|

市場調查報告書

商品編碼

1755220

非酒精性脂肪性肝炎生物標記市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Non-alcoholic Steatohepatitis Biomarkers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

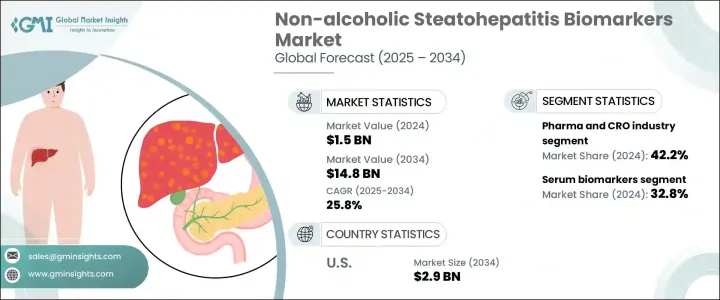

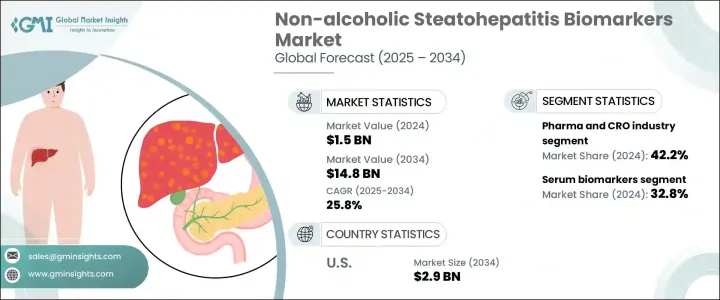

2024年,全球非酒精性脂肪性肝炎生物標記市場規模達15億美元,預計2034年將以25.8%的複合年成長率成長至148億美元。 NASH生物標記是幫助評估NASH存在和進展的生物指標。 NASH是一種由非酒精性脂肪肝病(NAFLD)演變而來的嚴重肝病。隨著醫療保健提供者越來越重視早期發現和針對性干預,對此類生物標記的需求也大幅成長。針對高風險族群的臨床建議不斷發展,進一步推動了主動肝病篩檢的發展。這其中包括患有肥胖症和2型糖尿病等代謝紊亂疾病的人群,他們更容易患上NASH。

隨著人們對肝臟相關併發症的認知不斷加深,醫療保健系統正在整合基於生物標記的診斷策略,以改善患者預後。這些工具可望監測病情進展、評估療效,並識別最有可能從新興療法中獲益的患者。它們在個人化醫療中日益重要的作用,推動了肝病診斷和治療方式的重大轉變。人們對微創方法的日益青睞,以及精準診斷在臨床研究中的日益普及,進一步鞏固了NASH生物標記在現代醫療保健中的重要性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 15億美元 |

| 預測值 | 148億美元 |

| 複合年成長率 | 25.8% |

根據生物標記類型,市場細分為氧化壓力生物標記、肝纖維化生物標記、血清生物標記、細胞凋亡生物標記等。其中,血清生物標記佔最大佔有率,2024 年貢獻了 32.8% 的收入。此細分市場的主導地位主要源於採血的便利性、非侵入性操作以及其在診斷、監測和預後中的頻繁應用。血清生物標記因能夠檢測肝細胞損傷和其他與疾病進展相關的細胞反應,為肝臟健康提供重要資訊而受到認可。它們在臨床和研究環境中的應用,進一步增強了其廣泛的實用性和市場吸引力。

就最終用途而言,市場分為製藥和合約研究組織 (CRO) 行業、醫院、診斷實驗室和學術研究機構。製藥和 CRO 產業在 2024 年佔據領先地位,佔總收入的 42.2%。這種主導地位反映了該行業在藥物發現、臨床試驗分層和治療監測方面對經過驗證的生物標記的高度依賴。隨著藥物開發商尋求加快進度並提高候選治療藥物的精準度,生物標記已成為整個開發週期中評估療效和安全性的關鍵。另一方面,CRO 透過提供生物標記驗證和測試的技術和監管專業知識來支持這些工作。他們的參與簡化了從生物標記發現到臨床應用的過渡,促進了標靶治療的開發,並促進了更快的市場成長。

從地理來看,美國已成為NASH生物標記領域的關鍵成長引擎。光是美國市場在2024年的估值就達3.088億美元,預計到2034年將飆升至約29億美元。這一顯著成長趨勢由多種因素促成,包括日益加重的肝臟相關疾病負擔,以及能夠支持先進診斷技術的強大醫療基礎設施。人口老化也是一個主要促進因素,因為老年人面臨更高的慢性肝病風險,需要及時的診斷干預。醫療保健部門在診斷領域的投資不斷增加,加上對非侵入性解決方案的關注,進一步推動了對生物標記技術的需求。對精準早期檢測工具的需求從未如此強烈,而美國憑藉著快速的技術進步和新一代檢測方案的整合,在滿足這一需求方面處於領先地位。

NASH 生物標記市場的競爭格局依然較為分散。專業的生物標記公司和診斷解決方案提供者正在積極塑造這一市場格局,領先的參與者合計佔了約 40% 的市場佔有率。這些公司正在透過整合新技術和建立合作夥伴關係來推動該領域的發展,旨在提升精準醫療能力。連接複用平台和人工智慧整合分析等創新正在改變生物標記資料在臨床和研究環境中的收集、解讀和應用方式。隨著市場的不斷發展,技術升級和跨產業合作預計將加速採用更有效率、可擴展且以患者為中心的生物標記解決方案。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 非酒精性脂肪性肝炎(NASH)盛行率上升

- 診斷技術的進步

- 提高對肝臟疾病的認知和篩檢舉措

- 產業陷阱與挑戰

- 生物標記驗證成本高且複雜

- 嚴格的監管情景

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 各國應對措施

- 對產業的影響

- 供應方影響(製造成本)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(消費者成本)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(製造成本)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 血清生物標記

- 肝纖維化生物標記

- 細胞凋亡生物標記

- 氧化壓力生物標記

- 其他類型

第6章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 製藥和CRO行業

- 醫院

- 診斷實驗室

- 學術研究機構

第7章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第8章:公司簡介

- BioPredictive

- GENFIT

- Glycotest

- Labcorp

- Nordic Bioscience

- Prometheus Laboratories

- Quest Diagnostics

- Siemens Healthineers

- SomaLogic

- Zora Biosciences

The Global Non-alcoholic Steatohepatitis Biomarkers Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 25.8% to reach USD 14.8 billion by 2034. NASH biomarkers are biological indicators that help evaluate the presence and progression of NASH, a severe liver condition that evolves from non-alcoholic fatty liver disease (NAFLD). As healthcare providers increasingly prioritize early detection and targeted interventions, the demand for such biomarkers has grown considerably. The push for proactive liver disease screening is further reinforced by evolving clinical recommendations targeting at-risk populations. This includes individuals with metabolic disorders such as obesity and type 2 diabetes, who are more likely to develop NASH.

As awareness of liver-related complications continues, healthcare systems are integrating biomarker-based diagnostic strategies to improve patient outcomes. These tools offer the potential to monitor disease progression, assess treatment efficacy, and identify patients most likely to benefit from emerging therapies. Their growing role in personalized medicine drives a significant shift in how liver diseases are diagnosed and managed. Increasing preference for minimally invasive methods and growing adoption of precision diagnostics in clinical research have further cemented the importance of NASH biomarkers in modern healthcare.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $14.8 Billion |

| CAGR | 25.8% |

The market is segmented by biomarker type into oxidative stress biomarkers, hepatic fibrosis biomarkers, serum biomarkers, apoptosis biomarkers, and others. Among these, serum biomarkers accounted for the largest share of revenue, contributing 32.8% in 2024. This segment's dominance is primarily due to the convenience of blood sampling, non-invasive procedures, and their frequent use in diagnosis, monitoring, and prognosis. Serum-based biomarkers are recognized for offering vital insights into liver health by detecting hepatocyte injury and other cellular responses linked to disease progression. Their application across both clinical settings and research environments adds to their widespread utility and market traction.

In terms of end use, the market is divided into the pharmaceutical and contract research organization (CRO) industry, hospitals, diagnostic laboratories, and academic research institutes. The pharmaceutical and CRO industry held the leading position in 2024, generating 42.2% of the overall revenue. This dominance reflects the industry's strong reliance on validated biomarkers for drug discovery, clinical trial stratification, and treatment monitoring. As drug developers seek to accelerate timelines and increase the precision of their therapeutic candidates, biomarkers have become essential in assessing efficacy and safety throughout the development cycle. CROs, on the other hand, support these efforts by offering technical and regulatory expertise for biomarker validation and testing. Their involvement has streamlined the transition from biomarker discovery to clinical application, bolstering the development of targeted treatments and contributing to faster market growth.

Geographically, the United States has emerged as a key growth engine within the NASH biomarkers space. The US market alone was valued at USD 308.8 million in 2024 and is anticipated to surge to approximately USD 2.9 billion by 2034. Several factors contribute to this significant trajectory, including a rising burden of liver-related conditions and a robust healthcare infrastructure capable of supporting advanced diagnostic technologies. The growing aging population is also a major driver, as older individuals face a higher risk of chronic liver diseases and require timely diagnostic interventions. Increasing healthcare investments in diagnostics, coupled with a focus on non-invasive solutions, are further driving demand for biomarker technologies. The need for accurate and early detection tools has never been greater, and the US is at the forefront of meeting this demand with rapid technological advancements and integration of next-generation testing protocols.

The competitive landscape of the NASH biomarkers market remains moderately fragmented. A mix of specialized biomarker firms and diagnostic solution providers is actively shaping the space, with leading players collectively capturing around 40% of the total market share. These companies are advancing the field by incorporating novel technologies and forming partnerships aimed at enhancing precision medicine capabilities. Innovations such as multiplexed platforms and AI-integrated analytics are transforming how biomarker data is collected, interpreted, and applied in both clinical and research settings. As the market continues to evolve, technological upgrades and cross-industry collaborations are expected to accelerate the adoption of more efficient, scalable, and patient-centered biomarker solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of non-alcoholic steatohepatitis (NASH)

- 3.2.1.2 Advancements in diagnostic technologies

- 3.2.1.3 Increased awareness and screening initiatives for liver diseases

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost and complexity of biomarker validation

- 3.2.2.2 Stringent regulatory scenario

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (cost of manufacturing)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (cost to consumers)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (cost of manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technological landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Serum biomarkers

- 5.3 Hepatic fibrosis biomarkers

- 5.4 Apoptosis biomarkers

- 5.5 Oxidative stress biomarkers

- 5.6 Other types

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Pharma and CRO industry

- 6.3 Hospitals

- 6.4 Diagnostic labs

- 6.5 Academic research institutes

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 BioPredictive

- 8.2 GENFIT

- 8.3 Glycotest

- 8.4 Labcorp

- 8.5 Nordic Bioscience

- 8.6 Prometheus Laboratories

- 8.7 Quest Diagnostics

- 8.8 Siemens Healthineers

- 8.9 SomaLogic

- 8.10 Zora Biosciences