|

市場調查報告書

商品編碼

1755248

氟塗料市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Fluorinated Coating Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

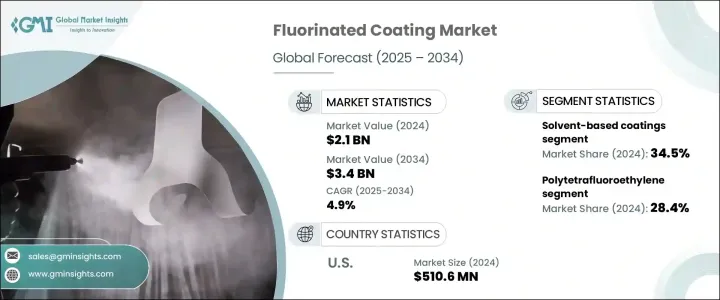

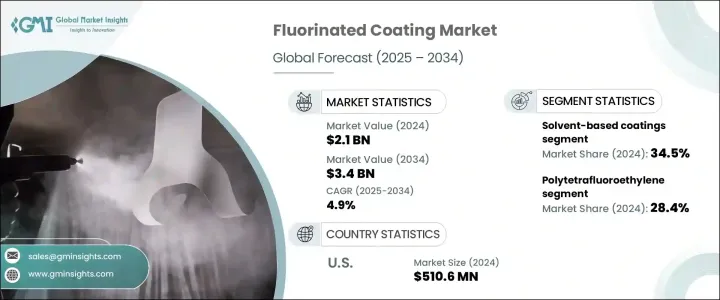

2024年,全球氟塗料市場規模達21億美元,預計到2034年將以4.9%的複合年成長率成長,達到34億美元。這類塗料主要採用氟聚合物材料配製而成,具有優異的耐久性、熱穩定性以及耐化學性和耐腐蝕性。這些特性對於需要在各種操作環境下使用持久耐用、性能卓越的塗料的行業至關重要。從極端溫度到化學反應性環境,氟塗料始終表現出色,尤其是在高濕度和環境壓力較大的地區。

隨著對能夠抵抗環境侵蝕的先進材料的需求不斷成長,這些塗料在注重材料效率和使用壽命的行業中正得到越來越廣泛的應用。此外,交通運輸和民用基礎設施的投資也推動了防護塗料的使用,這些塗料旨在延長關鍵資產的使用壽命,同時降低長期維護成本。技術創新、監管向永續性的轉變以及降低環境影響的動力,正在鼓勵製造商採用環保塗料解決方案,包括水性和紫外光固化塗料。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 21億美元 |

| 預測值 | 34億美元 |

| 複合年成長率 | 4.9% |

就產品類型而言,聚四氟乙烯 (PTFE) 在 2024 年佔據了全球市場的 28.4% 以上。 PTFE 以其低表面能和非反應性而聞名,已成為需要低摩擦、耐熱性和強耐化學性應用的主要材料。其用途廣泛,涵蓋了經常暴露於極端溫度和腐蝕性介質的終端使用領域。 PTFE 因其在應力下的穩定性而被廣泛應用於製造程序,使其成為承受機械磨損或化學腐蝕的部件的理想選擇。

依技術分類,溶劑型塗料在2024年佔了近34.5%的市場。其長期佔據主導地位的原因是其優異的附著力、更長的使用壽命以及在惡劣工況下的韌性。這些塗料在惡劣環境下性能可靠,因此廣泛應用於高機械負荷和熱負荷的行業。儘管揮發性有機化合物(VOC)排放面臨監管壓力,但溶劑型塗料憑藉其行業優勢仍保持著穩固的地位。然而,人們對環保解決方案日益成長的興趣正在逐漸改變產業格局。水性塗料越來越受歡迎,尤其是在實施更嚴格排放標準的地區;而紫外光固化塗料憑藉其快速固化和低能耗的特點,在精密製造領域也越來越受歡迎。

從基材來看,金屬在2024年佔據全球市場領先地位。金屬廣泛應用於製造業,其易受天氣、化學物質和高溫的影響,使其成為氟塗層的理想選擇。氟塗層能夠有效防止腐蝕和氧化,是延長結構部件和設備使用壽命的關鍵。其他基材,例如塑膠、複合材料和混凝土,也正經歷日益成長的需求,尤其是在需要耐候塗層的基礎設施項目中。

就性能屬性而言,耐化學性在2024年引領市場。許多工業領域需要處理腐蝕性化學品,在這些環境中使用的設備必須進行塗層處理才能承受此類暴露。氟塗層因其可防止表面老化、設備故障和污染風險而備受青睞。它們能夠作為儲罐、管道和加工設備的可靠內襯,確保不間斷運作和安全。熱穩定性、電絕緣性和低摩擦表面等特性也對其應用做出了重要貢獻,尤其是在高精度和高性能應用中。

從應用角度來看,航太和國防領域在2024年成為主導類別。這些產業需要能夠耐受極端環境的材料,而氟塗層憑藉其耐熱性、輕量化性能和長期保護特性滿足了這一需求。同時,由於在暴露於腐蝕性物質和高溫的機械設備中廣泛使用塗層,工業設備佔據了最大的市場佔有率。隨著商業和住宅應用對不沾黏、易清潔表面的需求不斷成長,食品相關領域也保持強勁成長。

從區域分析來看,美國氟塗料市場規模在2024年超過5.106億美元。憑藉其穩固的工業基礎、穩步的技術進步以及對產品性能的持續關注,美國繼續在北美保持領先地位。基礎設施和製造業的不斷發展進一步擴大了對高品質、耐用塗料的需求。消費者對易於維護材料的偏好也推動了家用和戶外產品應用的成長。

市場保持適度整合,幾家關鍵企業佔據了相當大的佔有率。競爭焦點集中在產品創新、法規合規性以及針對特定產業的客製化解決方案。領先企業正在持續提升表面保護能力,並拓展其在高成長應用領域的覆蓋範圍。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 貿易統計(HS編碼)

- 主要出口國

- 主要進口國

註:以上貿易統計僅針對重點國家。

- 衝擊力

- 市場促進因素

- 市場限制

- 市場機會

- 市場挑戰

- 產品概述

- 含氟聚合物化學與結構

- 性能特徵

- 耐化學性

- 熱穩定性

- 不沾黏和低摩擦特性

- 耐候性和耐用性

- 與其他塗層技術的比較

- 製造流程分析

- 樹脂生產

- 配方技術

- 申請方法

- 固化過程

- 品質控制程式

- 監管格局

- 成長潛力分析

- 2021-2034年價格分析(美元/噸)

- 永續性和環境影響評估

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 市佔率分析

- 戰略框架

- 併購

- 合資與合作

- 新產品開發

- 擴張策略

- 競爭基準測試

- 供應商格局

- 競爭定位矩陣

- 戰略儀表板

- 專利分析與創新評估

- 新參與者的市場進入策略

- 配電網路分析

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 聚四氟乙烯

- 純PTFE塗層

- PTFE基複合塗層

- 改質PTFE塗層

- 聚偏氟乙烯

- PVDF均聚物塗料

- PVDF共聚物塗層

- 改質PVDF塗料

- 氟化乙丙烯

- 全氟烷氧基烷烴

- 乙烯四氟乙烯

- 乙烯氯三氟乙烯

- 聚氯三氟乙烯

- 其他

第6章:市場估計與預測:按技術,2021 - 2034 年

- 主要趨勢

- 溶劑型塗料

- 水性塗料

- 粉末塗料

- 紫外線固化塗料

- 其他

第7章:市場估計與預測:按基材,2021 - 2034

- 主要趨勢

- 金屬

- 鋼

- 鋁

- 其他

- 塑膠和複合材料

- 玻璃

- 混凝土和磚石

- 其他

第8章:市場估計與預測:按性能屬性,2021 - 2034 年

- 主要趨勢

- 耐化學性

- 耐候性

- 不沾/低摩擦

- 熱穩定性

- 電絕緣

- 防腐蝕

- 其他

第9章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 工業設備

- 化學加工設備

- 石油和天然氣設備

- 食品加工設備

- 製藥設備

- 其他

- 建築與施工

- 建築塗料

- 屋頂材料

- 外牆和覆層

- 其他

- 汽車與運輸

- 外部元件

- 內裝部件

- 底層應用程式

- 其他

- 炊具和食品接觸

- 不沾鍋

- 烘焙用具

- 食品加工設備

- 其他

- 電學

- PCB塗層

- 電線電纜塗料

- 半導體應用

- 其他

- 航太與國防

- 海洋

- 醫療保健

- 其他

第 10 章:市場估計與預測:按最終用途產業,2021 年至 2034 年

- 主要趨勢

- 工業製造

- 化學

- 石油和天然氣

- 發電

- 其他

- 建築與施工

- 汽車與運輸

- 消費品

- 炊具和廚具

- 家電

- 其他

- 電子和半導體

- 航太與國防

- 食品和飲料

- 醫療保健和製藥

- 其他

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第12章:公司簡介

- 3M Company

- AFT Fluorotec

- AGC Chemicals Americas

- AGC Inc.

- AkzoNobel NV

- Arkema

- Beckers Group

- Daikin Industries

- Dow

- DuPont

- Fluorotherm Polymers

- Gujarat Fluorochemicals

- Jotun A/S

- Nippon Paint Holdings

- PPG Industries, Inc.

- Sherwin-Williams Company

- Solvay SA

- The Chemours Company

- Whitford Corporation

The Global Fluorinated Coating Market was valued at USD 2.1 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 3.4 billion by 2034. These coatings are primarily formulated using fluoropolymer materials that offer outstanding durability, thermal stability, and resistance to chemicals and corrosion. These properties make them vital for industries that demand long-lasting, high-performance coatings across various operational environments. From extreme temperatures to chemically reactive surroundings, fluorinated coatings continue to demonstrate strong performance, particularly in regions prone to high humidity and environmental stress.

As the demand for advanced materials capable of resisting environmental degradation grows, these coatings are seeing increased adoption across sectors that prioritize efficiency and longevity in materials. Moreover, investments in transportation and civil infrastructure have led to greater use of protective coatings designed to increase the service life of key assets while also reducing long-term maintenance costs. Technological innovations, regulatory shifts toward sustainability, and the push for lower environmental impact are encouraging manufacturers to adopt eco-conscious coating solutions, including water-based and UV-curable alternatives.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $3.4 Billion |

| CAGR | 4.9% |

In terms of product type, polytetrafluoroethylene (PTFE) accounted for over 28.4% of the global market in 2024. Known for its low surface energy and non-reactive nature, PTFE has become a staple material for applications that require minimal friction, thermal endurance, and strong chemical resistance. Its utility spans a broad spectrum of end-use sectors where exposure to extreme temperatures and corrosive agents is common. PTFE is widely used in manufacturing processes due to its stable behavior under stress, making it ideal for components exposed to mechanical wear or chemical exposure.

When categorized by technology, solvent-based coatings captured nearly 34.5% of the market share in 2024. Their long-standing dominance is attributed to superior adhesion, extended service life, and resilience in tough operating conditions. These coatings perform reliably under aggressive environments, which explains their widespread use in sectors involving high mechanical and thermal loads. Despite regulatory pressure around volatile organic compound (VOC) emissions, solvent-based coatings continue to maintain a solid presence due to their industrial advantages. However, rising interest in eco-friendly solutions is gradually shifting the industry landscape. Waterborne coatings are gaining traction, especially in regions enforcing stricter emission norms, while UV-curable coatings are becoming increasingly viable in precision manufacturing thanks to their rapid curing and low energy requirements.

Based on substrate, metal held the leading position in the global market in 2024. Metals are extensively used in manufacturing, and their exposure to weather, chemicals, and heat makes them suitable candidates for fluorinated coatings. These coatings provide a barrier against corrosion and oxidation, making them essential for extending the life of structural components and equipment. Other substrates such as plastics, composites, and concrete are also witnessing growing demand, particularly in infrastructure projects requiring weather-resistant finishes.

Regarding performance attributes, chemical resistance led the market in 2024. Many industrial sectors handle aggressive chemicals, and equipment used in these settings must be coated to withstand such exposure. Fluorinated coatings are preferred because they prevent surface degradation, equipment failure, and contamination risks. Their ability to act as reliable linings for tanks, pipelines, and processing equipment ensures uninterrupted operation and safety. Properties like thermal stability, electrical insulation, and low-friction surfaces also contribute significantly to their adoption, particularly in high-precision and high-performance applications.

By application, the aerospace and defense segment emerged as the dominant category in 2024. These industries require materials that can endure extreme environments, and fluorinated coatings meet that demand by offering heat resistance, lightweight performance, and long-term protection. Meanwhile, industrial equipment claimed the largest share of the market due to the widespread use of coatings in machinery exposed to corrosive substances and elevated temperatures. The food-related segment also remains strong as demand for non-stick, easy-clean surfaces grows in commercial and residential applications.

In regional analysis, the United States fluorinated coating market surpassed USD 510.6 million in 2024. The country continues to lead in North America, backed by a well-established industrial base, steady technological advancements, and an ongoing focus on product performance. The need for high-quality, durable coatings is further amplified by the continuous development of infrastructure and manufacturing sectors. Consumer trends favoring easy-maintenance materials also support growth in household and outdoor product applications.

The market remains moderately consolidated, with several key players commanding significant shares. Competitive focus revolves around product innovation, regulatory compliance, and customized solutions tailored for specific industries. Leading companies are consistently enhancing surface protection capabilities and expanding their reach across high-growth application areas.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

Note: the above trade statistics will be provided for key countries only.

- 3.4 Impact forces

- 3.4.1 Market drivers

- 3.4.2 Market restraints

- 3.4.3 Market opportunities

- 3.4.4 market challenges

- 3.5 Product overview

- 3.5.1 Fluoropolymer chemistry & structure

- 3.5.2 Performance characteristics

- 3.5.3 Chemical resistance properties

- 3.5.4 Thermal stability

- 3.5.5 Non-stick & low friction properties

- 3.5.6 Weather resistance & durability

- 3.5.7 Comparison with other coating technologies

- 3.6 Manufacturing process analysis

- 3.6.1 Resin production

- 3.6.2 Formulation techniques

- 3.6.3 Application methods

- 3.6.4 Curing processes

- 3.6.5 Quality control procedures

- 3.7 Regulatory landscape

- 3.8 Growth potential analysis

- 3.9 Pricing analysis (USD/Tons) 2021-2034

- 3.10 Sustainability & environmental impact assessment

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Market share analysis

- 4.2 Strategic framework

- 4.2.1 Mergers & acquisitions

- 4.2.2 Joint ventures & collaborations

- 4.2.3 New product developments

- 4.2.4 Expansion strategies

- 4.3 Competitive benchmarking

- 4.4 Vendor landscape

- 4.5 Competitive positioning matrix

- 4.6 Strategic dashboard

- 4.7 Patent analysis & innovation assessment

- 4.8 Market entry strategies for new players

- 4.9 Distribution network analysis

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Polytetrafluoroethylene

- 5.2.1 Pure PTFE coatings

- 5.2.2 PTFE-based composite coatings

- 5.2.3 Modified PTFE coatings

- 5.3 Polyvinylidene fluoride

- 5.3.1 PVDF homopolymer coatings

- 5.3.2 PVDF copolymer coatings

- 5.3.3 Modified PVDF coatings

- 5.4 Fluorinated ethylene propylene

- 5.5 Perfluoroalkoxy alkane

- 5.6 Ethylene tetrafluoroethylene

- 5.7 Ethylene chlorotrifluoroethylene

- 5.8 Polychlorotrifluoroethylene

- 5.9 Others

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Solvent-based coatings

- 6.3 Water-based coatings

- 6.4 Powder coatings

- 6.5 UV-curable coatings

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Substrate, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Metal

- 7.2.1 Steel

- 7.2.2 Aluminum

- 7.2.3 Others

- 7.3 Plastic & composites

- 7.4 Glass

- 7.5 Concrete & masonry

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Performance Attribute, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Chemical resistance

- 8.3 Weather resistance

- 8.4 Non-stick/low friction

- 8.5 Thermal stability

- 8.6 Electrical insulation

- 8.7 Corrosion protection

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Industrial equipment

- 9.2.1 Chemical processing equipment

- 9.2.2 Oil & gas equipment

- 9.2.3 Food processing equipment

- 9.2.4 Pharmaceutical equipment

- 9.2.5 Others

- 9.3 Building & construction

- 9.3.1 Architectural coatings

- 9.3.2 Roofing materials

- 9.3.3 Facades & cladding

- 9.3.4 Others

- 9.4 Automotive & transportation

- 9.4.1 Exterior components

- 9.4.2 Interior components

- 9.4.3 Under-the-hood applications

- 9.4.4 Others

- 9.5 Cookware & food contact

- 9.5.1 Non-Stick cookware

- 9.5.2 Bakeware

- 9.5.3 Food processing equipment

- 9.5.4 Others

- 9.6 Electronics & electrical

- 9.6.1 PCB coatings

- 9.6.2 Wire & cable coatings

- 9.6.3 Semiconductor applications

- 9.6.4 Others

- 9.7 Aerospace & defense

- 9.8 Marine

- 9.9 Healthcare & medical

- 9.10 Others

Chapter 10 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 Industrial manufacturing

- 10.2.1 Chemical

- 10.2.2 Oil & gas

- 10.2.3 Power generation

- 10.2.4 Others

- 10.3 Building & construction

- 10.4 Automotive & transportation

- 10.5 Consumer goods

- 10.5.1 Cookware & kitchenware

- 10.5.2 Appliances

- 10.5.3 Others

- 10.6 Electronics & semiconductors

- 10.7 Aerospace & defense

- 10.8 Food & beverage

- 10.9 Healthcare & pharmaceutical

- 10.10 Others

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Rest of Europe

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Rest of Asia Pacific

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Rest of Latin America

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

- 11.6.4 Rest of Middle East and Africa

Chapter 12 Company Profiles

- 12.1 3M Company

- 12.2 AFT Fluorotec

- 12.3 AGC Chemicals Americas

- 12.4 AGC Inc.

- 12.5 AkzoNobel N.V.

- 12.6 Arkema

- 12.7 Beckers Group

- 12.8 Daikin Industries

- 12.9 Dow

- 12.10 DuPont

- 12.11 Fluorotherm Polymers

- 12.12 Gujarat Fluorochemicals

- 12.13 Jotun A/S

- 12.14 Nippon Paint Holdings

- 12.15 PPG Industries, Inc.

- 12.16 Sherwin-Williams Company

- 12.17 Solvay S.A.

- 12.18 The Chemours Company

- 12.19 Whitford Corporation