|

市場調查報告書

商品編碼

1755339

電力工業加熱器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Electric Industrial Heater Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

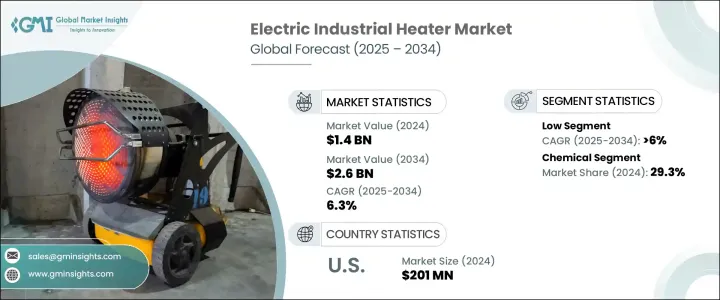

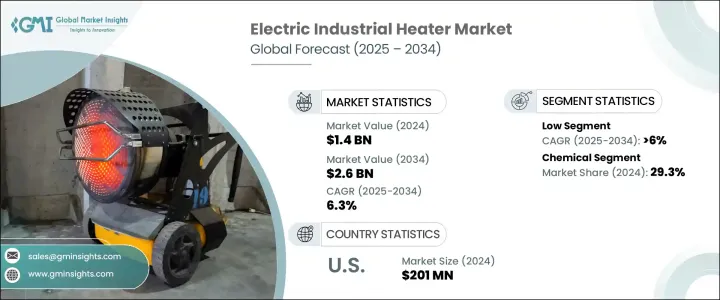

2024年,全球電工業加熱器市場規模達14億美元,預計2034年將以6.3%的複合年成長率成長,達到26億美元,這得益於全球向永續和節能供暖解決方案的轉變。隨著強調脫碳和能源效率的法規訂定,預計電力工業加熱器的使用將大幅成長。世界各國政府正在推出政策,鼓勵製造業使用更清潔的能源,推動各行各業從化石燃料系統轉型為電力替代能源。這些監管框架和激勵計劃支持清潔技術,從而有助於減少排放和改善營運。

低排放供暖方式的需求正在激增,尤其是與再生能源設備生產相關的行業。隨著工業營運的持續電氣化,製造商在實現長期環保目標的同時,也實現了更高的製程效率。能源成本的不斷攀升以及食品飲料加工等行業的成長,為電加熱市場創造了有利條件。先進能量回收和熱能儲存系統的推動推動了相關技術的採用,幫助企業降低營運成本並提升績效。隨著永續發展意識的不斷加深,人們對精準製程加熱燃料的投資興趣日益濃厚,這促使人們轉向更清潔、更有效率的供暖方式。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 14億美元 |

| 預測值 | 26億美元 |

| 複合年成長率 | 6.3% |

預計到2034年,低電工業加熱器市場將以6%的複合年成長率成長,這得益於向符合現代工業需求的緊湊型高性能加熱解決方案的加速轉變。低壓系統的需求正在成長,尤其是在安裝空間有限但可靠且持續加熱至關重要的應用中。隨著各行各業致力於減少碳足跡並滿足更嚴格的環境標準,這些電加熱器正在各個領域取代傳統的化石燃料驅動的設備。

2024年,化學工業佔29.3%的市場佔有率,這得益於日益嚴格的環保法規,這些法規要求加熱系統更加清潔,工藝精度更高。電加熱器為化學工業的敏感製程提供卓越的溫度控制。此外,材料科學和熱管理技術的進步使加熱器即使在腐蝕性或高溫條件下也能安全且有效率地運行,使其成為化工廠的首選。

受快速工業發展和國家對工業基礎電氣化的戰略重點推動,美國電加熱工業加熱器市場規模在2024年達到2.01億美元。由於能源成本飆升、能源效率政策影響力日益增強以及對脫碳製造解決方案的需求不斷成長,美國電加熱系統的採用率正在不斷提高。此外,各行各業擴大將電加熱設備與智慧感測器和物聯網系統整合,從而提升了數據驅動、自動化工業環境的吸引力。

塑造全球電力工業暖爐產業競爭格局的知名企業包括 Marathon Heater、Ulanet、ExcelHeaters、Tempco Electric Heater Corporation、Powrmatic、Elmec Heaters、Dragon Power Electric Co.、Wattco、Electron Systems、Omega Engineering、Accutherm、ELMATIC、Watlow Electric Manufacturing Company、Heat Technologiesxrexes Hotwatt、Tutco Farnam、Chromalox、Heatcon、HEATCO、Warren Electric 和 Winterwarm Heating Solutions。

為了鞏固市場地位,工業電加熱器領域的企業正優先考慮創新和產品差異化。許多企業正在加大研發投入,以打造更緊湊、更節能、控制更精準的加熱器,滿足多樣化的工業需求。企業利用策略性併購和合作夥伴關係,擴大全球影響力和技術能力。市場領導者專注於客製化產品,以滿足特定行業的需求,從而提高營運可靠性和效率。同時,企業正在採用數位監控和智慧控制技術,以在快速發展的市場中保持競爭力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與技術格局

第5章:市場規模及預測:依產能,2021 - 2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第6章:市場規模及預測:依產品,2021 - 2034

- 主要趨勢

- 管道加熱器

- 管道加熱器

- 筒式加熱器

- 浸入式加熱器

- 循環加熱器

第7章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 石油和天然氣

- 化學

- 食品和飲料

- 製造業

- 汽車

- 其他

第8章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 義大利

- 法國

- 荷蘭

- 西班牙

- 挪威

- 英國

- 瑞典

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 泰國

- 新加坡

- 馬來西亞

- 菲律賓

- 越南

- 印尼

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 伊朗

- 伊拉克

- 土耳其

- 南非

- 拉丁美洲

- 巴西

- 智利

- 阿根廷

第9章:公司簡介

- Accutherm

- Auzhan Electric Appliances

- Backer Hotwatt

- Chromalox

- Electron Systems

- Dragon Power Electric Co.

- Durex Industries

- ELMATIC

- Elmec Heaters

- ExcelHeaters

- HEATCO

- Heatcon

- Heatrex

- Magma Technologies

- Marathon Heater

- Omega Engineering

- Powrmatic

- Tempco Electric Heater Corporation

- Tutco Frrnam

- Ulanet

- Warren Electric

- Watlow Electric Manufacturing Company

- Wattco

- Winterwarm Heating Solutions

The Global Electric Industrial Heater Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 2.6 billion by 2034, driven by a global shift toward sustainable and energy-conscious heating solutions. With the introduction of regulations that emphasize decarbonization and energy efficiency, the use of electric industrial heaters is expected to rise significantly. Governments worldwide are introducing policies that promote cleaner energy usage in manufacturing, motivating industries to transition from fossil fuel-based systems to electric alternatives. These regulatory frameworks and incentive programs support clean technologies, thereby contributing to emissions reductions and operational improvements.

Demand for low-emission heating methods is surging, particularly in sectors linked with renewable energy equipment production. As industrial operations continue to electrify, manufacturers achieve better process efficiency while aligning with long-term environmental goals. Escalating energy costs and growth in sectors like food and beverage processing create favorable conditions for the electric heating market. The push for advanced energy recovery and thermal storage systems reinforces adoption, helping companies lower operating costs and boost performance. Increased interest in precise process heating fuel investments in specialized electric heating systems as awareness around sustainability deepens, prompting a shift to cleaner, more efficient heating options.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.6 Billion |

| CAGR | 6.3% |

The low-electric industrial heater segment is projected to grow at a CAGR of 6% through 2034, driven by an accelerating shift toward compact, high-performance heating solutions that align with modern industrial needs. The demand for low-voltage systems is rising particularly in applications where installation space is limited, yet reliable and consistent heating is critical. As industries aim to reduce their carbon footprints and meet stricter environmental standards, these electric heaters are replacing conventional fossil-fuel-powered units across various sectors.

The chemical segment held a 29.3% share in 2024 favored by intensifying environmental mandates that require cleaner heating systems and higher process accuracy. Electric heaters offer superior temperature control for the chemical industry's sensitive processes. Moreover, technological advancements in materials science and thermal management enable heaters to operate safely and efficiently even under corrosive or high-temperature conditions, making them a preferred choice in chemical manufacturing plants.

United States Electric Industrial Heater Market was valued at USD 201 million in 2024 driven by rapid industrial development and the nation's strategic focus on electrifying its industrial base. The country is witnessing heightened adoption of electric heating systems in response to surging energy costs, the growing influence of energy efficiency policies, and the demand for decarbonized manufacturing solutions. Furthermore, industries are increasingly integrating electric heating equipment with smart sensors and IoT-enabled systems, boosting their appeal for data-driven, automated industrial environments.

Prominent players shaping the competitive landscape of the Global Electric Industrial Heater Industry include Marathon Heater, Ulanet, ExcelHeaters, Tempco Electric Heater Corporation, Powrmatic, Elmec Heaters, Dragon Power Electric Co., Wattco, Electron Systems, Omega Engineering, Accutherm, ELMATIC, Watlow Electric Manufacturing Company, Heatrex, Durex Industries, Auzhan Electric Appliances, Magma Technologies, Backer Hotwatt, Tutco Farnam, Chromalox, Heatcon, HEATCO, Warren Electric, and Winterwarm Heating Solutions.

To strengthen their market positioning, companies in the electric industrial heater segment are prioritizing innovation and product differentiation. Many are investing in research and development to create more compact, energy-saving, and precision-controlled heaters that cater to diverse industrial needs. Strategic mergers, acquisitions, and partnerships are leveraged to expand global reach and technological capabilities. Market leaders focus on customizing products to meet sector-specific demands, enhancing operational reliability and efficiency. At the same time, companies are adopting digital monitoring and smart control technologies to stay competitive in a rapidly evolving landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Low

- 5.3 Medium

- 5.4 High

Chapter 6 Market Size and Forecast, By Product, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Pipe heater

- 6.3 Duct heater

- 6.4 Cartridge heater

- 6.5 Immersion heater

- 6.6 Circulation heater

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Oil & gas

- 7.3 Chemical

- 7.4 Food & beverage

- 7.5 Manufacturing

- 7.6 Automotive

- 7.7 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 Italy

- 8.3.3 France

- 8.3.4 Netherlands

- 8.3.5 Spain

- 8.3.6 Norway

- 8.3.7 UK

- 8.3.8 Sweden

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Thailand

- 8.4.7 Singapore

- 8.4.8 Malaysia

- 8.4.9 Philippines

- 8.4.10 Vietnam

- 8.4.11 Indonesia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Iran

- 8.5.4 Iraq

- 8.5.5 Turkey

- 8.5.6 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Chile

- 8.6.3 Argentina

Chapter 9 Company Profiles

- 9.1 Accutherm

- 9.2 Auzhan Electric Appliances

- 9.3 Backer Hotwatt

- 9.4 Chromalox

- 9.5 Electron Systems

- 9.6 Dragon Power Electric Co.

- 9.7 Durex Industries

- 9.8 ELMATIC

- 9.9 Elmec Heaters

- 9.10 ExcelHeaters

- 9.11 HEATCO

- 9.12 Heatcon

- 9.13 Heatrex

- 9.14 Magma Technologies

- 9.15 Marathon Heater

- 9.16 Omega Engineering

- 9.17 Powrmatic

- 9.18 Tempco Electric Heater Corporation

- 9.19 Tutco Frrnam

- 9.20 Ulanet

- 9.21 Warren Electric

- 9.22 Watlow Electric Manufacturing Company

- 9.23 Wattco

- 9.24 Winterwarm Heating Solutions