|

市場調查報告書

商品編碼

1755228

飛機微型渦輪引擎市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Aircraft Micro Turbine Engines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

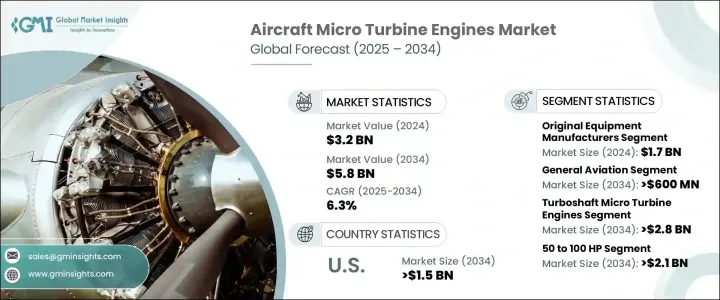

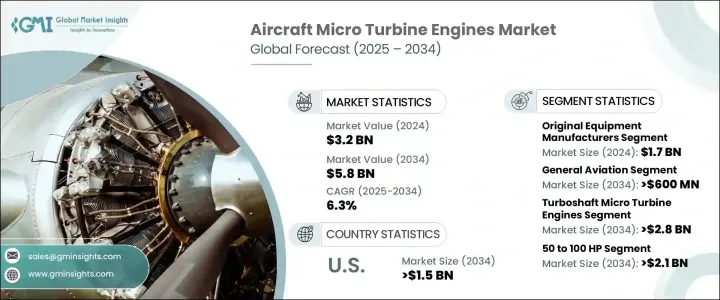

2024 年全球飛機微型渦輪引擎市場價值為 32 億美元,預計到 2034 年將以 6.3% 的複合年成長率成長,達到 58 億美元,這得益於國防、農業、物流和緊急應變行動中無人機 (UAV) 的不斷增加的部署。隨著航太工業的發展,微型渦輪引擎因其緊湊的尺寸、功率重量比以及擴大無人機作戰範圍和有效載荷能力的效率而獲得了關注。微型渦輪機擴大被納入通用航空和新興的城市空中交通解決方案。它們在支援混合動力和垂直起降 (VTOL) 飛機方面的作用進一步推動了它們的採用。同時,市場擴張面臨航太零件關稅和原料成本上漲的壓力,這可能會增加生產費用並推遲專案時間表,特別是對於先進的下一代航空系統而言。

針對航太零件和專用材料的貿易關稅持續推高微型渦輪機製造商的成本,削弱了其價格競爭力,並擾亂了國際採購鏈。這一趨勢對依賴全球採購精密工程零件的平台構成威脅。由於這些壁壘,混合動力無人機和AAM平台的長期創新和及時交付可能會遭遇阻礙。隨著無人機在各行各業的應用日益廣泛,對微型渦輪引擎的需求也隨之飆升。這些引擎因其高效驅動無人機、增強續航能力、航程和有效載荷處理能力而備受青睞。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 32億美元 |

| 預測值 | 58億美元 |

| 複合年成長率 | 6.3% |

2024年,原始設備製造商 (OEM) 部門的收入達到17億美元,凸顯了其在飛機微型渦輪引擎產業的核心地位。 OEM是將這些引擎整合到各種平台(包括無人機 (UAV)、通用航空飛機和先進空中機動 (AAM) 系統)背後的驅動力。這些製造商在早期設計階段嵌入微型渦輪引擎、確保無縫互通性和最佳化飛機整體性能方面發揮關鍵作用。他們憑藉根據特定平台需求客製化引擎系統的專業知識,提高了運作效率、續航時間和系統可靠性。

先進空中交通 (AAM) 領域在 2024 年創造了 3 億美元的收入,迅速成為城市交通變革的推動力。隨著城市尋求永續且節省空間的交通方式,電動和混合動力垂直起降 (VTOL) 飛機正成為主要關注點。微型渦輪引擎正被用作機載增程器或備用系統,使 AAM 飛行器能夠克服能量儲存限制,以實現更長距離、更安全的飛行。這些渦輪引擎提供持續的輔助推力並提高能量冗餘度,使其成為對不間斷電源和更大航程至關重要的任務的理想選擇。

美國飛機微型渦輪引擎市場規模預計2034年將達到15億美元。強勁的國防預算、技術創新和先進的航空生態系統鞏固了這一領先地位。美國對無人機系統(UAS)的投資,包括下一代戰術無人機和情報平台,持續推動微型渦輪引擎技術的發展。在政府機構和航太研究機構的支持下,正在進行的混合電力推進計畫正在突破效率、降噪和排放控制的極限。

市場主要參與者包括克拉托斯防務與安全解決方案公司、通用電氣航太、霍尼韋爾航太、賽峰集團和勞斯萊斯公司。戰術無人機和空中行動通訊系統(AAM)對先進推進系統的需求不斷成長,推動了全球範圍內的研發工作。為了鞏固市場地位,主要參與者正在大力投資研發,以生產適用於各種飛機的輕型、省油的微型渦輪機。他們正在加強垂直整合,以提高供應鏈的彈性,並減少對外國零件的依賴。各公司也正在與國防機構和商用無人機開發商建立戰略合作夥伴關係,以確保簽訂長期合約。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 供應商矩陣

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 產業衝擊力

- 成長動力

- 軍事和商業應用對無人機的需求不斷成長

- 用於空對空飛彈和區域機動性的混合動力電動飛機開發激增

- 渦輪機零件輕質材料和積層製造的進步

- 全球國防開支和現代化計劃增加

- 越來越重視燃料靈活性和超低排放引擎

- 產業陷阱與挑戰

- 微型渦輪機技術開發認證成本高

- 混合動力電力推進系統的基礎設施和監管支援有限

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按安裝量,2021 - 2034 年

- 原始設備製造商

- 售後市場

第6章:市場估計與預測:按平台,2021 - 2034 年

- 通用航空

- 輕型飛機

- 公務機

- 商業航空

- 軍事航空

- 軍用機

- 軍用無人機

- 先進的空中機動性

- 空中計程車

- 貨運無人機

第7章:市場估計與預測:按引擎類型,2021 - 2034 年

- 渦輪噴射微型渦輪引擎市場

- 渦輪軸微型渦輪引擎市場

- 渦輪螺旋槳微型渦輪引擎市場

第8章:市場估計與預測:按馬力,2021 - 2034 年

- 低於50 HP

- 50至100馬力

- 100至200馬力

- 大於200 HP

第9章:市場預估與預測:依燃料類型,2021 - 2034

- 噴射燃料

- 多燃料

第 10 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 推進系統

- 輔助電源

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第12章:公司簡介

- Honeywell Aerospace

- Rolls-Royce plc

- Safran Group

- GE Aerospace

- Kratos Defense & Security Solutions

- UAV Turbines Inc.

- Turbotech SAS

- PBS Velka Bíteš

- JetCat GmbH

- Williams International

- Turbine Technologies Ltd.

- Archjet (Archangel Systems)

- Pratt & Whitney (Raytheon Technologies)

- New Frontier Aerospace

- PBS Aerospace

- Aero Design Works LLC

- Opal-RT Technologies

- Rotron Power Ltd.

- Adept Airmotive

- PBS India

The Global Aircraft Micro Turbine Engines Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 5.8 billion by 2034, fueled by the rising deployment of unmanned aerial vehicles (UAVs) across defense, agriculture, logistics, and emergency response operations. As the aerospace industry evolves, microturbine engines have gained traction for their compact size, power-to-weight ratio, and efficiency in extending UAV operational range and payload capacity. Micro turbines are increasingly integrated into general aviation and emerging urban air mobility solutions. Their role in supporting hybrid-electric and vertical take-off and landing (VTOL) aircraft has further propelled their adoption. At the same time, market expansion faces pressure from rising aerospace component tariffs and raw material costs, which could increase production expenses and delay project timelines, particularly for advanced next-gen aerial systems.

Trade tariffs on aerospace components and specialized materials continue to drive up costs for microturbine manufacturers, undermining pricing competitiveness and disrupting international sourcing chains. This trend concerns platforms that depend on precision-engineered parts sourced globally. Long-term innovation and timely delivery in hybrid-electric UAV and AAM platforms may face setbacks due to such barriers. The demand for micro turbine engines is soaring with the expanding use of UAVs across diverse industries. These engines are favored for powering drones efficiently, providing enhanced endurance, range, and payload handling.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 billion |

| Forecast Value | $5.8 billion |

| CAGR | 6.3% |

In 2024, the original equipment manufacturers (OEMs) segment generated USD 1.7 billion, highlighting its central role in the aircraft micro turbine engines industry. OEMs are the driving force behind integrating these engines into various platforms, including unmanned aerial vehicles (UAVs), general aviation aircraft, and advanced air mobility (AAM) systems. These manufacturers play a pivotal role in embedding micro turbine engines during the early design phase, ensuring seamless interoperability and optimizing overall aircraft performance. Their expertise in customizing engine systems for specific platform needs enhances operational efficiency, endurance, and system reliability.

The advanced air mobility (AAM) segment generated USD 300 million in 2024, rapidly establishing itself as a transformative force in urban transportation. As cities look toward sustainable and space-efficient transit options, electric and hybrid vertical take-off and landing (VTOL) aircraft are becoming a major focus. Micro turbine engines are being adopted as onboard range extenders or backup systems, allowing AAM vehicles to overcome energy storage limitations and achieve longer, safer flights. These turbines provide consistent auxiliary thrust and improve energy redundancy, making them ideal for missions where uninterrupted power and expanded range are critical.

U.S. Aircraft Micro Turbine Engines Market is projected to reach USD 1.5 billion by 2034. This leadership is underpinned by robust defense budgets, technological innovation, and an advanced aviation ecosystem. The nation's investment in unmanned aerial systems (UAS), including next-gen tactical drones and intelligence platforms, continues to drive micro turbine technology. Ongoing hybrid-electric propulsion projects, supported by government agencies and aerospace research institutions, are pushing the boundaries of efficiency, noise reduction, and emissions control.

Major players in the market include Kratos Defense & Security Solutions, GE Aerospace, Honeywell Aerospace, Safran Group, and Rolls-Royce plc. Increased demand for advanced propulsion systems in tactical UAVs and AAM boosts development efforts globally. To strengthen their market position, key players are investing heavily in R&D to produce lightweight, fuel-efficient micro turbines suited for a range of aircraft. They are enhancing vertical integration to improve supply chain resilience and reduce dependency on foreign components. Companies are also forming strategic partnerships with defense agencies and commercial UAV developers to secure long-term contracts.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Vendor matrix

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news and initiatives

- 3.8 Industry impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising demand for UAVs in military and commercial applications

- 3.8.1.2 Surge in hybrid-electric aircraft development for AAM and regional mobility

- 3.8.1.3 Advancements in lightweight materials and additive manufacturing for turbine components

- 3.8.1.4 Increased defense spending and modernization programs globally

- 3.8.1.5 Growing emphasis on fuel flexibility and ultra-low emissions engines

- 3.8.2 Industry pitfalls and challenges

- 3.8.2.1 High development and certification costs for micro turbine technology

- 3.8.2.2 Limited infrastructure and regulatory support for hybrid-electric propulsion systems

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Regulatory landscape

- 3.11 Technology landscape

- 3.12 Future market trends

- 3.13 Gap analysis

- 3.14 Porter's analysis

- 3.15 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Installation, 2021 - 2034 (USD Million)

- 5.1 Original equipment manufacturers

- 5.2 Aftermarket

Chapter 6 Market estimates & forecast, By Platform, 2021 - 2034 (USD Million)

- 6.1 General aviation

- 6.1.1 Light aircraft

- 6.1.2 Business jets

- 6.2 Commercial aviation

- 6.2.1 Military aviation

- 6.2.2 Military aircraft

- 6.2.3 Military drones

- 6.3 Advanced air mobility

- 6.3.1 Air taxis

- 6.3.2 Cargo drones

Chapter 7 Market Estimates & Forecast, By Engine Type, 2021 - 2034 (USD Million)

- 7.1 Turbojet micro turbine engines market

- 7.2 Turboshaft micro turbine engines market

- 7.3 Turboprop micro turbine engines market

Chapter 8 Market estimates & forecast, By Horsepower, 2021 - 2034 (USD Million)

- 8.1 Below 50 HP

- 8.2 50 to 100 HP

- 8.3 100 to 200 HP

- 8.4 Greater than 200 HP

Chapter 9 Market Estimates & Forecast, By Fuel Type, 2021 - 2034 (USD Million)

- 9.1 Jet fuel

- 9.2 Multi fuel

Chapter 10 Market estimates & forecast, By By End Use, 2021 - 2034 (USD Million)

- 10.1 Propulsion

- 10.2 Auxiliary power

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Honeywell Aerospace

- 12.2 Rolls-Royce plc

- 12.3 Safran Group

- 12.4 GE Aerospace

- 12.5 Kratos Defense & Security Solutions

- 12.6 UAV Turbines Inc.

- 12.7 Turbotech SAS

- 12.8 PBS Velka Bíteš

- 12.9 JetCat GmbH

- 12.10 Williams International

- 12.11 Turbine Technologies Ltd.

- 12.12 Archjet (Archangel Systems)

- 12.13 Pratt & Whitney (Raytheon Technologies)

- 12.14 New Frontier Aerospace

- 12.15 PBS Aerospace

- 12.16 Aero Design Works LLC

- 12.17 Opal-RT Technologies

- 12.18 Rotron Power Ltd.

- 12.19 Adept Airmotive

- 12.20 PBS India