|

市場調查報告書

商品編碼

1755247

固體火箭引擎市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Solid Rocket Motors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

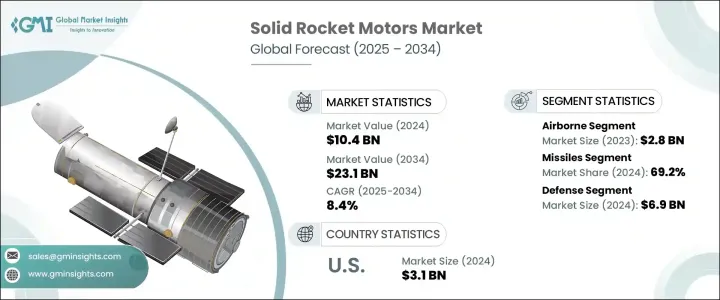

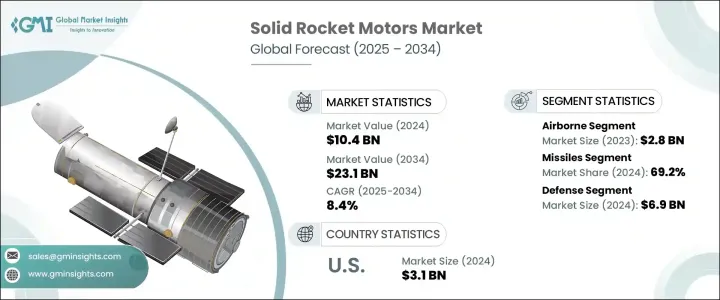

2024年,全球固體火箭引擎市場規模達104億美元,預計到2034年將以8.4%的複合年成長率成長,達到231億美元,這主要得益於全球國防預算的不斷成長以及對現代導彈和運載火箭系統的需求。固體火箭引擎因其結構簡單、推力輸出高、點火速度快和使用壽命長等特點,正日益受到青睞,成為軍事和航太領域的理想選擇。經濟和政治發展影響了供應鏈,並推高了零件成本,進一步影響了市場趨勢。儘管面臨這些挑戰,各國仍在繼續大力投資國家安全計畫和飛彈技術,這進一步增強了對可靠且可擴展推進系統的需求。

固體火箭引擎是國防項目的重要組成部分,其緊湊的外形尺寸可提供高性能,適用於地對空飛彈、戰術彈道飛彈和攔截飛彈系統。模組化和適應性強的推進技術正變得至關重要,因為它們能夠支援特定的任務需求,同時最佳化成本。市場受益於持續的創新,這些創新旨在提高引擎的機動性、射程和發射精度。隨著各國加強對威懾和太空能力的關注,固體引擎仍然是全球國防和航太基礎設施中不可或缺的一部分。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 104億美元 |

| 預測值 | 231億美元 |

| 複合年成長率 | 8.4% |

預計到2024年,衛星運載火箭市場將佔據30.8%的佔有率,這得益於對經濟高效、高可靠性發射解決方案日益成長的需求。固體推進系統因其維護成本低且易於部署,在中小型發射平台上廣受青睞。隨著公共和私人衛星部署項目的增多,固體火箭引擎的使用也日益增多,以滿足快速可靠的軌道發射需求。

2024年,國防領域產值達69億美元,成為固體火箭引擎市場的主要終端用途類別。對先進戰術武器系統和飛彈升級的持續需求,直接源自於全球軍事力量對快速反應能力和技術優勢的重視。固體火箭引擎以其高推重比、極低的維護要求和可靠的儲存能力而聞名,與這些目標高度契合。多個地區武裝部隊的持續現代化,加上戰略防禦舉措,進一步擴大了固體推進系統的採用。

2024年,美國固體火箭引擎市場產值達31億美元,鞏固了美國在固體推進技術領域的全球領先地位。國防和航太計畫雄厚的預算撥款持續推動著這一發展勢頭。對高超音速系統、下一代飛彈平台和可重複使用運載火箭的投資,正在協助推動固體引擎技術的國內生產和創新。美國軍方積極部署先進飛彈系統的時間表,以及美國國家航空暨太空總署(NASA)對深空探索的重新重視,正在推動對緊湊型高效推進解決方案的需求。

航空噴射火箭動力公司 (Aerojet Rocketdyne)、L3Harris Technologies, Inc.、諾斯羅普·格魯曼公司 (Northrop Grumman) 和拉斐爾先進防禦系統有限公司 (RAFAEL Advanced Defense Systems Ltd.) 等領先公司正在創新固體推進系統,以支持各種平台的政府和商業應用。為了鞏固市場地位,主要公司正在投資模組化引擎技術,以增強不同發射和防禦系統的靈活性和可擴展性。各公司專注於提高製造效率、降低生產成本並擴大下一代複合材料的研發。與航太和國防機構的合作有助於根據不斷變化的任務需求客製化固體推進解決方案,而戰略合約和收購則可以實現更深層的市場滲透。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 全球國防開支增加

- 衛星發射計畫激增

- 優惠的政府合約和研發資金

- 在高超音速和戰術飛彈系統中的應用

- 推進劑和材料的技術進步

- 產業陷阱與挑戰

- 嚴格的監管和安全合規性

- 開發成本高且可重複使用性有限

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依發布平台,2021-2034 年

- 主要趨勢

- 空降

- 地面

- 海軍

第6章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 衛星運載火箭

- 飛彈

第7章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 防禦

- 航太機構

- 商業空間

第8章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Anduril Industries

- AVIO SPA

- BrahMos Aerospace Private Limited

- General Dynamics Corporation

- Hanwha Group

- ISRO

- L3Harris Technologies, Inc.

- Lockheed Martin Corporation

- Mitsubishi Heavy Industries

- Nammo AS

- Northrop Grumman

- RAFAEL Advanced Defense Systems Ltd.

- ROKETSAN

- Roxel Group

- Tata Advanced Systems Limited

- URSA MAJOR TECHNOLOGIES INC

The Global Solid Rocket Motors Market was valued at USD 10.4 billion in 2024 and is estimated to grow at a CAGR of 8.4% to reach USD 23.1 billion by 2034, driven by rising global defense budgets and the need for modern missile and launch vehicle systems. Solid rocket motors are gaining traction due to their simplicity, high-thrust output, fast ignition, and long shelf life, making them ideal for military and aerospace use. Economic and political developments have affected supply chains and increased component costs, further influencing market trends. Despite these challenges, countries continue to invest heavily in national security initiatives and missile technologies, reinforcing the demand for reliable and scalable propulsion systems.

Solid rocket motors are vital components across defense programs, offering high performance in a compact form factor suitable for surface-to-air, tactical ballistic, and interceptor missile systems. Modular and adaptable propulsion technologies are becoming essential as they support specific mission requirements while optimizing cost. The market benefits from ongoing innovations to enhance maneuverability, range, and launch precision. As nations intensify their focus on deterrence and space capabilities, solid motors remain an indispensable part of defense and aerospace infrastructure worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.4 Billion |

| Forecast Value | $23.1 Billion |

| CAGR | 8.4% |

The satellite launch vehicle segment is projected to hold a 30.8% share in 2024, driven by the growing need for cost-efficient, high-reliability launch solutions. Solid propulsion systems are widely favored in small to medium-sized launch platforms due to their minimal maintenance and ease of deployment. As both public and private initiatives in satellite deployment grow, solid rocket motors are increasingly used to meet the needs of rapid and dependable orbital launches.

In 2024, the defense segment generated USD 6.9 billion, establishing itself as the dominant end-use category in the solid rocket motors market. The consistent demand for advanced tactical weapon systems and missile upgrades is a direct result of global military forces prioritizing rapid response capabilities and technological superiority. Solid rocket motors, known for their high thrust-to-weight ratio, minimal maintenance requirements, and dependable storage, align well with these objectives. Ongoing modernization of armed forces across several regions, coupled with strategic defense initiatives, has further amplified the adoption of solid propulsion systems.

United States Solid Rocket Motors Market generated USD 3.1 billion in 2024, reinforcing the country's role as a global leader in solid propulsion technologies. A robust budget allocation toward national defense and aerospace programs continues to drive this momentum. Investments in hypersonic systems, next-generation missile platforms, and reusable launch vehicles are helping fuel domestic production and innovation in solid motor technologies. The U.S. military's aggressive timeline for deploying advanced missile systems and NASA's renewed emphasis on deep space exploration are pushing demand for compact, high-efficiency propulsion solutions.

Leading firms such as Aerojet Rocketdyne, L3Harris Technologies, Inc., Northrop Grumman, and RAFAEL Advanced Defense Systems Ltd. are innovating solid motor systems that support government and commercial applications across various platforms. To solidify their market position, key companies are investing in modular motor technologies that provide enhanced flexibility and scalability across different launch and defense systems. Firms focus on improving manufacturing efficiencies, reducing production costs, and expanding R&D in next-gen composite materials. Collaborations with space and defense agencies help tailor solid propulsion solutions to evolving mission profiles, while strategic contracts and acquisitions enable deeper market penetration.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increased defense expenditure globally

- 3.7.1.2 Surge in satellite launch programs

- 3.7.1.3 Favorable government contracts and R&D funding

- 3.7.1.4 Adoption in hypersonic and tactical missile systems

- 3.7.1.5 Technological advancements in propellants and materials

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Stringent regulatory and safety compliance

- 3.7.2.2 High development costs and limited reusability

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Launch Platform, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Airborne

- 5.3 Ground-based

- 5.4 Naval

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Satellite launch vehicles

- 6.3 Missiles

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Defense

- 7.3 Space agencies

- 7.4 Commercial space

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Anduril Industries

- 9.2 AVIO SPA

- 9.3 BrahMos Aerospace Private Limited

- 9.4 General Dynamics Corporation

- 9.5 Hanwha Group

- 9.6 ISRO

- 9.7 L3Harris Technologies, Inc.

- 9.8 Lockheed Martin Corporation

- 9.9 Mitsubishi Heavy Industries

- 9.10 Nammo AS

- 9.11 Northrop Grumman

- 9.12 RAFAEL Advanced Defense Systems Ltd.

- 9.13 ROKETSAN

- 9.14 Roxel Group

- 9.15 Tata Advanced Systems Limited

- 9.16 URSA MAJOR TECHNOLOGIES INC