|

市場調查報告書

商品編碼

1755281

2D過渡金屬碳化物氮化物市場機會、成長動力、產業趨勢分析及2025-2034年預測2D Transition Metal Carbides Nitrides Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

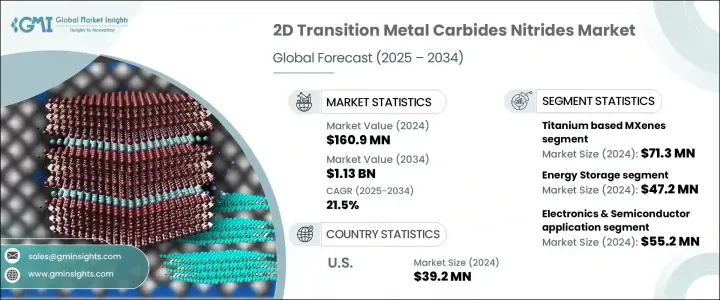

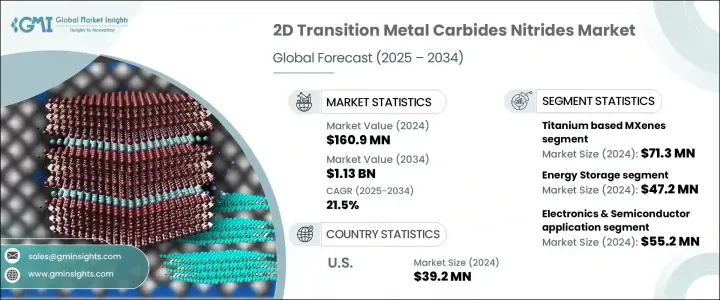

2024 年全球2D過渡金屬碳化物氮化物市場價值為 1.609 億美元,預計到 2034 年將以 21.5% 的複合年成長率成長,達到 11.3 億美元。各行各業對先進奈米材料日益成長的需求推動了這一成長,其應用在下一代電子產品、儲能系統和高性能複合材料中迅速湧現。這些2D材料被稱為 MXenes,由於其獨特的金屬導電性、結構柔韌性和多功能表面化學性質的組合而備受關注。它們能夠在保持高導電性和機械強度的同時對錶面進行工程設計,因此特別適合整合到商業系統中。來自全球機構的尖端研究和創新不斷增強其商業化準備度,使 MXenes 能夠順利應用於多種工業應用。

2024年,鈦基MXenes市場規模達7,130萬美元,預計2025年至2034年期間的複合年成長率將達到20.9%。這些MXenes以其卓越的導電性、親水性和層層結構而著稱,使其在許多應用領域具有廣泛的應用前景。它們支持高能量密度和穩定性的能力使其成為儲能系統、電磁干擾屏蔽和生物感測技術中的重要組件。它們在加工過程中的非擴散特性和極低的毒性進一步支持了其日益廣泛的應用,尤其是在電子和國防相關技術領域。人們對這些材料的廣泛研究興趣正在推動其商業化進程,有助於加速其在高影響力領域的部署。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1.609億美元 |

| 預測值 | 11.3億美元 |

| 複合年成長率 | 21.5% |

在儲能應用領域,2024 年市場規模達 4,720 萬美元,預計到 2034 年將以 26.4% 的複合年成長率成長。 MXene 憑藉其超大的表面積和優異的導電性,成為高性能超級電容器的理想選擇。其可調的層間距可支援快速離子傳輸並提高充放電效率,這對於電動車和電網等可擴展儲能解決方案至關重要。全球日益向永續能源基礎設施轉型,加速了對高效、可擴展儲能材料的需求,而 MXene 憑藉其高功能性和適應性,在其中發揮關鍵作用。

電子和半導體應用領域在2024年的營收為5,520萬美元,佔29.6%的市場佔有率,預計預測期內的複合年成長率為20.7%。 MXene憑藉其卓越的電氣性能和可調節的表面特性,在該領域日益不可或缺。這些特性有助於提升先進半導體裝置的微型化、熱管理和電路整合。受消費者對更快、更有效率設備日益成長的需求推動,半導體產業持續擴張,這推動了MXene被廣泛應用於各種電子元件。

在美國,2024 年2D過渡金屬碳化物氮化物市場規模達 3,920 萬美元,預計 2025 年至 2034 年的複合年成長率將達到 21.9%。該地區受益於政府在材料科學和奈米技術領域的大力支持,以及強大的電子和國防製造業基礎。這些因素,加上國內生產能力和強勁的進出口動態,使美國成為這個不斷發展的市場的關鍵參與者。研究投入、與學術機構的合作以及成熟的產業生態系統,進一步支持了 MXene 在各領域的快速應用。

中國在全球市場持續保持強勁地位,這得益於其不斷擴張的清潔能源和電動汽車產業,這些產業是先進材料的主要終端用戶。中國在MXene基組件和技術的供應鏈中扮演著至關重要的角色,尤其是在亞太和歐洲地區。中國對材料創新的戰略重點及其大規模生產能力使其能夠滿足國內外對這些新興材料的需求。

全球領先的市場參與者正將投資導向生物電子學、新一代能源設備和功能性塗層等領域的研究驅動型產品開發。各公司在材料產品中優先考慮客製化和品質,並在各種應用領域推動創新。合作開發、專有合成方法和獨家授權協議正在幫助利害關係人鞏固競爭優勢,推動MXenes在未來十年的進一步發展和更廣泛的商業應用。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 科技與創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計資料(HS 編碼)(註:僅提供主要國家的貿易統計數據

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 競爭格局

- 公司概況

- 產品組合和規格

- SWOT分析

- 公司市佔率分析

- 各公司全球市場佔有率

- 區域市佔率分析

- 產品組合佔有率分析

- 策略舉措

- 併購

- 夥伴關係和合作

- 產品發布和創新

- 擴張計劃和投資

- 公司標竿分析

- 產品創新標桿

- 定價策略比較

- 配電網路比較

- 客戶服務和支援比較

第5章:市場估計與預測:按材料類型,2021 - 2034 年

- 主要趨勢

- 鈦基MXenes

- 碳化鈦

- 碳化鈦

- Ti3CN

- 其他鈦基MXenes

- 鈮基MXenes

- Nb2C

- Nb4C3

- 其他鈮基MXenes

- 釩基MXenes

- V2C

- V4C3

- 其他釩基MXenes

- 鉬基MXenes

- Mo2C

- 其他鉬基MXenes

- 鉭基MXenes

- 碳化鉭

- 其他鉭基MXenes

- 其他MXene類型

第6章:市場估計與預測:依綜合方法,2021 - 2034 年

- 主要趨勢

- 氫氟酸(HF)蝕刻

- 氟鹽+HCl蝕刻

- 氟化鋰 + 鹽酸

- 氟化鈉+鹽酸

- 鉀+鹽酸

- 其他氟化鹽組合

- 電化學蝕刻

- 熔鹽蝕刻

- 其他合成方法

第7章:市場估計與預測:依形式,2021 - 2034

- 主要趨勢

- 粉末

- 分散體/油墨

- 水性分散體

- 有機溶劑分散體

- 其他分散類型

- 電影

- 獨立式薄膜

- 支援影片

- 其他影片類型

- 複合材料

- 其他形式

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 儲能

- 電池

- 鋰離子電池

- 鈉離子電池

- 其他電池類型

- 超級電容器

- 其他儲能應用

- 電池

- 電子與光電子

- 透明導電薄膜

- 場效電晶體

- 電磁干擾(EMI)屏蔽

- 其他電子應用

- 感測器和生物感測器

- 氣體感測器

- 生物感測器

- 壓力/應變感測器

- 其他感測器應用

- 催化

- 電催化

- 光催化

- 其他催化應用

- 環境修復

- 水淨化

- 氣體分離

- 其他環境應用

- 生物醫學應用

- 藥物輸送

- 生物影像

- 光熱療法

- 其他生物醫學應用

- 複合材料和塗料

- 其他應用

第9章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 電子和半導體

- 能源與電力

- 醫療保健和製藥

- 汽車與運輸

- 環境與水處理

- 航太與國防

- 研究與學術

- 其他最終用途產業

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第 11 章:公司簡介

- Drexel University (Technology Transfer)

- 2D Materials Pte Ltd.

- Nanochemazone

- ACS Material, LLC

- Alfa Chemistry

- American Elements

- Sigma-Aldrich (Merck KGaA)

- Ossila Ltd.

- Nanografi Nano Technology

- SkySpring Nanomaterials, Inc.

- Cheap Tubes Inc.

The Global 2D Transition Metal Carbides Nitrides Market was valued at USD 160.9 million in 2024 and is estimated to grow at a CAGR of 21.5% to reach USD 1.13 billion by 2034. The rising demand for advanced nanomaterials across industries is fueling this growth, with applications rapidly emerging in next-generation electronics, energy storage systems, and high-performance composite materials. Known as MXenes, these two-dimensional materials are gaining prominence due to their unique combination of metallic conductivity, structural flexibility, and versatile surface chemistry. The ability to engineer their surfaces while retaining high conductivity and mechanical strength makes them especially suitable for integration into commercial systems. Cutting-edge research and innovation from global institutions continue to enhance their commercial readiness, enabling the smooth adaptation of MXenes across multiple industrial applications.

The titanium-based MXenes segment stood at USD 71.3 million in 2024 and is expected to record a CAGR of 20.9% between 2025 and 2034. These MXenes are recognized for their outstanding conductivity, hydrophilic nature, and layer-by-layer structure, making them highly relevant for a wide array of applications. Their capability to support high energy density and stability positions them as valuable components in energy storage systems, electromagnetic interference shielding, and biosensing technologies. Their non-diffusive behavior during processes and minimal toxicity further support their growing adoption, particularly in electronics and defense-related technologies. The widespread research interest in these materials is driving commercialization efforts, helping accelerate their deployment across high-impact sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $160.9 million |

| Forecast Value | $1.13 billion |

| CAGR | 21.5% |

In the energy storage application segment, the market was valued at USD 47.2 million in 2024 and is projected to grow at a CAGR of 26.4% through 2034. Thanks to their ultra-large surface area and superior conductivity, MXenes are ideal candidates for high-performance supercapacitors. Their tunable interlayer spacing supports fast ion transport and enhances charge-discharge efficiency, which is crucial for scalable storage solutions such as electric vehicles and power grids. The growing global shift toward sustainable energy infrastructure is accelerating the demand for efficient and scalable energy storage materials, where MXenes play a critical role due to their high functionality and adaptability.

The electronics and semiconductor application segment accounted for USD 55.2 million in 2024, capturing a market share of 29.6%, and is estimated to register a CAGR of 20.7% during the forecast period. MXenes are increasingly indispensable in this field owing to their exceptional electrical performance and tunable surface characteristics. These attributes contribute to improved miniaturization, heat management, and circuit integration in advanced semiconductor devices. The continued expansion of the semiconductor sector, driven by growing consumer demand for faster and more efficient devices, is propelling the inclusion of MXenes in a wide range of electronic components.

In the United States, the 2D transition metal carbides nitrides market was valued at USD 39.2 million in 2024 and is projected to grow at a CAGR of 21.9% from 2025 to 2034. The region benefits from significant government backing in materials science and nanotechnology, along with a strong base in electronics and defense manufacturing. These factors, combined with domestic production capabilities and robust import-export dynamics, make the U.S. a key player in this evolving market. Investments in research, partnerships with academic institutions, and the presence of a mature industrial ecosystem further support the rapid adoption of MXenes across various domains.

China continues to maintain a strong foothold in the global market, driven by its expanding clean energy and electric vehicle sectors, which are major end-users of advanced materials. The country plays a crucial role in the supply chain for MXene-based components and technologies, particularly in the Asia Pacific and European regions. China's strategic focus on materials innovation and its large-scale production capabilities enable it to meet both domestic and international demand for these emerging materials.

Globally, leading market participants are channeling investments toward research-driven product development in areas such as bioelectronics, next-gen energy devices, and functional coatings. Companies are prioritizing customization and quality in their material offerings, pushing innovation across various use cases. Collaborative developments, proprietary synthesis methods, and exclusive licensing agreements are helping stakeholders solidify their competitive edge, fueling further advancements and broader commercial uptake of MXenes in the coming decade.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material Type

- 2.2.3 Form

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Competitive landscape

- 4.1.1 Company overview

- 4.1.2 Product portfolio and specifications

- 4.1.3 SWOT analysis

- 4.2 Company market share analysis, 2024

- 4.2.1 Global market share by company

- 4.2.2 Regional market share analysis

- 4.2.3 Product portfolio share analysis

- 4.3 Strategic initiative

- 4.3.1 Mergers and acquisitions

- 4.3.2 Partnerships and collaborations

- 4.3.3 Product launches and innovations

- 4.3.4 Expansion plans and investments

- 4.4 Company benchmarking

- 4.4.1 Product innovation benchmarking

- 4.4.2 Pricing strategy comparison

- 4.4.3 Distribution network comparison

- 4.4.4 Customer service and support comparison

Chapter 5 Market Estimates & Forecast, By Material Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Titanium based MXenes

- 5.2.1 Ti3C2

- 5.2.2 Ti2C

- 5.2.3 Ti3CN

- 5.2.4 Other Titanium based MXenes

- 5.3 Niobium based MXenes

- 5.3.1 Nb2C

- 5.3.2 Nb4C3

- 5.3.3 Other Niobium based MXenes

- 5.4 Vanadium Based MXenes

- 5.4.1 V2C

- 5.4.2 V4C3

- 5.4.3 Other Vanadium based MXenes

- 5.5 Molybdenum based MXenes

- 5.5.1 Mo2C

- 5.5.2 Other Molybdenum based MXenes

- 5.6 Tantalum based MXenes

- 5.6.1 Ta4C3

- 5.6.2 Other tantalum based MXenes

- 5.7 Other MXene types

Chapter 6 Market Estimates & Forecast, By Synthesis Method, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Hydrofluoric acid (HF) etching

- 6.3 Fluoride salt + HCl etching

- 6.3.1 LiF + HCl

- 6.3.2 NaF + HCl

- 6.3.3 KF + HCl

- 6.4 Other fluoride salt combinations

- 6.5 Electrochemical etching

- 6.6 Molten salt etching

- 6.7 Other synthesis methods

Chapter 7 Market Estimates & Forecast, By Form, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Powder

- 7.3 Dispersion/ink

- 7.3.1 Aqueous dispersions

- 7.3.2 Organic solvent dispersions

- 7.3.3 Other dispersion types

- 7.4 Film

- 7.4.1 Free standing films

- 7.4.2 Supported films

- 7.4.3 Other film types

- 7.5 Composite materials

- 7.6 Other forms

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Energy storage

- 8.2.1 Batteries

- 8.2.1.1 Lithium ion batteries

- 8.2.1.2 Sodium ion batteries

- 8.2.1.3 Other battery types

- 8.2.2 Supercapacitors

- 8.2.3 Other energy storage applications

- 8.2.1 Batteries

- 8.3 Electronics & optoelectronics

- 8.3.1 Transparent conductive films

- 8.3.2 Field effect transistors

- 8.3.3 Electromagnetic interference (emi) shielding

- 8.3.4 Other electronics applications

- 8.4 Sensors & biosensors

- 8.4.1 Gas sensors

- 8.4.2 Biosensors

- 8.4.3 Pressure/strain sensors

- 8.4.4 Other sensor applications

- 8.5 Catalysis

- 8.5.1 Electrocatalysis

- 8.5.2 Photocatalysis

- 8.5.3 Other catalytic applications

- 8.6 Environmental remediation

- 8.6.1 Water purification

- 8.6.2 Gas separation

- 8.6.3 Other environmental applications

- 8.7 Biomedical applications

- 8.7.1 Drug delivery

- 8.7.2 Bioimaging

- 8.7.3 Photothermal therapy

- 8.7.4 Other biomedical applications

- 8.8 Composites & coatings

- 8.9 Other applications

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 Electronics & semiconductor

- 9.3 Energy & power

- 9.4 Healthcare & pharmaceuticals

- 9.5 Automotive & transportation

- 9.6 Environmental & water treatment

- 9.7 Aerospace & defense

- 9.8 Research & academia

- 9.9 Other end use industries

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Drexel University (Technology Transfer)

- 11.2 2D Materials Pte Ltd.

- 11.3 Nanochemazone

- 11.4 ACS Material, LLC

- 11.5 Alfa Chemistry

- 11.6 American Elements

- 11.7 Sigma-Aldrich (Merck KGaA)

- 11.8 Ossila Ltd.

- 11.9 Nanografi Nano Technology

- 11.10 SkySpring Nanomaterials, Inc.

- 11.11 Cheap Tubes Inc.