|

市場調查報告書

商品編碼

1755334

汽車語音辨識市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Voice Recognition Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

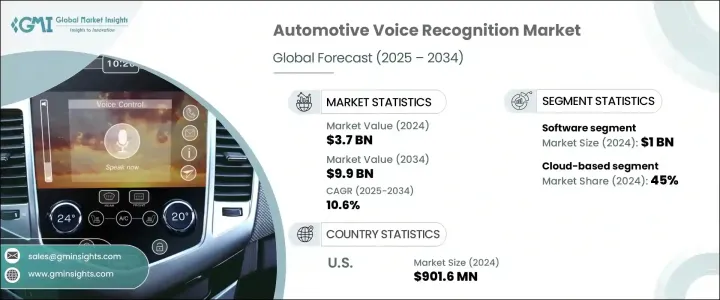

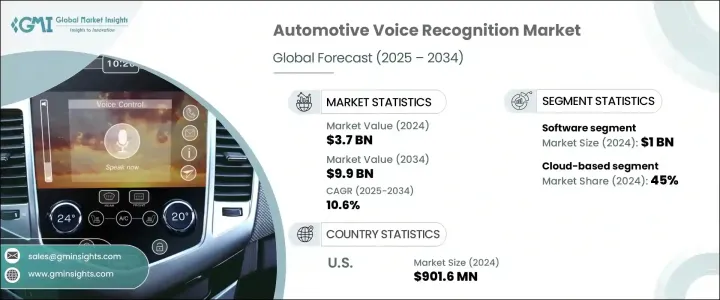

2024年,全球汽車語音辨識市場規模達37億美元,預計2034年將以10.6%的複合年成長率成長,達到99億美元。這得歸功於先進語音控制系統的快速普及,因為越來越多的汽車採用旨在提升駕駛安全性和便利性的智慧技術。這些系統減少了駕駛員分心,提高了道路安全合規性。隨著越來越多的汽車製造商致力於提供連網汽車,對語音辨識技術的需求持續成長。將這些系統與Google Assistant和Alexa等熱門數位助理整合,可以顯著提升汽車的吸引力和功能性,使用戶能夠控制各種汽車功能,例如資訊娛樂、空調設置,甚至車輛診斷。

5G 和雲端運算技術的發展進一步推動了更複雜語音辨識功能的需求。借助 5G 低延遲和高頻寬支援的即時音訊處理,車載語音助理如今能夠即時響應,帶來更豐富的用戶體驗。這些進步為汽車帶來了新的功能和服務,增強了汽車的數位介面,並擴展了其功能。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 37億美元 |

| 預測值 | 99億美元 |

| 複合年成長率 | 10.6% |

2024年,軟體市場價值達10億美元。這個市場的重要性在於軟體在語音辨識系統中的核心作用,尤其是在語音轉文字、自然語言處理和命令處理等領域。人工智慧和機器學習的軟體開發能夠持續提升系統的準確性和個人化,使這些系統更能適應各種語言、駕駛偏好和車輛平台。

2024年,雲端系統佔據了45%的市場。雲端系統能夠無縫更新語音辨識程序,無需召回實體車輛,從而確保技術始終保持最新和競爭力。這些系統還可以與其他數位助理和智慧型裝置整合,為用戶提供跨平台、更互聯的體驗。雲端系統支援即時學習,並可在全球範圍內運行,從而提升了其在汽車語音識別市場的可擴展性和多功能性。

2024年,美國汽車語音辨識市場規模達9.016億美元。美國在整合先進語音辨識系統的豪華高階汽車普及率方面處於領先地位。美國消費者高度重視人身安全和便利,進一步推動了對這些系統的需求。此外,憑藉成熟完善的汽車市場,美國持續在連網汽車技術方面投入巨資,確保其在語音辨識領域保持領先地位。

全球汽車語音辨識市場的主要參與者包括愛信精機、阿里巴巴集團、亞馬遜、百度、博世、Cerence、大陸集團、Google、哈曼國際和微軟。為了保持競爭優勢,汽車語音辨識市場的公司越來越注重開發融合人工智慧和機器學習的先進軟體,以實現更出色的語音命令識別和更個性化的用戶體驗。與汽車製造商和科技巨頭的合作也正成為一種常見策略,因為各公司都希望將其語音辨識系統與數位助理和其他車載技術結合。各公司正大力投資研發,以突破即時處理的界限,減少延遲並改善語音控制系統的功能。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 汽車製造商

- 一級供應商

- 語音AI/軟體供應商

- 雲端基礎設施供應商

- 硬體提供者

- 最終用途

- 利潤率分析

- 專利分析

- 重要新聞和舉措

- 監管格局

- 語音辨識統計

- 採用率

- 使用模式

- 顧客偏好

- 成本細分分析

- 價格趨勢

- 地區

- 硬體

- 衝擊力

- 成長動力

- 連網汽車需求不斷成長

- 消費者對車載資訊娛樂的偏好

- 雲端運算和5G的成長

- 加強駕駛員安全法規

- 產業陷阱與挑戰

- 實施成本高

- 與遺留系統的複雜整合

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 硬體

- 麥克風

- 電子控制單元(ECU)

- 資訊娛樂主機/(HMI)

- 連接硬體

- 其他

- 軟體

- 自動語音辨識(ASR)

- 自然語言理解(NLU)

- 文字轉語音 (TTS)

- 語音助理平台(定製或第三方)

- 其他

- 服務

- OTA 更新(無線)

- 第三方應用程式整合

- 多語言支援服務

- 其他

第6章:市場估計與預測:依部署模型,2021 - 2034 年

- 主要趨勢

- 嵌入式

- 基於雲端

- 混合

第7章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 冰

- 電的

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 導航

- 氣候控制

- 資訊娛樂

- 車輛管理

- 安全功能

- 其他

第9章:市場估計與預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- 原始設備製造商

- 售後市場

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- Aisin Seiki

- Alibaba Group

- Amazon

- Baidu Inc.

- Bosch

- Cerence

- Continental

- Emagine

- Harman International

- iNAGO

- Kardome

- Microsoft

- Nextgen Technologies

- Nissan

- Qualcomm Technologies

- Sensory

- SoundHound

- Speak With Me

- Visteon

The Global Automotive Voice Recognition Market was valued at USD 3.7 billion in 2024 and is estimated to grow at a CAGR of 10.6% to reach USD 9.9 billion by 2034, driven by the rapid adoption of advanced voice-controlled systems as more vehicles incorporate smart technology designed to enhance driving safety and convenience. These systems reduce driver distractions, improving safety compliance on the road. As more automakers strive to offer connected vehicles, the demand for voice recognition technology continues to rise. Integrating these systems with popular digital assistants, such as Google Assistant and Alexa, adds significant appeal and functionality, enabling users to control various car features, such as infotainment, climate settings, and even vehicle diagnostics.

The growth of 5G and cloud computing technologies has further propelled the demand for more sophisticated voice recognition capabilities. With real-time audio processing powered by 5G's low latency and high bandwidth, voice assistants in cars can now respond instantly, enabling a richer user experience. These advancements provide cars with new features and services, enhancing their digital interfaces and expanding their functions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.7 Billion |

| Forecast Value | $9.9 Billion |

| CAGR | 10.6% |

The software segment was valued at USD 1 billion in 2024. This segment's importance lies in the core role of software in voice recognition systems, particularly in areas like speech-to-text, natural language processing, and command processing. Software development, enhanced by AI and machine learning, allows for continuous improvements in system accuracy and personalization, making these systems more adaptable to various languages, driver preferences, and vehicle platforms.

The cloud-based segment held a 45% share in 2024. Cloud-based systems enable seamless updates to voice recognition programs without the need for physical vehicle recalls, ensuring that the technology remains up-to-date and competitive. These systems can also integrate with other digital assistants and smart devices, offering users a more connected experience across multiple platforms. Cloud systems support real-time learning and can operate globally, boosting their scalability and versatility in the automotive voice recognition market.

United States Automotive Voice Recognition Market reached USD 901.6 million in 2024. The U.S. leads in adopting luxury and high-end vehicles integrated with advanced voice recognition systems. Consumers in the U.S. place significant value on personal safety and convenience, further driving demand for these systems. Moreover, with an established and well-developed automotive market, the U.S. continues to make substantial investments in connected car technology, ensuring that the country remains a leading player in the voice recognition space.

Key players in the Global Automotive Voice Recognition Market include Aisin Seiki, Alibaba Group, Amazon, Baidu, Bosch, Cerence, Continental, Google, Harman International, and Microsoft. To maintain a competitive edge, companies in the automotive voice recognition market are increasingly focusing on developing advanced software that incorporates artificial intelligence and machine learning, allowing for better voice command recognition and more personalized user experiences. Partnerships with automakers and tech giants are also becoming a common strategy, as companies look to integrate their voice recognition systems with digital assistants and other in-car technologies. Companies are investing heavily in research and development to push the boundaries of real-time processing, reducing latency and improving the functionality of voice-controlled systems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Automotive manufacturers

- 3.2.2 Tier 1 suppliers

- 3.2.3 Voice AI/software providers

- 3.2.4 Cloud infrastructure providers

- 3.2.5 Hardware providers

- 3.2.6 End use

- 3.3 Profit margin analysis

- 3.4 Patent analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Voice recognition statistics

- 3.7.1 Adoption rates

- 3.7.2 Usage patterns

- 3.7.3 Customer preferences

- 3.8 Cost breakdown analysis

- 3.9 Price trend

- 3.9.1 Region

- 3.9.2 Hardware

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Increasing demand for connected cars

- 3.10.1.2 Consumer preference for in-car infotainment

- 3.10.1.3 Growth in cloud computing and 5G

- 3.10.1.4 Enhanced driver safety regulations

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High implementation costs

- 3.10.2.2 Complex integration with legacy systems

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Microphones

- 5.2.2 Electronic control units (ECUs)

- 5.2.3 Infotainment head unit / (HMI)

- 5.2.4 Connectivity hardware

- 5.2.5 Others

- 5.3 Software

- 5.3.1 Automatic speech recognition (ASR)

- 5.3.2 Natural language understanding (NLU)

- 5.3.3 Text-to-speech (TTS)

- 5.3.4 Voice assistant platforms (custom or third-party)

- 5.3.5 Others

- 5.4 Services

- 5.4.1 OTA updates (Over-the-Air)

- 5.4.2 Third-party app integrations

- 5.4.3 Multilingual support services

- 5.4.4 Others

Chapter 6 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Embedded

- 6.3 Cloud-based

- 6.4 Hybrid

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 ICE

- 7.3 Electric

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Navigation

- 8.3 Climate control

- 8.4 Infotainment

- 8.5 Vehicle management

- 8.6 Safety features

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEMs

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Aisin Seiki

- 11.2 Alibaba Group

- 11.3 Amazon

- 11.4 Baidu Inc.

- 11.5 Bosch

- 11.6 Cerence

- 11.7 Continental

- 11.8 Emagine

- 11.9 Google

- 11.10 Harman International

- 11.11 iNAGO

- 11.12 Kardome

- 11.13 Microsoft

- 11.14 Nextgen Technologies

- 11.15 Nissan

- 11.16 Qualcomm Technologies

- 11.17 Sensory

- 11.18 SoundHound

- 11.19 Speak With Me

- 11.20 Visteon