|

市場調查報告書

商品編碼

1755239

動脈過濾器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Arterial Filter Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

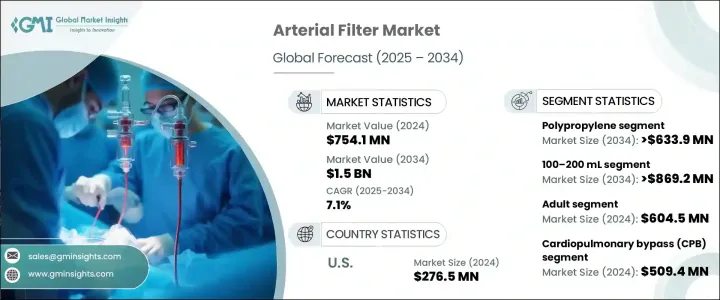

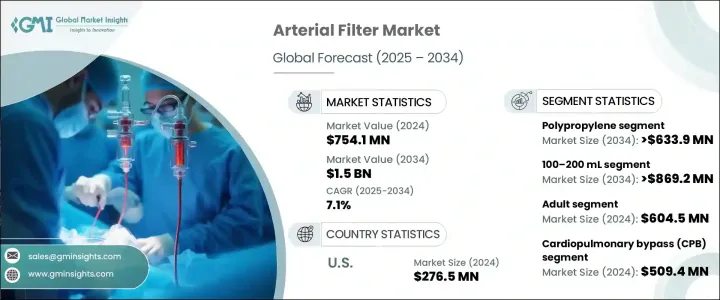

2024年,全球動脈過濾器市場規模達7.541億美元,預估年複合成長率為7.1%,2034年將達15億美元。市場擴張的主要驅動力包括心血管疾病發病率的上升、心胸外科手術數量的增加、過濾器設計的技術進步以及醫療保健投資的不斷成長。對病人安全的高度重視以及嚴格手術方案的採用進一步推動了對動脈過濾器的需求。這些過濾器有助於減少體外循環中的栓塞併發症,其使用得到了美國食品藥物管理局(FDA)和歐洲藥品管理局(EMA)等監管機構的支持,確保其被納入標準醫療實踐。

動脈過濾器是體外循環 (CPB) 和體外膜氧合 (ECMO) 過程中必不可少的醫療器械,用於在血液返回患者動脈系統之前去除血液中的氣泡、血塊和微栓子。這些過濾器有助於降低栓塞和器官損傷的風險,這在心臟手術和其他重症監護手術中至關重要。隨著產業的發展,過濾器設計的創新、向微創手術的轉變以及生物相容性和血液相容性材料的進步正在推動動脈過濾器市場的擴張。客製化需求以及一次性過濾器解決方案的興起進一步增強了市場的成長潛力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7.541億美元 |

| 預測值 | 15億美元 |

| 複合年成長率 | 7.1% |

聚丙烯市場預計將顯著成長,複合年成長率達7%,到2034年將達到6.339億美元。聚丙烯(PP)因其耐化學性和耐高溫性而備受推崇,是體外循環等高壓力環境的理想選擇。其在不同溫度下的穩定性以及良好的生物相容性確保其不會干擾人體的自然生理過程。該材料在體外循環過程中減少血栓形成和發炎的能力預計將推動該市場的成長。

預計100-200毫升過濾器市場的複合年成長率將達到6.9%,到2034年將達到8.692億美元。這些過濾器在過濾效率和血液稀釋之間實現了最佳平衡,適用於成人手術。它們有利於維持患者的血液容量,同時減少對捐贈者輸血的需求。這些過濾器改進了微泡和排氣功能,這對於維護患者安全和確保高手術標準至關重要。其設計最大限度地減少了血流阻力,進一步增強了其在心臟手術(尤其是成人手術)中的需求,而成人手術在全球心臟手術市場中佔據主導地位。

2024年,美國動脈過濾器市場規模達2.765億美元。美國先進的醫療保健體系和一流的外科手術基礎設施使其成為動脈過濾器市場的關鍵參與者。訓練有素的醫務人員和大量複雜的心臟手術,推動了美國醫院對動脈過濾器的持續需求,推動了市場的成長。

全球動脈過濾器市場的知名公司包括:美敦力 (Medtronic)、GETINGE、SENKO Medical Instrument、Braile Biomedica、頗爾 (Pall Corporation)、LivaNova、Lifeline Systems、EUROSETS、尼普羅 (NIPRO)、Gen World Medical Devices、TERUMO 和北京美多斯艾特生物科技有限公司。在動脈過濾器市場,各公司正在實施多項策略以提升其市場地位。他們專注於開發滿足特定手術需求的先進客製化產品,使其產品脫穎而出。此外,許多公司正在投資研發可提高過濾器性能的材料,例如生物相容性和血液相容性材料,以滿足對更安全、更有效設備日益成長的需求。與醫院和醫療保健提供者的合作也至關重要,這使得製造商能夠將其過濾器整合到標準的手術實踐中。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 心血管疾病盛行率不斷上升

- 體外循環手術的成長

- 過濾器設計的技術進步

- 老年人口不斷增加

- 產業陷阱與挑戰

- 心臟手術和設備費用高昂

- 過濾器併發症的風險

- 市場機會

- 下一代動脈過濾器的開發

- 小兒和新生兒心臟外科手術的成長

- 成長動力

- 成長潛力分析

- 監管格局

- 美國

- 歐洲

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

- 未來市場趨勢

- 價值鏈分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 按地區

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

- 關鍵進展

- 併購

- 夥伴關係和合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按過濾材料,2021 - 2034 年

- 主要趨勢

- 聚丙烯

- 聚乙烯

- 聚氯乙烯(PVC)

- 其他過濾材料

第6章:市場估計與預測:按啟動量,2021 - 2034 年

- 主要趨勢

- 少於100毫升

- 100–200 毫升

- 超過200毫升

第7章:市場估計與預測:按年齡層,2021 - 2034 年

- 主要趨勢

- 成人

- 新生兒/兒科

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 體外循環(CPB)

- 體外膜氧合(ECMO)

- 其他應用

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 其他最終用途

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Beijing MEDOS AT Biotechnology

- Braile Biom'dica

- EUROSETS

- Gen World Medical Devices

- GETINGE

- Lifeline Systems

- LivaNova

- Medtronic

- NIPRO

- Pall Corporation

- SENKO Medical Instrument

- TERUMO

The Global Arterial Filter Market was valued at USD 754.1 million in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 1.5 billion by 2034. This market expansion is primarily driven by the rising incidence of cardiovascular diseases, the increasing number of cardiothoracic surgeries, technological advancements in filter designs, and growing healthcare investments. The heightened focus on patient safety and the adoption of strict surgical protocols further contribute to the demand for arterial filters. These filters help reduce embolic complications during extracorporeal circulation, and their use is supported by regulatory bodies like the FDA and EMA, ensuring their integration into standard medical practices.

Arterial filters are essential medical devices used during cardiopulmonary bypass (CPB) and extracorporeal membrane oxygenation (ECMO) to remove air bubbles, blood clots, and microemboli from the blood before it is returned to the patient's arterial system. These filters help reduce the risk of embolism and organ damage, which is crucial during cardiac surgeries and other critical care procedures. As the industry grows, innovations in filter design, the shift towards minimally invasive surgeries, and advancements in biocompatible and hemocompatible materials are fueling the expansion of the arterial filter market. The demand for customization, along with the rise of disposable filter solutions, further strengthens the market's growth potential.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $754.1 Million |

| Forecast Value | $1.5 Billion |

| CAGR | 7.1% |

The polypropylene segment is anticipated to see significant growth, growing at a CAGR of 7% and reach USD 633.9 million by 2034. Polypropylene (PP) is highly valued for its resistance to chemicals and high temperatures, making it ideal for use in high-stress environments such as cardiopulmonary bypass. Its stability at varying temperatures, alongside its biocompatibility, ensures it does not interfere with the body's natural processes. This material's ability to reduce thrombosis and inflammation during extracorporeal circulation is expected to drive the segment's growth.

The 100-200 mL segment is expected to grow at a CAGR of 6.9% to reach USD 869.2 million by 2034. These filters provide an optimal balance between filtration efficiency and hemodilution, making them suitable for adult surgeries. They are beneficial in preserving the patient's blood volume while reducing the need for donor blood transfusions. These filters have improved microbubble and air venting capabilities, which are essential for maintaining patient safety and ensuring high surgical standards. Their design minimizes blood flow resistance, further enhancing their demand in cardiac surgeries, particularly in adult cases, which dominate the global cardiac surgery market.

U.S. Arterial Filter Market accounted for USD 276.5 million in 2024. The country's advanced healthcare system and state-of-the-art surgical infrastructure have made it a key player in the arterial filter market. A highly trained medical workforce and a high volume of complex cardiac surgeries contribute to the ongoing demand for arterial filters in U.S. hospitals, driving the market's growth.

Prominent companies operating in the Global Arterial Filter Market include: Medtronic, GETINGE, SENKO Medical Instrument, Braile Biomedica, Pall Corporation, LivaNova, Lifeline Systems, EUROSETS, NIPRO, Gen World Medical Devices, TERUMO, and Beijing MEDOS AT Biotechnology. In the arterial filter market, companies are implementing several strategies to enhance their market position. They are focusing on the development of advanced, customized products that meet specific surgical needs, thereby differentiating their offerings. Additionally, many companies are investing in the research and development of materials that improve filter performance, such as biocompatible and hemocompatible options, to meet the growing demand for safer, more effective devices. Partnerships with hospitals and healthcare providers are also crucial, allowing manufacturers to integrate their filters into standard surgical practices.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Market scope and definitions

- 1.3 Research design

- 1.3.1 Research approach

- 1.3.2 Data collection methods

- 1.4 Data mining sources

- 1.4.1 Global

- 1.4.2 Regional/Country

- 1.5 Base estimates and calculations

- 1.5.1 Base year calculation

- 1.5.2 Key trends for market estimation

- 1.6 Primary research and validation

- 1.6.1 Primary sources

- 1.7 Forecast model

- 1.8 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Filter material trends

- 2.2.3 Priming volume trends

- 2.2.4 Age group trends

- 2.2.5 Application trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of cardiovascular diseases

- 3.2.1.2 Growth in cardiopulmonary bypass procedures

- 3.2.1.3 Technological advancements in filter design

- 3.2.1.4 Rising geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of cardiac surgeries and devices

- 3.2.2.2 Risk of complications from filters

- 3.2.3 Market opportunities

- 3.2.3.1 Development of next-gen arterial filters

- 3.2.3.2 Growth in pediatric and neonatal cardiac surgery

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

- 3.11 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 By region

- 4.3.1.1 North America

- 4.3.1.2 Europe

- 4.3.1.3 Asia Pacific

- 4.3.1 By region

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Filter Material, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Polypropylene

- 5.3 Polyethylene

- 5.4 Polyvinyl chloride (PVC)

- 5.5 Other filter materials

Chapter 6 Market Estimates and Forecast, By Priming Volume, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Less than 100 mL

- 6.3 100–200 mL

- 6.4 More than 200 mL

Chapter 7 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Adult

- 7.3 Neonatal/ pediatric

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Cardiopulmonary bypass (CPB)

- 8.3 Extracorporeal membrane oxygenation (ECMO)

- 8.4 Other applications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Ambulatory surgical centers

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Beijing MEDOS AT Biotechnology

- 11.2 Braile Biom'dica

- 11.3 EUROSETS

- 11.4 Gen World Medical Devices

- 11.5 GETINGE

- 11.6 Lifeline Systems

- 11.7 LivaNova

- 11.8 Medtronic

- 11.9 NIPRO

- 11.10 Pall Corporation

- 11.11 SENKO Medical Instrument

- 11.12 TERUMO