|

市場調查報告書

商品編碼

1755300

硬質工業包裝市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Rigid Industrial Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

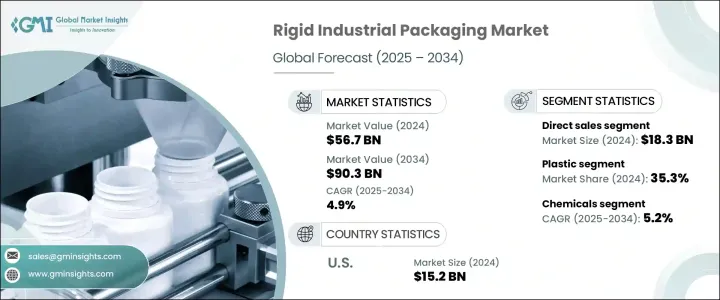

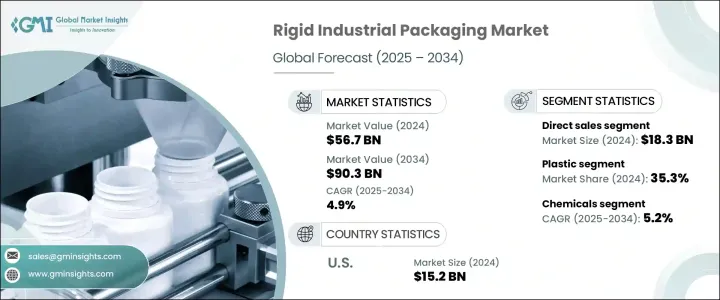

2024年,全球硬質工業包裝市場價值為567億美元,預計到2034年將以4.9%的複合年成長率成長,達到903億美元,這主要得益於化工、汽車、製藥和食品加工等關鍵行業的持續需求。中型散裝容器 (IBC)、圓桶和桶等硬質包裝解決方案在安全高效地運輸危險和非危險材料方面繼續發揮至關重要的作用。

化學品出口的不斷成長以及全球危險物質運輸法規的日益嚴格,為該行業的長期成長提供了支撐。這些轉變促使企業投資於高效能、耐用的包裝解決方案,這些解決方案既符合合規標準,又能確保成本效益和永續性。儘管對進口鋁和鋼徵收的關稅提高了生產成本並擾亂了供應鏈,但市場已透過重新調整定價策略和探索國內採購來適應變化。行業發展和強勁的跨行業整合為全球硬包裝生產商保持了強勁的發展勢頭。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 567億美元 |

| 預測值 | 903億美元 |

| 複合年成長率 | 4.9% |

隨著汽車、農業、石化和建築等行業的擴張,對耐用、安全且經濟高效的包裝解決方案的需求也隨之成長。這些產業需要能夠在極端環境條件下維持產品完整性的大容量運輸和儲存系統,這使得硬包裝不可或缺。此外,全球製造生態系統的整合也促進了包裝形式的標準化,簡化了物流流程,並提高了營運效率。

2023年,桶裝容器市場產值達154億美元,反映出其作為石油和化學工業液體產品首選容器的穩固地位。這些桶裝容器安全可靠、可堆疊、可重複使用,符合安全法規,尤其適用於散裝運輸。它們因其在儲存、搬運和運輸應用中的強度和效率而備受推崇。

預計到2024年,塑膠基硬質包裝市場將貢獻35.3%的佔有率。塑膠的受歡迎程度源自於其耐腐蝕性、輕質性以及在食品和化學品等終端使用領域的適應性。可回收和環保塑膠的創新進一步鞏固了其市場地位,這與對永續工業包裝替代品日益成長的需求相一致。

2024年,美國硬質工業包裝市場價值達152億美元,主要驅動力來自製藥和化學工業,這些產業高度依賴高完整性包裝。美國對環保材料的重視以及先進物流基礎設施的不斷擴張,為可重複使用的硬質包裝創造了有利條件。完善的基礎設施和數位化的運輸網路,將助力符合環保和營運目標的高性能包裝的廣泛應用。

該領域的領先企業包括SCHUTZ GmbH & Co. KGaA、Mauser Packaging Solutions和Greif, Inc.。為了在硬質工業包裝市場保持競爭優勢,各公司優先考慮可重複使用和永續材料的創新,同時增強其全球供應鏈的韌性。他們投資智慧包裝技術和自動化製造流程,以提高效率並降低營運成本。與化學、食品和製藥行業的關鍵客戶建立合作夥伴關係,使我們能夠開發符合特定合規性和安全標準的客製化產品。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 新興經濟體工業化進程不斷加速

- 化工和石化產業蓬勃發展

- 永續性和可重複使用性趨勢

- 嚴格的安全和運輸法規

- 工業品電子商務的成長

- 產業陷阱與挑戰

- 原物料價格波動

- 可重複使用解決方案的初始投資較高

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 鼓

- 中型散裝容器(IBC)

- 桶

- 罐頭

- 盒子和箱子

- 其他

第6章:市場估計與預測:依材料類型,2021-2034 年

- 主要趨勢

- 塑膠

- 金屬

- 纖維

- 木頭

第7章:市場估計與預測:按配銷通路,2021-2034

- 主要趨勢

- 直銷

- 經銷商

- 線上B2B平台

- 其他

第8章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 化學品

- 製藥

- 食品和飲料配料

- 農業

- 汽車

- 電子產品

- 其他

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Balmer Lawrie

- Berry Global

- DS Smith Rigid

- Greif

- HOYER

- Mauser Packaging Solutions

- Mauser-Werke

- Nefab

- Rikutec Group

- Schoeller Allibert

- SCHUTZ

- Thielmann Group

- Time Technoplast

- Tosca Services

The Global Rigid Industrial Packaging Market was valued at USD 56.7 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 90.3 billion by 2034, driven by the consistent demand from key industries such as chemicals, automotive, pharmaceuticals, and food processing. Rigid packaging solutions like intermediate bulk containers (IBCs), drums, and barrels continue to play a crucial role in transporting both hazardous and non-hazardous materials safely and efficiently.

The long-term growth of the sector is supported by expanding chemical exports and stricter global regulations regarding the transport of dangerous substances. These shifts push companies to invest in high-performance, durable packaging solutions that meet compliance standards while ensuring cost-effectiveness and sustainability. Although tariffs on imported aluminum and steel raised production costs and disrupted supply chains, the market has adapted by recalibrating pricing strategies and exploring domestic sourcing. Industrial development and robust cross-sector integration keep the momentum strong for rigid packaging producers worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $56.7 Billion |

| Forecast Value | $90.3 Billion |

| CAGR | 4.9% |

As sectors like automotive, agriculture, petrochemicals, and construction expand, the demand for durable, safe, and cost-efficient packaging solutions rises in parallel. These industries require high-volume transportation and storage systems that maintain product integrity under extreme environmental conditions, making rigid packaging indispensable. Moreover, integrating global manufacturing ecosystems prompts standardized packaging formats, streamlining logistics, and driving operational efficiencies.

In 2023, the drums segment generated USD 15.4 billion, reflecting its solid role as a preferred container for liquid products across the oil and chemical sectors. These drums offer safe, stackable, and reusable solutions that comply with safety regulations, especially for bulk transport. They are highly valued for their strength and efficiency in storage, handling, and transit applications.

Plastic-based rigid packaging segment is expected to contribute 35.3% share in 2024. The popularity of plastic stems from its corrosion resistance, lightweight, and adaptability across end-use sectors, including food and chemicals. Innovations in recyclable and eco-friendly plastics further strengthen its market position, aligning with the rising demand for sustainable industrial packaging alternatives.

U.S. Rigid Industrial Packaging Market was valued at USD 15.2 billion in 2024 fueled by the pharmaceutical and chemical sectors, which rely heavily on high-integrity containers. The country's focus on eco-conscious materials and expanding advanced logistics infrastructure create favorable conditions for reusable rigid packaging. Enhanced infrastructure and digitalized shipping networks support the wide adoption of high-performance packaging that meets environmental and operational goals.

The leading players in this space include SCHUTZ GmbH & Co. KGaA, Mauser Packaging Solutions, and Greif, Inc. To maintain a competitive edge in the rigid industrial packaging market, companies prioritize innovation in reusable and sustainable materials while enhancing their global supply chain resilience. They invest in smart packaging technologies and automated manufacturing processes to increase efficiency and reduce operational costs. Partnerships with key clients across chemical, food, and pharma industries allow tailored product development that meets specific compliance and safety standards.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising industrialization across emerging economies

- 3.7.1.2 Boom in chemical and petrochemical industries

- 3.7.1.3 Sustainability and reusability trends

- 3.7.1.4 Stringent safety and transport regulations

- 3.7.1.5 Growth in E-commerce for industrial goods

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Volatility in raw material prices

- 3.7.2.2 High initial investment for reusable solutions

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Drums

- 5.3 Intermediate Bulk Containers (IBCs)

- 5.4 Pails

- 5.5 Cans

- 5.6 Boxes & bins

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Material Type, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Metal

- 6.4 Fiber

- 6.5 Wood

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Direct sales

- 7.3 Distributors

- 7.4 Online B2B platforms

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Chemicals

- 8.3 Pharmaceuticals

- 8.4 Food & beverage ingredients

- 8.5 Agriculture

- 8.6 Automotive

- 8.7 Electronics

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Balmer Lawrie

- 10.2 Berry Global

- 10.3 DS Smith Rigid

- 10.4 Greif

- 10.5 HOYER

- 10.6 Mauser Packaging Solutions

- 10.7 Mauser-Werke

- 10.8 Nefab

- 10.9 Rikutec Group

- 10.10 Schoeller Allibert

- 10.11 SCHUTZ

- 10.12 Thielmann Group

- 10.13 Time Technoplast

- 10.14 Tosca Services