|

市場調查報告書

商品編碼

1755255

汽車遮陽板市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Sun Visor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

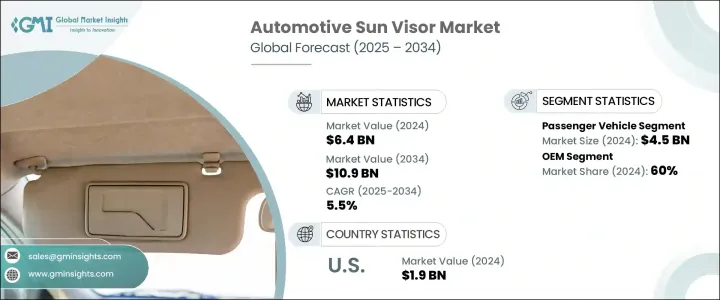

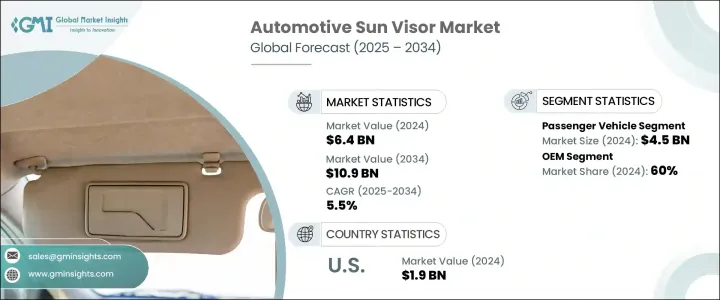

2024 年全球汽車遮陽板市場價值為 64 億美元,預計到 2034 年將以 5.5% 的複合年成長率成長至 109 億美元。全球汽車產量不斷成長,加之消費者對更佳車內舒適度和道路安全性的期望不斷提高,共同推動了這一成長。隨著汽車製造商擴大產量(尤其是在快速發展的經濟體中),對遮陽板等關鍵內裝零件的需求持續成長。消費者對先進的遮陽板系統的需求超越了基本的遮陽功能,並融合了整合照明、觸控和防眩光技術等功能。這些升級迎合了人們對兼具時尚與實用性內飾日益成長的需求,這些內飾優先考慮舒適性和可視性。此外,監管機構和安全標準也促使製造商將增強型遮陽板功能作為商用車和乘用車的標準配備之一。

日益成長的道路安全需求也在推動遮陽板需求方面發揮關鍵作用。遮陽板可以提高駕駛者的視野,並有助於防止眩光相關事故,這與全球減少交通事故的計劃一致。電動車進一步促進了市場的成長,因為其現代內裝通常需要精密、可自訂的遮陽板系統。電動車製造商更青睞高品質、技術增強的遮陽板,這些遮陽板能夠與其先進的座艙設計無縫融合,從而推動整個領域的創新。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 64億美元 |

| 預測值 | 109億美元 |

| 複合年成長率 | 5.5% |

2024年,乘用車市場價值達45億美元,憑藉龐大的產量和日常使用率,引領整個細分市場。這些車輛是各地區個人出行的核心,這推動了對遮陽板等舒適內裝零件的持續需求。隨著汽車製造商不斷投資於美觀和安全改進,遮陽板配備了照明後視鏡、伸縮擋板和智慧功能,以提升駕駛體驗。從入門級車型到高階轎車,種類繁多的車輛確保了能夠根據不同的需求和偏好提供多樣化的遮陽板解決方案。

2024年,汽車原始設備製造商 (OEM) 市場佔據60%的市場佔有率,在遮陽板與車輛整合方面保持主導地位。這些製造商在生產階段採購遮陽板,以滿足嚴格的性能和安全標準。他們能夠提供客製化的原廠組裝組件,從而在提供經濟高效且無縫的遮陽板解決方案方面擁有競爭優勢。汽車製造商與一級供應商之間的合作也日益加強,從而催生出具有附加功能的創新產品,例如照明的化妝鏡和先進材料,這些都體現了品牌形象和消費者的期望。

2024年,北美汽車遮陽板市場規模達19億美元,預計2034年將以5.8%的複合年成長率成長。美國市場持續受益於嚴格的安全法規以及對科技融合型汽車內裝日益成長的需求。製造商正轉向兼具實用性和美觀性的多功能遮陽板。豪華車和電動車銷量的激增推動了對高階遮陽板設計的需求,這些設計能夠支持不斷發展的高階駕駛環境概念。現代材料、數位介面和時尚造型的融合,使遮陽板成為車內體驗的重要組成部分。

引領汽車遮陽板市場的領導者包括偉世通、泰極愛思、安通林集團、大陸集團、塞特拉格、IAC、白木工業、河西工業、豐和紡織和安道拓。這些公司正在投資策略性產品創新,以滿足不斷變化的消費者需求。許多公司專注於開發輕量化和模組化設計,以在保持耐用性的同時降低車輛總重。先進的材料整合,例如防眩光膜和智慧後視鏡解決方案,正被用於提升性能。各公司也正在加強與汽車製造商的合作,以提供符合品牌形象和人體工學的OEM專屬設計。擴大生產規模(尤其是在成本效益高的地區)以及實現產品組合多元化,仍是提升競爭力和市場覆蓋率的核心策略。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 生產統計

- 生產中心

- 消費中心

- 匯出和匯入

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 傳統的

- 發光

- 雙面板

- 液晶/數字

- 客製化/內建

第6章:市場估計與預測:按材料類型,2021 - 2034 年

- 主要趨勢

- 織物

- 乙烯基塑膠

- 塑膠

- 其他

第7章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 越野車

- 掀背車

- 轎車

- 商用車

- 輕型商用車(LCV)

- 中型商用車(MCV)

- 重型商用車(HCV)

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 防眩光保護

- 提高駕駛員和乘客的舒適度

- 梳妝鏡整合

- 後窗和側窗應用

- 其他

第9章:市場估計與預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第 11 章:公司簡介

- AC Group

- Adient

- CIE Automotive

- Continental

- Faurecia

- Ficosa

- Grupo Antolin

- Howa Textile

- Kasai Kogyo

- Lear Corporation

- Magneti Marelli

- Motherson Sumi

- NHK Spring

- Setrag

- Shiroki

- Tachi-S

- Tokai Rika

- Toyota Boshoku

- Visteon

- Yanfeng

The Global Automotive Sun Visor Market was valued at USD 6.4 billion in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 10.9 billion by 2034. The growth is driven by the increasing vehicle production worldwide, along with rising consumer expectations for better in-cabin comfort and road safety, is driving this expansion. As automakers scale output-especially in fast-developing economies-the demand for key interior components like sun visors continues to rise. Consumers seek advanced sun visor systems beyond basic shading and incorporate features like integrated lighting, touch controls, and glare-reducing technology. These upgrades cater to the growing desire for stylish yet functional interiors that prioritize comfort and visibility. Additionally, regulatory bodies and safety standards are prompting manufacturers to include enhanced visor features as part of standard offerings in both commercial and passenger vehicles.

The growing need for road safety also plays a critical role in boosting demand. Sun visors improve driver visibility and help prevent glare-related incidents, aligning with global initiatives to reduce traffic accidents. Electric vehicles contribute further to the market's growth, as their modern interiors often call for sophisticated, customizable visor systems. EV manufacturers prefer high-quality, tech-enhanced visors that blend seamlessly into their advanced cabin designs fueling innovation across the segment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.4 Billion |

| Forecast Value | $10.9 Billion |

| CAGR | 5.5% |

Passenger vehicles accounted for a market value of USD 4.5 billion in 2024, leading the overall segment due to their large production volumes and everyday usage. These vehicles are central to personal mobility across regions, which fuels consistent demand for comfort-enhancing interior parts like sun visors. As automakers continue investing in aesthetic and safety improvements, sun visors are equipped with illuminated mirrors, extension flaps, and smart functionality to elevate the driving experience. From entry-level models to high-end sedans, the broad spectrum of vehicle offerings ensures a diverse range of visor solutions tailored to varying needs and preferences.

OEMs segment represented a 60% share in 2024, maintaining a dominant role in how sun visors are integrated into vehicles. These manufacturers source visors during the production stage to meet strict performance and safety criteria. Their ability to provide tailored, factory-fitted components gives them a competitive edge in delivering cost-effective and seamless visor solutions. Collaborations between automakers and Tier 1 suppliers have also intensified, allowing for innovative products with added features like lighted vanity mirrors and advanced materials that reflect brand identity and consumer expectations.

North America Automotive Sun Visor Market held USD 1.9 billion in 2024 and is set to grow at a CAGR of 5.8% through 2034. The American market continues to benefit from strong safety regulations and increasing demand for tech-integrated vehicle interiors. Manufacturers are shifting toward multi-functional sun visors that blend utility with aesthetics. A surge in luxury and electric vehicle sales drives the need for high-end sun visor designs that support the evolving concept of premium driving environments. Integrating modern materials, digital interfaces, and sleek styling transforms sun visors into essential components of the vehicle's cabin experience.

Leading players shaping the Automotive Sun Visor Market include Visteon, Tachi-S, Grupo Antolin, Continental, Setrag, IAC, Shiroki, Kasai Kogyo, Howa Textile, and Adient. These companies are investing in strategic product innovations to meet evolving consumer demands. Many focus on developing lightweight and modular designs that reduce overall vehicle weight while maintaining durability. Advanced material integration, such as anti-glare films and smart mirror solutions, is being used to improve performance. Firms are also strengthening collaborations with automakers to deliver OEM-specific designs that align with branding and ergonomics. Expanding manufacturing footprints, particularly in cost-effective regions, and diversifying product portfolios remain central strategies to enhance competitiveness and market reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Material

- 2.2.4 Vehicle

- 2.2.5 Application

- 2.2.6 Sales channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Conventional

- 5.3 Illuminated

- 5.4 Dual-panel

- 5.5 LCD/digital

- 5.6 Custom/built-in

Chapter 6 Market Estimates & Forecast, By Material Type, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Fabric

- 6.3 Vinyl

- 6.4 Plastic

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Passenger Vehicle

- 7.2.1 SUV

- 7.2.2 Hatchbacks

- 7.2.3 Sedan

- 7.3 Commercial Vehicles

- 7.3.1 Light commercial vehicles (LCV)

- 7.3.2 Medium commercial vehicles (MCV)

- 7.3.3 Heavy commercial vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Sun glare protection

- 8.3 Driver and passenger comfort enhancement

- 8.4 Vanity mirror integration

- 8.5 Rear and side window applications

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 AC Group

- 11.2 Adient

- 11.3 CIE Automotive

- 11.4 Continental

- 11.5 Faurecia

- 11.6 Ficosa

- 11.7 Grupo Antolin

- 11.8 Howa Textile

- 11.9 Kasai Kogyo

- 11.10 Lear Corporation

- 11.11 Magneti Marelli

- 11.12 Motherson Sumi

- 11.13 NHK Spring

- 11.14 Setrag

- 11.15 Shiroki

- 11.16 Tachi-S

- 11.17 Tokai Rika

- 11.18 Toyota Boshoku

- 11.19 Visteon

- 11.20 Yanfeng