|

市場調查報告書

商品編碼

1755317

穿戴式生物電子皮膚貼片市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Wearable Bioelectronic Skin Patches Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

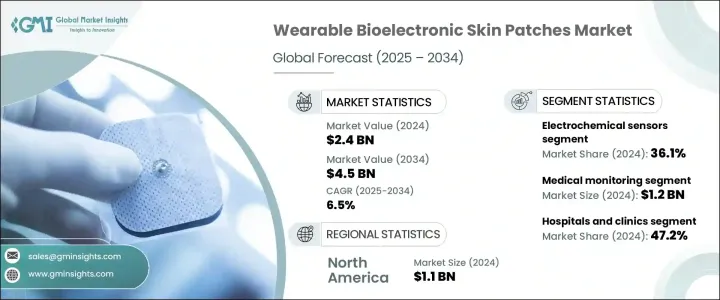

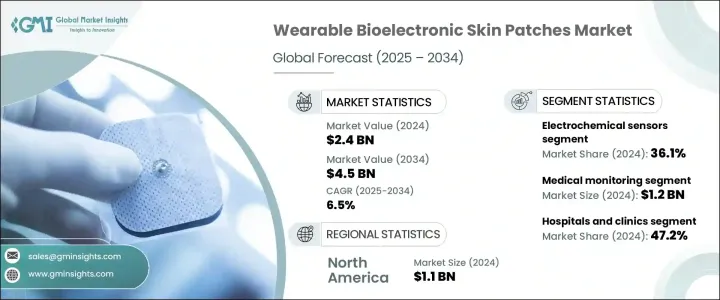

2024年,全球穿戴式生物電子皮膚貼片市場規模達24億美元,預計到2034年將以6.5%的複合年成長率成長,達到45億美元。這一成長源於對非侵入式即時健康監測解決方案日益成長的需求,這與全球醫療保健向更個人化和主動化的方向轉變的目標相契合。隨著人口老化和慢性病的日益普遍,對能夠實現持續居家監測的技術的需求也日益成長。穿戴式生物電子皮膚貼片貼附在皮膚上,可以無痛地追蹤生命徵象、生化指標和其他生理資料,無需就醫。

它們能夠無線傳輸資料,為遠距醫療、早期診斷和持續健康狀況管理(尤其針對慢性病患者)打開了大門。這項轉變與世界衛生組織(WHO)的《數位健康議程(2020-2025)》等國際策略高度契合,該議程倡導將科技融入醫療保健領域,以增強全民健康覆蓋。這些貼片的先進特性——例如靈活性、更長的電池壽命和多感測器功能——使其成為臨床和消費者健康應用的理想選擇,並有望在健身和醫療保健等多個領域中廣泛應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 24億美元 |

| 預測值 | 45億美元 |

| 複合年成長率 | 6.5% |

2024年,電化學感測器細分市場的佔有率為36.1%。隨著糖尿病和心臟病等慢性疾病的盛行率不斷上升,對持續性、非侵入性監測技術的需求也日益成長。電化學感測器使這些皮膚貼片能夠檢測各種生物標記物,從葡萄糖和乳酸到汗水和組織液中的電解質。這種持續監測為患者提供即時資料,使他們能夠更有效地管理自身健康和病情。電化學感測器靈敏度高,能夠及早發現和診斷健康問題,這是降低醫院再入院率的重要因素。這一趨勢標誌著家庭醫療保健管理方式的轉變,有助於改善疾病控制和生活品質。

2024年,醫院和診所在穿戴式生物電子皮膚貼片市場的佔有率為47.2%。這些貼片在醫療保健環境中的應用日益廣泛,用於持續監測心率、體溫和呼吸等生命徵象。穿戴式貼片取代了傳統的床邊設備,能夠更快地識別患者的變化並更及時地進行醫療干預。它們在重症監護病房和術後恢復區域非常有用,因為這些區域的持續監測至關重要。醫院也正在使用穿戴式貼片來簡化操作流程,減少文件錯誤,並減輕護理人員的負擔,從而改善患者護理並提高工作效率。

預計到 2034 年,美國穿戴式生物電子皮膚貼片市場規模將達到 18 億美元。這一成長歸因於糖尿病和高血壓等慢性病發病率的上升,以及人口老化。隨著慢性病日益普遍,穿戴式科技在醫療保健管理中發揮關鍵作用,尤其對於出院後患者或需要持續監測的老年人。美國醫療保險和醫療補助服務中心 (CMS) 擴大了遠距患者監測技術的報銷政策,這激勵了穿戴式生物電子貼片的採用,使其成為慢性病管理不可或缺的一部分。遠端監測特定計費代碼的引入,進一步支持了醫院和醫療機構使用穿戴式裝置帶來的市場成長。

全球穿戴式生物電子皮膚貼片市場的主要參與者包括雅培實驗室、Biolinq、Epicore Biosystems、Feeligreen、GE醫療、Gentag、久光製藥、Insulet、iRhythm Technologies、Kenzen、美敦力、Nemaura Medical、荷蘭皇家飛利浦、VivaLNK 和 3M。為鞏固市場地位,穿戴式生物電子皮膚貼片市場的公司正專注於幾項關鍵策略。這些措施包括投資研發以提高感測器的準確性、靈活性和電池壽命,使貼片更加可靠且方便用戶使用。公司正在與醫療保健提供者、保險公司和政府組織建立合作夥伴關係以滲透市場,特別是在慢性病管理和遠距醫療服務領域。此外,該公司正在透過整合資料分析、人工智慧健康洞察以及與現有醫療保健平台的無縫整合等高級功能來增加其產品供應。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 對非侵入性和即時健康監測解決方案的需求不斷成長

- 軟性和可拉伸電子產品的技術進步

- 慢性病盛行率不斷上升

- 提高健康意識和健身意識

- 產業陷阱與挑戰

- 開發和製造成本高

- 對資料隱私和安全的擔憂

- 成長動力

- 成長潛力分析

- 技術格局

- 未來市場趨勢

- 監管格局

- 專利分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 競爭市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 電化學感測器

- ECG 感測器

- 溫度感測器

- 肌電圖感測器

- 其他類型

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 健身與健康

- 醫療監護

- 其他應用

第7章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院和診所

- 居家照護環境

- 其他最終用戶

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 日本

- 中國

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Abbott Laboratories

- Biolinq

- Epicore Biosystems

- Feeligreen

- GE Healthcare

- Gentag

- Hisamitsu Pharmaceutical

- Insulet

- iRhythm Technologies

- Kenzen

- Medtronic

- Nemaura Medical

- Koninklijke Philips

- VivaLNK

- 3M

The Global Wearable Bioelectronic Skin Patches Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 4.5 billion by 2034. This growth is driven by the increasing demand for non-invasive, real-time health monitoring solutions, aligning with global healthcare goals to shift toward more personalized and proactive approaches. As populations age and chronic diseases become more prevalent, there is a greater need for technologies that enable continuous, at-home monitoring. Wearable bioelectronic skin patches, which adhere to the skin, allow for tracking vital signs, biochemical markers, and other physiological data painlessly and without the need for hospital visits.

Their ability to wirelessly transmit data opens the door for remote healthcare, early diagnosis, and ongoing management of health conditions, especially in chronic patients. This shift is closely aligned with international strategies like the WHO's digital health agenda (2020-2025), which advocates for the integration of technology in healthcare to enhance universal health coverage. The advanced features of these patches-such as flexibility, extended battery life, and multi-sensor capabilities-make them ideal for both clinical and consumer wellness applications, fostering adoption across multiple sectors, including fitness and healthcare.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $4.5 Billion |

| CAGR | 6.5% |

The electrochemical sensor segment held a share of 36.1% in 2024. As the prevalence of chronic diseases such as diabetes and heart disease increases, the demand for continuous, non-invasive monitoring technologies is growing. Electrochemical sensors enable these skin patches to detect a wide range of biomarkers, from glucose and lactate to electrolytes in sweat and interstitial fluid. This continuous monitoring provides patients with real-time data, empowering them to manage their health and conditions more effectively. Electrochemical sensors offer high sensitivity, allowing for early detection and diagnosis of health issues, which is a significant factor in reducing hospital readmission rates. This trend marks a shift in how healthcare is managed at home, improving both disease control and quality of life.

In 2024, the hospitals and clinics segment in the wearable bioelectronic skin patches market, accounting for 47.2%. These patches are increasingly being used in healthcare settings to continuously monitor vital signs such as heart rate, body temperature, and respiration. By eliminating the need for traditional bedside equipment, wearable patches enable quicker identification of patient changes and more timely medical interventions. They are useful in intensive care units and post-operative recovery areas, where continuous monitoring is essential. Hospitals are also using wearable patches to streamline operations, reduce documentation errors, and lessen the burden on nursing staff, allowing for improved patient care and efficiency.

United States Wearable Bioelectronic Skin Patches Market is expected to generate USD 1.8 billion by 2034. This growth is attributed to the increasing incidence of chronic diseases, such as diabetes and hypertension, coupled with an aging population. As chronic conditions become more common, wearable technology plays a key role in healthcare management, particularly for post-discharge patients or elderly individuals who require ongoing monitoring. The expansion of reimbursement policies by the Centers for Medicare and Medicaid Services (CMS) for remote patient monitoring technologies has incentivized the adoption of wearable bioelectronic patches, making them an integral part of chronic disease management. The introduction of specific billing codes for remote monitoring has further supported the market's growth through the use of wearable devices viable for hospitals and healthcare providers.

Key players in the Global Wearable Bioelectronic Skin Patches Market include Abbott Laboratories, Biolinq, Epicore Biosystems, Feeligreen, GE Healthcare, Gentag, Hisamitsu Pharmaceutical, Insulet, iRhythm Technologies, Kenzen, Medtronic, Nemaura Medical, Koninklijke Philips, VivaLNK, and 3M. To strengthen their market position, companies operating in the wearable bioelectronic skin patches market are focusing on several key strategies. These include investing in research and development to enhance sensor accuracy, flexibility, and battery life, making the patches more reliable and user-friendly. Partnerships with healthcare providers, insurance companies, and government organizations are being pursued for market penetration, especially in chronic care management and telehealth services. Additionally, companies are increasing their product offerings by incorporating advanced features such as data analytics, AI-powered health insights, and seamless integration with existing healthcare platforms.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for non-invasive and real-time health monitoring solutions

- 3.2.1.2 Technological advancements in flexible and stretchable electronics

- 3.2.1.3 Growing prevalence of chronic diseases

- 3.2.1.4 Increasing health awareness and fitness consciousness

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development and manufacturing costs

- 3.2.2.2 Concerns regarding data privacy and the security

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.5 Future market trends

- 3.6 Regulatory landscape

- 3.7 Patent analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Electrochemical sensors

- 5.3 ECG sensors

- 5.4 Temperature sensors

- 5.5 EMG sensors

- 5.6 Other types

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Fitness and wellness

- 6.3 Medical monitoring

- 6.4 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals and clinics

- 7.3 Home care settings

- 7.4 Other end users

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Mexico

- 8.5.2 Brazil

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Biolinq

- 9.3 Epicore Biosystems

- 9.4 Feeligreen

- 9.5 GE Healthcare

- 9.6 Gentag

- 9.7 Hisamitsu Pharmaceutical

- 9.8 Insulet

- 9.9 iRhythm Technologies

- 9.10 Kenzen

- 9.11 Medtronic

- 9.12 Nemaura Medical

- 9.13 Koninklijke Philips

- 9.14 VivaLNK

- 9.15 3M