|

市場調查報告書

商品編碼

1755306

眼科顯微鏡市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Ophthalmic Microscopes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

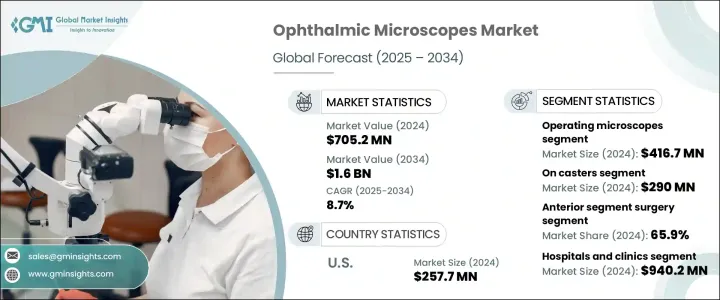

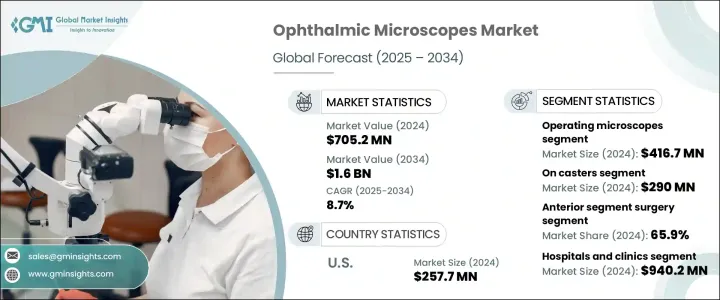

2024年,全球眼科顯微鏡市場規模達7.052億美元,預計年複合成長率將達8.7%,2034年將達到16億美元。這一大幅成長得益於眼科設備技術的不斷進步、老年人口的不斷成長以及人們對微創眼科手術日益成長的偏好。白內障、青光眼和老年性黃斑部病變等眼科疾病的日益流行,加速了先進外科手術的需求。

現代眼科顯微鏡現已配備3D視覺化、光學相干斷層掃描 (OCT) 和擴增實境疊加技術,可提高手術精確度、增強訓練效果並縮短手術時間。隨著對設備精良、符合人體工學設計的手術器械的需求日益成長,這些配備高精度光學系統的顯微鏡也不斷發展,功能更加多樣,並在診所和醫院中廣泛應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7.052億美元 |

| 預測值 | 16億美元 |

| 複合年成長率 | 8.7% |

這些設備對於各種眼科手術至關重要,尤其是涉及眼前節和後節的手術。透過為外科醫生提供高解析度的放大影像,它們有助於執行精準複雜的手術,例如白內障摘除術、角膜移植、視網膜手術和青光眼治療。能夠清楚地觀察角膜、水晶體、視網膜和玻璃體等精細結構,使外科醫生能夠以無與倫比的精確度執行這些手術。這種高清成像技術確保即使是最複雜的手術也能以最小的風險進行,從而降低出錯的可能性並改善患者的預後。

2024年,手術顯微鏡市場規模達4.167億美元,領先市場。隨著與年齡相關的眼部疾病發生率的上升,尤其是在老年人群中,眼科手術的需求激增。此外,門診和日間手術的流行也推動了對緊湊、移動和多功能手術顯微鏡的需求。這些顯微鏡採用模組化組件設計,易於維護和移動,是門診手術中心的理想選擇。它們易於運輸並在各個診所使用,這與醫療保健領域對靈活、經濟高效的解決方案日益成長的需求相契合。

醫院和診所細分市場在2024年佔據最大佔有率,預計到2034年將達到9.402億美元。隨著專業眼科服務需求的成長,許多醫院和多專科診所正在設立專門的眼科科室,這些科室需要先進的手術顯微鏡來進行各種眼科手術。隨著城市醫療基礎設施(尤其是醫療中心)投資的增加,眼科顯微鏡的購買量顯著增加。這些醫療中心優先考慮能夠確保高手術準確性、安全性和整體患者療效的設備。眼科顯微鏡不僅可以增強可視化效果,還可以最大限度地減少手術失誤和術後併發症,從而推動了其需求。

2024年,美國眼科顯微鏡市場規模達2.577億美元。白內障、青光眼和老年性黃斑部病變等眼科疾病發生率的上升,推動了對這些先進設備的需求。此外,美國對白內障手術的優惠報銷政策,也支持醫療保健機構採用高階手術系統。這種報銷結構加速了對眼科手術新技術的投資,簡化了成本回收。此外,美國是眼科顯微鏡市場領先製造商和創新者的聚集地。

全球眼科顯微鏡市場的知名公司包括蔡司、愛爾康、HAAG-STREIT GROUP、HAI Laboratories、Inami、KARL KAPS、Keeler、LABOMED、徠卡、MOPTIM、Reichert、Rexxam、TAKAGI 和 TOPCON。在眼科顯微鏡市場,各公司正在採用多種關鍵策略來鞏固其地位。這些措施包括不斷創新產品功能,例如增強的數位整合、3D 成像功能和人體工學設計,以滿足不斷變化的手術需求。製造商正在投資先進技術,以提高顯微鏡的功能和精度,使其成為眼科手術不可或缺的工具。為了擴大市場佔有率,許多公司正在與醫療機構和診所建立策略夥伴關係和合作關係。此外,該公司還瞄準新興市場,提供符合當地醫療保健需求且確保卓越品質的經濟高效的型號。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 眼科疾病盛行率上升

- 微創眼科手術的採用日益增多

- 技術進步

- 白內障和屈光手術數量激增

- 產業陷阱與挑戰

- 先進的眼科顯微鏡成本高昂

- 嚴格的監管要求

- 成長動力

- 成長潛力分析

- 監管格局

- 美國

- 歐洲

- 技術格局

- 報銷場景

- 定價分析

- 產品對比展望

- 波特的分析

- PESTEL分析

- 差距分析

- 價值鏈分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 手術顯微鏡

- 檢查顯微鏡

第6章:市場估計與預測:按方式,2021 - 2034 年

- 主要趨勢

- 帶腳輪

- 天花板式

- 桌面

- 壁掛式

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 前段手術

- 白內障手術

- 屈光手術

- 青光眼手術

- 角膜手術

- 雷射眼科手術

- 後段手術

- 血管切除術

- 視網膜剝離修復

- 黃斑裂孔修復

- 黃斑病變手術

- 後鞏膜切除術

- 放射狀視神經切開術

- 黃斑移位手術

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院和診所

- 門診手術中心

- 其他最終用途

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- ZEISS

- Alcon

- HAAG-STREIT GROUP

- HAI Laboratories

- Inami

- KARL KAPS

- Keeler

- LABOMED

- Leica

- MOPTIM

- Reichert

- Rexxam

- TAKAGI

- TOPCON

The Global Ophthalmic Microscopes Market was valued at USD 705.2 million in 2024 and is estimated to grow at a CAGR of 8.7% to reach USD 1.6 billion by 2034. The substantial growth can be attributed to the rising technological advancements in ophthalmic equipment, the increasing geriatric population, and the growing preference for minimally invasive ophthalmic surgeries. The prevalence of eye-related conditions like cataracts, glaucoma, and age-related macular degeneration is accelerating the demand for advanced surgical interventions.

Modern ophthalmic microscopes now feature 3D visualization, optical coherence tomography (OCT), and augmented reality overlays that improve the precision of surgeries, enhance training, and reduce surgical time. As the demand for better-equipped, ergonomically designed surgical instruments increases, these microscopes, with their high-precision optics, continue to evolve, becoming more multifunctional and widely adopted across clinics and hospitals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $705.2 Million |

| Forecast Value | $1.6 Billion |

| CAGR | 8.7% |

These devices are essential for a wide range of ophthalmic surgeries, particularly those involving both the anterior and posterior segments of the eye. By providing surgeons with high-resolution, magnified images, they facilitate precise and intricate procedures, such as cataract removal, corneal transplants, retinal surgeries, and glaucoma treatments. The ability to visualize delicate structures, such as the cornea, lens, retina, and vitreous, allows surgeons to perform these operations with unparalleled accuracy. This high-definition imaging ensures that even the most complex surgeries are conducted with minimal risk, reducing the likelihood of errors and improving patient outcomes.

In 2024, the operating microscope segment led the market, generating USD 416.7 million. With the increasing incidence of age-related eye diseases, particularly among the elderly, the demand for ophthalmic surgeries has surged. Moreover, the trend toward outpatient and daycare surgeries is driving the need for compact, mobile, and versatile operating microscopes. These microscopes are designed with modular components for easy maintenance and mobility, making them ideal for ambulatory surgery centers. Their ability to be easily transported and used across various clinics aligns with the growing need for flexible, cost-effective solutions in the healthcare sector.

The hospitals and clinics segment held the largest share in 2024 and is expected to reach USD 940.2 million by 2034. As demand for specialized ophthalmology services rises, many hospitals and multi-specialty clinics are establishing dedicated ophthalmic units, which require advanced surgical microscopes for a variety of eye procedures. With increasing investments in urban healthcare infrastructure, particularly in healthcare hubs, there has been a marked rise in the purchase of ophthalmic microscopes. These medical centers prioritize equipment that ensures high surgical accuracy, safety, and overall patient outcomes. Ophthalmic microscopes not only enhance visualization but also minimize surgical errors and postoperative complications, driving their demand.

U.S. Ophthalmic Microscopes Market was valued at USD 257.7 million in 2024. The rising incidence of ophthalmic conditions such as cataracts, glaucoma, and age-related macular degeneration is boosting the demand for these advanced devices. Furthermore, favorable reimbursement policies for cataract surgeries in the U.S. support the adoption of high-end surgical systems by healthcare providers. This reimbursement structure accelerates the investment in new technologies for ophthalmic procedures, streamlining cost recovery. Additionally, the U.S. serves as a hub for leading manufacturers and innovators in the ophthalmic microscopes market.

Prominent companies operating in the Global Ophthalmic Microscopes Market include ZEISS, Alcon, HAAG-STREIT GROUP, HAI Laboratories, Inami, KARL KAPS, Keeler, LABOMED, Leica, MOPTIM, Reichert, Rexxam, TAKAGI, and TOPCON. In the ophthalmic microscopes market, companies are employing several key strategies to solidify their positions. These include ongoing innovation in product features, such as enhanced digital integration, 3D imaging capabilities, and ergonomic designs, to cater to evolving surgical needs. Manufacturers are investing in advanced technologies to improve the functionality and precision of microscopes, making them indispensable tools for eye surgeries. To expand market share, many companies are forming strategic partnerships and collaborations with healthcare institutions and clinics. Additionally, firms are targeting emerging markets with cost-effective models that meet local healthcare demands while ensuring superior quality.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of ophthalmic disorders

- 3.2.1.2 Growing adoption of minimally invasive ophthalmic surgeries

- 3.2.1.3 Technological advancements

- 3.2.1.4 Surge in cataract and refractive surgery volumes

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with advanced ophthalmic microscopes

- 3.2.2.2 Stringent regulatory requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Pricing analysis

- 3.8 Product comparison outlook

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Gap analysis

- 3.12 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Operating microscopes

- 5.3 Examination microscopes

Chapter 6 Market Estimates and Forecast, By Modality, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 On casters

- 6.3 Ceiling-mounted

- 6.4 Table-top

- 6.5 Wall-mounted

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Anterior segment surgery

- 7.2.1 Cataract surgery

- 7.2.2 Refractive surgery

- 7.2.3 Glaucoma surgery

- 7.2.4 Corneal surgery

- 7.2.5 Laser eye surgery

- 7.3 Posterior segment surgery

- 7.3.1 Virectomy

- 7.3.2 Retinal detachment repair

- 7.3.3 Macular hole repair

- 7.3.4 Maculopathy surgery

- 7.3.5 Posterior scelerectomy

- 7.3.6 Radial optic neurotomy

- 7.3.7 Macular translocaion surgery

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals and clinics

- 8.3 Ambulatory surgical centres

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ZEISS

- 10.2 Alcon

- 10.3 HAAG-STREIT GROUP

- 10.4 HAI Laboratories

- 10.5 Inami

- 10.6 KARL KAPS

- 10.7 Keeler

- 10.8 LABOMED

- 10.9 Leica

- 10.10 MOPTIM

- 10.11 Reichert

- 10.12 Rexxam

- 10.13 TAKAGI

- 10.14 TOPCON