|

市場調查報告書

商品編碼

1755271

包絡追蹤晶片市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Envelope Tracking Chip Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

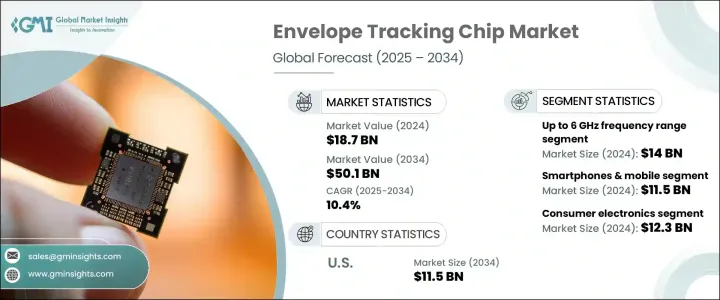

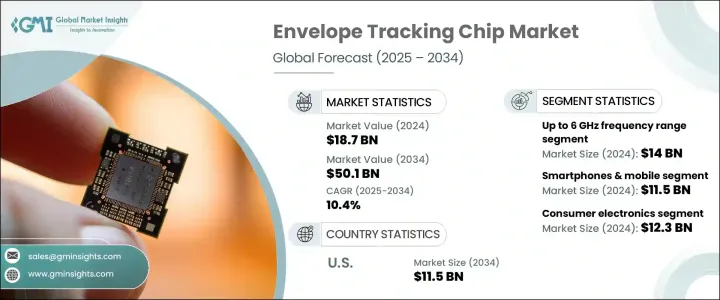

2024年,全球包絡追蹤晶片市場規模達187億美元,預計到2034年將以10.4%的複合年成長率成長,達到501億美元。 5G網路部署的激增顯著增加了行動裝置對節能射頻組件的需求。對進口半導體徵收關稅的貿易政策提高了國內生產商的製造成本,促使全球供應鏈轉變。這種轉變鼓勵了國內投資以及與印度、越南和台灣等國家和地區的戰略合作,以減少依賴並降低關稅相關風險。

包絡追蹤晶片使功率放大器的運行功耗降低高達 40%,這對於延長智慧型手機電池續航時間並保持熱效率至關重要。這些晶片對於 5G 設備多頻段射頻系統實現最佳性能至關重要。全球對小型基地台和 5G 基地台的需求不斷成長,進一步加速了市場擴張。開放式 RAN 架構中的節能優先順序凸顯了包絡追蹤在降低電信營運成本方面的作用。支援高容量 5G 網路的波束成形和大規模 MIMO 等技術也推動了對高效能功率放大器的需求,推動了包絡追蹤晶片在全球電信基礎設施中的應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 187億美元 |

| 預測值 | 501億美元 |

| 複合年成長率 | 10.4% |

2024年,頻率範圍高達6 GHz的細分市場以140億美元的估值領先市場。該細分市場因其在5G行動網路、LTE系統和Wi-Fi 6/7技術中的重要性而佔據主導地位。這些包絡追蹤晶片對於提升射頻前端設計中功率放大器的效率至關重要,可降低高達40%的功耗。隨著網路營運商專注於覆蓋範圍最佳化,北美和亞太地區6 GHz以下5G網路的快速普及正在推動需求。 Skyworks Solutions、德州儀器和高通等公司持續創新包絡追蹤技術,以支援動態頻譜共享和載波聚合。基於人工智慧的追蹤演算法的增強也支援在頻寬密集型環境中(尤其是在流量高峰期)實現最佳的功率性能。

預計到2034年,汽車領域的包絡追蹤晶片市場將以16.2%的複合年成長率成長。這一強勁成長得益於5G-V2X技術的日益普及以及自動駕駛技術的不斷發展。包絡追蹤晶片用於最佳化汽車雷達和聯網遠端資訊處理系統的能耗,尤其是在用於導航和安全功能的24/77 GHz系統中。歐洲和中國等地區對V2X功能的監管要求,進一步推動了支援包絡追蹤的射頻系統在車輛中的應用。英飛凌、恩智浦和高通等領先公司正在設計高可靠性的包絡追蹤晶片,以滿足下一代汽車技術的車規級標準。

預計到2034年,美國包絡追蹤晶片市場規模將達到115億美元。聯邦政府旨在提升國內半導體製造能力的措施推動了這一成長。智慧型手機中人工智慧驅動的包絡追蹤功能的日益整合是關鍵的成長動力。各大電信業者持續推動5G網路建設,持續推動高效能射頻組件的需求。包括ADI公司和Qorvo在內的美國主要製造商繼續以尖端的GaN基包絡追蹤解決方案引領市場,尤其是在衛星系統和國防應用領域。

全球包絡追蹤晶片產業值得關注的參與者包括德州儀器 (TI)、ADI 公司、Qorvo 公司、高通技術公司和 Skyworks Solutions 公司。在包絡追蹤晶片市場營運的公司正專注於開發節能且整合 AI 的射頻組件,以支援高速 5G 基礎設施和下一代行動裝置。在監管激勵措施的推動下,對國內製造業的策略性投資正在幫助企業減少對全球供應鏈的依賴。主要參與者還在擴大與電信和汽車原始設備製造商 (OEM) 的合作,以提供客製化的、特定於應用的包絡追蹤解決方案。研發工作旨在提高 6 GHz 以下和毫米波頻段的晶片效率,同時改善熱性能。各公司正在擴大基於 GaN 的設計創新,以用於航太和國防用途。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響

- 價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 節能 5G 智慧型手機的需求不斷成長

- 5G基礎設施和開放式RAN(無線存取網路)部署的擴展

- 汽車雷達和 V2X 通訊的成長

- 國防和衛星通訊現代化

- 產業陷阱與挑戰

- 開發成本高

- 複雜設計整合

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依頻率範圍,2021-2034 年

- 主要趨勢

- 高達 6 GHz

- 6 - 24 GHz

- 24 GHz 以上

第6章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 智慧型手機和行動裝置

- 基地台和電信基礎設施

- 物聯網和穿戴式裝置

- 車輛

- 軍用雷達

- 醫療器材

- 其他

第7章:市場估計與預測:按最終用途產業,2021-2034 年

- 消費性電子產品

- 電信

- 汽車

- 工業的

- 國防與航太

- 衛生保健

- 其他

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Analog Devices, Inc.

- Broadcom Inc

- MediaTek

- Murata Manufacturing Co., Ltd.

- Qorvo, Inc.

- Qualcomm Technologies, Inc.

- R2 Semiconductor, Inc.

- Samsung

- Skyworks Solutions, Inc.

- Texas Instruments

The Global Envelope Tracking Chip Market was valued at USD 18.7 billion in 2024 and is estimated to grow at a CAGR of 10.4% to reach USD 50.1 billion by 2034. The surge in 5G network deployments is significantly increasing the demand for power-efficient RF components in mobile devices. Trade policies that imposed tariffs on imported semiconductors raised manufacturing costs for domestic producers, prompting a shift in the global supply chain. This transition encouraged domestic investments and strategic collaborations with countries like India, Vietnam, and Taiwan to reduce dependency and mitigate tariff-related risks.

Envelope tracking chips enable power amplifiers to operate with up to 40% less energy consumption, which plays a vital role in extending smartphone battery life while maintaining thermal efficiency. These chips are critical to achieving optimal performance in multiband RF systems for 5G devices. The rising demand for small cells and 5G base stations worldwide is further accelerating market expansion. Energy-saving priorities in open RAN architectures are highlighting the role of envelope tracking in lowering telecom operational costs. Technologies such as beamforming and massive MIMO that support high-capacity 5G networks are also boosting the need for efficient power amplifiers, propelling the use of ET chips across telecom infrastructure globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18.7 Billion |

| Forecast Value | $50.1 Billion |

| CAGR | 10.4% |

In 2024, the frequency range up to 6 GHz segment led the market with a valuation of USD 14 billion. This segment dominates due to its importance in 5G mobile networks, LTE systems, and Wi-Fi 6/7 technology. These ET chips are essential for boosting power amplifier efficiency in RF front-end designs, offering energy reductions of up to 40%. Rapid adoption of Sub-6 GHz 5G in North America and Asia-Pacific is driving demand, as network operators focus on coverage optimization. Players such as Skyworks Solutions, Texas Instruments, and Qualcomm continue to innovate ET technologies that support dynamic spectrum sharing and carrier aggregation. Enhancements in AI-based tracking algorithms also support optimal power performance in bandwidth-intensive environments, particularly during peak traffic.

The envelope tracking chip market from the automotive segment is set to grow at a CAGR of 16.2% through 2034. This strong growth is linked to the increasing deployment of 5G-V2X and the progression of autonomous driving. ET chips are used to optimize energy use in automotive radar and connected telematics, particularly in 24/77 GHz systems for navigation and safety functions. Regulatory mandates requiring V2X functionality in regions such as Europe and China are further boosting the use of ET-enabled RF systems in vehicles. Leading companies like Infineon, NXP, and Qualcomm are designing high-reliability ET chips to meet automotive-grade standards for next-generation vehicle technologies.

U.S. Envelope Tracking Chip Market is expected to reach USD 11.5 billion by 2034. Growth is supported by federal initiatives aimed at increasing domestic semiconductor manufacturing capacity. The rising integration of AI-driven envelope tracking in smartphones is a key growth driver. Ongoing 5G expansion by national telecom providers is sustaining demand for high-performance RF components. Major manufacturers in the U.S., including Analog Devices and Qorvo, continue to lead with cutting-edge GaN-based ET solutions, particularly for satellite systems and defense applications.

Noteworthy participants in the Global Envelope Tracking Chip Industry include Texas Instruments, Analog Devices, Qorvo, Inc., Qualcomm Technologies, Inc., and Skyworks Solutions, Inc. Companies operating in the envelope-tracking chip market are focusing on developing energy-efficient and AI-integrated RF components to support high-speed 5G infrastructure and next-gen mobile devices. Strategic investments in domestic manufacturing, driven by regulatory incentives, are helping firms reduce dependency on global supply chains. Major players are also expanding their partnerships with telecom and automotive OEMs to deliver custom, application-specific envelope-tracking solutions. R&D efforts are being directed at enhancing chip efficiency across sub-6 GHz and mmWave bands while improving thermal performance. Firms are scaling innovations in GaN-based designs for aerospace and defense uses.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.1.3 Impact on the industry

- 3.2.1.3.1 Supply-side impact

- 3.2.1.3.1.1 Price volatility

- 3.2.1.3.1.2 Supply chain restructuring

- 3.2.1.3.1.3 Production cost implications

- 3.2.1.3.2 Demand-side impact

- 3.2.1.3.2.1 Price transmission to end markets

- 3.2.1.3.2.2 Market share dynamics

- 3.2.1.3.2.3 Consumer response patterns

- 3.2.1.3.1 Supply-side impact

- 3.2.1.4 Key companies impacted

- 3.2.1.5 Strategic industry responses

- 3.2.1.5.1 Supply chain reconfiguration

- 3.2.1.5.2 Pricing and product strategies

- 3.2.1.5.3 Policy engagement

- 3.2.1.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising demand for energy-efficient 5G smartphones

- 3.3.1.2 Expansion of 5G infrastructure and open RAN (radio access network) deployments

- 3.3.1.3 Growth in automotive radar and V2X communication

- 3.3.1.4 Defense and satellite communications modernization

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High development costs

- 3.3.2.2 Complex design integration

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Frequency Range, 2021-2034 (USD Billion & Units)

- 5.1 Key trends

- 5.2 Up to 6 GHz

- 5.3 6 - 24 GHz

- 5.4 Above 24 GHz

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion & Units)

- 6.1 Key trends

- 6.2 Smartphones & mobile devices

- 6.3 Base stations & telecom infrastructure

- 6.4 IoT & wearables

- 6.5 Vehicles

- 6.6 Military radars

- 6.7 Medical devices

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion & Units)

- 7.1 Consumer electronics

- 7.2 Telecom

- 7.3 Automotive

- 7.4 Industrial

- 7.5 Defense & aerospace

- 7.6 Healthcare

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Analog Devices, Inc.

- 9.2 Broadcom Inc

- 9.3 MediaTek

- 9.4 Murata Manufacturing Co., Ltd.

- 9.5 Qorvo, Inc.

- 9.6 Qualcomm Technologies, Inc.

- 9.7 R2 Semiconductor, Inc.

- 9.8 Samsung

- 9.9 Skyworks Solutions, Inc.

- 9.10 Texas Instruments