|

市場調查報告書

商品編碼

1755285

移動機器人市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Mobile Robots Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

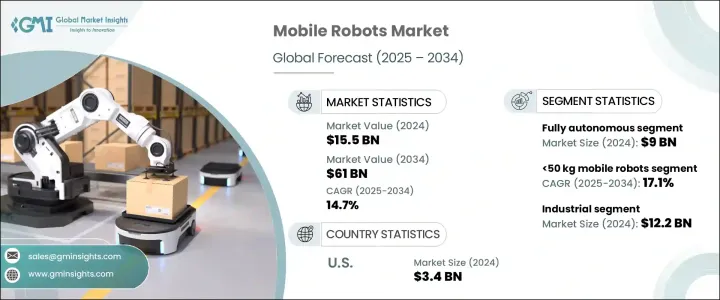

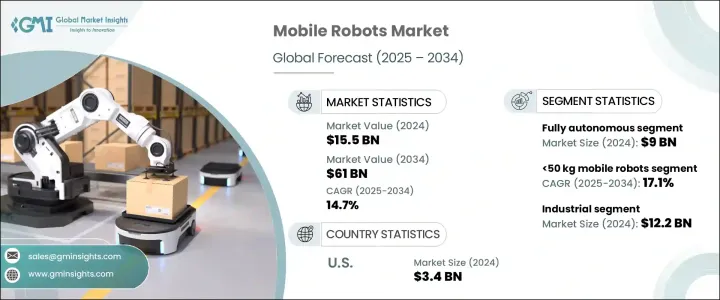

2024年,全球移動機器人市場規模達155億美元,預計到2034年將以14.7%的複合年成長率成長,達到610億美元,這主要得益於全球熟練勞動力的短缺,尤其是在製造業和物流領域。這種短缺促使企業採用機器人解決方案來處理重複性任務、訂單履行和物料搬運。川普政府時期對機器人零件徵收關稅,導致美國企業製造成本飆升,減緩了中小企業對自主移動機器人 (AMR) 和自動導引車 (AGV) 的採用。

因此,製造商們實現了供應鏈多元化,將生產轉移到其他地區,並恢復了生產活動。從長遠來看,這些策略透過建立區域樞紐來降低貿易風險,有助於增強供應鏈的韌性。已開發經濟體最低工資的提高進一步推動了移動機器人的普及,證明了機器人解決方案的投資回報是合理的。電子商務等行業會經歷季節性需求激增,它們依賴移動機器人來實現可擴展性,這種趨勢在日本和德國等老齡化社會尤為明顯,因為這些國家的勞動力缺口日益令人擔憂。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 155億美元 |

| 預測值 | 610億美元 |

| 複合年成長率 | 14.7% |

2024年,全自動移動機器人市場規模達90億美元,並將持續主導。這些機器人利用人工智慧和機器學習,無需人工輸入即可即時決策,是倉庫和醫院等動態環境的理想選擇。它們使用先進的感測器和SLAM(同步定位與地圖建構)技術在複雜空間中導航。全自動設施(即無人值守倉庫)的興起加速了AMR的普及,尤其是在亞太地區和北美地區。然而,在需要類似人類靈活性的應用領域,挑戰仍然存在,這推動了對電腦視覺和自適應夾持器等先進技術的投資。

2024年,有效載荷為50-500公斤的移動機器人市場規模達74億美元,反映出其在各行各業的廣泛應用。這些機器人對於倉庫物料搬運、製造環境中重型零件的運輸以及醫院大型設備的移動都至關重要。這些機器人在處理中等載荷方面功能多樣,使其成為連接用於小型任務的輕型機器人和用於更大工業規模作業的重型機器人的關鍵紐帶。隨著工業領域自動化程度的不斷提升,這類移動機器人在簡化操作和提高效率方面發揮越來越重要的作用。

受勞動力短缺、最低工資上漲以及物流、醫療保健和零售等行業對自動化技術日益成長的興趣等因素推動,美國移動機器人市場規模在2024年達到34億美元。由於勞動力成本高且營運效率要求日益提高,各行各業紛紛使用移動機器人來最佳化其供應鏈和物料搬運流程。美國市場也受益於政府推動機器人技術創新的措施和政策,這些措施和政策有助於企業提高生產力並減少對人力的依賴。

全球移動機器人產業的一些領導者包括庫卡股份公司、ABB、海康機器人股份有限公司、泰瑞達公司和極智嘉。為了鞏固市場地位,移動機器人產業的公司正專注於多種策略。一種關鍵方法是透過將人工智慧、機器學習和先進感測器等尖端技術整合到他們的機器人解決方案中來擴展其產品組合。公司也擴大將其製造業務本地化,以降低貿易風險並減少對國際供應鏈的依賴。此外,許多公司與物流、電子商務和製造業的行業領導者合作,根據特定行業需求量身定做機器人。研發投資是另一項重要策略,使公司能夠透過在自主導航、靈活性和人機互動方面的創新來保持領先地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響

- 價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 勞動力短缺和勞動成本上升

- 電子商務成長與倉庫自動化

- 人工智慧和感測器技術的進步

- 監管支援和工業 4.0 計劃

- 產業陷阱與挑戰

- 初期投資成本高

- 缺乏熟練的操作員

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依自動化水平,2021 - 2034 年

- 主要趨勢

- 完全自主

- 半自主

- 手動(遙控車輛)

第6章:市場估計與預測:依酬載容量,2021 - 2034 年

- 主要趨勢

- <50公斤

- 50–500公斤

- 500–1000公斤

- >1000公斤

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 住宅/家用

- 商業場所

- 工業的

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- ABB

- KUKA AG

- Boston Dynamics

- OMRON Corporation

- Yaskawa America, Inc.

- Universal Robots A/S

- Seiko Epson Corporation

- FANUC America Corporation

- Teradyne Inc.

- Geek+

- Hikrobot Co., Ltd.

- Locus Robotics

- Ocado Group plc.

- Rockwell Automation, Inc.

- Vecna Robotics

- Agility Robotics

The Global Mobile Robots Market was valued at USD 15.5 billion in 2024 and is estimated to grow at a CAGR of 14.7% to reach USD 61 billion by 2034, driven by the global shortage of skilled labor, especially in manufacturing and logistics. This shortage encourages businesses to adopt robotic solutions for handling repetitive tasks, order fulfillment, and material handling. The imposition of tariffs on robotic components during the Trump administration led to a spike in manufacturing costs for U.S. companies, which slowed the adoption of autonomous mobile robots (AMRs) and automated guided vehicles (AGVs) in small and medium-sized enterprises (SMEs).

As a result, manufacturers diversified their supply chains, shifted production to other regions, and restored manufacturing activities. In the long run, these strategies helped strengthen supply chain resilience by establishing regional hubs to mitigate trade risks. The adoption of mobile robots is further bolstered by rising minimum wages in developed economies, justifying the return on investment for robotic solutions. Industries like e-commerce, which experience seasonal demand surges, rely on mobile robots for scalability, a trend seen particularly in aging societies like Japan and Germany, where the labor gap is a growing concern.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.5 Billion |

| Forecast Value | $61 Billion |

| CAGR | 14.7% |

The fully autonomous mobile robot segment was valued at USD 9 billion in 2024 and remains a dominant segment. These robots, which leverage AI and machine learning, can make real-time decisions without human input, making them ideal for dynamic environments like warehouses and hospitals. They navigate complex spaces using advanced sensors and SLAM (Simultaneous Localization and Mapping) technology. The rise of fully automated facilities, known as lights-out warehouses, accelerated the adoption of AMRs, particularly in Asia-Pacific and North America. However, challenges remain in applications requiring human-like dexterity, driving investments in advanced technologies like computer vision and adaptive grippers.

The mobile robots market with a payload capacity of 50-500 kg segment was valued at USD 7.4 billion in 2024, reflecting their widespread application in various industries. These robots are essential for material handling in warehouses, facilitating the transport of heavy components in manufacturing environments, and moving large equipment in hospitals. The versatility of these robots in handling mid-range payloads makes them a critical link between lightweight robots used for smaller tasks and heavy-duty robots designed for more industrial-scale operations. As automation continues to expand in industrial sectors, this category of mobile robots is playing an increasingly vital role in streamlining operations and improving efficiency.

United States Mobile Robot Market reached USD 3.4 billion in 2024, driven by a combination of labor shortages, rising minimum wages, and growing interest in automation technologies across sectors such as logistics, healthcare, and retail. With high labor costs and an increasing need for operational efficiency, industries use mobile robots to optimize their supply chain and material handling processes. The U.S. market has also benefited from government initiatives and policies that foster innovation in robotics, helping companies improve productivity and reduce reliance on human labor.

Some leading players in the Global Mobile Robots Industry include KUKA AG, ABB, Hikrobot Co., Ltd., Teradyne Inc., and Geek+. To strengthen their market position, companies in the mobile robots industry are focusing on several strategies. One key approach is expanding their product portfolio by integrating cutting-edge technologies such as AI, machine learning, and advanced sensors into their robotic solutions. Companies are also increasingly localizing their manufacturing operations to mitigate trade risks and reduce reliance on international supply chains. Additionally, many partners with industry leaders in logistics, e-commerce, and manufacturing to tailor their robots to specific industry needs. Investment in R&D is another essential strategy, enabling companies to stay ahead of the curve with innovations in autonomous navigation, dexterity, and human-robot interaction.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Labor shortages and rising workforce costs

- 3.3.1.2 E-commerce growth and warehouse automation

- 3.3.1.3 Advancements in AI and sensor technologies

- 3.3.1.4 Regulatory support and industry 4.0 initiatives

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High initial investment costs

- 3.3.2.2 Lack of skilled operators

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Automation Level, 2021 - 2034 (USD Billion & Thousand Units)

- 5.1 Key trends

- 5.2 Fully autonomous

- 5.3 Semi-autonomous

- 5.4 Manual (remotely operated vehicle)

Chapter 6 Market Estimates & Forecast, By Payload Capacity, 2021 - 2034 (USD Billion & Thousand Units)

- 6.1 Key trends

- 6.2 <50 kg

- 6.3 50–500 kg

- 6.4 500–1000 kg

- 6.5 >1000 kg

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Billion & Thousand Units)

- 7.1 Key trends

- 7.2 Residential/domestic

- 7.3 Commercial places

- 7.4 Industrial

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion & Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 KUKA AG

- 9.3 Boston Dynamics

- 9.4 OMRON Corporation

- 9.5 Yaskawa America, Inc.

- 9.6 Universal Robots A/S

- 9.7 Seiko Epson Corporation

- 9.8 FANUC America Corporation

- 9.9 Teradyne Inc.

- 9.10 Geek+

- 9.11 Hikrobot Co., Ltd.

- 9.12 Locus Robotics

- 9.13 Ocado Group plc.

- 9.14 Rockwell Automation, Inc.

- 9.15 Vecna Robotics

- 9.16 Agility Robotics