|

市場調查報告書

商品編碼

1755207

物流與供應鏈中的人工智慧市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測AI in Logistics and Supply Chain Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

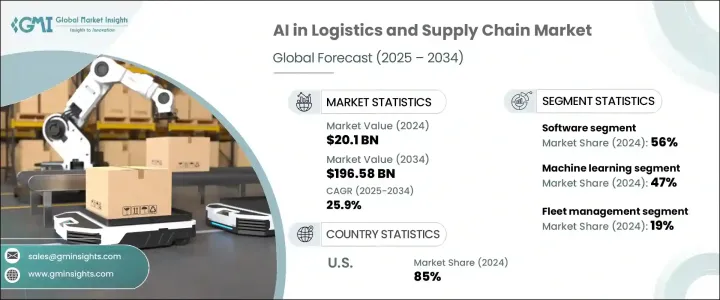

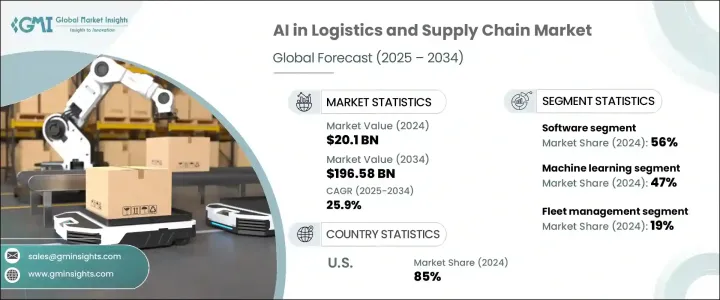

2024年,全球人工智慧物流和供應鏈市場規模達201億美元,預計到2034年將以25.9%的複合年成長率成長,達到1965.8億美元。這得歸功於對即時供應鏈視覺性、最佳化路線規劃、精準需求預測和倉庫自動化日益成長的需求。企業擴大將人工智慧融入其營運,以增強決策流程、降低營運成本並管理複雜的物流網路。預測分析、機器人流程自動化和自動駕駛汽車等人工智慧解決方案正在將傳統供應鏈轉變為智慧且適應性強的生態系統。

全球供應鏈日益複雜,催生了對預測分析和即時資料的需求,使企業能夠分析來自感測器、GPS 和企業資源規劃 (ERP) 系統的大量資料,從而最佳化庫存管理並降低成本。人工智慧 (AI) 可協助企業快速適應市場變化、防止中斷並提高客戶滿意度。電子商務和全通路零售的擴張進一步凸顯了對速度、準確性和靈活性的需求,而人工智慧技術有助於簡化訂單處理、自動化交付計劃並預測客戶行為。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 201億美元 |

| 預測值 | 1965.8億美元 |

| 複合年成長率 | 25.9% |

2024年,軟體產業以56%的市佔率領先市場,預計到2034年將以26%的複合年成長率成長。軟體有助於增強整個供應鏈的智慧決策、自動化和即時資料分析。人工智慧驅動的軟體解決方案,包括路線最佳化、需求預測和倉庫自動化,已被物流供應商廣泛採用,以最佳化營運、降低成本並提高效率。這些解決方案對於提高規劃準確性、最大限度地減少人為錯誤以及快速適應市場波動至關重要。對預測分析和即時可視性的重視極大地促進了對人工智慧軟體應用程式日益成長的需求。

機器學習 (ML) 領域在 2024 年佔據了 47% 的市場。它能夠處理大量資料集並即時產生可操作的洞察,這對於分析來自物聯網設備、GPS 系統和客戶互動的結構化和非結構化資料至關重要。 ML 演算法可以最佳化庫存管理,發現需求模式,消除營運瓶頸,從而提高效率和成本效益。這些演算法不斷發展,提供超越傳統系統的預測洞察和自動化機會。

由於先進的數位基礎設施和新興技術的廣泛應用,美國在物流和供應鏈市場佔據了85%的佔有率,2024年創造了62億美元的市場規模。美國物流公司是首批將人工智慧應用於路線最佳化、需求預測、倉庫自動化和預測性維護等解決方案的公司之一。大型科技公司和人工智慧供應商的加入進一步鞏固了美國的領先地位,加速了人工智慧在物流領域的應用。公營和私營部門對人工智慧研發的投入,加上《國家人工智慧計劃法案》等政府舉措,推動了人工智慧技術在物流和供應鏈領域的應用。

物流和供應鏈市場人工智慧的知名企業包括亞馬遜網路服務、甲骨文、Blue Yonder、SAP SE、FourKites、C3.ai、Google、微軟、IBM 和曼哈頓聯合公司。為了鞏固市場地位,各公司正專注於策略合作夥伴關係和收購,以增強其人工智慧能力並拓寬服務範圍。利用尖端技術,這些公司將機器學習、機器人技術和自動化整合到物流和供應鏈營運中,以提高效率並降低成本。許多公司投資於人工智慧驅動的軟體解決方案,用於即時分析、路線最佳化和需求預測,使它們在快速發展的市場中保持競爭力。此外,人工智慧解決方案提供者正越來越關注電子商務領域,確保快速、靈活且準確的交付系統,以滿足日益成長的消費者期望。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 技術提供者

- 系統整合商和顧問公司

- 物流技術提供商

- 硬體和機器人公司

- 託管服務提供者 (MSP)

- 利潤率分析

- 川普政府關稅的影響

- 對貿易的影響

- 貿易量中斷

- 其他國家的報復措施

- 對產業的影響

- 主要材料價格波動

- 供應鏈重組

- 提供成本影響

- 策略產業反應

- 供應鏈重組

- 定價和供應策略

- 對貿易的影響

- 技術與創新格局

- 價格趨勢

- 成本細分分析

- 專利分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 對即時供應鏈可視性的需求不斷成長

- 電子商務和全通路零售的成長

- 預測分析和機器學習的進步

- 物聯網與人工智慧整合,實現智慧倉儲

- 採用自動駕駛汽車和無人機

- 產業陷阱與挑戰

- 初期實施成本高

- 資料隱私和安全問題

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 硬體

- 感應器

- 機器人(例如自動導引車、無人機)

- 軟體

- 預測分析

- 運輸管理系統

- 庫存管理

- 倉庫管理

- 服務

- 託管服務

- 專業服務

- 部署與整合

- 諮詢

- 支援與維護

第6章:市場估計與預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 機器學習

- 自然語言處理(NLP)

- 電腦視覺

- 情境感知計算

- 機器人流程自動化(RPA)

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 車隊管理

- 供應鏈規劃

- 庫存和倉庫管理

- 貨運經紀與風險管理

- 需求預測

- 客戶服務(聊天機器人、虛擬助理)

- 訂單履行和最後一英里交付

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 零售與電子商務

- 製造業

- 汽車

- 食品和飲料

- 醫療保健和製藥

- 運輸與物流

- 能源與公用事業

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- Amazon Web Services

- Blue Yonder

- C3.ai

- ClearMetal

- Fetch Robotics

- FourKites

- GE Digital

- Honeywell International

- Infor

- Korber Supply Chain

- Llamasoft

- Manhattan Associates

- Microsoft Corporation

- NVIDIA Corporation

- SAP SE

- Siemens AG

- Zebra Technologies

The Global AI in Logistics and Supply Chain Market was valued at USD 20.1 billion in 2024 and is estimated to grow at a CAGR of 25.9% to reach USD 196.58 billion by 2034, driven by the increasing need for real-time supply chain visibility, optimized route planning, accurate demand forecasting, and automation in warehouses. Companies are increasingly incorporating AI into their operations to enhance decision-making processes, reduce operational costs, and manage complex logistics networks. AI-enabled solutions such as predictive analytics, robotic process automation, and autonomous vehicles are transforming traditional supply chains into intelligent, adaptable ecosystems.

The growing intricacy of global supply chains has created a need for predictive analytics and real-time data, allowing businesses to analyze massive amounts of data from sensors, GPS, and enterprise resource planning (ERP) systems to optimize inventory management and reduce costs. AI helps companies adapt quickly to shifts in market conditions, prevent disruptions, and improve customer satisfaction. The expansion of e-commerce and omnichannel retail further emphasizes the need for speed, accuracy, and flexibility, where AI technologies help streamline order processing, automate delivery schedules, and forecast customer behavior.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $20.1 Billion |

| Forecast Value | $196.58 Billion |

| CAGR | 25.9% |

In 2024, the software sector led the market with a share of 56%, anticipated to grow at a CAGR of 26% through 2034. Software helps in empowering intelligent decision-making, automation, and real-time data analysis throughout the supply chain. AI-driven software solutions, including route optimization, demand forecasting, and warehouse automation, are widely adopted by logistics providers to optimize operations, reduce costs, and enhance efficiency. These solutions are key to improving planning accuracy, minimizing human error, and quickly adjusting to market fluctuations. The emphasis on predictive analytics and real-time visibility significantly contributes to the growing demand for AI-powered software applications.

The machine learning (ML) segment held a 47% share in 2024. Its capability to process massive datasets and generate actionable insights in real time makes it essential for analyzing structured and unstructured data from IoT devices, GPS systems, and customer interactions. ML algorithms optimize inventory management, uncover demand patterns, and eliminate operational bottlenecks, thus enhancing efficiency and cost-effectiveness. These algorithms evolve continuously, providing predictive insights and automation opportunities that outperform traditional systems.

United States AI in the Logistics and Supply Chain Market held an 85% share and generated USD 6.2 billion in 2024 due to its advanced digital infrastructure and widespread adoption of emerging technologies. U.S.-based logistics firms are among the first to integrate AI for solutions such as route optimization, demand forecasting, warehouse automation, and predictive maintenance. The country's leading position is further bolstered by the presence of major tech companies and AI providers, accelerating AI adoption in logistics. Public and private sector investments in AI research and development, coupled with government initiatives like the National AI Initiative Act, support the adoption of AI technologies across the logistics and supply chain landscape.

Prominent players in the AI in Logistics and Supply Chain Market include Amazon Web Services, Oracle, Blue Yonder, SAP SE, FourKites, C3.ai, Google, Microsoft, IBM, and Manhattan Associates. To strengthen their market position, companies are focusing on strategic partnerships and acquisitions to enhance their AI capabilities and broaden service offerings. Leveraging cutting-edge technologies, these companies are integrating machine learning, robotics, and automation into logistics and supply chain operations to improve efficiency and reduce costs. Many firms invest in AI-driven software solutions for real-time analytics, route optimization, and demand forecasting, allowing them to stay competitive in a rapidly evolving market. Additionally, AI solution providers are increasing their focus on the e-commerce sector, ensuring quick, flexible, and accurate delivery systems to meet growing consumer expectations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Technology providers

- 3.2.2 System integrators and consulting firms

- 3.2.3 Logistics technology providers

- 3.2.4 Hardware and robotics companies

- 3.2.5 Managed service providers (MSPs)

- 3.3 Profit margin analysis

- 3.4 Impact of Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price Volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Offering cost implications

- 3.4.3 Strategic industry responses

- 3.4.3.1 Supply chain reconfiguration

- 3.4.3.2 Pricing and Offering strategies

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Price trends

- 3.7 Cost breakdown analysis

- 3.8 Patent analysis

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Rising demand for real-time supply chain visibility

- 3.11.1.2 Growth of e-commerce and omnichannel retailing

- 3.11.1.3 Advancements in predictive analytics and machine learning

- 3.11.1.4 Integration of IoT and AI for smart warehousing

- 3.11.1.5 Adoption of autonomous vehicles and drones

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High initial implementation costs

- 3.11.2.2 Data privacy and security concerns

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Sensors

- 5.2.2 Robots (e.g., automated guided vehicles, drones)

- 5.3 Software

- 5.3.1 Predictive analytics

- 5.3.2 Transportation management systems

- 5.3.3 Inventory management

- 5.3.4 Warehouse management

- 5.4 Services

- 5.4.1 Managed services

- 5.4.2 Professional services

- 5.4.2.1 Deployment & integration

- 5.4.2.2 Consulting

- 5.4.2.3 Support & maintenance

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Machine learning

- 6.3 Natural language processing (NLP)

- 6.4 Computer vision

- 6.5 Context-aware computing

- 6.6 Robotics process automation (RPA)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Fleet management

- 7.3 Supply chain planning

- 7.4 Inventory & warehouse management

- 7.5 Freight brokerage & risk management

- 7.6 Demand forecasting

- 7.7 Customer service (chatbots, virtual assistants)

- 7.8 Order fulfillment & last-mile delivery

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Retail & e-commerce

- 8.3 Manufacturing

- 8.4 Automotive

- 8.5 Food & beverage

- 8.6 Healthcare & pharmaceuticals

- 8.7 Transportation & logistics

- 8.8 Energy & utilities

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Amazon Web Services

- 10.2 Blue Yonder

- 10.3 C3.ai

- 10.4 ClearMetal

- 10.5 Fetch Robotics

- 10.6 FourKites

- 10.7 GE Digital

- 10.8 Google

- 10.9 Honeywell International

- 10.10 Infor

- 10.11 Korber Supply Chain

- 10.12 Llamasoft

- 10.13 Manhattan Associates

- 10.14 Microsoft Corporation

- 10.15 NVIDIA Corporation

- 10.16 SAP SE

- 10.17 Siemens AG

- 10.18 Zebra Technologies