|

市場調查報告書

商品編碼

1755289

閘極驅動器 IC 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Gate Driver IC Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

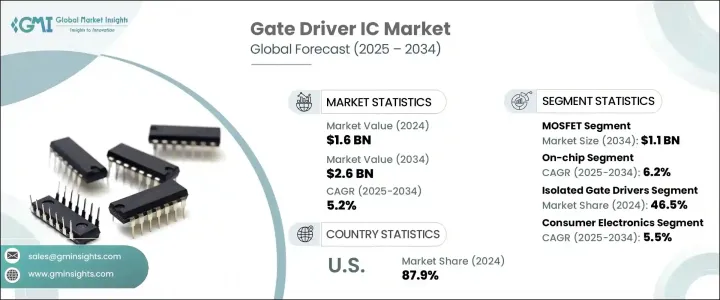

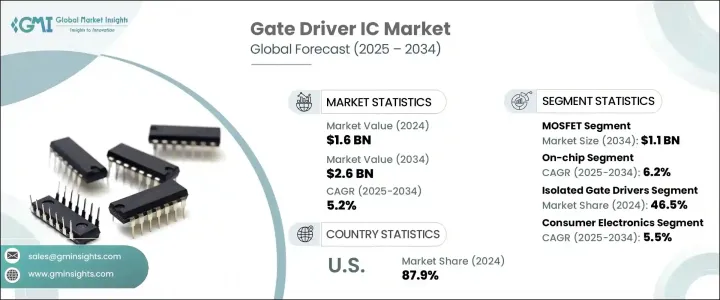

2024年,全球閘極驅動器IC市場規模達16億美元,預計2034年將以5.2%的複合年成長率成長,達到26億美元。這一成長主要源於電動和混合動力汽車(EV/HEV)的日益普及,以及工業自動化和機器人技術的日益普及。隨著製造、物流和製程控制等行業向更高程度的自動化邁進,對高效可靠的電源管理解決方案的需求也隨之激增。閘極驅動器IC對於自動化系統中的馬達驅動器、執行器和電源轉換器的供電至關重要,使其成為將製造設施轉變為智慧生產中心的重要組成部分。

儘管市場需求強勁,但由於川普政府時期徵收的關稅,市場也面臨挑戰。這些關稅,尤其是針對中國進口產品的關稅,影響了全球半導體供應鏈和閘極驅動器IC製造商,其中許多製造商依賴中國零件。關稅增加了生產成本和供應鏈的不確定性,促使企業尋求替代採購策略或實現生產多元化,以最大限度地降低成本影響。這些干擾一度減緩了市場成長,但也促使企業重新思考其全球供應鏈。隨著工業自動化的發展和電動車的普及,閘極驅動器IC市場正在穩步擴張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 16億美元 |

| 預測值 | 26億美元 |

| 複合年成長率 | 5.2% |

柵極驅動器IC市場進一步按電晶體類型細分,包括MOSFET、IGBT和其他類別。其中,MOSFET市場規模預計到2034年將達到11億美元。 MOSFET(金屬氧化物半導體場效電晶體)廣泛應用於電力電子領域,尤其是在消費性電子、電源以及各種中低功率應用。其高效率和多功能性使其成為推動多個行業進步的關鍵元件。 GaN基MOSFET(氮化鎵)應用的日益普及也促進了市場的成長。

閘極驅動器IC市場的另一個關鍵細分領域是連接方式,包括晶片和分立配置。預計到2034年,片上閘極驅動器IC市場的複合年成長率將達到6.2%,這反映了市場對更緊湊、整合度更高的解決方案日益成長的需求。片上閘極驅動器IC在同一晶片內整合了控制和保護功能,顯著降低了系統複雜性並節省了寶貴的空間。這使得它們特別適合需要高整合度和小型化的應用,例如緊湊型電源模組、穿戴式裝置和可攜式電子設備。

在電動車市場、航太電子和工業自動化的推動下,美國閘極驅動器IC市場在2024年佔據了87.9%的市場。支持國內半導體製造業的《晶片法案》(CHIPS Act)增加了研發資金,有助於進一步推動閘極驅動器IC技術的創新。此外,美國電動車新創公司和國防承包商的崛起也刺激了對高性能閘極驅動器IC的需求。

全球閘極驅動器 IC 市場的主要參與者包括英飛凌科技、Allegro Microsystems、博通、Diodes Incorporated 和 ADI 公司。為了鞏固市場地位,閘極驅動器 IC 市場的公司專注於提高產品性能和能源效率的創新。大量的研發投資開發了新的閘極驅動器 IC 技術,這些技術可以提供更快的開關速度、更高的可靠性和更好的熱管理。與汽車、航太和工業自動化等行業主要參與者的策略合作正在幫助公司擴大產品供應。許多公司正在實現供應鏈多元化,以減輕關稅等地緣政治因素的影響,同時國內生產能力滿足不斷成長的需求。此外,該公司正在努力加強其在新興市場的影響力,這些市場的工業自動化和電動車普及率正在迅速成長,有助於鞏固其全球影響力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 電動和混合動力汽車(EV/HEV)的普及率不斷提高

- 再生能源系統需求不斷成長

- 增加工業自動化和機器人技術的部署

- 消費性電子及家電業務擴張

- 智慧電網和配電系統中閘極驅動器 IC 的整合

- 產業陷阱與挑戰

- 設計複雜性高,整合挑戰大

- 散熱和熱管理問題增加

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- Pestel 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場預估與預測:依電晶體類型,2021 - 2034

- 主要趨勢

- 場效電晶體

- 絕緣柵雙極電晶體(IGBT)

- 其他

第6章:市場估計與預測:按附著方式,2021 - 2034 年

- 主要趨勢

- 片上

- 離散的

第7章:市場估計與預測:依隔離類型,2021 - 2034

- 主要趨勢

- 隔離閘極驅動器

- 光隔離

- 磁隔離

- 電容隔離

- 非隔離閘極驅動器

第8章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 消費性電子產品

- 汽車

- 能源與電力

- 電信

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Allegro Microsystems

- Analog Devices

- Broadcom

- Diodes Incorporated

- Infineon Technologies

- Littelfuse

- Microchip Technology

- NXP Semiconductors

- Onsemi

- Renesas Electronics

- Rohm Semiconductor

- Semikron Danfoss

- Skyworks Solutions

- STMicroelectronics

- Texas Instruments

- Toshiba

- Vishay Intertechnology

- Wolfspeed

The Global Gate Driver IC Market was valued at USD 1.6 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 2.6 billion by 2034. The growth is driven by the rising adoption of electric and hybrid electric vehicles (EV/HEV), alongside the growing implementation of industrial automation and robotics. As industries move toward greater automation in manufacturing, logistics, and process control, the need for efficient and reliable power management solutions has surged. Gate driver ICs are critical for powering motor drives, actuators, and power converters in automated systems, making them an essential component for transforming manufacturing facilities into smart production hubs.

While the market is witnessing robust demand, it has faced challenges due to tariffs imposed during the Trump administration. These tariffs, particularly on Chinese imports, impacted the global semiconductor supply chain and gate driver IC manufacturers, many of whom relied on Chinese components. The tariffs increased production costs and supply chain uncertainties, prompting businesses to seek alternative sourcing strategies or diversify their production to minimize cost impacts. These disruptions slowed market growth for a time but also led companies to rethink their global supply chains. As industrial automation grows and EV adoption accelerates, the market for gate driver ICs is steadily expanding.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $2.6 Billion |

| CAGR | 5.2% |

The gate driver IC market is further segmented by transistor type, which includes MOSFET, IGBT, and other categories. Among these, the MOSFET segment is expected to reach USD 1.1 billion by 2034. MOSFETs (Metal-Oxide-Semiconductor Field-Effect Transistors) are widely utilized in power electronics, particularly in consumer electronics, power supplies, and various low to mid-power applications. Their efficiency and versatility have made them a key component in driving advancements across several sectors. The increasing use of GaN-based (Gallium Nitride) MOSFETs has also contributed to market growth.

Another key area of segmentation in the gate driver IC market is the mode of attachment, which includes on-chip and discrete configurations. The on-chip gate driver IC segment is expected to grow at a CAGR of 6.2% through 2034, reflecting the increasing demand for more compact and integrated solutions. On-chip gate driver ICs integrate control and protection functions within the same chip, significantly reducing system complexity and saving valuable space. This makes them particularly suitable for applications that require high integration and miniaturization, such as in compact power modules, wearables, and portable electronics.

United States Gate Driver IC Market accounted for 87.9% share in 2024 driven by the electric vehicle market, aerospace electronics, and industrial automation. The CHIPS Act, which supports domestic semiconductor manufacturing, has increased R&D funding, helping to further drive innovation in gate driver IC technologies. Additionally, the rise of electric vehicle startups and defense contractors in the U.S. boosts the demand for high-performance gate driver ICs.

Key players in the Global Gate Driver IC Market include Infineon Technologies, Allegro Microsystems, Broadcom, Diodes Incorporated, and Analog Devices. To strengthen their market position, companies in the gate driver IC market focus on innovations that improve product performance and energy efficiency. Significant R&D investments developed new gate driver IC technologies that offer faster switching speeds, higher reliability, and better thermal management. Strategic collaborations with key players in industries like automotive, aerospace, and industrial automation are helping companies expand their product offerings. Many companies are diversifying their supply chains to mitigate the impact of geopolitical factors such as tariffs, while domestic production capacity meets rising demand. Moreover, companies are working to enhance their presence in emerging markets, where industrial automation and electric vehicle adoption are rapidly growing, helping to solidify their global footprint.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1.1 Supply chain reconfiguration

- 3.2.4.1.2 Pricing and product strategies

- 3.2.4.1.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growing adoption of electric and hybrid electric vehicles (EV/HEV)

- 3.3.1.2 Rising demand for renewable energy systems

- 3.3.1.3 Increasing deployment of industrial automation and robotics

- 3.3.1.4 Expansion of consumer electronics and home appliances

- 3.3.1.5 Integration of gate driver ICs in smart grid and power distribution systems

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High design complexity and integration challenges

- 3.3.2.2 Increased heat dissipation and thermal management issues

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 Pestel analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Transistor Type, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 MOSFET

- 5.3 IGBT

- 5.4 Others

Chapter 6 Market Estimates & Forecast, By Mode of Attachment, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 On-chip

- 6.3 Discrete

Chapter 7 Market Estimates & Forecast, By Isolation Type, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Isolated gate drivers

- 7.2.1 Opto-isolated

- 7.2.2 Magnetic-isolated

- 7.2.3 Capacitive-isolated

- 7.3 Non-Isolated gate drivers

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Consumer electronics

- 8.3 Automotive

- 8.4 Energy & power

- 8.5 Telecommunications

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Allegro Microsystems

- 10.2 Analog Devices

- 10.3 Broadcom

- 10.4 Diodes Incorporated

- 10.5 Infineon Technologies

- 10.6 Littelfuse

- 10.7 Microchip Technology

- 10.8 NXP Semiconductors

- 10.9 Onsemi

- 10.10 Renesas Electronics

- 10.11 Rohm Semiconductor

- 10.12 Semikron Danfoss

- 10.13 Skyworks Solutions

- 10.14 STMicroelectronics

- 10.15 Texas Instruments

- 10.16 Toshiba

- 10.17 Vishay Intertechnology

- 10.18 Wolfspeed