|

市場調查報告書

商品編碼

1755312

國防電子淘汰市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Defense Electronics Obsolescence Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

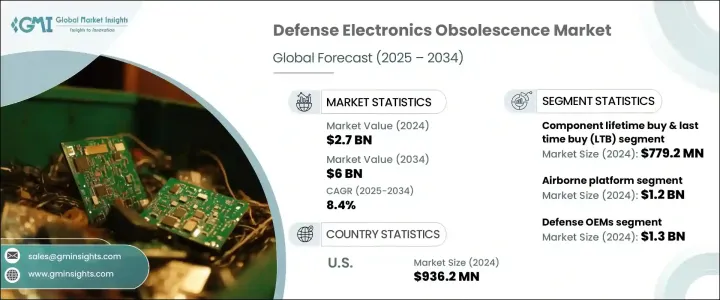

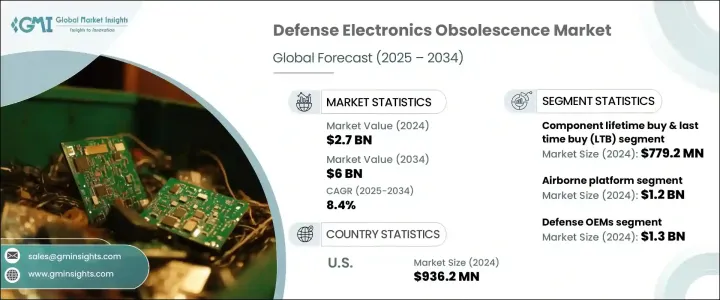

2024年,全球國防電子產品淘汰市場價值27億美元,預計到2034年將以8.4%的複合年成長率成長,達到60億美元,這得益於全球國防預算的不斷成長以及數位孿生技術和預測分析應用的日益普及。隨著軍隊持續現代化,同時嚴重依賴長期服役的平台,為老化的電子元件系統提供支援的需求變得至關重要。永續性、系統升級和元件相容性方面的努力不斷加強,這推動了對生命週期管理和緩解電子元件淘汰解決方案的需求。同時,旨在增強工業基礎韌性的採購改革和策略正在鼓勵整個國防工業的國內採購和數位轉型。

多年來,結構現代化策略和遺留系統的持續使用促使人們更加重視舊電子設備的維護和支援。推廣主動生命週期管理的政策催生了更靈活、技術更先進的電子元件報廢預測方法。對平台壽命的重視催生了強大的DMSMS(減少製造來源和材料短缺)計畫。由於國防平台的服役週期長達數十年,較短的組件生命週期與較長的系統壽命之間的不匹配使得報廢管理至關重要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 27億美元 |

| 預測值 | 60億美元 |

| 複合年成長率 | 8.4% |

2024年,組件生命週期和最後一次購買 (LTB) 細分市場的價值為7.792億美元。這些策略有助於滿足日益成長的對舊系統支援的需求,尤其是在國防平台普遍使用商用現貨 (COTS) 零件的情況下。由於電子組件的生命週期通常限制在5-10年,生命週期和最後一次購買策略有助於彌補與可能服役超過40年的平台之間的差距。地緣政治不確定性、出口限制和半導體短缺加速了對LTB策略的依賴,以避免供應中斷。

2024年,機上平台市場價值達12億美元。隨著對延長空中平台使用壽命的需求不斷成長,推動了對航空電子設備、雷達系統和電子戰 (EW) 升級的投資。將新技術整合到現有系統所帶來的相容性挑戰,加劇了對外形尺寸和功能匹配的替換以及傳統組件模擬的需求。此外,無人機和支援飛機依賴COTS零件以降低成本,這使其容易過早淘汰,並依賴強大的售後市場採購。

2024年,美國國防電子產品淘汰市場規模達9.362億美元,主因是軍用艦隊老化,需要持續維護過時的電子系統。國防機構對維護計畫和現代化措施的投資,以及預測分析和數位孿生技術的快速實施,正在推動市場向前發展。

市場上的知名企業包括 Lynx、RTX、Thales Group、SMT Corp、Mercury Systems、Leonardo、Northrop Grumman、Boeing Defense、Teledyne Technologies、TT Electronics、Lockheed Martin、Saab RDS、L3Harris Technologies、Rheinmetall、AT Engine Controls 和 Bae Systems。為了鞏固市場地位,國防電子報廢市場正在採取多項關鍵策略,包括爭取長期政府契約,以及強調終身採購和最後一次採購,以確保零件的供應。許多企業正在大力投資人工智慧預測和數位孿生等數位工具,以改善報廢預測能力。此外,各供應鏈之間的合作也正在加強,以減少對外國來源的依賴。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響

- 關鍵零件價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重構

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 老化的軍事平台

- 增加國防預算

- 電子技術進步

- 地緣政治緊張局勢與威脅現代化

- 數位孿生和預測分析的採用日益增多

- 產業陷阱與挑戰

- 有限的預測工具

- 智慧財產權(IP)限制

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按解決方案類型,2021 - 2034 年

- 主要趨勢

- 過時監控和預測

- 組件終身購買和最後一次購買 (LTB)

- 重新設計與改造解決方案

- 仿真與模擬

- 替代採購(售後市場、經紀人)

- 軟體和韌體更新

第6章:市場估計與預測:按平台,2021 - 2034 年

- 主要趨勢

- 空降

- 海軍

- 土地

- 空間

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 國防原始設備製造商

- MRO 提供者

- 政府和國防機構

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- AT Engine Controls

- Bae Systems

- Boeing Defense

- L3Harris Technologies

- Leonardo

- Lockheed Martin

- Lynx

- Mercury Systems

- Northrop Grumman

- Rheinmetall

- RTX

- Saab RDS

- SMT Corp

- Teledyne Technologies

- Thales Group

- TT Electronics

The Global Defense Electronics Obsolescence Market was valued at USD 2.7 billion in 2024 and is estimated to grow at a CAGR of 8.4% to reach USD 6 billion by 2034, driven by a rising global defense budget and the increasing use of digital twin technology and predictive analytics. As military forces continue modernizing while relying heavily on long-serving platforms, the need to support aging systems with obsolete electronic components has become critical. Efforts toward sustainability, system upgrades, and component compatibility have intensified, prompting demand for lifecycle management and obsolescence mitigation solutions. In parallel, procurement reforms and strategies aimed at reinforcing industrial base resilience are encouraging domestic sourcing and digital transformation across the defense sector.

Over the years, structural modernization strategies and the continued use of legacy systems have prompted increased focus on maintaining and supporting older electronics. Policies promoting proactive lifecycle management have led to a more agile and technologically advanced approach to forecasting electronic component obsolescence. The emphasis on platform longevity has resulted in robust DMSMS (Diminishing Manufacturing Sources and Material Shortages) programs. As defense platforms remain active for decades, the mismatch between short component life cycles and long system lifespans has made obsolescence management essential.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.7 Billion |

| Forecast Value | $6 Billion |

| CAGR | 8.4% |

The component lifetime and last-time buy (LTB) segment was valued at USD 779.2 million in 2024. These strategies help address the growing need to secure legacy system support, especially as commercial off-the-shelf (COTS) parts are used across defense platforms. With electronic component lifecycles often limited to 5-10 years, lifetime and last-time buys help bridge the gap with platforms that may remain in service for over four decades. Geopolitical uncertainties, restricted exports, and semiconductor shortages accelerate reliance on LTB strategies to avoid supply disruptions.

The airborne platform segment was valued at USD 1.2 billion in 2024. Increased demand for extended service life of air platforms has fueled investments in avionics, radar systems, and electronic warfare (EW) upgrades. Compatibility challenges with integrating newer technologies into existing systems have amplified the need for form-fit-function replacements and legacy component emulation. Additionally, UAVs and support aircraft depend on COTS parts for affordability, making them vulnerable to early obsolescence and dependent on strong aftermarket sourcing.

United States Defense Electronics Obsolescence Market generated USD 936.2 million in 2024 driven by an aging military fleet that requires constant support for outdated electronic systems. Investments in sustainment programs and modernization initiatives, alongside the rapid implementation of predictive analytics and digital twin technologies by defense agencies, are pushing the market forward.

The prominent players in the market include Lynx, RTX, Thales Group, SMT Corp, Mercury Systems, Leonardo, Northrop Grumman, Boeing Defense, Teledyne Technologies, TT Electronics, Lockheed Martin, Saab RDS, L3Harris Technologies, Rheinmetall, AT Engine Controls, and Bae Systems. To strengthen its market foothold, the Defense Electronics Obsolescence Market is adopting several key strategies. These include securing long-term government contracts and emphasizing lifetime and last-time buys to ensure component availability. Many are investing heavily in digital tools like AI-powered forecasting and digital twins to improve obsolescence prediction. Collaborations across supply chains are being strengthened to reduce dependency on foreign sources.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 industry ecosystem analysis

- 3.2 trump administration tariffs

- 3.2.1 impact on trade

- 3.2.1.1 trade volume disruptions

- 3.2.1.2 retaliatory measures

- 3.2.2 impact on the industry

- 3.2.2.1 supply-side impact

- 3.2.2.1.1 price volatility in key components

- 3.2.2.1.2 supply chain restructuring

- 3.2.2.1.3 production cost implications

- 3.2.2.2 demand-side impact (selling price)

- 3.2.2.2.1 price transmission to end markets

- 3.2.2.2.2 market share dynamics

- 3.2.2.2.3 consumer response patterns

- 3.2.2.1 supply-side impact

- 3.2.3 key companies impacted

- 3.2.4 strategic industry responses

- 3.2.4.1 supply chain reconfiguration

- 3.2.4.2 pricing and product strategies

- 3.2.4.3 policy engagement

- 3.2.5 outlook and future considerations

- 3.2.1 impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Aging military platforms

- 3.3.1.2 Increasing defense budgets

- 3.3.1.3 Technological advancement in electronics

- 3.3.1.4 Geopolitical tensions & threat modernization

- 3.3.1.5 Growing adoption of digital twin & predictive analytics

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Limited forecasting tools

- 3.3.2.2 Intellectual property (IP) restrictions

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Solution Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Obsolescence monitoring & forecasting

- 5.3 Component lifetime buy & last-time buy (LTB)

- 5.4 Redesign & retrofit solutions

- 5.5 Emulation & simulation

- 5.6 Alternative sourcing (aftermarket, brokers)

- 5.7 Software & firmware updates

Chapter 6 Market Estimates and Forecast, By Platform, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Airborne

- 6.3 Naval

- 6.4 Land

- 6.5 Space

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Defense OEMs

- 7.3 MRO providers

- 7.4 Government & defense agencies

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AT Engine Controls

- 9.2 Bae Systems

- 9.3 Boeing Defense

- 9.4 L3Harris Technologies

- 9.5 Leonardo

- 9.6 Lockheed Martin

- 9.7 Lynx

- 9.8 Mercury Systems

- 9.9 Northrop Grumman

- 9.10 Rheinmetall

- 9.11 RTX

- 9.12 Saab RDS

- 9.13 SMT Corp

- 9.14 Teledyne Technologies

- 9.15 Thales Group

- 9.16 TT Electronics