|

市場調查報告書

商品編碼

1755214

電致變色材料市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Electrochromic Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

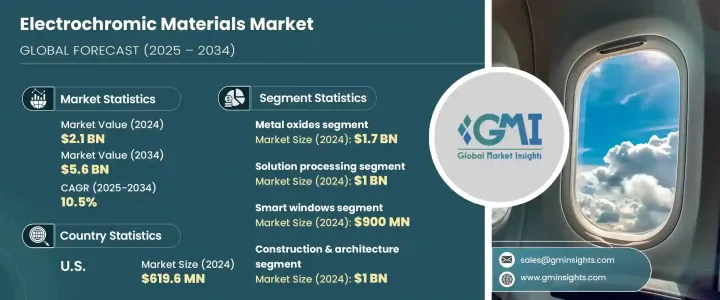

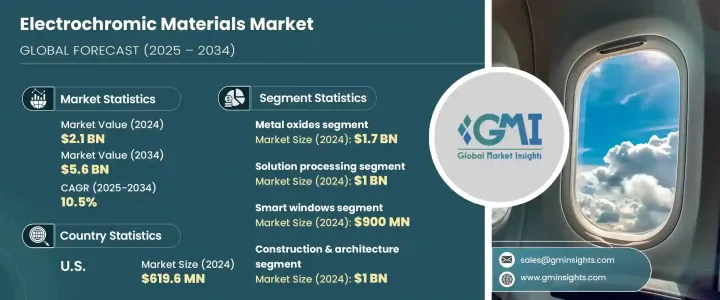

2024年,全球電致變色材料市場規模達21億美元,預計2034年將以10.5%的複合年成長率成長,達到56億美元。這得歸功於住宅和商業建築中日益普及的智慧窗戶需求的不斷成長。智慧窗戶透過控制光和熱來幫助降低能耗,使其成為旨在滿足能源效率標準的綠色建築專案的關鍵組成部分。

此外,電致變色材料在汽車產業的應用日益廣泛,尤其是在自動調光後視鏡、自適應天窗和側窗領域。這些創新不僅提升了用戶舒適度、減少了眩光,也提升了汽車品牌形象。包括導電聚合物和混合複合材料在內的材料科學的進步,提高了電致變色材料的性能和成本效益,推動了其應用。隨著節能日益重要,尤其是在永續發展標準嚴格的地區,對這些材料的需求正在大幅成長。它們能夠提高能源效率,使其成為各種應用的關鍵組成部分,並成為尋求降低能耗的行業的重要解決方案。從旨在獲得綠色認證的建築項目到專注於提高燃油效率的汽車應用,這些材料在實現環境和經濟目標方面發揮著至關重要的作用。它們的多功能性、日益成長的監管壓力以及消費者對永續解決方案的需求,推動了它們的廣泛應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 21億美元 |

| 預測值 | 56億美元 |

| 複合年成長率 | 10.5% |

2024年,溶液加工細分市場規模達10億美元,預計到2034年將以9.6%的複合年成長率成長。這一成長得益於溶液加工方法的成本效益和可擴展性,這些方法在智慧窗戶和顯示器等應用領域的應用日益廣泛。這些方法用途廣泛,可與各種基材相容,進一步推動建築和汽車行業的成長。

智慧窗戶市場規模預計在2024年將達到9億美元,預計也將在節能產品需求不斷成長的推動下快速成長。這些窗戶有助於降低建築能耗,提升舒適度。智慧鏡子和天窗因其舒適性和安全性而日益普及。

2024年,美國電致變色材料市場規模達6.196億美元,預計到2034年將以10%的複合年成長率成長,這得益於智慧建築和汽車領域對節能技術日益成長的需求。美國市場受益於政府對永續性和節能技術的強大監管,以及產業領導者積極參與,推動創新和技術進步。

全球電致變色材料市場的主要參與者包括 Gentex Corporation、AGC Inc.、Sage Electrochromics, Inc. (Saint-Gobain)、PPG Industries, Inc. 和 View, Inc. 為了鞏固其在電致變色材料市場的地位,各公司正專注於多種策略。一個關鍵方法是持續投資研發,以創造創新的高效能產品,滿足日益成長的節能應用需求。透過提高電致變色材料的性能,公司旨在增強其市場競爭力。許多公司正在擴展其產品組合,包括用於住宅、商業和汽車應用的智慧窗戶解決方案。此外,與建築公司、汽車製造商和政府建立合作夥伴關係對於獲得新的市場機會和確保將這些技術整合到大型專案中至關重要。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 市場介紹

- 川普政府關稅的影響—結構化概述

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 貿易統計資料(HS 編碼) 註:以上貿易統計僅提供主要國家。

- 主要出口國

- 國家 1

- 國家 2

- 國家 3

- 主要進口國

- 國家 1

- 國家 2

- 國家 3

- 主要出口國

- 產業價值鏈分析

- 材料概述

- 電致變色:原理與機制

- 氧化還原反應和顏色變化過程

- 光調製特性

- 切換速度和著色效率

- 耐用性和循環穩定性

- 能源效率特性

- 與其他智慧材料的比較

- 市場動態

- 市場促進因素

- 節能智慧窗戶需求不斷成長

- 在汽車應用的採用率不斷提高

- 電致變色材質的技術進步

- 日益重視綠建築認證

- 市場限制

- 電致變色裝置的初始成本高

- 某些材料類型的切換速度有限

- 市場機會

- 市場挑戰

- 市場促進因素

- 產業衝擊力

- 成長潛力分析

- 產業陷阱與挑戰

- 監管框架和標準

- 能源效率法規

- 建築規範和標準

- 汽車安全標準

- 環境法規

- 性能測試標準

- 製造流程分析

- 材料合成方法

- 薄膜沉積技術

- 裝置製造程序

- 品質控制程式

- 原料分析與採購策略

- 定價分析

- 永續性和環境影響評估

- 杵分析

- 波特五力分析

第4章:競爭格局

- 市佔率分析

- 戰略框架

- 併購

- 合資與合作

- 新產品開發

- 擴張策略

- 競爭基準化分析

- 供應商格局

- 競爭定位矩陣

- 戰略儀表板

- 專利分析與創新評估

- 新參與者的市場進入策略

- 研發強度分析

第5章:市場估計與預測:依材料類型,2021 年至 2034 年

- 主要趨勢

- 金屬氧化物

- 氧化鎢(WO3)

- 氧化鎳(NiO)

- 二氧化鈦(TiO2)

- 五氧化二釩(V2O5)

- 氧化鉬(MoO3)

- 其他金屬氧化物

- 導電聚合物

- 聚苯胺(PANI)

- 聚吡咯(PPy)

- 聚(3,4-乙撐二氧噻吩)(PEDOT)

- 其他導電聚合物

- 紫羅蘭鹼

- 普魯士藍類似物

- 液晶

- 混合及複合材料

- 其他電致變色材料

第6章:市場估計與預測:按技術,2021 年至 2034 年

- 主要趨勢

- 溶液處理

- 溶膠-凝膠法

- 電沉積

- 旋塗

- 其他溶液處理方法

- 氣相沉積

- 物理氣相沉積(PVD)

- 化學氣相沉積(CVD)

- 濺射

- 其他氣相沉積方法

- 印刷技術

- 噴墨列印

- 網版印刷

- 其他印刷方法

- 其他技術

第7章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 智慧窗戶

- 建築窗戶

- 天窗和屋頂窗

- 隔間和隱私玻璃

- 其他智慧窗應用

- 智慧鏡子

- 汽車後視鏡

- 建築鏡子

- 其他鏡子應用

- 顯示器

- 電子紙顯示器

- 資訊顯示

- 其他顯示應用

- 汽車應用

- 天窗

- 後視鏡

- 側窗

- 其他汽車應用

- 航太應用

- 穿戴式裝置

- 儲能設備

- 其他應用

第8章:市場估計與預測:按最終用途產業,2021 年至 2034 年

- 主要趨勢

- 建築與建築

- 住宅建築

- 商業建築

- 機構建築

- 其他建築類型

- 汽車與運輸

- 搭乘用車

- 商用車

- 其他交通

- 航太與國防

- 電子產品和顯示器

- 海洋

- 醫療保健

- 其他最終用途產業

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Gentex Corporation

- View, Inc.

- ChromoGenics AB

- Sage Electrochromics, Inc. (Saint-Gobain)

- AGC Inc.

- Magna Glass and Window Company

- Guardian Industries Corp.

- PPG Industries, Inc.

- Kinestral Technologies, Inc.

- E Ink Holdings Inc.

- Gesimat GmbH

- EControl-Glas GmbH & Co. KG

- Merck KGaA

- 3M Company

- Nippon Sheet Glass Co., Ltd.

- Halio, Inc.

- Pleotint LLC

- Research Frontiers Inc.

- Heliotrope Technologies

- SAGE Electrochromics, Inc.

- Polytronix, Inc.

- Chromogenics AB

- Innovative Glass Corporation

- Gauzy Ltd.

- Smart Glass International Ltd.

- SPD Control Systems Corporation

- Diamond Glass

- InvisiShade

- Continental AG

The Global Electrochromic Materials Market was valued at USD 2.1 billion in 2024 and is estimated to grow at a CAGR of 10.5% to reach USD 5.6 billion by 2034, driven by the increasing demand for smart windows, which are gaining popularity in both residential and commercial buildings. These windows help reduce energy consumption by controlling light and heat, making them a key component in green building projects aiming to meet energy efficiency standards.

Additionally, electrochromic materials are seeing increased applications in the automotive industry, particularly in self-dimming mirrors, adaptive sunroofs, and side windows. These innovations not only improve user comfort and reduce glare but also enhance vehicle branding. The advancement of material science, including conducting polymers and hybrid composites, has improved the performance and cost-efficiency of electrochromic materials, driving their adoption. As energy conservation gains importance, particularly in regions with stringent sustainability standards, the demand for these materials is experiencing a significant surge. Their ability to enhance energy efficiency makes them a key component in applications, positioning them as a vital solution for industries seeking to reduce energy consumption. From construction projects aiming for green certifications to automotive applications focused on improving fuel efficiency, these materials play a crucial role in meeting environmental and economic goals. Their versatility, growing regulatory pressure, and consumer demand for sustainable solutions, drive their widespread adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $5.6 Billion |

| CAGR | 10.5% |

In 2024, the solution processing segment accounted for USD 1 billion and is expected to grow at a CAGR of 9.6% through 2034. This growth is attributed to the cost-effectiveness and scalability of solution processing methods, which are increasingly used for applications like smart windows and displays. These methods offer versatility, making them compatible with a wide range of substrates, further boosting growth in the architectural and automotive sectors.

The smart windows segment, valued at USD 900 million in 2024, is also projected to expand rapidly, driven by the growing demand for energy-efficient products. These windows help reduce energy consumption in buildings and enhance comfort. Smart mirrors and sunroofs are gaining popularity for their comfort and safety benefits.

U.S. Electrochromic Materials Market was valued at USD 619.6 million in 2024 and is expected to grow at a 10% CAGR through 2034 driven by the increasing demand for energy-saving technologies in smart buildings and vehicles. The U.S. market benefits from strong governmental regulations focused on sustainability and energy-efficient technologies, and the active involvement of leading industry players driving innovation and technical advancements.

Key players in the Global Electrochromic Materials Market include Gentex Corporation, AGC Inc., Sage Electrochromics, Inc. (Saint-Gobain), PPG Industries, Inc., and View, Inc. To strengthen their position in the electrochromic materials market, companies are focusing on multiple strategies. One key approach is the continued investment in research and development to create innovative, high-performance products that cater to the growing demand for energy-efficient applications. By advancing the capabilities of electrochromic materials, companies aim to enhance their market competitiveness. Many are expanding their product portfolios to include smart window solutions for residential, commercial, and automotive applications. In addition, partnerships with construction firms, automotive manufacturers, and governments are vital for securing new market opportunities and ensuring the integration of these technologies into large-scale projects.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research methodology

- 1.2 Research scope & assumptions

- 1.3 List of data sources

- 1.4 Market estimation technique

- 1.5 Market segmentation & breakdown

- 1.6 Research limitations

Chapter 2 Executive Summary

- 2.1 Market snapshot

- 2.2 Segment highlights

- 2.3 Competitive landscape snapshot

- 2.4 Regional market outlook

- 2.5 Key market trends

- 2.6 Future market outlook

Chapter 3 Industry Insights

- 3.1 Market Introduction

- 3.2 Impact of trump administration tariffs – structured overview

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1.1 Supply-side impact (raw materials)

- 3.2.2.1.2 Price volatility in key materials

- 3.2.2.1.3 Supply chain restructuring

- 3.2.2.1.4 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (hs code) Note: The above trade statistics will be provided for key countries only.

- 3.3.1 Major exporting countries

- 3.3.1.1 Country 1

- 3.3.1.2 Country 2

- 3.3.1.3 Country 3

- 3.3.2 Major importing countries

- 3.3.2.1 Country 1

- 3.3.2.2 Country 2

- 3.3.2.3 Country 3

- 3.3.1 Major exporting countries

- 3.4 Industry value chain analysis

- 3.5 Material overview

- 3.5.1 Electrochromism: principles & mechanisms

- 3.5.2 Redox reactions & color change processes

- 3.5.3 Optical modulation properties

- 3.5.4 Switching speed & coloration efficiency

- 3.5.5 Durability & cycling stability

- 3.5.6 Energy efficiency characteristics

- 3.5.7 Comparison with other smart materials

- 3.6 Market dynamics

- 3.6.1 Market drivers

- 3.6.1.1 Rising demand for energy-efficient smart windows

- 3.6.1.2 Increasing adoption in automotive applications

- 3.6.1.3 Technological advancements in electrochromic materials

- 3.6.1.4 Growing emphasis on green building certifications

- 3.6.2 Market restraints

- 3.6.2.1 High initial cost of electrochromic devices

- 3.6.2.2 Limited switching speed for some material types

- 3.6.3 Market opportunities

- 3.6.4 Market challenges

- 3.6.1 Market drivers

- 3.7 Industry impact forces

- 3.7.1 Growth potential analysis

- 3.7.2 Industry pitfalls & challenges

- 3.8 Regulatory framework & standards

- 3.9 Energy efficiency regulations

- 3.9.1 Building codes & standards

- 3.9.2 Automotive safety standards

- 3.9.3 Environmental regulations

- 3.9.4 Performance testing standards

- 3.10 Manufacturing process analysis

- 3.10.1 Material synthesis methods

- 3.10.2 Thin film deposition techniques

- 3.10.3 Device fabrication processes

- 3.10.4 Quality control procedures

- 3.11 Raw material analysis & procurement strategies

- 3.12 Pricing analysis

- 3.13 Sustainability & environmental impact assessment

- 3.14 Pestle analysis

- 3.15 Porter's five forces analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Market Share Analysis

- 4.2 Strategic Framework

- 4.2.1 Mergers & Acquisitions

- 4.2.2 Joint Ventures & Collaborations

- 4.2.3 New Product Developments

- 4.2.4 Expansion Strategies

- 4.3 Competitive Benchmarking

- 4.4 Vendor Landscape

- 4.5 Competitive Positioning Matrix

- 4.6 Strategic Dashboard

- 4.7 Patent Analysis & Innovation Assessment

- 4.8 Market Entry Strategies for New Players

- 4.9 Research & Development Intensity Analysis

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Metal oxides

- 5.2.1 Tungsten oxide (WO3)

- 5.2.2 Nickel oxide (NiO)

- 5.2.3 Titanium dioxide (TiO2)

- 5.2.4 Vanadium pentoxide (V2O5)

- 5.2.5 Molybdenum oxide (MoO3)

- 5.2.6 Other metal oxides

- 5.3 Conducting polymers

- 5.3.1 Polyaniline (PANI)

- 5.3.2 Polypyrrole (PPy)

- 5.3.3 Poly(3,4-ethylenedioxythiophene) (PEDOT)

- 5.3.4 Other conducting polymers

- 5.4 Viologens

- 5.5 Prussian blue analogs

- 5.6 Liquid crystals

- 5.7 Hybrid & composite materials

- 5.8 Other electrochromic materials

Chapter 6 Market Estimates and Forecast, By Technology, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Solution processing

- 6.2.1 Sol-gel method

- 6.2.2 Electrodeposition

- 6.2.3 Spin coating

- 6.2.4 Other solution processing methods

- 6.3 Vapor deposition

- 6.3.1 Physical vapor deposition (PVD)

- 6.3.2 Chemical vapor deposition (CVD)

- 6.3.3 Sputtering

- 6.3.4 Other vapor deposition methods

- 6.4 Printing technologies

- 6.4.1 Inkjet printing

- 6.4.2 Screen printing

- 6.4.3 Other printing methods

- 6.5 Other technologies

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Smart windows

- 7.2.1 Architectural windows

- 7.2.2 Skylights & roof windows

- 7.2.3 Partitions & privacy glass

- 7.2.4 Other smart window applications

- 7.3 Smart mirrors

- 7.3.1 Automotive mirrors

- 7.3.2 Architectural mirrors

- 7.3.3 Other mirror applications

- 7.4 Displays

- 7.4.1 E-paper displays

- 7.4.2 Information displays

- 7.4.3 Other display applications

- 7.5 Automotive applications

- 7.5.1 Sunroofs

- 7.5.2 Rearview mirrors

- 7.5.3 Side windows

- 7.5.4 Other automotive applications

- 7.6 Aerospace applications

- 7.7 Wearable devices

- 7.8 Energy storage devices

- 7.9 Other applications

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Construction & architecture

- 8.2.1 Residential buildings

- 8.2.2 Commercial buildings

- 8.2.3 Institutional buildings

- 8.2.4 Other building types

- 8.3 Automotive & transportation

- 8.3.1 Passenger vehicles

- 8.3.2 Commercial vehicles

- 8.3.3 Other transportation

- 8.4 Aerospace & defense

- 8.5 Electronics & displays

- 8.6 Marine

- 8.7 Healthcare & medical

- 8.8 Other end-use industries

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Gentex Corporation

- 10.2 View, Inc.

- 10.3 ChromoGenics AB

- 10.4 Sage Electrochromics, Inc. (Saint-Gobain)

- 10.5 AGC Inc.

- 10.6 Magna Glass and Window Company

- 10.7 Guardian Industries Corp.

- 10.8 PPG Industries, Inc.

- 10.9 Kinestral Technologies, Inc.

- 10.10 E Ink Holdings Inc.

- 10.11 Gesimat GmbH

- 10.12 EControl-Glas GmbH & Co. KG

- 10.13 Merck KGaA

- 10.14 3M Company

- 10.15 Nippon Sheet Glass Co., Ltd.

- 10.16 Halio, Inc.

- 10.17 Pleotint LLC

- 10.18 Research Frontiers Inc.

- 10.19 Heliotrope Technologies

- 10.20 SAGE Electrochromics, Inc.

- 10.21 Polytronix, Inc.

- 10.22 Chromogenics AB

- 10.23 Innovative Glass Corporation

- 10.24 Gauzy Ltd.

- 10.25 Smart Glass International Ltd.

- 10.26 SPD Control Systems Corporation

- 10.27 Diamond Glass

- 10.28 InvisiShade

- 10.29 Continental AG