|

市場調查報告書

商品編碼

1755208

焊接耗材市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Welding Consumables Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

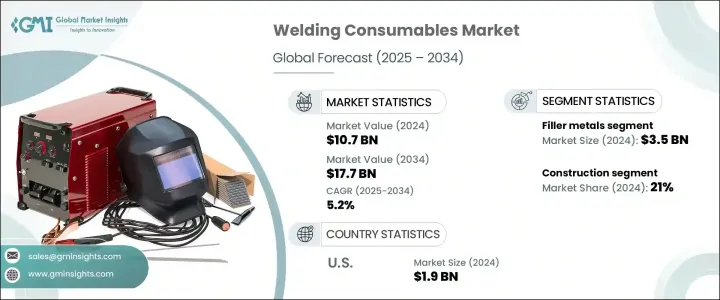

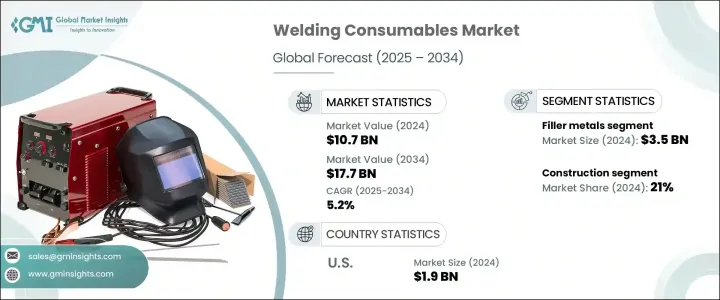

2024年,全球焊接耗材市場規模達107億美元,預計到2034年將以5.2%的複合年成長率成長,達到177億美元。這一成長主要源於基礎設施和建築項目對焊接耗材的需求不斷成長,以及工業應用中自動化和機器人技術的日益普及。此外,新興市場對環保焊接材料的日益青睞以及汽車產業的擴張也進一步促進了市場成長。在發展中國家,城鎮化和可支配收入的提高預計將帶來基礎設施的大量投資,進而刺激對焊接耗材的需求。

隨著這些地區工業的持續繁榮,焊接需求也將持續成長,為市場創造新的機會。焊接技術的進步,例如更堅固耐用材料的開發,也正在支撐市場的成長。隨著製造商對客製化產品的需求不斷增加,汽車產業(尤其是在已開發經濟體和新興經濟體)對焊接製程的應用正在不斷增加。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 107億美元 |

| 預測值 | 177億美元 |

| 複合年成長率 | 5.2% |

2024年,填充金屬佔據了最大的市場佔有率,產值達35億美元,預計2025年至2034年期間的複合年成長率將達到5.6%。隨著製造商不斷推出創新產品以滿足管道安裝、重型機械生產和海上製造等行業不斷變化的需求,對填充金屬的需求也在不斷成長。這些行業擴大轉向使用強度更高的材料來提高產品的耐用性和性能。

建築業在2024年佔21%的佔有率,預計2025年至2034年的複合年成長率將達到5.9%。焊接是建築業必不可少的工藝,尤其是在結構金屬框架的製造中。隨著大型建築項目的推進和金屬用量的增加,焊接在確保建築物和基礎設施的結構完整性方面發揮著至關重要的作用。該行業對焊接材料的需求與整個建築行業的發展密切相關,焊接在預製和現場組裝工作中都發揮著重要作用。

美國焊接耗材市場佔77%的市場佔有率,2024年價值達19億美元。基礎設施建設的蓬勃發展,加上機器人技術和自動化在製造業的廣泛應用,正在推動該市場的成長。除了機器人技術外,協作焊接機器人(cobot)也擴大應用於製造工廠,以協助人工焊工,從而提高焊接過程的效率和精度。環保耗材的需求以及汽車產業在新興地區的擴張也促進了美國市場的成長。

全球焊接耗材市場的主要參與者包括林肯電氣、松下、伊薩、D&H Secheron、米勒電氣、神戶製鋼、現代焊接、Ador Welding、霍巴特焊接產品、Berkenhoff、EWM、Welding Alloys、Diffusion Engineers、Hilco Welding 和 Nouveaux。為了鞏固其在焊接耗材市場的地位,各公司正專注於其產品的技術進步,例如開發具有增強機械和化學性能的新型填充金屬。他們也強調環保解決方案,以滿足製造業對永續實踐日益成長的需求。此外,製造商正在大力投資研發,以開發滿足日益成長的客製化解決方案需求的產品,尤其是在汽車和建築行業。擴大在新興市場的影響力並專注於自動化和機器人技術也是關鍵策略,使公司能夠提高生產效率並降低勞動力成本。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素。

- 利潤率分析。

- 中斷

- 未來展望

- 製成品

- 經銷商

- 供應商格局

- 重要新聞和舉措

- 監管格局

- 價格趨勢分析

- 衝擊力

- 成長動力

- 基礎設施和建築項目激增

- 汽車和製造業的成長

- 產業陷阱與挑戰

- 原物料價格波動

- 地緣政治與貿易壁壘

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 電極

- 焊條電弧焊

- 氣體保護金屬電弧焊電極

- 其他

- 助焊劑

- 埋弧焊劑

- 氧氣燃料焊劑

- 其他(釬焊劑等)

- 氣體

- 保護氣體

- 支持氣體

- 其他

- 填充金屬

- 實心線

- 藥芯焊絲

- 金屬芯線

- 焊條

- 其他(特種填充金屬等)

- 其他

第6章:市場估計與預測:按材料類型,2021 - 2034 年

- 主要趨勢

- 低碳鋼

- 不銹鋼

- 鋁

- 鎳合金

- 銅合金

- 其他(鈷合金等)

第7章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 建造

- 汽車

- 能源

- 造船

- 航太

- 重型工程

- 其他(國防等)

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 直銷

- 間接銷售

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- Ador Welding

- Berkenhoff

- D&H Secheron

- Diffusion Engineers

- ESAB

- EWM

- Hilco Welding

- Hobart Welding Products

- Hyundai Welding

- Kobe Steel

- Lincoln Electric

- Miller Electric

- Nouveaux

- Panasonic

- Welding Alloys

The Global Welding Consumables Market was valued at USD 10.7 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 17.7 billion by 2034. This growth is driven by the increasing demand for welding consumables in infrastructure and construction projects with the rising adoption of automation and robotics in industrial applications. Additionally, the growing preference for eco-friendly welding materials and the expansion of the automotive sector in emerging markets are further contributing to market growth. In developing nations, urbanization and rising disposable incomes are expected to lead to significant investments in infrastructure, which in turn will fuel the demand for welding consumables.

As the industrial sector in these regions continues to thrive, the need for welding will grow, creating new opportunities in the market. Advances in welding technology, such as the development of stronger, more durable materials, are also supporting market growth. The automotive sector, particularly in both developed and emerging economies, is seeing a rise in the application of welding processes as manufacturers demand more custom-made products.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.7 Billion |

| Forecast Value | $17.7 Billion |

| CAGR | 5.2% |

Filler metals held the largest market share in 2024, generating USD 3.5 billion, and is expected to grow at a CAGR of 5.6% between 2025 and 2034. The demand for filler metals is rising as manufacturers introduce innovative products to meet the evolving needs of industries like pipeline installation, heavy machinery production, and offshore fabrication. These industries are increasingly turning to higher-strength materials to improve the durability and performance of their products.

The construction segment held a 21% share in 2024 and is expected to grow at a CAGR of 5.9% from 2025 to 2034. Welding is an essential process in construction, especially in the fabrication of structural metal frameworks. With large-scale construction projects and increasing metal usage, welding plays a critical role in ensuring the structural integrity of buildings and infrastructure. The demand for welding consumables in this sector is closely tied to the growth of the overall construction industry, with welding playing a significant role in both prefabricated and on-site assembly work.

United States Welding Consumables Market held a 77% share and was valued at USD 1.9 billion in 2024. The surge in infrastructure development, coupled with the adoption of robotics and automation in manufacturing, is propelling the growth of this market. In addition to robotics, collaborative welding robots (cobots) are increasingly being used in manufacturing facilities to assist human welders, making welding processes more efficient and precise. The demand for eco-friendly consumables and the automotive sector's expansion in emerging regions are also contributing to market growth in the U.S.

Key players operating in the Global Welding Consumables Market include Lincoln Electric, Panasonic, ESAB, D&H Secheron, Miller Electric, Kobe Steel, Hyundai Welding, Ador Welding, Hobart Welding Products, Berkenhoff, EWM, Welding Alloys, Diffusion Engineers, Hilco Welding, and Nouveaux. To strengthen their position in the welding consumables market, companies are focusing on technological advancements in their product offerings, such as the development of new filler metals with enhanced mechanical and chemical properties. They are also emphasizing eco-friendly solutions to cater to the growing demand for sustainable practices in manufacturing. Additionally, manufacturers are investing heavily in R&D to develop products that meet the increasing need for customized solutions, especially in the automotive and construction sectors. Expanding their presence in emerging markets and focusing on automation and robotics are also key strategies, enabling companies to improve production efficiency while reducing labor costs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Key news & initiatives

- 3.4 Regulatory landscape

- 3.5 Pricing trend analysis

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Surge in infrastructure and construction projects

- 3.6.1.2 Growth in automotive and manufacturing sectors

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Fluctuating raw material prices

- 3.6.2.2 Geopolitical and trade barriers

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Billion, Million Units)

- 5.1 Key trends

- 5.2 Electrodes

- 5.2.1 Shielded metal arc welding electrodes

- 5.2.2 Gas metal arc welding electrodes

- 5.2.3 Others

- 5.3 Fluxes

- 5.3.1 Submerged arc welding flux

- 5.3.2 Oxy-fuel welding flux

- 5.3.3 Others (brazing flux etc.)

- 5.4 Gases

- 5.4.1 Shielding Gases

- 5.4.2 Backing Gases

- 5.4.3 Others

- 5.5 Filler metals

- 5.5.1 Solid wire

- 5.5.2 flux-cored wire

- 5.5.3 Metal cored wire

- 5.5.4 Welding rods

- 5.5.5 Others (specialty filler metals etc.)

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Material Type, 2021 - 2034 ($Billion, Million Units)

- 6.1 Key trends

- 6.2 Mild steel

- 6.3 Stainless steel

- 6.4 Aluminum

- 6.5 Nickel alloys

- 6.6 Copper alloys

- 6.7 Others (cobalt alloys etc.)

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 ($Billion, Million Units)

- 7.1 Key trends

- 7.2 Construction

- 7.3 Automobile

- 7.4 Energy

- 7.5 Shipbuilding

- 7.6 Aerospace

- 7.7 Heavy engineering

- 7.8 Others (defense etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Million Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Ador Welding

- 10.2 Berkenhoff

- 10.3 D&H Secheron

- 10.4 Diffusion Engineers

- 10.5 ESAB

- 10.6 EWM

- 10.7 Hilco Welding

- 10.8 Hobart Welding Products

- 10.9 Hyundai Welding

- 10.10 Kobe Steel

- 10.11 Lincoln Electric

- 10.12 Miller Electric

- 10.13 Nouveaux

- 10.14 Panasonic

- 10.15 Welding Alloys