|

市場調查報告書

商品編碼

1755251

光學衛星市場機會、成長動力、產業趨勢分析及2025-2034年預測Optical Satellite Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

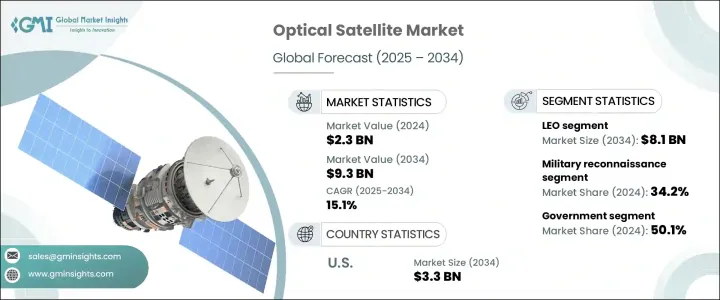

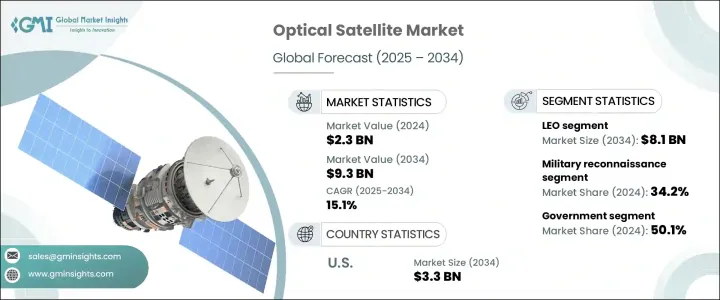

2024 年全球光學衛星市場規模為 23 億美元,預計到 2034 年將以 15.1% 的複合年成長率成長,達到 93 億美元,這得益於商業衛星服務需求的不斷成長,尤其是對地球觀測和監視應用的需求。隨著光學衛星在軌道上越來越普遍,製造商面臨與生產成本上升相關的新障礙。近期的關稅政策給半導體、精密光學感測器和航空級材料等關鍵零件帶來了成本壓力,迫使許多製造商轉向國內採購。這種轉變導致資本支出增加和專案工期延長,給已經管理複雜衛星生產週期的公司帶來了更大壓力。此外,持續的供應鏈中斷導致專案延誤和預算超支,對持續產出構成挑戰。

對高解析度地球觀測 (EO) 影像日益成長的需求正在迅速改變衛星和航太工業的營運格局。如今,商業和公共部門都高度依賴高細節光學成像技術,用於環境監測、基礎設施建設、災害管理和農業分析等應用。精準農業尤其受益於這些能力,衛星透過多光譜成像提供有關土壤健康、作物生長和土地利用的可操作洞察。這些衛星能夠實現近乎即時的資料傳輸,從而提高農業作業的準確性和效率,並進一步推動全球農業科技市場的採用。增強的成像能力加上可操作資料的快速週轉時間,持續推動光學衛星部署的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 23億美元 |

| 預測值 | 93億美元 |

| 複合年成長率 | 15.1% |

到2034年,低地球軌道(LEO)市場規模預計將達到81億美元。 LEO靠近地球,使其成為部署光學衛星的首選軌道,尤其適用於需要高解析度地面成像的任務。政府支持的措施與私營部門的能力相結合,以支持有針對性的衛星部署。這些合作收集了用於地形分析、氣候建模和戰略情報的詳細圖像,並增強了LEO市場對市場擴張的影響力。

隨著精準農業診斷的重要性日益提升,預計2034年,作物監測應用的市場規模將達到23億美元。光學衛星能夠利用多光譜成像技術,在作物早期壓力跡象的檢測中發揮重要作用,從而防止產量損失。精準農業的發展,加上數位化農業的進步,持續推動對光電解決方案的需求,這些解決方案能夠提供即時洞察,並幫助最佳化土地管理策略。

預計到2034年,英國光學衛星市場的複合年成長率將達到14.1%。英國政府持續投資地球觀測技術,為衛星監測開闢了新的機會。英國對高品質成像解決方案的需求日益成長,這些解決方案可用於追蹤環境變遷、增強監測系統,並為氣候適應力和永續性相關政策提供資訊。

全球光學衛星市場的領導者包括洛克希德·馬丁公司、空中巴士公司、泰雷茲·阿萊尼亞宇航公司和麥克薩科技公司。這些公司正在實施策略措施,以維持並擴大其市場地位。主要重點在於擴大衛星數量,並透過先進的光學技術提升影像解析度。他們投資與政府機構和私人航太公司的合作項目,以確保簽訂長期合約並共同開發下一代系統。大量的研發支出、零件的在地化採購以及精簡製造流程的努力,正在幫助企業應對不斷上漲的材料成本和生產挑戰。此外,許多企業正在增強其軟體平台,以支援更快的影像處理和分析整合,從而為最終用戶創造更大的價值。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 成長動力

- 對高解析度地球觀測資料的需求不斷成長

- 增加對國家安全和監控的投資

- 商業衛星快速成長

- 影像和資料處理技術的進步

- 氣候變遷監測和環境保護措施日益增多

- 產業陷阱與挑戰

- 資本和營運成本高

- 資料過載和處理複雜性

- 對貿易的影響

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依軌道類型,2021-2034

- 主要趨勢

- 低地球軌道

- 中歐

- 地理

- 其他

第6章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 軍事偵察

- 作物監測

- 都市計畫

- 災害管理

- 礦物測繪

- 環境監測

- 其他

第7章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 政府

- 商業的

- 學術的

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Airbus

- China Aerospace Science and Technology Corp.

- Elbit Systems

- Hanwha Group

- Israeli Aerospace Industry

- ISRO

- Lockheed Martin Corporation

- Maxar Technologies

- Mitsubishi Electric Corporation

- OHB SE

- Satellogic

- Surrey Satellite Technology Ltd

- Thales Alenia Space

- Turksat

The Global Optical Satellite Market was valued at USD 2.3 billion in 2024 and is estimated to grow at a CAGR of 15.1% to reach USD 9.3 billion by 2034, driven by increasing demand for commercial satellite services, particularly for Earth observation and surveillance applications. As optical satellites become more prevalent in orbit, manufacturers are facing new hurdles tied to escalating production costs. Recent tariff policies have created cost pressures on critical components such as semiconductors, precision optical sensors, and aerospace-grade materials, forcing many manufacturers to pivot toward domestic sourcing. This shift has resulted in rising capital expenditure and extended project timelines, adding strain to companies already managing complex satellite production cycles. Additionally, persistent supply chain disruptions are causing delays and budget overruns, presenting a challenge for consistent output.

Heightened demand for high-resolution Earth Observation (EO) imagery is rapidly transforming the operational landscape of the satellite and space industry. Both commercial and public sectors now rely heavily on high-detail optical imaging for applications like environmental monitoring, infrastructure development, disaster management, and agricultural analysis. Precision farming has especially benefited from these capabilities, with satellites offering actionable insights on soil health, crop growth, and land use through multispectral imaging. These satellites allow for nearly real-time data delivery, improving the accuracy and efficiency of agricultural operations and further fueling adoption across global agritech markets. Enhanced imaging capabilities combined with quick turnaround times for actionable data continue to push the demand for optical satellite deployment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $9.3 Billion |

| CAGR | 15.1% |

The Low Earth Orbit (LEO) segment is poised to reach USD 8.1 billion by 2034. Its proximity to Earth makes LEO a preferred orbit for deploying optical satellites, especially for missions requiring high-resolution surface imaging. Government-backed initiatives integrated with private sector capabilities to support targeted satellite deployments. These collaborations gather detailed imagery for terrain analysis, climate modeling, and strategic intelligence, reinforcing the LEO segment's influence on market expansion.

The crop monitoring application is expected to hit USD 2.3 billion by 2034, backed by the rising importance of accurate agricultural diagnostics. Optical satellites are instrumental in detecting early signs of crop stress using multispectral imaging to prevent yield loss. The growth in precision agriculture, combined with advancements in digital farming, continues to boost demand for EO-enabled solutions that deliver real-time insights and help optimize land management strategies.

UK Optical Satellite Market is anticipated to grow at a CAGR of 14.1% through 2034. Ongoing investment in Earth observation technologies by the UK government has opened new opportunities for satellite-based monitoring. There's increasing national demand for high-quality imaging solutions used for tracking environmental changes, enhancing surveillance systems, and informing policies around climate resilience and sustainability.

Leading players in the Global Optical Satellite Market include Lockheed Martin Corporation, Airbus, Thales Alenia Space, and Maxar Technologies. These companies are implementing strategic measures to maintain and grow their market presence. A major focus lies in expanding satellite fleets and enhancing image resolution capabilities through advanced optics. They invest in collaborative programs with government agencies and private space firms to secure long-term contracts and co-develop next-generation systems. Significant R&D spending, localized sourcing of components, and efforts to streamline manufacturing are helping address rising material costs and production challenges. In addition, many players are enhancing their software platforms to support faster image processing and analytics integration delivering greater value to end-users.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.3 Trump administration tariffs analysis

- 3.3.1 Impact on trade

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.1.3 Impact on the industry

- 3.3.1.3.1 Supply-side impact (raw material)

- 3.3.1.3.1.1 Price volatility

- 3.3.1.3.1.2 Supply chain restructuring

- 3.3.1.3.1.3 Production cost implications

- 3.3.1.3.2 Demand-side impact

- 3.3.1.3.2.1 Price transmission to end markets

- 3.3.1.3.2.2 Market share dynamics

- 3.3.1.3.2.3 Consumer response patterns

- 3.3.1.3.1 Supply-side impact (raw material)

- 3.3.1.4 Key companies impacted

- 3.3.1.5 Strategic industry responses

- 3.3.1.5.1 Supply chain reconfiguration

- 3.3.1.5.2 Pricing and product strategies

- 3.3.1.5.3 Policy engagement

- 3.3.1.5.4 Outlook and future considerations

- 3.3.2 Growth drivers

- 3.3.2.1 Rising demand for high-resolution earth observation data

- 3.3.2.2 Increased investments in national security and surveillance

- 3.3.2.3 Rapid growth of commercial satellite

- 3.3.2.4 Technological advancements in imaging and data processing

- 3.3.2.5 Growing climate change monitoring and environmental protection initiatives

- 3.3.3 Industry pitfalls and challenges

- 3.3.3.1 High capital and operational costs

- 3.3.3.2 Data overload and processing complexity

- 3.3.1 Impact on trade

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Orbit Type, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 LEO

- 5.3 MEO

- 5.4 GEO

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Military reconnaissance

- 6.3 Crop monitoring

- 6.4 Urban planning

- 6.5 Disaster management

- 6.6 Mineral mapping

- 6.7 Environmental monitoring

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Government

- 7.3 Commercial

- 7.4 Academic

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Airbus

- 9.2 China Aerospace Science and Technology Corp.

- 9.3 Elbit Systems

- 9.4 Hanwha Group

- 9.5 Israeli Aerospace Industry

- 9.6 ISRO

- 9.7 Lockheed Martin Corporation

- 9.8 Maxar Technologies

- 9.9 Mitsubishi Electric Corporation

- 9.10 OHB SE

- 9.11 Satellogic

- 9.12 Surrey Satellite Technology Ltd

- 9.13 Thales Alenia Space

- 9.14 Turksat