|

市場調查報告書

商品編碼

1755316

太空網路安全市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Space Cybersecurity Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

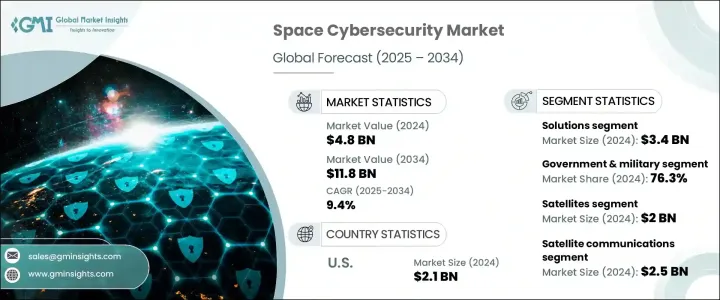

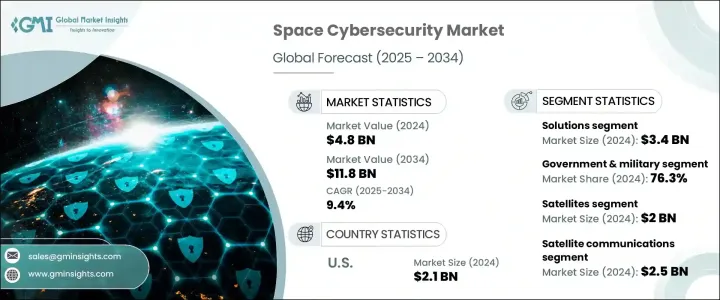

2024年,全球太空網路安全市場規模達48億美元,預計2034年將以9.4%的複合年成長率成長,達到118億美元。這得益於政府和國防機構加大對太空網路安全計畫的投資,以及商業太空運作的持續成長。隨著太空領域戰略意義日益增強,保護軌道數位基礎設施已成為國家乃至全球的優先事項。公營和私營實體紛紛部署網路安全解決方案,以保護敏感的衛星網路、通訊系統和關鍵任務太空資產。隨著軌道技術的發展以及軍事和商業平台網路攻擊威脅的加劇,太空運作對端到端保護的需求持續成長。

隨著戰略國防政策不斷推進太空系統的現代化,軌道資產的網路保護成為優先事項。對衛星通訊和太空監視的日益依賴,使得保護這些系統免受網路漏洞攻擊成為迫切需求。早期的關稅政策推高了加密系統和安全通訊硬體等關鍵部件的價格,導致該行業承受巨大的成本壓力。這些關稅影響了美國公司從主要國際供應商的採購,並增加了美國公司的營運成本,影響了它們的定價結構和交貨時間。同時,全球供應鏈的不穩定導致衛星和關鍵任務基礎設施的關鍵網路安全解決方案的部署長期延遲。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 48億美元 |

| 預測值 | 118億美元 |

| 複合年成長率 | 9.4% |

2024年,解決方案板塊價值34億美元,隨著對保護衛星、任務電腦和太空通訊系統免受新興網路威脅的複雜工具的需求激增,該板塊呈現強勁成長勢頭。加密硬體、先進的網路安全平台和安全通訊協定等技術如今對於確保在軌無縫安全運作至關重要。隨著全球商業和國防衛星發射數量的增加,對強大、可擴展且專業的安全解決方案的需求也迅速成長。

按最終用途細分,政府和軍事領域在2024年佔據了76.3%的佔有率,凸顯了其主導地位。該領域的領先地位歸因於通訊、監視和國家安全行動對安全加密的衛星系統的日益依賴。針對國防基礎設施的網路攻擊促使國家機構在網路安全方面投入更多預算。日益複雜的威脅和地緣政治的不確定性,使得國防組織必須採用整合的分層安全架構。

預計到2034年,德國太空網路安全市場將以9.6%的複合年成長率成長,這得益於其在航太製造業的領先地位以及對太空基礎設施網路保護的持續重視。國家機構在衛星通訊、地球觀測和太空研究方面的投資持續推動需求。德國致力於將網路安全融入商業和國防航太計劃,這正在創造穩定持續的市場成長。

塑造競爭格局的關鍵參與者包括RTX公司、泰雷茲集團、洛克希德·馬丁公司和諾斯羅普·格魯曼公司。這些公司正透過多項重點策略提升其市場地位。他們投資研發,打造專為太空應用量身打造的下一代網路安全系統。許多公司正在與國防機構建立戰略聯盟,以確保長期契約,從而確保穩定的收入流。此外,各公司正在提升其國內生產能力,以減少對動盪的全球供應鏈的依賴。採用人工智慧驅動的安全平台和預測性威脅偵測模型,可以提高太空任務的即時回應能力和長期韌性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響

- 價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 衝擊力

- 成長動力

- 政府和軍事投資

- 太空資產面臨的威脅日益加劇

- 商業空間活動的擴展

- 全球太空探索努力

- 太空交通量增加

- 產業陷阱與挑戰

- 實施成本高

- 缺乏熟練的網路安全專業人員

- 成長動力

- 成長潛力分析

- 科技與創新格局

- 重要新聞和舉措

- 未來市場趨勢

- 波特的分析

- PESTEL分析

- 監管格局

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依發行量,2021 - 2034 年

- 主要趨勢

- 解決方案

- 網路安全

- 端點和物聯網安全

- 應用程式安全

- 雲端安全

- 資料保護

- 身分和存取管理 (IAM)

- 其他

- 服務

- 託管服務

- 專業服務

第6章:市場估計與預測:依平台,2021 - 2034 年

- 主要趨勢

- 衛星

- 運載火箭

- 地面站

- 航太港和發射設施

- 指揮與控制中心

- 其他

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 衛星通訊

- 地球觀測

- 導航

- 太空探索

- 其他

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 政府和軍隊

- 商業的

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Airbus

- BAE Systems

- Boeing

- Booz Allen Hamilton Inc.

- CYSEC

- General Dynamics

- Kratos Defense & Security Solutions, Inc.

- L3Harris Technologies, Inc.

- Leidos

- Leonardo SpA

- Lockheed Martin Corporation

- Microsoft

- Northrop Grumman

- OHB Digital Connect GmbH

- RTX Corporation

- SpiderOak Inc.

- Thales Group

- Xage Security

The Global Space Cybersecurity Market was valued at USD 4.8 billion in 2024 and is estimated to grow at a CAGR of 9.4% to reach USD 11.8 billion by 2034, fueled by increased investments in space-focused cybersecurity initiatives from government and defense bodies, alongside the ongoing rise in commercial space operations. As space becomes an increasingly strategic domain, securing digital infrastructure in orbit has become a national and global priority. Public and private entities deploy cybersecurity solutions to protect sensitive satellite networks, communications systems, and mission-critical space assets. The demand for end-to-end protection in space operations continues to grow as orbital technologies evolve and the threat of cyber-attacks intensifies across both military and commercial platforms.

As strategic defense policies continue to modernize space systems, cyber protection of orbital assets is prioritized. The rising dependency on satellite communication and space surveillance has created a critical need to shield these systems from cyber vulnerabilities. The industry experienced significant cost pressures due to earlier tariff policies, which drove up prices for essential components like encryption systems and secure communications hardware. These tariffs affected sourcing from major international suppliers and increased operational costs for US-based companies, impacting their pricing structures and delivery timelines. Simultaneously, global supply chain instability led to prolonged deployment delays of key cybersecurity solutions for satellite and mission-critical infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.8 Billion |

| Forecast Value | $11.8 Billion |

| CAGR | 9.4% |

In 2024, the solutions segment was valued at USD 3.4 billion witnessing strong momentum as demand surges for sophisticated tools that can secure satellites, mission computers, and space communications systems from emerging cyber threats. Technologies such as encryption hardware, advanced cybersecurity platforms, and secure communication protocols are now critical to ensuring seamless and safe operations in orbit. With commercial and defense satellite launches increasing globally, the need for robust, scalable, and specialized security solutions is rapidly expanding.

When segmented by end-use, the government and military segment accounted for a 76.3% share in 2024, highlighting its dominance. The segment's lead is attributed to growing reliance on secure, encrypted satellite-based systems for communication, surveillance, and national security operations. Cyberattacks targeting defense infrastructure have pushed state agencies to allocate higher budgets toward cybersecurity. The increasing complexity of threats and geopolitical uncertainty has made it essential for defense organizations to adopt integrated and layered security architectures.

Germany Space Cybersecurity Market is expected to grow at a CAGR of 9.6% through 2034, backed by its leadership in aerospace manufacturing and continued emphasis on cyber protection within space infrastructure. Investments from national agencies in satellite communications, earth observation, and space research continue to drive demand. Germany's focus on integrating cybersecurity across both commercial and defense aerospace initiatives is creating steady and sustained market growth.

Key players shaping the competitive landscape include RTX Corporation, Thales Group, Lockheed Martin Corporation, and Northrop Grumman. These companies are advancing their market presence through several focused strategies. They invest in R&D to create next-generation cybersecurity systems tailored for space applications. Many are forming strategic alliances with defense agencies to secure long-term contracts, ensuring consistent revenue flow. Additionally, companies are enhancing their domestic production capabilities to reduce reliance on volatile global supply chains. Adopting AI-powered security platforms and predictive threat detection models, improve real-time response capabilities and long-term resilience for space missions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 key companies impacted

- 3.2.4 strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Government and military investments

- 3.3.1.2 Rising threats to space assets

- 3.3.1.3 Expansion of commercial space activities

- 3.3.1.4 Global space exploration efforts

- 3.3.1.5 Increased space traffic

- 3.3.2 Industry pitfalls & challenges

- 3.3.2.1 High costs of implementation

- 3.3.2.2 Shortage of skilled cybersecurity professionals

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Technological & innovation landscape

- 3.6 Key news and initiatives

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Regulatory landscape

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Offerings, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Solutions

- 5.2.1 Network security

- 5.2.2 Endpoint and IoT security

- 5.2.3 Application security

- 5.2.4 Cloud security

- 5.2.5 Data protection

- 5.2.6 Identity and access management (IAM)

- 5.2.7 Others

- 5.3 Services

- 5.3.1 Managed services

- 5.3.2 Professional services

Chapter 6 Market Estimates & Forecast, By Platform, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Satellites

- 6.3 Launch vehicles

- 6.4 Ground stations

- 6.5 Spaceports & launch facilities

- 6.6 Command & control centers

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Satellite communications

- 7.3 Earth observation

- 7.4 Navigation

- 7.5 Space exploration

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 Government & military

- 8.3 Commercial

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Airbus

- 10.2 BAE Systems

- 10.3 Boeing

- 10.4 Booz Allen Hamilton Inc.

- 10.5 CYSEC

- 10.6 General Dynamics

- 10.7 Kratos Defense & Security Solutions, Inc.

- 10.8 L3Harris Technologies, Inc.

- 10.9 Leidos

- 10.10 Leonardo S.p.A.

- 10.11 Lockheed Martin Corporation

- 10.12 Microsoft

- 10.13 Northrop Grumman

- 10.14 OHB Digital Connect GmbH

- 10.15 RTX Corporation

- 10.16 SpiderOak Inc.

- 10.17 Thales Group

- 10.18 Xage Security