SEK Surebond

- Silpro Corporation

- SPEC MIX

- SpecChem

- SRW Products

- TCC Materials

- Techniseal

- Tensar Corporation

The Global Polymeric Sand Market was valued at USD 117.1 billion in 2024 and is estimated to grow at a CAGR of 7% to reach USD 230.2 billion by 2034. The growth is fueled by a rise in construction projects, ongoing urban development, and consumer preference for durable, low-maintenance materials in landscaping. Polymeric sand has become a go-to material for residential and commercial hardscaping owing to locking pavers in place, reducing weed growth, and resisting erosion and insect damage. Its formulation-fine sand combined with polymer additives-hardens when activated by water, enhancing surface stability and durability. Homeowners, contractors, and municipalities use polymeric sand in patios, driveways, walkways, and pool decks, appreciating its performance and visual appeal. In addition, availability in a variety of colors makes it suitable for aesthetic customization.

As developing economies prioritize modernization and infrastructure upgrades, and wealthier regions continue enhancing their public and private outdoor environments, polymeric sand is increasingly seen as a go-to material. Its practical advantages-such as ease of application, resistance to erosion, and compatibility with various climates-make it an ideal solution across diverse geographies. Professional landscapers rely on it for its strength and efficiency, while homeowners value its ability to reduce maintenance and enhance curb appeal. Additionally, its wide availability in various color options allows users to achieve functional and aesthetic goals in paving projects.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $117.1 Billion |

| Forecast Value | $230.2 Billion |

| CAGR | 7% |

In 2024, the polymeric sand segment reached USD 82.2 billion. Its effectiveness in stabilizing joints between pavers- stone, concrete, or brick-has made it the preferred option for patios, driveways, and commercial landscapes. The water-activated bonding agents in polymeric sand form a solid yet flexible joint that resists environmental wear and tear, helping maintain paved surfaces for years. It works especially well in joint widths from 1/8 to 4 inches, which are standard in most paving applications. Both residential and commercial sectors continue to drive growth, with long-term performance and ease of application at the core of its popularity.

The pavement application segment held a 40% share in 2024 and is forecast to grow at a CAGR of 6.8%. Pavements, including urban walkways, garden paths, and pedestrian zones, rely on interlocking pavers and jointing materials that hold up under traffic and weather. Polymeric sand ensures long-term durability, controls weed growth and maintains surface integrity crucial in high-traffic public areas and aesthetically driven residential settings. Cities in regions like Southeast Asia, North America, and Europe are implementing polymeric sand in beautification and sustainability-focused urban development, valuing its drainage efficiency, visual cohesion, and maintenance benefits.

United States Polymeric Sand Market was valued at USD 27.2 billion in 2024 and is expected to generate USD 55.7 billion by 2034. The increasing popularity of outdoor living, including investments in patios, pool decks, and walkways, has made polymeric sand a preferred solution among homeowners and professionals. Its ability to withstand different climates-from harsh winters to humid summers-gives it broad geographic appeal. Retail availability and consumer education on installation, especially through DIY outlets, have further supported growth. Public sector investment in green spaces and infrastructure upgrades also adds to commercial demand, ensuring the product's stronghold in the region.

Key players driving the Global Polymeric Sand Market include Gator Base, Euro Quarz, Pavestone Company, Quikrete, Alliance Designer Products, Sakrete, TCC Materials, Silpro Corporation, CEMEX, Techniseal, Polybind, Romex, SEK Surebond, SPEC MIX, Sable Marco, Ash Grove Cement Company, SRW Products, Tensar Corporation, Basalite Concrete Products, and SpecChem. To reinforce their position in the competitive polymeric sand market, companies prioritize innovation, sustainability, and customer education. Key strategies include enhancing product formulations for better weather resistance and durability, offering eco-friendly variants to meet rising environmental expectations, and expanding product lines to include multiple color and texture options. Many firms leverage digital platforms to connect with contractors and DIY consumers through video tutorials and mobile tools.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Raw material analysis

- 3.3 Key news and initiatives

- 3.4 Regulatory landscape

- 3.5 Impact forces

- 3.5.1 Growth drivers

- 3.5.1.1 Rapid urbanization

- 3.5.1.2 Increasing infrastructure investments

- 3.5.1.3 Growing awareness of long-term cost efficiency

- 3.5.1.4 Growing trend toward urban beautification and landscaping

- 3.5.2 Industry pitfalls & challenges

- 3.5.2.1 Market saturation

- 3.5.1 Growth drivers

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.7.1 Supplier power

- 3.7.2 Buyer power

- 3.7.3 Threat of new entrants

- 3.7.4 Threat of substitutes

- 3.7.5 Industry rivalry

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034, (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Polymeric sand

- 5.3 Polymeric dust

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Pavements

- 6.3 Parking spaces

- 6.4 Pool decks

- 6.5 Auxiliary building spaces

- 6.6 Patios

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.4 Industrial

- 7.5 Municipal

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Rest of Latin America

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

- 9.6.4 Rest of MEA

Chapter 10 Company Profiles

- 10.1 Alliance Designer Products

- 10.2 Ash Grove Cement Company

- 10.3 Basalite Concrete Products

- 10.4 CEMEX

- 10.5 Euro Quarz

- 10.6 Gator Base

- 10.7 Pavestone Company

- 10.8 Polybind

- 10.9 Quikrete

- 10.10 Romex

- 10.11 Sable Marco

- 10.12 Sakrete

- 10.13 SEK Surebond

- 10.14 Silpro Corporation

- 10.15 SPEC MIX

- 10.16 SpecChem

- 10.17 SRW Products

- 10.18 TCC Materials

- 10.19 Techniseal

- 10.20 Tensar Corporation