|

市場調查報告書

商品編碼

1755352

脊椎植入物市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Spinal Implants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

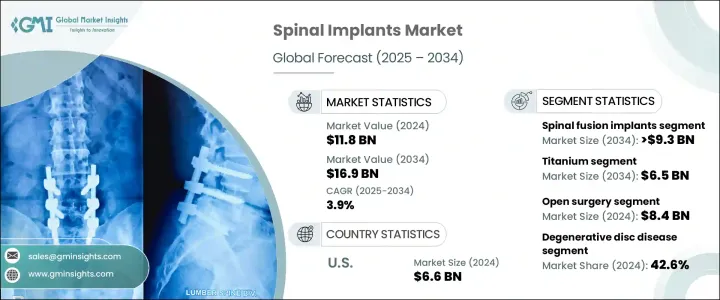

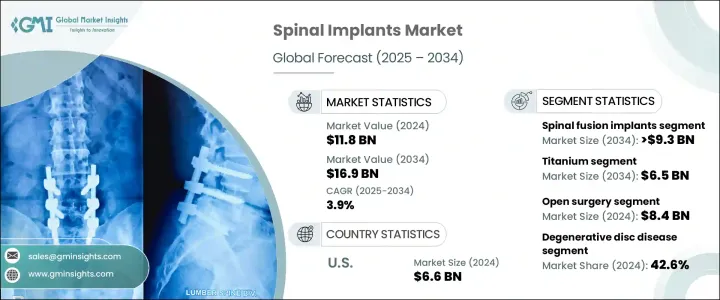

2024年,全球脊椎植入物市場規模達118億美元,預計到2034年將以3.9%的複合年成長率成長,達到169億美元。人口老化加劇、脊椎疾病發病率上升、微創手術的興起以及植入材料和手術技術的進步,共同推動了市場需求的成長。隨著椎管狹窄、退化性椎間盤疾病和椎間盤突出等脊椎疾病的發生率日益上升,尤其是在老年人群體中,對外科手術和脊椎穩定解決方案的需求也隨之成長。

肥胖和久坐不動的生活方式進一步加劇了脊椎退化。因此,越來越多的患者選擇手術矯正,尤其是在新的解決方案能夠減輕疼痛、加速復原的情況下。機器人系統和導航工具在脊椎手術中的引入,不僅提高了手術精準度,還最大限度地降低了併發症發生率,從而鼓勵了先進植入物的廣泛應用。許多器械製造商正在積極應對這項挑戰,設計出適用於微創技術的植入物,隨著成本逐漸下降和可及性不斷提高,這些植入物正在全球範圍內被更廣泛的臨床應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 118億美元 |

| 預測值 | 169億美元 |

| 複合年成長率 | 3.9% |

脊椎融合植入物市場預計將以4.3%的複合年成長率強勁成長,到2034年將達到93億美元。這些器械的廣泛應用源自於其在治療因退化或創傷引起的脊椎不穩定方面的關鍵作用。隨著脊椎滑脫和椎間盤疾病等退化性疾病的日益常見,脊椎融合手術的數量也持續增加。採用PEEK和鈦等先進材料製成的新型融合植入物設計,因其與人體的兼容性、更高的強度以及與周圍骨組織的更好結合,如今已得到更廣泛的應用。這些特性能夠改善患者的長期療效,有助於鞏固該領域在市場上的主導地位。

預計到2034年,鈦基脊椎植入物市場將達到65億美元的產值。鈦因其高生物相容性、耐腐蝕性和結構耐久性,仍是脊椎外科手術的首選材料。它與人體無縫融合,最大限度地降低免疫排斥風險,同時在富含液體的環境中保持良好的彈性。鈦植入物堅固而輕便,這對於患者在康復期間和康復後保持舒適度和良好的治療效果至關重要。它們能夠承受較大的機械負荷,使其成為頸椎和腰椎手術中椎間融合器、棒和板等應用的理想選擇。其長期的安全記錄進一步鞏固了其在現代脊椎手術中的地位。

2024年,美國脊椎植入物市場規模達66億美元,預計2025年至2034年期間的複合年成長率將達到3.5%。由於強生、史賽克、美敦力、捷邁邦美和NuVasive等主要製造商的鼎力支持,美國仍是脊椎植入物生產的全球領導者。這些公司走在創新的前沿,投資開發機器人技術和智慧植入物,以提高手術精準度和臨床療效。憑藉著遍布全國的廣泛研發網路和製造設施,這些公司正在加速產品的部署和應用,增強美國在全球脊椎護理領域的影響力。

影響全球脊椎植入物市場的關鍵參與者包括 Spineart、Ulrich、Orthofix Holdings、B. Braun、CENTINEL SPINE、INTEGRA、Seaspine、RTI Surgical、Zimmer Biomet、Stryker、強生、Globus Medical、Alphatec Spine、美敦力和 NuVasive。為了擴大市場佔有率,脊椎植入物產業的公司正專注於策略性研發投資,以增強植入物的功能及其與微創技術的兼容性。他們正積極透過合併、合作和收購進行全球擴張,以接觸新的客戶群並加強分銷管道。將機器人技術和數位導航整合到他們的產品組合中,幫助他們提高手術準確性和患者滿意度。該公司還與臨床機構合作,以驗證產品性能,獲得更快的監管批准,並加強其在全球醫療保健提供者中的信譽。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 脊椎疾病盛行率上升

- 微創手術的需求不斷增加

- 技術進步

- 已開發國家優惠的報銷政策

- 產業陷阱與挑戰

- 脊椎植入物和手術費用高昂

- 已開發國家的嚴格監管環境

- 市場機會

- 人工智慧和機器人技術在脊椎手術中的整合

- 日益關注門診與流動醫療環境

- 成長動力

- 成長潛力分析

- 監管格局

- 美國

- 歐洲

- 技術格局

- 報銷場景

- 波特的分析

- PESTEL分析

- 定價分析

- 差距分析

- 價值鏈分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 按地區

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 年至 2034 年

- 主要趨勢

- 脊椎融合植入物

- 椎弓根螺釘

- 椎間融合裝置(IBFD)

- 桿

- 盤子

- 籠子

- 其他脊椎融合植入物

- 動態穩定裝置

- 人工椎間盤

- 子宮頸

- 腰椎

- 其他產品類型

第6章:市場估計與預測:按材料,2021 年至 2034 年

- 主要趨勢

- 鈦

- 鈷鉻合金

- 不銹鋼

- 聚醚醚酮(PEEK)

- 其他材料

第7章:市場估計與預測:依手術類型,2021 年至 2034 年

- 主要趨勢

- 開放性手術

- 微創手術

第 8 章:市場估計與預測:按適應症,2021 年至 2034 年

- 主要趨勢

- 椎間盤退化性疾病

- 脊椎畸形

- 脊椎創傷

- 骨折

- 其他適應症

第9章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 其他最終用途

第10章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Alphatec Spine

- B. Braun

- CENTINEL SPINE

- Globus Medical

- INTEGRA

- Johnson & Johnson

- Medtronic

- NuVasive

- Orthofix Holdings

- RTI Surgical

- Seaspine

- Spineart

- Stryker

- Ulrich

- Zimmer Biomet

The Global Spinal Implants Market was valued at USD 11.8 billion in 2024 and is estimated to grow at a CAGR of 3.9% to reach USD 16.9 billion by 2034. The growing demand is fueled by a rising aging population, an increase in spinal disorders, a shift toward minimally invasive procedures, and technological advancements in implant materials and surgical techniques. As spinal conditions like spinal stenosis, degenerative disc disease, and herniated discs become more prevalent, especially among older individuals, the need for surgical intervention and spinal stabilization solutions continues to climb.

Obesity and sedentary lifestyles further contribute to spinal degeneration. As a result, more patients are opting for surgical correction, especially with new solutions offering reduced pain and faster recovery. The introduction of robotic systems and navigation tools in spinal surgeries has not only enhanced procedural precision but also minimized complication rates, encouraging greater use of advanced implants. Many device manufacturers are responding by designing implants tailored for minimally invasive techniques, driving broader clinical adoption globally as costs gradually decline and accessibility improves.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.8 Billion |

| Forecast Value | $16.9 Billion |

| CAGR | 3.9% |

The spinal fusion implants segment is projected to witness strong growth at a CAGR of 4.3%, reaching USD 9.3 billion by 2034. The widespread use of these devices stems from their critical role in treating spinal instability caused by degeneration or trauma. As degenerative conditions such as spondylolisthesis and disc disorders become more common, the volume of spinal fusion procedures continues to grow. New fusion implant designs made from advanced materials such as PEEK and titanium are now more commonly used due to their compatibility with the human body, enhanced strength, and better integration with surrounding bone tissue. These properties increase long-term patient outcomes, helping to solidify the segment's dominance in the market.

Titanium-based spinal implants segment is expected to generate USD 6.5 billion by 2034. Titanium remains the preferred material in spinal surgeries due to its high biocompatibility, corrosion resistance, and structural durability. It integrates seamlessly with the body, minimizing the risk of immune rejection while maintaining resilience in fluid-rich environments. Titanium implants are strong yet lightweight, which is essential for patient comfort and performance during and after the recovery phase. They withstand significant mechanical loads, making them ideal for applications such as interbody cages, rods, and plates in both cervical and lumbar spine procedures. Their long-term safety record further reinforces their position in modern spinal procedures.

U.S. Spinal Implants Market was valued at USD 6.6 billion in 2024 and is expected to grow at a CAGR of 3.5% between 2025 and 2034. The U.S. remains a global leader in spinal implant production, supported by the presence of major manufacturers including Johnson & Johnson, Stryker, Medtronic, Zimmer Biomet, and NuVasive. These companies are at the forefront of innovation, investing in the development of robotics and smart implants that enhance surgical precision and clinical outcomes. With extensive R&D networks and manufacturing facilities across the country, these firms accelerate product deployment and adoption, strengthening the country's influence in the global spinal care landscape.

Key players shaping the Global Spinal Implants Market include Spineart, Ulrich, Orthofix Holdings, B. Braun, CENTINEL SPINE, INTEGRA, Seaspine, RTI Surgical, Zimmer Biomet, Stryker, Johnson & Johnson, Globus Medical, Alphatec Spine, Medtronic, and NuVasive. To expand their market footprint, companies within the spinal implants industry are focusing on strategic R&D investments to enhance implant functionality and compatibility with minimally invasive techniques. They are actively pursuing global expansion through mergers, partnerships, and acquisitions to reach new customer bases and reinforce distribution channels. Integration of robotics and digital navigation into their product portfolios is helping them improve surgical accuracy and patient satisfaction. Firms are also collaborating with clinical institutions to validate product performance, obtain faster regulatory approvals, and strengthen their credibility among healthcare providers worldwide.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product type trends

- 2.2.3 Material trends

- 2.2.4 Surgery type trends

- 2.2.5 Indication trends

- 2.2.6 End use trends

- 2.3 CXO Perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of spinal diseases

- 3.2.1.2 Increasing demand for minimally invasive procedures

- 3.2.1.3 Technological advancements

- 3.2.1.4 Favorable reimbursement policies in developed countries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of spinal implants and surgeries

- 3.2.2.2 Stringent regulatory scenario in developed countries

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of AI and robotics in spine surgery

- 3.2.3.2 Growing focus on outpatient and ambulatory settings

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Pricing analysis

- 3.10 GAP analysis

- 3.11 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 By region

- 4.3.1.1 North America

- 4.3.1.2 Europe

- 4.3.1.3 Asia Pacific

- 4.3.1 By region

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Spinal fusion implants

- 5.2.1 Pedicle screws

- 5.2.2 Intervertebral body fusion device (IBFD)

- 5.2.3 Rods

- 5.2.4 Plates

- 5.2.5 Cages

- 5.2.6 Other spinal fusion implants

- 5.3 Dynamic stabilization devices

- 5.4 Artificial discs

- 5.4.1 Cervical

- 5.4.2 Lumbar

- 5.5 Other product types

Chapter 6 Market Estimates and Forecast, By Material, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Titanium

- 6.3 Cobalt chrome

- 6.4 Stainless steel

- 6.5 Polyetheretherketone (PEEK)

- 6.6 Other materials

Chapter 7 Market Estimates and Forecast, By Surgery Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Open surgery

- 7.3 Minimally invasive surgery

Chapter 8 Market Estimates and Forecast, By Indication, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Degenerative disc disease

- 8.3 Spinal deformities

- 8.4 Spinal trauma

- 8.5 Fractures

- 8.6 Other indications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Ambulatory surgical centers

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Alphatec Spine

- 11.2 B. Braun

- 11.3 CENTINEL SPINE

- 11.4 Globus Medical

- 11.5 INTEGRA

- 11.6 Johnson & Johnson

- 11.7 Medtronic

- 11.8 NuVasive

- 11.9 Orthofix Holdings

- 11.10 RTI Surgical

- 11.11 Seaspine

- 11.12 Spineart

- 11.13 Stryker

- 11.14 Ulrich

- 11.15 Zimmer Biomet