|

市場調查報告書

商品編碼

1755294

神經血管內線圈市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Neuroendovascular Coil Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

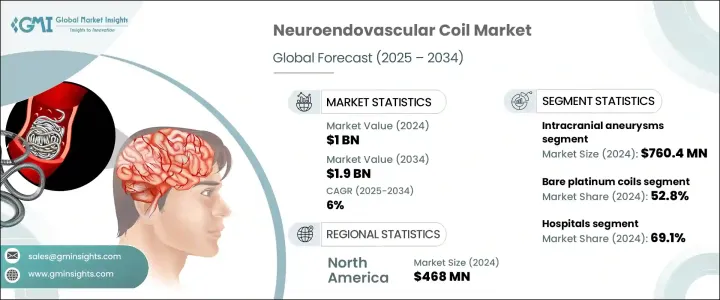

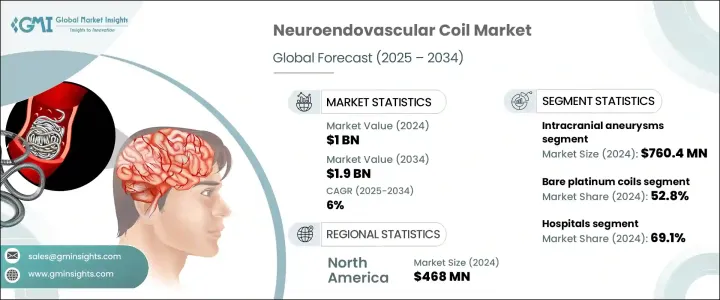

2024年,全球神經血管內彈簧圈市場規模達10億美元,預計到2034年將以6%的複合年成長率成長,達到19億美元。腦動脈瘤和缺血性中風的發生率不斷上升,加上高血壓、糖尿病和吸菸等風險因素,推動了神經血管內彈簧圈的需求。人口老化也導致腦動脈瘤診斷率上升。彈簧圈材料、設計和輸送系統的創新使血管內治療更加安全、準確和有效。近期技術進步促使美國食品藥物管理局(FDA)批准了幾種新型彈簧圈系統,這反映了該治療方法的快速發展。

這些新型彈簧圈更貼合、易於拆卸且不透射線,使其適用於治療動脈瘤,即使在複雜的血管解剖結構中也是如此。血管內彈簧圈已被證明比傳統外科手術併發症風險更低,因此越來越多醫生採用。微創治療因其恢復時間更快、風險更低、住院時間更短,越來越受到醫生和患者的青睞。美國心臟協會和美國中風協會推薦神經血管內彈簧圈作為大多數顱內動脈瘤類型的初始治療,使其成為手術夾閉的重要替代方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 10億美元 |

| 預測值 | 19億美元 |

| 複合年成長率 | 6% |

2024年,裸鉑線圈在神經血管內線圈市場的市佔率為52.8%。這些線圈因其在治療顱內動脈瘤方面已證實的臨床有效性而被廣泛應用。一旦置入,裸鉑線圈即使隨著時間推移也能提供可靠的動脈瘤閉塞。這些線圈長期的臨床記錄確保了最低的併發症發生率,使其成為許多病例的首選。其卓越的可靠性持續推動已開發市場和新興市場的需求。此外,裸鉑線圈的價格在醫療保健系統中也具有優勢,因為這些系統注重成本敏感性,且報銷並非總是可行。

醫院在神經血管內彈簧圈市場中佔據主導地位,2024 年佔 69.1%。世界各地的醫院正在擴大設立專門的中風和神經血管護理科室,以滿足對動脈瘤栓塞等時間敏感型手術日益成長的需求。這些專科科室嚴重依賴神經血管內彈簧圈的穩定供應,而這些彈簧圈對於治療腦血管疾病至關重要。隨著神經系統護理和預防中風後併發症的日益普及,對先進彈簧圈設備的需求顯著成長。在高收入國家,私人保險公司和公共醫療體系為醫院內的血管內治療提供支持性的報銷政策。

美國神經血管內線圈市場預計到2034年將達到7.522億。美國廣泛的專業中風中心和神經外科網路促進了大量的神經血管內手術。強大的醫療基礎設施促進了神經血管內線圈的廣泛應用,並支持新技術的逐步推廣。這些醫療機構的穩定成長以及神經血管內治療技術的日益普及是推動美國神經血管內線圈市場擴張的關鍵因素。

全球神經血管內線圈市場的主要參與者包括:Acandis、Allium Medical、Balt、Boston Scientific、Cardinal Health、Cook Medical、Kaneka、Medtronic、MicroPort、MicroVention、Penumbra、Rapid Medical、Shape Memory Medical、Stryker 和 Terumo。為了鞏固其在神經血管內線圈市場的地位,各公司正專注於多種策略。這些策略包括大力投資研發以引進先進的線圈技術,特別著重於提高安全性、精準度和輸送機制。透過開發新的線圈材料和設計,製造商正在滿足對複雜動脈瘤更有效治療日益成長的需求。各公司也透過與醫院和醫療中心建立合作夥伴關係和協作來擴大其地理覆蓋範圍,尤其是在醫療基礎設施快速發展的地區。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 腦動脈瘤和中風發生率不斷上升

- 線圈設計與傳輸系統的技術進步

- 老年人口不斷增加

- 影像導引和血管內手術的採用日益增多

- 產業陷阱與挑戰

- 神經血管內手術和設備成本高昂

- 手術相關併發症和動脈瘤復發的風險

- 成長動力

- 成長潛力分析

- 技術格局

- 未來市場趨勢

- 監管格局

- 專利分析

- 波特的分析

- PESTEL分析

- 報銷場景

第4章:競爭格局

- 介紹

- 競爭市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 裸鉑線圈

- 水凝膠塗層彈簧圈

- 其他類型

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 顱內動脈瘤

- 動靜脈畸形

- 其他應用

第7章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 專科診所

- 學術和研究機構

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 日本

- 中國

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Acandis

- Allium Medical

- Balt

- Boston Scientific

- Cardinal Health

- Cook Medical

- Kaneka

- Medtronic

- MicroPort

- MicroVention

- Penumbra

- Rapid Medical

- Shape Memory Medical

- Stryker

- Terumo

The Global Neuroendovascular Coil Market was valued at USD 1 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 1.9 billion by 2034. The increasing prevalence of brain aneurysms and ischemic strokes, coupled with risk factors like hypertension, diabetes, and smoking, is fueling the demand for neuroendovascular coils. The aging population is also contributing to the rise in cerebral aneurysm diagnoses. Innovations in coil materials, designs, and delivery systems have made endovascular therapy safer, more accurate, and more effective. Recent advancements in technology have led to FDA approvals for several new coiling systems, which reflect the rapid development of this treatment method.

These new coils are more conformable, detachable, and radiopaque, making them suitable for treating aneurysms, even in complex vascular anatomies. Endovascular coiling has been shown to have a lower risk of procedural complications than traditional surgical approaches, contributing to its growing adoption by physicians. Minimally invasive treatments are increasingly favored by both doctors and patients because they involve quicker recovery times, fewer risks, and shorter hospital stays. The American Heart Association and American Stroke Association recommend neuroendovascular coiling for the initial treatment of most intracranial aneurysm types, making it an important alternative to surgical clipping.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1 Billion |

| Forecast Value | $1.9 Billion |

| CAGR | 6% |

The bare platinum coils segment in the neuroendovascular coil market held 52.8% share in 2024. These coils are widely used due to their proven clinical effectiveness in treating intracranial aneurysms. Once placed, bare platinum coils provide reliable aneurysm occlusion over time, even as they age. The long-standing clinical track record of these coils ensures minimal complication rates, making them the preferred choice for many cases. Their established reliability continues to drive demand in both developed and emerging markets. Additionally, the price point of bare platinum coils offers an advantage in healthcare systems where cost sensitivity is a significant factor, and reimbursement is not always available.

Hospitals represented the dominant segment in the neuroendovascular coil market, contributing a 69.1% share in 2024. Hospitals worldwide are increasingly setting up dedicated units for stroke and neurovascular care to meet the growing demand for time-sensitive procedures such as aneurysm coiling. These specialized units rely heavily on a steady supply of neuroendovascular coils, which are essential for treating cerebrovascular diseases. With the focus on neurological care and preventing complications after stroke, the demand for advanced coiling devices has risen significantly. In high-income nations, private insurance providers and public healthcare systems offer supportive reimbursement policies for hospital-based endovascular therapies.

U.S Neuroendovascular Coil Market is expected to reach 752.2 million by 2034. The country's extensive network of specialized stroke centers and neurosurgical departments facilitates a high volume of neuroendovascular procedures. This robust healthcare infrastructure promotes the widespread use of neuroendovascular coils and supports the adoption of new technologies over time. The steady growth of these healthcare facilities and the increasing uptake of neuroendovascular treatment technologies are key factors contributing to the market's expansion in the U.S.

Key players in the Global Neuroendovascular Coil Market include: Acandis, Allium Medical, Balt, Boston Scientific, Cardinal Health, Cook Medical, Kaneka, Medtronic, MicroPort, MicroVention, Penumbra, Rapid Medical, Shape Memory Medical, Stryker, Terumo. To solidify their position in the neuroendovascular coil market, companies are focusing on multiple strategies. These include heavy investments in research and development to introduce advanced coil technologies, with a particular focus on improving safety, precision, and delivery mechanisms. By developing new coil materials and designs, manufacturers are responding to the growing demand for more effective treatments for complex aneurysms. Companies are also expanding their geographic reach through partnerships and collaborations with hospitals and medical centers, particularly in regions where healthcare infrastructure is rapidly developing.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence of cerebral aneurysms and stroke

- 3.2.1.2 Technological advancements in coil design and delivery systems

- 3.2.1.3 Rising geriatric population

- 3.2.1.4 Growing adoption of image-guided and endovascular procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of neuroendovascular procedures and devices

- 3.2.2.2 Risk of procedure-related complications and recurrence of aneurysms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.5 Future market trends

- 3.6 Regulatory landscape

- 3.7 Patent analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Reimbursement scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Bare platinum coils

- 5.3 Hydrogel-coated coils

- 5.4 Other types

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Intracranial aneurysms

- 6.3 Arteriovenous malformation

- 6.4 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Specialty clinics

- 7.5 Academic and research institutes

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Mexico

- 8.5.2 Brazil

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Acandis

- 9.2 Allium Medical

- 9.3 Balt

- 9.4 Boston Scientific

- 9.5 Cardinal Health

- 9.6 Cook Medical

- 9.7 Kaneka

- 9.8 Medtronic

- 9.9 MicroPort

- 9.10 MicroVention

- 9.11 Penumbra

- 9.12 Rapid Medical

- 9.13 Shape Memory Medical

- 9.14 Stryker

- 9.15 Terumo