|

市場調查報告書

商品編碼

1755270

智慧型助聽器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Smart Hearing Aids Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

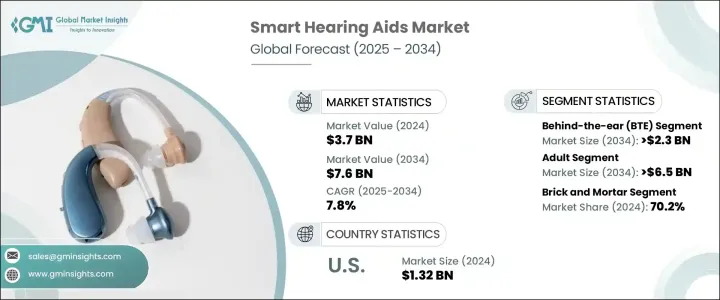

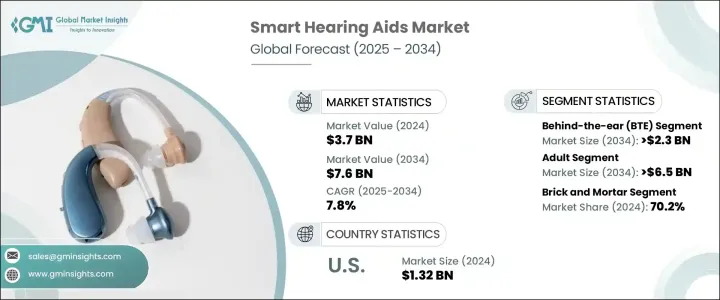

2024年,全球智慧助聽器市場規模達37億美元,預計到2034年將以7.8%的複合年成長率成長,達到76億美元。推動這一成長的因素包括聽力技術的快速創新、聽力健康意識的提升、早期診斷率的提高、老齡人口的成長以及消費者對可自訂、方便用戶使用型解決方案日益成長的興趣。如今的智慧助聽器採用人工智慧和機器學習技術,使設備能夠適應不同的聲音環境,從而確保更清晰的語音和更佳的聆聽體驗。藍牙連接可與智慧型手機、電視和其他數位裝置無縫整合,使助聽器成為用途廣泛、功能多樣的工具,其功能遠超傳統的擴音器。

智慧型助聽器是先進的電子設備,透過融合人工智慧、藍牙和基於應用程式的控制功能來增強聽力。這些設備可以直接從相容的電子設備傳輸音頻,並根據環境噪音調整聲音設定。部分型號還提供使用者遠端程式設計、健身追蹤和環境自適應等功能。數位訊號處理的創新、個人化解決方案的強勁需求以及對便利且經濟實惠的聽力技術的日益關注,正在加速市場的成長。這些裝置相容於藍牙,讓使用者隨時隨地體驗高品質的串流媒體和通訊。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 37億美元 |

| 預測值 | 76億美元 |

| 複合年成長率 | 7.8% |

耳背式助聽器 (BTE) 市場預計將以 6.8% 的複合年成長率成長,到 2034 年將達到 23 億美元。 BTE 助聽器因其能夠處理從輕度到重度的各種聽力損失而廣受青睞。其更大的外形設計支援整合式定向麥克風、AI 驅動的聲音最佳化、降噪和無線連接等高級功能。這種設計也使其更易於使用和控制,尤其適合老年用戶或行動不便者。 BTE 設備佩戴舒適,經久耐用,維護成本低,是長期佩戴的理想選擇。

2024年,實體店市佔率達70.2%。實體聽力診所和聽力中心在智慧助聽器的購買過程中仍然至關重要,主要是因為面對面診斷和客製化驗配能夠確保設備的最佳性能。聽力圖和真耳測量等服務通常由認證專業人員提供,有助於根據使用者的聽力狀況客製化產品。許多消費者在使用個人醫療技術時更喜歡獲得親身體驗的照護和指導。老年人在進行高價值購買之前往往會尋求專業人士的建議。個人化服務、售後支援和麵對面諮詢將繼續推動實體零售空間的成長。

2024年,美國智慧助聽器市場規模達13.2億美元。美國消費者對新技術持續表現出高度的接受度,尤其是具備藍牙串流媒體、健身追蹤、自適應噪音過濾和應用程式整合功能的助聽器。智慧型手機的廣泛普及進一步佐證了這一趨勢。非處方助聽器的推出也為輕度至中度聽力損失人士提供了更多獲得聽力保健產品的機會。監管法規的轉變促進了創新,並為科技公司和沃爾格林、百思買等零售連鎖店進入該領域創造了機會,從而重塑了競爭格局。

智慧型助聽器市場的主要參與者包括索諾瓦 (Sonova)、EARGO、Audina Hearing Instruments、Starkey、WS Audiology、Clariti Hearing、GN Store Nord、RION、西門子助聽器 (Siemens Hearing Aids)、Audio Service、SeboTek Hearing Systems、Nanoek Hearing Systems、Deanoman、Zearing、Hekman、Yearing Systems、Deanoman.這些公司專注於長期策略,以提升其在競爭激烈的市場中的影響力並保持領先地位。策略重點包括擴大研發規模以提高產品智慧化和連接性,在不犧牲性能的情況下進行微型化投資,以及透過與當地分銷商和診所合作進入新興市場。許多參與者也利用直接面對消費者的管道,提供遠端聽力測試,並採用基於人工智慧的工具來提高用戶參與度和滿意度。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 聽力損失盛行率不斷上升

- 人口老化日益加劇

- 數位化和互聯醫療解決方案的採用率不斷上升

- 消費者對獨立多功能設備的需求激增

- 產業陷阱與挑戰

- 智慧助聽器成本高昂

- 發展中地區的認知有限

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 差距分析

- 波特的分析

- PESTEL分析

- 未來市場趨勢

- 價值鏈分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 耳背式(BTE)

- 耳內接收器/耳道接收器 (RITE/RIC)

- 完全耳道式/隱形耳道式(CIC/IIC)

- 耳內式 (ITE)

- 耳道內(ITC)

第6章:市場估計與預測:按患者,2021 - 2034 年

- 主要趨勢

- 成人

- 兒科

第7章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 實體店面

- 電子商務

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- RION

- Audina Hearing Instruments

- Audio Service

- Clariti Hearing

- Demant

- Ear Technology

- EARGO

- GN Store Nord

- Nano Hearing Aids

- SeboTek Hearing Systems

- Siemens Hearing Aids

- sonova

- Starkey

- WS Audiology

- Zounds Hearing

The Global Smart Hearing Aids Market was valued at USD 3.7 billion in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 7.6 billion by 2034. The growth is driven by rapid innovation in hearing technologies, rising awareness about hearing health, early diagnosis rates, a growing elderly population, and increasing consumer interest in customizable, user-friendly solutions. Today's smart hearing aids are powered by artificial intelligence and machine learning, allowing devices to adapt to different sound environments. This ensures better clarity and improved listening experience. Bluetooth connectivity enables seamless integration with smartphones, TVs, and other digital devices, transforming hearing aids into versatile, multi-functional tools that extend far beyond traditional amplification.

Smart hearing aids are advanced electronic devices that enhance hearing by incorporating AI, Bluetooth, and app-based control features. These devices can stream audio directly from compatible electronics and adjust sound settings according to ambient noise. In some models, users benefit from features like remote programming, fitness tracking, and environmental adaptation. Market growth is being accelerated by innovation in digital signal processing, strong demand for personalized solutions, and increasing attention toward accessible and affordable hearing technologies. With Bluetooth compatibility, these devices allow users to experience high-quality streaming and communication on the go.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.7 Billion |

| Forecast Value | $7.6 Billion |

| CAGR | 7.8% |

The behind-the-ear (BTE) category is expected to grow at a CAGR of 6.8%, to reach USD 2.3 billion by 2034. BTE hearing aids are widely chosen due to their ability to handle various degrees of hearing loss, ranging from mild to profound. Their larger form factor supports integrating advanced features like directional microphones, AI-driven sound optimization, noise reduction, and wireless connectivity. This design also enables easier use and control, particularly for elderly users or individuals with dexterity limitations. BTE devices deliver comfort over long periods and offer durability and low maintenance, making them ideal for extended wear.

The brick-and-mortar segment captured a 70.2% share in 2024. Physical audiology clinics and hearing centers remain vital in the purchase journey for smart hearing aids, primarily because in-person diagnosis and custom fitting ensure optimal device performance. Services such as audiograms and real-ear measurements, often delivered by certified professionals, help tailor the product to a user's hearing profile. Many consumers prefer hands-on care and guidance when dealing with personal medical technology. Older adults tend to rely on professional advice before making high-value purchases. Personalized service, post-sale support, and face-to-face consultations continue to drive growth in physical retail spaces.

United States Smart Hearing Aids Market generated USD 1.32 billion in 2024. American consumers continue to show high receptivity toward new technology, especially hearing aids that offer Bluetooth streaming, fitness tracking, adaptive noise filtering, and app integration. The widespread adoption of smartphones further supports this trend. The introduction of over-the-counter (OTC) hearing aids has also increased access to hearing care products for individuals with mild to moderate hearing loss. This regulatory shift promotes innovation and opens opportunities for tech companies and retail chains such as Walgreens and Best Buy to enter space, reshaping the competitive landscape.

Key players in the Smart Hearing Aids Market include Sonova, EARGO, Audina Hearing Instruments, Starkey, WS Audiology, Clariti Hearing, GN Store Nord, RION, Siemens Hearing Aids, Audio Service, SeboTek Hearing Systems, Nano Hearing Aids, Demant, Zounds Hearing, and Ear Technology. These companies are focused on long-term strategies to enhance their presence and maintain leadership in a highly competitive market. Strategic priorities include expanding R&D to improve product intelligence and connectivity, investing in miniaturization without sacrificing power, and entering emerging markets through partnerships with local distributors and clinics. Many players are also leveraging direct-to-consumer channels, offering remote hearing tests, and adopting AI-based tools to drive user engagement and satisfaction.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of hearing loss

- 3.2.1.2 Growing aging population

- 3.2.1.3 Rising adoption of digital and connected health solutions

- 3.2.1.4 Surge in consumer demand for discreet and multifunctional devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of smart hearing aids

- 3.2.2.2 Limited awareness in developing regions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.10 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Behind-the-ear (BTE)

- 5.3 Receiver in the ear/receiver in canal (RITE/RIC)

- 5.4 Completely-in-the-canal/invisible-in-canal (CIC/IIC)

- 5.5 In-the-ear (ITE)

- 5.6 In-the-canal (ITC)

Chapter 6 Market Estimates and Forecast, By Patient, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Adult

- 6.3 Pediatric

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Brick and mortar

- 7.3 E-commerce

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 RION

- 9.2 Audina Hearing Instruments

- 9.3 Audio Service

- 9.4 Clariti Hearing

- 9.5 Demant

- 9.6 Ear Technology

- 9.7 EARGO

- 9.8 GN Store Nord

- 9.9 Nano Hearing Aids

- 9.10 SeboTek Hearing Systems

- 9.11 Siemens Hearing Aids

- 9.12 sonova

- 9.13 Starkey

- 9.14 WS Audiology

- 9.15 Zounds Hearing