|

市場調查報告書

商品編碼

1755224

化工高溫工業鍋爐市場機會、成長動力、產業趨勢分析及2025-2034年預測Chemical High Temperature Industrial Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

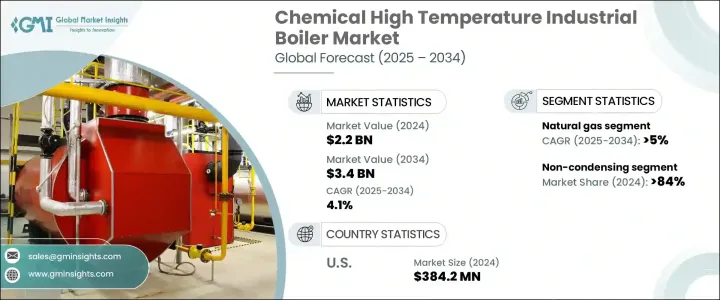

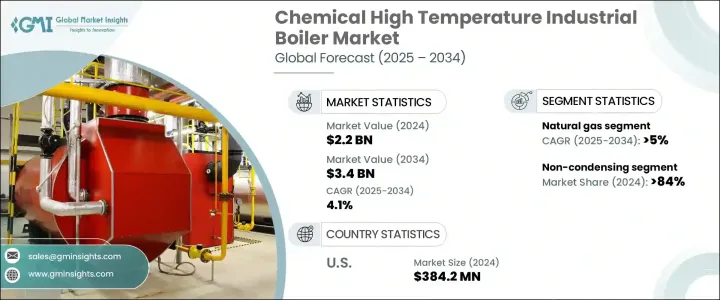

2024年,全球工高溫工業鍋爐市場規模達22億美元,預計到2034年將以4.1%的複合年成長率成長,達到34億美元。這主要得益於快速城鎮化推動發展中經濟體各產業對先進供熱技術的需求不斷成長。化學合成、聚合和蒸餾等化學生產過程的複雜性和規模日益擴大,推動了對高效高溫蒸汽系統的需求。

此外,採用物聯網和自動化技術可以增強即時監控、維護預測和效能最佳化,從而提高鍋爐的效率。這項轉變對於提高能源效率、最大限度地減少停機時間和遵守嚴格的排放標準至關重要。在化工廠中,採用先進技術改造現有鍋爐正變得越來越普遍,這不僅延長了鍋爐的使用壽命,還確保了鍋爐符合最新法規。然而,全球貿易中斷,尤其是川普總統任期內對進口零件徵收的關稅,可能會影響國際貿易動態和營運成本,導致製造業長期轉移到國內。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 22億美元 |

| 預測值 | 34億美元 |

| 複合年成長率 | 4.1% |

在化工高溫工業鍋爐市場中,天然氣驅動部分有望實現顯著成長,預計到2034年複合年成長率將達到5%,這得益於天然氣基礎設施的持續擴張以及各行業對能源安全的日益重視。隨著對清潔能源的需求日益成長,天然氣被認為比煤炭或石油更環保,進一步推動了這個市場轉變。此外,天然氣鍋爐還具有許多優勢,包括更低的排放和更高的燃油效率,使其成為那些致力於遵守更嚴格環境法規的行業的理想選擇。

至2034年,冷凝鍋爐市場將以4%的複合年成長率成長。這類鍋爐因其卓越的能源效率而越來越受歡迎。冷凝技術能夠捕獲並再利用廢氣中的熱量,不僅降低了能耗,也減少了溫室氣體排放。隨著人們對環境問題的日益關注以及對更環保技術的追求,各行各業紛紛採用冷凝鍋爐,以符合更嚴格的排放控制標準並降低營運成本。

到2024年,美國化工高溫工業鍋爐市場價值將達到3.842億美元,這得益於其持續推進的現有基礎設施現代化和老舊鍋爐系統的更新換代。美國市場受到了有關能源效率和排放控制的新法規和修訂法規的支持,這些法規促使化工廠和其他工業營運商投資先進的鍋爐技術。政府對永續發展的日益重視以及企業滿足環保標準的需求是推動這一成長的關鍵驅動力。

在這個市場上營運的公司包括 Babcock & Wilcox Enterprises、Bharat Heavy Electricals、Clayton Industries、Cleaver-Brooks、Cochran、Doosan Heavy Industries & Construction、FERROLI、Fonderie Sime、FONDITAL、Forbes Marshall、GE Vernova、Groupe Atlantic、Hok、FONDITAL、Forbes Marshall、GE Vernova、Groupe Atlantic、Hoval、Hurman、Iilman、Itilla. Group、三菱重工、Miura America、Rentech Boilers、Robert Bosch、西門子、Sofinter、The Fulton Companies、Thermax、Victory Energy Operations、Viessmann 和 Walchandnagar Industries。化工高溫工業鍋爐市場的關鍵策略包括廣泛的研發投資,以整合物聯網和人工智慧等創新技術,從而提高營運效能並降低維護成本。此外,公司正致力於以節能解決方案改造舊設備,確保符合更嚴格的環境和排放標準。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:依溫度,2021 - 2034 年

- 主要趨勢

- 180°F - 200°F

- > 200°F - 220°F

- > 220°F - 240°F

- > 240°F

第6章:市場規模及預測:依產品,2021 - 2034

- 主要趨勢

- 火管

- 水管

第7章:市場規模及預測:依產能,2021 - 2034

- 主要趨勢

- < 10 百萬英熱單位/小時

- 10 - 25 百萬英熱單位/小時

- 25 - 50 百萬英熱單位/小時

- 50 - 75 百萬英熱單位/小時

- 75 - 100 百萬英熱單位/小時

- 100 - 175 百萬英熱單位/小時

- 175 - 250 百萬英熱單位/小時

- > 250 百萬英熱單位/小時

第8章:市場規模及預測:依燃料,2021 - 2034

- 主要趨勢

- 天然氣

- 油

- 煤炭

- 其他

第9章:市場規模及預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 冷凝

- 無凝結

第 10 章:市場規模與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 法國

- 英國

- 波蘭

- 義大利

- 西班牙

- 奧地利

- 德國

- 瑞典

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 菲律賓

- 日本

- 韓國

- 澳洲

- 印尼

- 中東和非洲

- 沙烏地阿拉伯

- 伊朗

- 阿拉伯聯合大公國

- 奈及利亞

- 南非

- 拉丁美洲

- 阿根廷

- 智利

- 巴西

第 11 章:公司簡介

- Babcock and Wilcox Enterprises

- Bharat Heavy Electricals

- Clayton Industries

- Cleaver-Brooks

- Cochran

- Doosan Heavy Industries & Construction

- FERROLI

- Fonderie Sime

- FONDITAL

- Forbes Marshall

- GE Vernova

- Groupe Atlantic

- Hoval

- Hurst Boiler and Welding

- IHI Corporation

- John Cockerill

- John Wood Group

- Mitsubishi Heavy Industries

- Miura America

- Rentech Boilers

- Robert Bosch

- Siemens

- Sofinter

- The Fulton Companies

- Thermax

- Victory Energy Operations

- Viessmann

- Walchandnagar Industries

The Global Chemical High Temperature Industrial Boiler Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 4.1% to reach USD 3.4 billion by 2034, driven by the rising demand for advanced heating technologies in in industries across developing economies, fueled by rapid urbanization. The increasing complexity and scale of chemical production processes, including chemical synthesis, polymerization, and distillation, propel the need for efficient, high-temperature steam systems.

Furthermore, adopting IoT and automation technologies enhances real-time monitoring, maintenance predictions, and performance optimization, making these boilers increasingly efficient. This shift is critical for improving energy efficiency, minimizing downtime, and complying with strict emissions standards. Retrofitting existing boilers with advanced technologies is becoming common among chemical plants, extending boiler lifespans and ensuring compliance with updated regulations. However, global trade disruptions, particularly tariffs on imported components during the Trump presidency, could impact international trade dynamics and operational costs, creating a shift toward domestic manufacturing in the long term.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $3.4 Billion |

| CAGR | 4.1% |

The natural gas-powered segment of the chemical high-temperature industrial boiler market is poised for significant growth, with an anticipated CAGR of 5% by 2034 fueled by the continuous expansion of natural gas infrastructure and a heightened focus on energy security across industries. The increasing demand for cleaner energy sources, natural gas is considered more environmentally friendly than coal or oil, further supports this market shift. Additionally, natural gas boilers offer several advantages, including lower emissions and better fuel efficiency, making them an attractive choice for industries aiming to comply with stricter environmental regulations.

The condensing boilers segment will grow at a 4% CAGR by 2034. These boilers are becoming increasingly popular due to their superior energy efficiency. Condensing technology enables the capture and reuse of heat from exhaust gases, which not only reduces energy consumption but lowers greenhouse gas emissions. With growing environmental concerns and the push for greener technologies, industries are adopting condensing boilers to comply with more stringent emission control standards and to reduce operational costs.

United States Chemical High Temperature Industrial Boiler Market was valued at USD 384.2 million by 2024 attributed to the ongoing efforts toward modernizing existing infrastructure and replacing outdated boiler systems. The U.S. market has been supported by new and revised regulations concerning energy efficiency and emission controls, which have prompted chemical plants and other industrial operators to invest in advanced boiler technologies. The government's increasing focus on sustainability and the need for businesses to meet environmental standards are key drivers of this growth.

Companies operating in this market include Babcock & Wilcox Enterprises, Bharat Heavy Electricals, Clayton Industries, Cleaver-Brooks, Cochran, Doosan Heavy Industries & Construction, FERROLI, Fonderie Sime, FONDITAL, Forbes Marshall, GE Vernova, Groupe Atlantic, Hoval, Hurst Boiler and Welding, IHI Corporation, John Cockerill, John Wood Group, Mitsubishi Heavy Industries, Miura America, Rentech Boilers, Robert Bosch, Siemens, Sofinter, The Fulton Companies, Thermax, Victory Energy Operations, Viessmann, and Walchandnagar Industries. Key strategies in the chemical high-temperature industrial boiler market include extensive R&D investment to integrate innovative technologies, such as IoT and AI, which improve operational performance and reduce maintenance costs. Additionally, companies are focusing on retrofitting older units with energy-efficient solutions, ensuring compliance with stricter environmental and emissions standards.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Temperature, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 5.1 Key trends

- 5.2 180°F - 200°F

- 5.3 > 200°F - 220°F

- 5.4 > 220°F - 240°F

- 5.5 > 240°F

Chapter 6 Market Size and Forecast, By Product, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 6.1 Key trends

- 6.2 Fire-tube

- 6.3 Water-tube

Chapter 7 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 7.1 Key trends

- 7.2 < 10 MMBTU/hr

- 7.3 10 - 25 MMBTU/hr

- 7.4 25 - 50 MMBTU/hr

- 7.5 50 - 75 MMBTU/hr

- 7.6 75 - 100 MMBTU/hr

- 7.7 100 - 175 MMBTU/hr

- 7.8 175 - 250 MMBTU/hr

- 7.9 > 250 MMBTU/hr

Chapter 8 Market Size and Forecast, By Fuel, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 8.1 Key trends

- 8.2 Natural gas

- 8.3 Oil

- 8.4 Coal

- 8.5 Others

Chapter 9 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 9.1 Key trends

- 9.2 Condensing

- 9.3 Non-condensing

Chapter 10 Market Size and Forecast, By Region, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 Europe

- 10.3.1 France

- 10.3.2 UK

- 10.3.3 Poland

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Austria

- 10.3.7 Germany

- 10.3.8 Sweden

- 10.3.9 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Philippines

- 10.4.4 Japan

- 10.4.5 South Korea

- 10.4.6 Australia

- 10.4.7 Indonesia

- 10.5 Middle East & Africa

- 10.5.1 Saudi Arabia

- 10.5.2 Iran

- 10.5.3 UAE

- 10.5.4 Nigeria

- 10.5.5 South Africa

- 10.6 Latin America

- 10.6.1 Argentina

- 10.6.2 Chile

- 10.6.3 Brazil

Chapter 11 Company Profiles

- 11.1 Babcock and Wilcox Enterprises

- 11.2 Bharat Heavy Electricals

- 11.3 Clayton Industries

- 11.4 Cleaver-Brooks

- 11.5 Cochran

- 11.6 Doosan Heavy Industries & Construction

- 11.7 FERROLI

- 11.8 Fonderie Sime

- 11.9 FONDITAL

- 11.10 Forbes Marshall

- 11.11 GE Vernova

- 11.12 Groupe Atlantic

- 11.13 Hoval

- 11.14 Hurst Boiler and Welding

- 11.15 IHI Corporation

- 11.16 John Cockerill

- 11.17 John Wood Group

- 11.18 Mitsubishi Heavy Industries

- 11.19 Miura America

- 11.20 Rentech Boilers

- 11.21 Robert Bosch

- 11.22 Siemens

- 11.23 Sofinter

- 11.24 The Fulton Companies

- 11.25 Thermax

- 11.26 Victory Energy Operations

- 11.27 Viessmann

- 11.28 Walchandnagar Industries