|

市場調查報告書

商品編碼

1755357

白水泥市場機會、成長動力、產業趨勢分析及2025-2034年預測White Cement Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

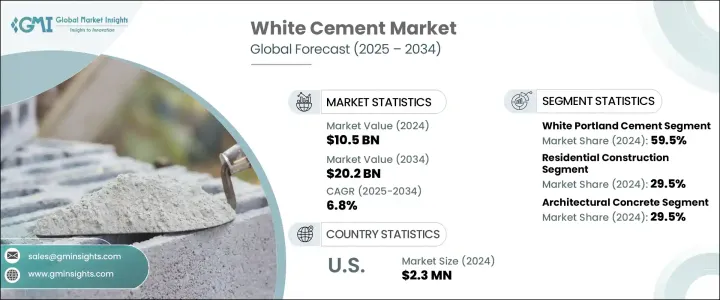

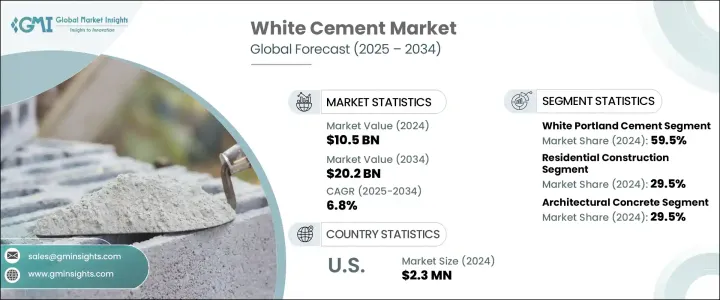

2024年,全球白水泥市場規模達105億美元,預計到2034年將以6.8%的複合年成長率成長,達到202億美元,這得益於全球基礎建設的蓬勃發展。隨著都市化進程的快速推進,各國政府紛紛增加對道路、橋樑和公共建築的投資,對白水泥等高品質、美觀的建築材料的需求也隨之增加。

永續性已成為推動白水泥市場發展的另一個關鍵因素。其優異的熱反射性能使其成為節能建築的絕佳選擇,這與日益成長的環保建築材料需求相契合。隨著建築師和建築商力求在設計中減少碳足跡,白水泥在節能和環境永續性方面的益處使其成為建築業的首選材料。為了滿足不斷變化的市場需求,製造商正在推出新的白水泥配方,以增強其性能特徵,例如提高強度和縮短凝固時間。這些創新正在拓展白水泥的應用範圍,使其在大型建築專案中更具可行性和成本效益。隨著城市化持續發展和建築趨勢的演變,預計市場將保持積極勢頭,為建築材料行業的老牌企業和新進者提供重大機會。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 105億美元 |

| 預測值 | 202億美元 |

| 複合年成長率 | 6.8% |

2024年,白色波特蘭水泥的市佔率為59.5%。由於其高強度、卓越的表面處理和美觀度,白色波特蘭水泥的應用最為廣泛。它主要用於建築和裝飾領域,例如牆面、地板和雕塑,這些領域對顏色和亮度的均勻性至關重要。白色波特蘭水泥的需求很大程度上源於高階建築項目的蓬勃發展,以及人們對住宅和商業空間中美觀結構的日益偏好。

2024年,住宅建築業的市佔率為29.5%。白水泥因其卓越的飾面效果、耐用性和美觀性而備受住宅建築青睞,成為內外牆、地板和裝飾元素的熱門選擇。城鎮化和人口成長推動的住房需求成長是該產業成長的關鍵因素。隨著屋主尋求兼具優雅和耐用性的材料,白水泥已成為打造高階持久住宅空間的首選。

2024年,美國白水泥市場佔了85%的市場佔有率,價值230萬美元。受建築活動擴張、技術進步以及對永續建築實踐的高度重視的推動,美國白水泥消費量預計將快速成長。對耐用且美觀的建築材料的高需求,加上基礎設施建設的激增,正在顯著推動美國白水泥的消費量。

JK Cement、Aalborg Portland、UltraTech Cement、Cemex 和 Cimsa 等主要參與者正在利用這些策略來滿足日益成長的白水泥需求,並在競爭激烈的市場中保持領先地位。白水泥市場中的企業已實施多項關鍵策略,以鞏固其市場地位,包括專注於產品創新、擴大產能和建立策略合作夥伴關係。透過開發滿足高強度配方、美觀飾面或永續性等特定需求的專用白水泥品種,企業確保滿足住宅和商業領域日益成長的需求。投資於可提高生產效率和品質的尖端技術也是一項關鍵策略。這使企業能夠滿足不斷成長的需求,同時確保卓越的產品一致性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 製造流程分析

- 原料分析與採購策略

- 白水泥與灰水泥:比較分析

- 利潤率分析

- 價值鏈分析

- 川普政府關稅的影響—結構化概述

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 貿易統計資料(HS 編碼) 註:以上貿易統計僅提供重點國家。

- 主要出口國

- 主要進口國

- 利潤率分析

- 重要新聞和舉措

- 技術格局

- 傳統製造技術

- 先進製造技術

- 新興技術

- 專利分析

- 監管格局

- 市場動態

- 市場促進因素

- 對美觀建築材料的需求不斷成長

- 都市化和基礎建設不斷推進

- 在建築應用的採用率不斷上升

- 預製和預製建築的成長

- 市場限制

- 與灰水泥相比生產成本更高

- 環境問題和碳排放

- 原物料價格波動

- 優質原料供應有限

- 市場機會

- 生產流程的技術進步

- 新興經濟體的需求不斷成長

- 環保白水泥的開發

- 擴大應用領域

- 市場挑戰

- 嚴格的環境法規

- 生產能耗高

- 運輸和物流挑戰

- 來自替代材料的競爭

- 規範架構分析

- 國際標準(ASTM C989/C989 M、EN 197-1)

- 區域法規和標準

- 環境合規要求

- 品質認證體系

- 技術格局

- 當前的技術趨勢

- 礦渣水泥生產的新興技術

- 數位化和工業4.0的影響

- 研發計畫與創新管道

- 定價分析

- 價格趨勢分析

- 成本結構分析

- 影響定價的因素

- 區域價格差異

- 市場促進因素

- 大環境分析

- 波特五力分析

- 監管框架和政府舉措

- 新冠疫情對白水泥市場的影響

- 俄烏衝突對供應鏈的影響

- 新參與者的市場進入策略

- 定價分析和趨勢

- 貿易分析:進出口情景

第4章:競爭格局

- 市佔率分析

- 戰略儀表板

- 主要利害關係人和市場定位

- 競爭基準測試

- 競爭定位矩陣

- 競爭策略

- 新產品開發

- 併購

- 夥伴關係和合作

- 產能擴張

- 關鍵參與者的 SWOT 分析

- 競爭強度—波特五力分析

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 白色波特蘭水泥

- 白色砌築水泥

- 白色波特蘭石灰石水泥(PLC)

- 其他(白鋁酸鈣水泥等)

第6章:市場估計與預測:依等級,2021 - 2034 年

- 主要趨勢

- 52.5型

- 42.5型

- 32.5型

- 其他

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 住宅建築

- 商業建築

- 基礎建設發展

- 裝飾應用

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 建築混凝土

- 預製產品

- 水磨石地板

- 泳池

- 檯面和裝飾元素

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- Aalborg Portland A/S

- Adana Cimento Sanayii TAS

- Aditya Birla Group (UltraTech Cement Ltd. - Birla White)

- Cementir Holding NV

- Cemex SAB de CV

- Cimsa Cimento Sanayi ve Ticaret AS.

- Federal White Cement Ltd.

- Holcim Group

- JK Cement Ltd.

- Lehigh White Cement Company

- OYAK Cement

- Ras Al Khaimah Cement Company (RAKCC)

- Royal White Cement Inc.

- Saveh White Cement Co.

- Shargh White Cement Co.

The Global White Cement Market was valued at USD 10.5 billion in 2024 and is estimated to grow at 6.8% CAGR to reach USD 20.2 billion by 2034, driven by the surge in global infrastructure development. With urbanization progressing rapidly, governments are investing significantly in constructing roads, bridges, and public buildings, increasing the demand for high-quality, visually appealing building materials such as white cement.

Sustainability has become another key factor propelling the white cement market forward. Its heat-reflective properties make it an excellent choice for energy-efficient construction, aligning with the increasing demand for eco-friendly building materials. As architects and builders seek to reduce carbon footprints in their designs, white cement's benefits in contributing to energy savings and environmental sustainability have positioned it as a preferred material in the construction industry. In response to evolving market needs, manufacturers are introducing new formulations of white cement that offer enhanced performance characteristics, such as improved strength and faster setting times. These innovations are expanding the scope of white cement applications, making them more viable and cost-effective for large-scale construction projects. As urban growth continues and construction trends evolve, the market is expected to maintain its positive momentum, offering significant opportunities for established companies and new entrants in the building materials sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.5 Billion |

| Forecast Value | $20.2 Billion |

| CAGR | 6.8% |

In 2024, white Portland cement represented a 59.5% share. This segment is the most widely used due to its high strength, superior finish, and aesthetic appeal. It is predominantly employed in architectural and decorative applications, such as walls, flooring, and sculptures, where uniformity in color and brightness is essential. The demand for this segment is largely driven by the growing development of premium construction projects and an increasing preference for visually appealing structures in residential and commercial spaces.

The residential construction sector held a market share of 29.5% in 2024. White cement is highly favored in residential construction due to its exceptional finishing, durability, and aesthetic value, making it a popular choice for interior and exterior walls, flooring, and decorative elements. The rise in housing demand, fueled by urbanization and population growth, has been a key factor in the sector's growth. As homeowners seek materials that offer elegance and longevity, white cement has become a preferred option for creating high-end, lasting residential spaces.

U.S. White Cement Market held an 85% share valued at USD 2.3 million in 2024. The country is set to experience rapid growth in white cement consumption, driven by an expansion in construction activities, technological advancements, and a strong focus on sustainable building practices. The high demand for durable and aesthetically pleasing building materials, combined with a surge in infrastructure development, is significantly boosting the consumption of white cement in the U.S.

Key players such as J.K. Cement, Aalborg Portland, UltraTech Cement, Cemex, and Cimsa are capitalizing on these strategies to meet the growing demand for white cement and stay ahead in the highly competitive market. Companies in the white cement market have implemented several key strategies to bolster their presence and strengthen their market position. These include focusing on product innovation, expanding production capacities, and building strategic partnerships. By developing specialized white cement variants that cater to specific needs like high-strength formulations, aesthetic finishes, or sustainability, companies ensure they meet the growing demand from both residential and commercial sectors. Investment in cutting-edge technologies that improve production efficiency and quality is also a crucial strategy. This allows companies to meet the rising demand while ensuring superior product consistency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research Methodology

- 1.2 Research Objectives

- 1.3 Market Definition and Scope

- 1.4 Market Segmentation

- 1.5 Data Sources

- 1.5.1 Primary Research

- 1.5.2 Secondary Research

- 1.6 Market Estimation Approach

- 1.7 Research Assumptions and Limitations

- 1.8 Base Year and Forecast Period

Chapter 2 Executive Summary

- 2.1 Market Snapshot

- 2.2 Global White Cement Market Highlights

- 2.3 Regional Market Highlights

- 2.4 Segmental Market Highlights

- 2.5 Competitive Landscape Snapshot

- 2.6 Investment Highlights and Strategic Recommendations

- 2.7 Key Market Trends and Future Growth Indicators

- 2.8 Analyst Perspective and Critical Insights

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Manufacturing process analysis

- 3.1.2 Raw material analysis and sourcing strategies

- 3.1.3 White cement vs. gray cement: comparative analysis

- 3.1.4 Profit margin analysis

- 3.1.5 Value chain analysis

- 3.2 Impact of trump administration tariffs - structured overview

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.2 Price volatility in key materials

- 3.2.2.3 Supply chain restructuring

- 3.2.2.4 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code) Note: the above trade statistics will be provided for key countries only.

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.5.1 Technology landscape

- 3.5.2 Traditional manufacturing technologies

- 3.5.3 Advanced manufacturing technologies

- 3.5.4 Emerging technologies

- 3.5.5 Patent analysis

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 MEA

- 3.7 Market dynamics

- 3.7.1 Market drivers

- 3.7.1.1 Growing demand for aesthetic construction materials

- 3.7.1.2 Increasing urbanization and infrastructure development

- 3.7.1.3 Rising adoption in architectural applications

- 3.7.1.4 Growth in precast and prefabricated construction

- 3.7.2 Market Restraints

- 3.7.2.1 Higher production costs compared to gray cement

- 3.7.2.2 Environmental concerns and carbon emissions

- 3.7.2.3 Raw material price volatility

- 3.7.2.4 Limited availability of high-quality raw materials

- 3.7.3 Market Opportunities

- 3.7.3.1 Technological advancements in production processes

- 3.7.3.2 Growing demand in emerging economies

- 3.7.3.3 Development of eco-friendly white cement variants

- 3.7.3.4 Expansion of application areas

- 3.7.4 Market Challenges

- 3.7.4.1 Stringent Environmental Regulations

- 3.7.4.2 High energy consumption in production

- 3.7.4.3 Transportation and logistics challenges

- 3.7.4.4 Competition from alternative materials

- 3.7.5 Regulatory Framework Analysis

- 3.7.5.1. International standards (ASTM C989/C989 M, EN 197-1)

- 3.7.5.2 Regional regulations and standards

- 3.7.5.3 Environmental compliance requirements

- 3.7.5.4 Quality certification systems

- 3.7.6 Technology Landscape

- 3.7.6.1 Current technological trends

- 3.7.6.2 Emerging technologies in slag cement production

- 3.7.6.3 Digitalization and industry 4.0 impact

- 3.7.6.4 R&d initiatives and innovation pipeline

- 3.7.7 Pricing Analysis

- 3.7.7.1 Price trend analysis

- 3.7.7.2 Cost structure analysis

- 3.7.7.3 Factors affecting pricing

- 3.7.7.4 Regional price variations

- 3.7.1 Market drivers

- 3.8 PESTLE Analysis

- 3.9 Porter's five forces analysis

- 3.10 Regulatory framework and government initiatives

- 3.11 Impact of covid-19 on white cement market

- 3.12 Impact of Russia Ukraine conflict on supply chain

- 3.13 Market entry strategies for new players

- 3.14 Pricing analysis and trends

- 3.15 Trade analysis: import-export scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Market share analysis, 2024

- 4.2 Strategic dashboard

- 4.3 Key stakeholders and market positioning

- 4.4 Competitive benchmarking

- 4.5 Competitive positioning matrix

- 4.6 Competitive strategies

- 4.6.1 new product developments

- 4.6.2 mergers and acquisitions

- 4.6.3 partnerships and collaborations

- 4.6.4 capacity expansions

- 4.7 SWOT analysis of key players

- 4.8 competitive intensity - Porter's five forces analysis

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 White Portland Cement

- 5.3 White Masonry Cement

- 5.4 White Portland Limestone Cement (PLC)

- 5.5 Others (White Calcium Aluminate Cement, etc.)

Chapter 6 Market Estimates and Forecast, By Grade, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Type 52.5

- 6.3 Type 42.5

- 6.4 Type 32.5

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Residential Construction

- 7.3 Commercial Construction

- 7.4 Infrastructure Development

- 7.5 Decorative Applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Architectural Concrete

- 8.3 Precast Products

- 8.4 Terrazzo Flooring

- 8.5 Swimming Pools

- 8.6 Countertops and Decorative Elements

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Aalborg Portland A/S

- 10.2 Adana Cimento Sanayii T.A.S.

- 10.3 Aditya Birla Group (UltraTech Cement Ltd. - Birla White)

- 10.4 Cementir Holding N.V.

- 10.5 Cemex S.A.B. de C.V.

- 10.6 Cimsa Cimento Sanayi ve Ticaret A.S..

- 10.7 Federal White Cement Ltd.

- 10.8 Holcim Group

- 10.9 J.K. Cement Ltd.

- 10.10 Lehigh White Cement Company

- 10.11 OYAK Cement

- 10.12 Ras Al Khaimah Cement Company (RAKCC)

- 10.13 Royal White Cement Inc.

- 10.14 Saveh White Cement Co.

- 10.15 Shargh White Cement Co.