|

市場調查報告書

商品編碼

1755212

自主貨機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Autonomous Cargo Aircraft Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

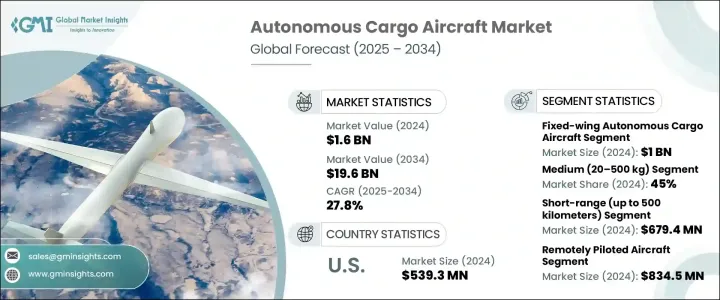

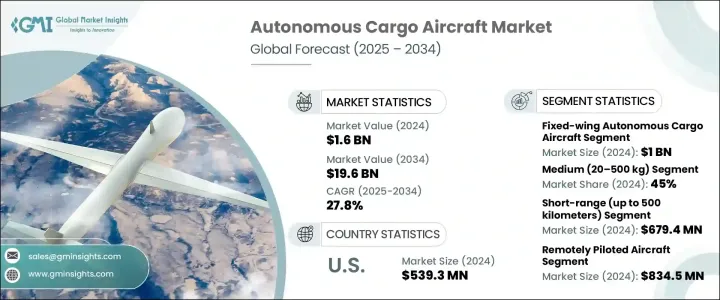

2024年,全球自動駕駛貨運飛機市場價值為16億美元,預計到2034年將以27.8%的複合年成長率成長,達到196億美元。這得益於人們對「中間一英里」和「最後一英里」配送創新的日益關注、國防和軍事應用的不斷成長,以及新興國家城市發展步伐的加快。在基礎建設跟不上城市擴張步伐的城市,自動駕駛貨運飛機正成為應對物流挑戰的關鍵解決方案。它們能夠繞過傳統的交通堵塞,並在複雜的城市地形上快速運送貨物,使其成為下一代供應鏈中的關鍵要素。

隨著對更快配送速度的需求不斷成長,空中貨運平台對於克服傳統地面運輸無法解決的最後一哩低效率問題至關重要。自動駕駛貨運飛機能夠實現點對點配送,減少交接次數,有助於減少延誤、提高供應鏈可視性並降低營運成本。在交通擁擠、地理障礙或道路基礎設施有限的地區,傳統卡車難以維持服務標準,而自動駕駛貨運飛機的使用尤其具有變革意義。對於物流公司而言,這些飛機提供了簡化營運並確保即使在需求高峰或緊急情況下也能及時交付的機會。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 16億美元 |

| 預測值 | 196億美元 |

| 複合年成長率 | 27.8% |

到2034年,垂直起降 (VTOL) 市場將創造80億美元的市場價值。其緊湊的佔地面積、無需跑道即可飛行的能力以及快速的響應能力,使其非常適合人口密集的城市環境、偏遠地區的配送任務以及醫療物流等時間敏感的需求。在電池效率和輕質複合材料方面的大量投資增強了 VTOL 飛機的可擴展性。透過在傳統運輸方式無法覆蓋的地區運送貨物,這些飛機正在重塑城市空中物流。

2024年,中型載重飛機佔據45%的市場佔有率,支援對運能和航程有較高要求的物流場景。這些飛機具備適應區域配送路線的能力,擴大用於運輸時效性要求高的貨物,例如醫療用品、備件和零售庫存。其可擴展性和成本效益使其能夠頻繁進行短途運輸,在連接偏遠地區和主要配送中心方面尤為重要。隨著敏捷、分散式供應網路的需求日益成長,中等載重飛機類別有望成為已開發地區和發展中地區自主航空貨運系統的骨幹。

2024年,美國自主貨機市場規模達5.393億美元,這得益於聯邦政府大力支持無人系統融入國家空域。美國在醫療物流、緊急應變和城市空中交通等領域的應用取得了重大進展。機器學習、基於人工智慧的路線規劃和災害應變感測器的快速發展正在提升營運效率,使美國成為該領域的領導者。政府的激勵措施、不斷完善的聯邦航空管理局(FAA)指南以及私營部門的持續參與,都加速了無人貨運飛機在商業和公共服務領域的部署。

空中巴士、億航、Natilus、Elroy Air 和 Dronamics 正透過創新、合作夥伴關係和可擴展的技術平台積極塑造自動駕駛貨運飛機市場的未來。這些公司著重於對以人工智慧為基礎的導航系統、電力推進系統和模組化貨物設計的研發投入。與物流網路和供應鏈營運商的策略合作正在幫助試點實際用例並擴大營運規模。許多公司也在多個地區獲得監管部門的批准和適航認證,以擴大其全球影響力。這些公司專注於最佳化垂直起降 (VTOL) 設計並整合先進的感測器技術,正準備滿足日益成長的安全、永續和快速的自動駕駛貨物運輸需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業影響力量

- 成長動力

- 自然災害和人道危機發生率上升

- 中英里和最後一英里配送解決方案日益普及

- 增加軍事和國防投資

- 新興經濟體的快速都市化

- 人工智慧、導航和飛行控制系統的不斷進步

- 產業陷阱與挑戰

- 電動無人機的有效載荷和航程限制

- 網路安全威脅與通訊干擾

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略儀表板

第5章:市場估計與預測:依技術類型,2021-2034

- 主要趨勢

- 固定翼自主貨機

- VTOL(垂直起降)自主飛機

第6章:市場估計與預測:依酬載容量,2021-2034 年

- 主要趨勢

- 小型(20公斤以下)

- 中型(20–500公斤)

- 大型(500公斤以上)

第7章:市場估計與預測:依範圍,2021-2034

- 主要趨勢

- 短程(最遠500公里)

- 中程(500-2000公里)

- 遠程(超過2000公里)

第8章:市場估計與預測:依自治級別,2021-2034 年

- 主要趨勢

- 完全自主

- 遙控飛機

- 半自主

第9章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 電子商務與零售物流

- 工業和離岸物流

- 軍事與國防

- 人道與災難救援

第10章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Airbus

- Dronamics Group Limited

- Ehang

- Elroy Air

- Jestar Logistics

- MightyFly

- Natilus

- Pipistrel

- Pyka Inc.

- Skydio, Inc.

- UAVOS

- Unmanned Systems Technology

- Xwing

- Zipline

The Global Autonomous Cargo Aircraft Market was valued at USD 1.6 billion in 2024 and is estimated to grow at a CAGR of 27.8% to reach USD 19.6 billion by 2034 fueled by the increasing focus on middle-mile and last-mile delivery innovation, rising defense and military adoption, and the accelerating pace of urban development across emerging nations. In cities where infrastructure development can't keep pace with urban expansion, autonomous cargo aircraft are emerging as a critical solution to logistical challenges. Their ability to bypass traditional traffic congestion and deliver goods quickly over complex urban terrain makes them a pivotal element in next-gen supply chains.

As demand for faster fulfillment grows, aerial cargo platforms are essential to overcoming last-mile inefficiencies that conventional ground transport cannot resolve. Autonomous cargo aircraft enable point-to-point delivery with fewer handoffs, which helps reduce delays, improve supply chain visibility, and lower operational costs. Their use is particularly transformative in areas prone to traffic congestion, geographic barriers, or limited road infrastructure, where traditional trucks struggle to maintain service standards. For logistics companies, these aircraft present an opportunity to streamline operations and ensure timely delivery even during peak demand or emergencies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $19.6 Billion |

| CAGR | 27.8% |

The Vertical Take-off and Landing (VTOL) segment will generate USD 8 billion by 2034. Its compact footprint, ability to operate without runways, and responsiveness make it highly suitable for dense urban settings, remote delivery missions, and time-sensitive needs like medical logistics. Significant investments in battery efficiency and lightweight composite materials enhance VTOL aircraft's scalability. By delivering cargo where conventional transport fails, these aircraft are reshaping urban air logistics.

The medium payload segment held a 45% share in 2024, supporting logistics scenarios that require capacity and range. With capabilities suited to regional delivery lanes, these aircraft are increasingly used to transport time-sensitive goods like medical supplies, spare parts, and retail inventory. Their scalability and cost-effectiveness allow frequent short-haul operations, making them especially valuable in bridging gaps between remote locations and major distribution centers. As the need for agile, decentralized supply networks grows, the medium payload category is well-positioned to become the backbone of autonomous air freight systems in developed and developing regions.

United States Autonomous Cargo Aircraft Market generated USD 539.3 million in 2024, supported by strong federal backing for unmanned systems integration into national airspace. The country is making major strides in adopting these aircraft for healthcare logistics, emergency response, and urban air mobility. Rapid growth in machine learning, AI-based routing, and disaster-response sensors is boosting operational efficiency, making the U.S. a leader in this segment. Government incentives, evolving FAA guidelines, and rising private-sector participation contribute to accelerated deployment across commercial and public service applications.

Airbus, eHang, Natilus, Elroy Air, and Dronamics are actively shaping the future of the autonomous cargo aircraft market through innovation, partnerships, and scalable technology platforms. These companies emphasize R&D investments in AI-based navigation systems, electric propulsion, and modular cargo designs. Strategic collaborations with logistics networks and supply chain operators are helping to pilot real-world use cases and scale operations. Many are also securing regulatory approvals and airworthiness certifications across multiple geographies to expand their global reach. With a focus on optimizing VTOL designs and integrating advanced sensor technologies, these firms are preparing to meet the growing demand for safe, sustainable, and fast autonomous cargo delivery.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry Impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising incidences of natural disasters & humanitarian crises

- 3.3.1.2 Growing proliferation of middle-mile and last-mile delivery solutions

- 3.3.1.3 Increased military and defense investments

- 3.3.1.4 Rapid urbanization in emerging economies

- 3.3.1.5 Growing advancement in AI, navigation & flight control systems

- 3.3.2 Industry pitfalls & challenges

- 3.3.2.1 Payload and range limitations of electric UAVs

- 3.3.2.2 Cybersecurity threats and communication interference

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic dashboard

Chapter 5 Market Estimates & Forecast, By Technology Type, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Fixed-wing autonomous cargo aircraft

- 5.3 VTOL (vertical take-off and landing) autonomous aircraft)

Chapter 6 Market Estimates & Forecast, By Payload Capacity, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Small (up to 20 kg)

- 6.3 Medium (20–500 kg)

- 6.4 Large (500 kg and above)

Chapter 7 Market Estimates & Forecast, By Range, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Short-range (Up to 500 kilometers)

- 7.3 Medium-range (500-2,000 kilometers)

- 7.4 Long-range (Over 2,000 kilometers)

Chapter 8 Market Estimates & Forecast, By Autonomy Level, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Fully autonomous

- 8.3 Remotely piloted aircraft

- 8.4 Semi-autonomous

Chapter 9 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 E-commerce & retail logistics

- 9.3 Industrial & offshore logistics

- 9.4 Military & defense

- 9.5 Humanitarian and disaster relief

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Airbus

- 11.2 Dronamics Group Limited

- 11.3 Ehang

- 11.4 Elroy Air

- 11.5 Jestar Logistics

- 11.6 MightyFly

- 11.7 Natilus

- 11.8 Pipistrel

- 11.9 Pyka Inc.

- 11.10 Skydio, Inc.

- 11.11 UAVOS

- 11.12 Unmanned Systems Technology

- 11.13 Xwing

- 11.14 Zipline