|

市場調查報告書

商品編碼

1755213

搖臂開關市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Rocker Switch Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

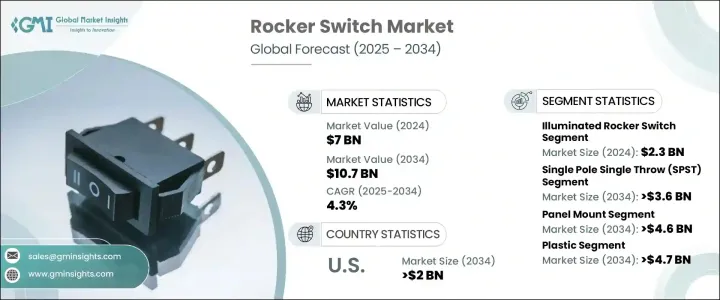

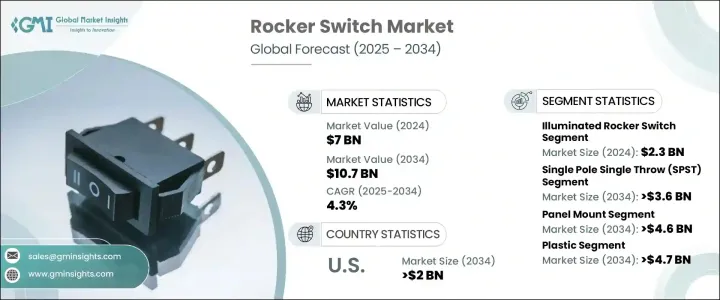

2024年,全球搖臂開關市場規模達70億美元,預計到2034年將以4.3%的複合年成長率成長,達到107億美元,這得益於不斷變化的需求動態和不斷演變的監管環境。針對搖臂開關生產中使用的塑膠、金屬和電子接點等材料的貿易關稅大幅提高了製造成本。這些進口壁壘影響全球供應鏈,尤其對依賴跨國採購的原始設備製造商(OEM)而言,最終將減緩產品創新,並降低其在全球市場的成本競爭力。

儘管如此,由於電動車 (EV) 和智慧家居解決方案的普及,需求仍在持續成長。隨著電動車產量的擴大,翹板開關憑藉其可靠且直覺的設計,在照明、暖氣和車窗控制等車輛功能中發揮關鍵作用。此外,政府主導的電動車稅收優惠和基礎設施建設等舉措,也推動了汽車應用中翹板開關的需求。同樣,智慧家庭的普及也引發了人們對用於控制照明、暖通空調系統和安全設備的響應式、方便用戶使用型介面日益成長的興趣。這一趨勢正在加速智慧翹板開關融入日常家庭自動化系統,提供兼具功能性、美觀性和便利性的產品。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 70億美元 |

| 預測值 | 107億美元 |

| 複合年成長率 | 4.3% |

2024年,發光搖桿開關市場規模達23億美元,凸顯了人們對具有視覺指示和功能的開關日益成長的偏好。這些開關配有內部照明,可指示其工作狀態,使其在能見度低的環境中特別有用。它們在汽車內飾、船舶應用和家用電器中的應用日益廣泛,增強了安全性和用戶互動性。

預計到2034年,面板安裝開關市場規模將達到46億美元,這得益於其在工業機械和汽車系統中的普及。這些開關設計易於操作且經久耐用,並配有安全的面板安裝機制,可確保在高使用率環境下始終如一的性能。其堅固耐用和操作簡便的特性使其成為需要可靠用戶互動的設備的首選。

預計到2034年,美國搖臂開關市場規模將達到20億美元,這得益於汽車、航太和智慧家庭領域的持續需求。隨著家庭自動化的不斷發展和工業建築的現代化改造,搖臂開關整合仍然至關重要。此外,國防部門對堅固可靠的開關系統的需求也提升了其應用前景。國內創新正在支持彈性供應鏈的發展,並推動智慧開關技術取得新的進步。

全球翹板開關市場的領導者包括 Leviton Manufacturing Co., Inc.、OTTO Engineering、Carling Technologies、Eaton Corporation、TE Connectivity 和 Honeywell International Inc.。為了鞏固其市場地位,主要企業優先考慮開關設計的創新,專注於為互聯環境量身定做的智慧照明功能。他們也加大研發投入,以提高性能、縮小尺寸並提升能源效率。與電動車製造商和智慧家庭開發商的策略合作,有助於實現更好的整合和更快的跨產業部署。此外,企業正在加強區域製造,以最大限度地減少關稅影響並增強供應鏈的韌性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 供應商矩陣

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 產業衝擊力

- 成長動力

- 電動車採用

- 智慧家庭與消費性電子擴張

- 工業自動化成長

- 小型化和客製化需求

- 新興市場製造業成長

- 產業陷阱與挑戰

- 商品化帶來的價格壓力

- 供應鏈中斷與關稅風險

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 - 2034 年

- 發光翹板開關

- 不發光翹板開關

- 密封/防水搖臂開關

- 微型/微型搖臂開關

- 智慧翹板開關

第6章:市場估計與預測:按開關配置,2021 - 2034 年

- 單刀單擲(SPST)

- 單刀雙擲(SPDT)

- 雙刀單擲(DPST)

- 雙刀雙擲(DPDT)

- 其他

第7章:市場估計與預測:按安裝類型,2021 - 2034 年

- 面板安裝

- PCB安裝

- 表面貼裝

第8章:市場估計與預測:按材料,2021 - 2034 年

- 塑膠

- 金屬

- 合成的

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 汽車

- 消費性電子產品

- 工業設備和機械

- 航太與國防

- 電信

- 其他

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Eaton Corporation

- Honeywell International Inc.

- TE Connectivity

- Carling Technologies (a Littelfuse brand)

- OTTO Engineering

- Leviton Manufacturing Co., Inc.

- APEM (part of IDEC Group)

- C&K Components

- NKK Switches Co., Ltd.

- Schurter AG

- Omron Corporation

- Panasonic Corporation

- ABB Ltd.

- Schneider Electric SE

- Marquardt GmbH

- HELLA GmbH & Co. KGaA

- Zippy Technology Corp.

- E-Switch Inc.

- Bulgin Ltd.

- ALPS Alpine Co., Ltd.

- Defond Group

The Global Rocker Switch Market was valued at USD 7 billion in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 10.7 billion by 2034, driven by shifting demand dynamics and evolving regulatory environments. Trade tariffs on materials like plastics, metals, and electronic contacts used in rocker switch production have significantly raised manufacturing costs. These import barriers impact global supply chains, especially for OEMs that depend on cross-border sourcing, ultimately slowing product innovation and reducing cost competitiveness in global markets.

Nonetheless, demand continues to rise due to the increased adoption of electric vehicles (EVs) and smart home solutions. As EV production expands, rocker switches play a critical role in vehicle functions such as lighting, heating, and window controls, owing to their reliable and intuitive design. Additionally, government-led initiatives such as tax incentives and infrastructure development for EVs are boosting the demand for rocker switches in automotive applications. Similarly, the proliferation of smart homes has sparked a growing interest in responsive and user-friendly interfaces for controlling lighting, HVAC systems, and security devices. This trend is accelerating the integration of smart rocker switches into everyday home automation systems, offering a combination of functionality, aesthetics, and convenience.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7 Billion |

| Forecast Value | $10.7 Billion |

| CAGR | 4.3% |

The illuminated rocker switch segment generated USD 2.3 billion in 2024, underscoring the expanding preference for switches that offer visual indication and functionality. These switches are equipped with internal lighting that signals their operational status, making them especially useful in environments with low visibility. Their presence is increasingly felt across automotive interiors, marine applications, and home appliances, where they enhance both safety and user interaction.

The panel mount switches segment is projected to achieve USD 4.6 billion by 2034, driven by their popularity in industrial machinery and automotive systems. These switches are designed to be easily accessible and durable, with a secure panel-mounting mechanism that ensures consistent performance in high-use environments. Their robustness and simplicity make them a preferred choice for equipment requiring reliable user interaction.

U.S. Rocker Switch Market is expected to generate USD 2 billion by 2034, fueled by sustained demand from the automotive, aerospace, and smart home sectors. As home automation continues to evolve and industrial construction undergoes modernization, rocker switch integration remains essential. Additionally, the defense sector's demand for rugged and reliable switch systems enhances the application landscape. Domestic innovation is supporting the development of resilient supply chains and pushing new advancements in smart switching technologies.

Leading players in the Global Rocker Switch Market include Leviton Manufacturing Co., Inc., OTTO Engineering, Carling Technologies, Eaton Corporation, TE Connectivity, and Honeywell International Inc. To strengthen their presence in the market, key companies are prioritizing innovation in switch design, focusing on smart and illuminated functionalities tailored for connected environments. They are also increasing investment in R&D to improve performance, reduce size, and enhance energy efficiency. Strategic collaborations with EV manufacturers and smart home developers allow for better integration and quicker deployment across industries. Additionally, players are strengthening regional manufacturing to minimize tariff impact and boost supply chain resilience.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Vendor matrix

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news and initiatives

- 3.8 Industry impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Electric vehicle adoption

- 3.8.1.2 Smart home & consumer electronics expansion

- 3.8.1.3 Industrial automation growth

- 3.8.1.4 Miniaturization & customization demand

- 3.8.1.5 Emerging market manufacturing growth

- 3.8.2 Industry pitfalls and challenges

- 3.8.2.1 Price pressure from commoditization

- 3.8.2.2 Supply chain disruptions & tariff risks

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Regulatory landscape

- 3.11 Technology landscape

- 3.12 Future market trends

- 3.13 Gap analysis

- 3.14 Porter's analysis

- 3.15 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 (USD Million)

- 5.1 Illuminated rocker switch

- 5.2 Non-Illuminated rocker switch

- 5.3 Sealed/Waterproof rocker switch

- 5.4 Miniature/Micro rocker switch

- 5.5 Smart rocker switch

Chapter 6 Market estimates & forecast, By Switch Configuration, 2021 - 2034 (USD Million)

- 6.1 Single Pole Single Throw (SPST)

- 6.2 Single Pole Double Throw (SPDT)

- 6.3 Double Pole Single Throw (DPST)

- 6.4 Double Pole Double Throw (DPDT)

- 6.5 Others

Chapter 7 Market estimates & forecast, By Mounting Type, 2021 - 2034 (USD Million)

- 7.1 Panel mount

- 7.2 PCB mount

- 7.3 Surface mount

Chapter 8 Market Estimates & Forecast, By Material, 2021 - 2034 (USD Million)

- 8.1 Plastic

- 8.2 Metal

- 8.3 Composite

Chapter 9 Market estimates & forecast, By End Use, 2021 - 2034 (USD Million)

- 9.1 Automotive

- 9.2 Consumer electronics

- 9.3 Industrial equipment & machinery

- 9.4 Aerospace & defense

- 9.5 Telecommunications

- 9.6 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Eaton Corporation

- 11.2 Honeywell International Inc.

- 11.3 TE Connectivity

- 11.4 Carling Technologies (a Littelfuse brand)

- 11.5 OTTO Engineering

- 11.6 Leviton Manufacturing Co., Inc.

- 11.7 APEM (part of IDEC Group)

- 11.8 C&K Components

- 11.9 NKK Switches Co., Ltd.

- 11.10 Schurter AG

- 11.11 Omron Corporation

- 11.12 Panasonic Corporation

- 11.13 ABB Ltd.

- 11.14 Schneider Electric SE

- 11.15 Marquardt GmbH

- 11.16 HELLA GmbH & Co. KGaA

- 11.17 Zippy Technology Corp.

- 11.18 E-Switch Inc.

- 11.19 Bulgin Ltd.

- 11.20 ALPS Alpine Co., Ltd.

- 11.21 Defond Group