|

市場調查報告書

商品編碼

1755332

風機盤管市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Fan Coil Unit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

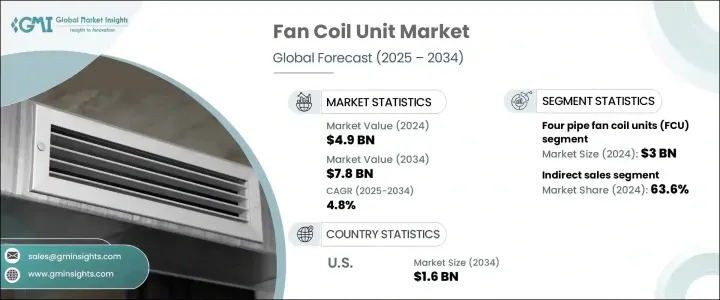

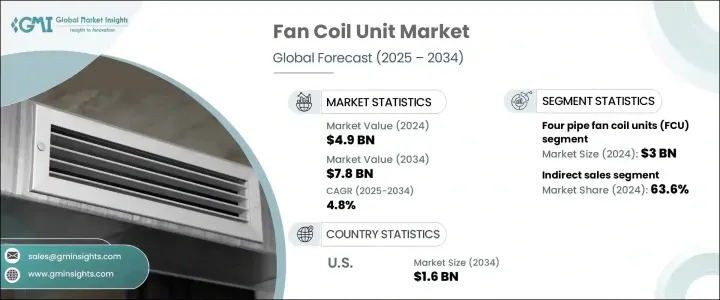

2024年,全球風機盤管市場規模達49億美元,預計2034年將以4.8%的複合年成長率成長,達到78億美元。這一成長主要源於人們對室內空氣品質重要性的日益重視。隨著人們大部分時間都待在住宅、辦公室和其他封閉迴路境中,對空氣污染和濕度控制的擔憂也日益凸顯。消費者如今尋求的空調解決方案不僅要能夠製冷或製熱,還要能夠確保室內環境更清潔、更健康。配備高性能空氣過濾和濕度調節功能的風扇盤管越來越受到住宅和商業買家的青睞。在辦公室、學校和醫療保健等環境中,更好的室內空氣品質與健康和生產力的提高密切相關,這進一步推動了其普及。

此外,為滿足當代能源標準而對老化基礎設施進行現代化改造的趨勢,也催生了對節能暖通空調 (HVAC) 解決方案(例如 FCU)的強勁需求。由於建築仍然是全球能源消耗的最大貢獻者之一,整合高效的氣候控制系統對於減少能源足跡至關重要。現代 FCU,尤其是整合智慧技術的 FCU,因其增強的控制和自動化功能而日益受到青睞。遠端監控、基於佔用率的設置以及與建築管理系統的整合,使 FCU 對設施管理人員和建築業主更具吸引力。這些智慧系統有助於更有效地調節能源使用,最佳化性能,同時最大限度地降低營運成本。它們還能提供即時洞察,從而實現主動維護和性能調整,從而實現長期效率提升。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 49億美元 |

| 預測值 | 78億美元 |

| 複合年成長率 | 4.8% |

根據配置,風扇盤管市場可分為兩管和四管兩種類型。其中,四管類型佔最大收益佔有率,2024 年價值約 30 億美元,預計 2025 年至 2034 年的複合年成長率為 4.9%。四管系統能夠同時提供暖氣和冷氣,這使其在不同區域具有不同氣候控制需求的建築中具有功能優勢。這種靈活性使建築業者能夠根據特定空間客製化精確的室內溫度。這些系統尤其適用於需要在多個房間或部門保持一致舒適度的大型商業或機構設施。雖然初始安裝和設備成本相對較高,但四管風機盤管卓越的熱控制和適應性使其成為高級暖通空調設計的首選。

按配銷通路評估時,市場分為直接銷售和間接銷售。間接銷售部分在 2024 年佔據主導地位,貢獻了總收入的約 63.6%,預計在預測期內將以 4.9% 的複合年成長率成長。這一部門的優勢在於其廣泛的中間商網路,包括經銷商、分銷商和零售合作夥伴。這些管道幫助製造商擴大其在不同地理位置和客戶群的影響力。與當地承包商、建築商和最終用戶建立的關係使銷售週期更有效率、更有反應。此外,經銷商提供的售後支援、安裝和維護等增值服務進一步增強了該通路的吸引力。間接銷售也受惠於在地化的行銷策略和深入的市場知識,這有助於提升品牌在區域市場的知名度和客戶信任度。

在美國,風機盤管市場規模在2024年超過10億美元,預計2034年將達到16億美元。日益轉向節能永續的建築系統是推動這一成長的主要因素。風機盤管擴大被納入綠色建築設計,因為它們能夠提供局部氣候控制,與集中式暖通空調系統相比,可顯著節省能源。透過最佳化房間溫度控制,風扇盤管可以最大限度地減少能源浪費,並符合國家推廣永續建築實踐的目標。這使得風機盤管成為推動環保基礎設施升級的重要組成部分。

全球FCU市場仍高度分散,許多區域性參與者在國際層面運作。這些公司合計約佔總市場佔有率的10%至15%。本地公司通常會滿足特定的區域需求,根據當地法規和建築規範的要求客製化產品。他們還提供符合區域偏好的客製化解決方案。另一方面,全球品牌受益於大規模生產、成熟的國際網路和強大的市場信譽,使其能夠在多個地區保持競爭力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 技術概述

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 提高對室內空氣品質的認知

- 都市化進程加速

- 技術進步

- 產業陷阱與挑戰

- 初始成本高

- 監理和合規問題

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:風機盤管市場估計與預測:依配置,2021 - 2032 年

- 主要趨勢

- 雙管制風機盤管機組

- 四管制風機盤管機組

第6章:風機盤管市場估計與預測:依方向,2021 - 2032 年

- 主要趨勢

- 水平的

- 壁掛式

- 管道鼓風機類型

- 天花闆卡式

- 天花板暗裝型

- 垂直(落地式)

第7章:風機盤管市場估計與預測:按風量,2021 - 2032 年

- 主要趨勢

- 低於500立方米/小時

- 500 立方米/小時 - 1000 立方米/小時

- 1000 立方米/小時 - 1500 立方米/小時

- 1500 立方米/小時 - 2000 立方米/小時

- 2000 立方米/小時以上

第8章:風機盤管市場估計與預測:依最終用途,2021 - 2032 年

- 主要趨勢

- 住宅

- 商業的

- 辦公室空間

- 飯店

- 餐廳

- 醫院

- 零售

- 超市

- 百貨公司

- 品牌直營店

- 物流(倉庫)

- 其他(製造業等)

- 工業的

第9章:風機盤管市場估計與預測:按配銷通路,2021 - 2032 年

- 主要趨勢

- 直銷

- 間接銷售

第10章:風機盤管市場估計與預測:按地區,2021 - 2032 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地區

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- MEA 其餘地區

第 11 章:公司簡介

- Aermec

- Carrier Global Corporation

- Daikin Industries

- Dunham-Bush

- Emerson Electric

- Fujitsu General Limited

- Gree Electric Appliances

- Honeywell International

- Johnson Controls International

- Lennox International

- LG Electronics

- Mitsubishi Electric Corporation

- Samsung Electronics

- Trane Technologies

- TROX

The Global Fan Coil Unit Market was valued at USD 4.9 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 7.8 billion by 2034. This growth is primarily fueled by rising awareness about the importance of indoor air quality. As people spend a large portion of their time inside homes, offices, and other enclosed environments, concerns around air pollution and humidity control have become more prominent. Consumers are now looking for air conditioning solutions that not only cool or heat the air but also ensure cleaner, healthier indoor environments. FCUs equipped with high-performance air filtration and humidity regulation features are increasingly favored by both residential and commercial buyers. In environments such as offices, schools, and healthcare settings, better indoor air quality is closely linked with improved wellness and productivity, which further drives adoption.

Additionally, the trend of modernizing aging infrastructure to meet contemporary energy standards has created a strong demand for energy-efficient HVAC solutions like FCUs. As buildings remain one of the highest contributors to energy use globally, integrating efficient climate control systems has become essential for reducing energy footprints. Modern FCUs, particularly those integrated with smart technology, are gaining momentum as they offer enhanced control and automation features. Remote monitoring, occupancy-based settings, and integration with building management systems are making FCUs more attractive to facility managers and building owners. These intelligent systems help regulate energy usage more effectively, optimizing performance while minimizing operational expenses. They also offer real-time insights that allow for proactive maintenance and performance tuning, leading to long-term efficiency gains.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.9 Billion |

| Forecast Value | $7.8 Billion |

| CAGR | 4.8% |

By configuration, the fan coil unit market is segmented into two-pipe and four-pipe FCUs. Among these, the four-pipe segment accounted for the largest revenue share, valued at approximately USD 3 billion in 2024, and is expected to grow at a CAGR of 4.9% from 2025 to 2034. The ability of four-pipe systems to deliver both heating and cooling at the same time gives them a functional advantage in buildings with varied climate control needs across different zones. This flexibility enables building operators to maintain precise indoor temperatures tailored to specific spaces. These systems are particularly suitable for large-scale commercial or institutional facilities that require consistent comfort across multiple rooms or departments. Although the initial installation and equipment costs are relatively high, the superior thermal control and adaptability of four-pipe FCUs make them a preferred choice in advanced HVAC design.

When assessed by distribution channel, the market is divided into direct and indirect sales. The indirect sales segment held the dominant share in 2024, contributing roughly 63.6% of the overall revenue, and is forecasted to rise at a CAGR of 4.9% over the forecast period. The strength of this segment lies in its widespread network of intermediaries, including dealers, distributors, and retail partners. These channels help manufacturers expand their reach into diverse geographic locations and customer bases. Established relationships with local contractors, builders, and end-users make the sales cycle more efficient and responsive. Additionally, value-added services such as post-sale support, installation, and maintenance offered by distributors further enhance the attractiveness of this channel. Indirect sales also benefit from localized marketing strategies and in-depth market knowledge, which help boost brand visibility and customer trust in regional markets.

In the United States, the fan coil unit market surpassed USD 1 billion in value in 2024 and is projected to hit USD 1.6 billion by 2034. The increasing shift toward energy-efficient and sustainable building systems is a major factor behind this growth. FCUs are increasingly being incorporated into green building designs as they offer localized climate control, which contributes to significant energy savings compared to centralized HVAC systems. By optimizing temperature control at the room level, FCUs minimize energy waste and align with nationwide goals to promote sustainable building practices. This has made FCUs a vital component in the drive toward environmentally conscious infrastructure upgrades.

The global FCU market remains highly fragmented, with numerous regional players operating on an international level. Collectively, these companies account for approximately 10% to 15% of the total market share. Local firms often cater to specific regional demands, tailoring their offerings to meet local regulatory and building code requirements. They also provide customized solutions that appeal to regional preferences. On the other hand, global brands benefit from large-scale production, established international networks, and strong market credibility, enabling them to maintain competitiveness across multiple regions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technological overview

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increased awareness of indoor air quality

- 3.7.1.2 Rising urbanization

- 3.7.1.3 Technological advancements

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High initial costs

- 3.7.2.2 Regulatory and compliance issues

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Fan Coil Unit Market Estimates & Forecast, By Configuration, 2021 - 2032 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Two pipe fan coil unit

- 5.3 Four pipe fan coil unit

Chapter 6 Fan Coil Unit Market Estimates & Forecast, By Orientation, 2021 - 2032 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Horizontal

- 6.2.1 Wall mounted

- 6.2.2 Ducted blower type

- 6.2.3 Ceiling cassette type

- 6.2.4 Ceiling concealed type

- 6.3 Vertical (floor mounted)

Chapter 7 Fan Coil Unit Market Estimates & Forecast, By Air Flow, 2021 - 2032 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Below 500 m³/h

- 7.3 500 m³/h - 1000 m³/h

- 7.4 1000 m³/h - 1500 m³/h

- 7.5 1500 m³/h - 2000 m³/h

- 7.6 Above 2000 m³/h

Chapter 8 Fan Coil Unit Market Estimates & Forecast, By End Use, 2021 - 2032 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.3.1 Office spaces

- 8.3.2 Hotels

- 8.3.3 Restaurants

- 8.3.4 Hospitals

- 8.3.5 Retail

- 8.3.5.1 Supermarkets

- 8.3.5.2 Departmental stores

- 8.3.5.3 Brand outlet stores

- 8.3.6 Logistics (warehouse)

- 8.3.7 Others (manufacturing, etc.)

- 8.4 Industrial

Chapter 9 Fan Coil Unit Market Estimates & Forecast, By Distribution Channel, 2021 - 2032 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Fan Coil Unit Market Estimates & Forecast, By Region, 2021 - 2032 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Rest of Latin America

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Rest of MEA

Chapter 11 Company Profiles

- 11.1 Aermec

- 11.2 Carrier Global Corporation

- 11.3 Daikin Industries

- 11.4 Dunham-Bush

- 11.5 Emerson Electric

- 11.6 Fujitsu General Limited

- 11.7 Gree Electric Appliances

- 11.8 Honeywell International

- 11.9 Johnson Controls International

- 11.10 Lennox International

- 11.11 LG Electronics

- 11.12 Mitsubishi Electric Corporation

- 11.13 Samsung Electronics

- 11.14 Trane Technologies

- 11.15 TROX