|

市場調查報告書

商品編碼

1755203

神經病學設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Neurology Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

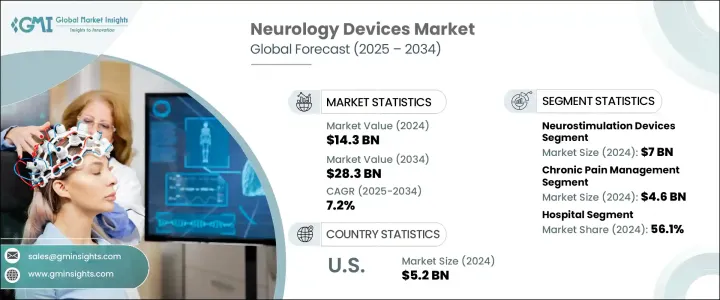

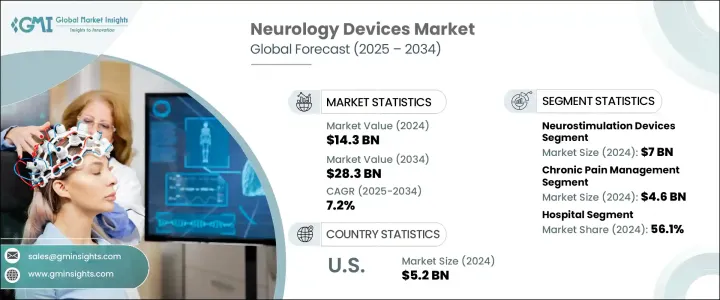

2024 年全球神經病學設備市場價值為 143 億美元,預計到 2034 年將以 7.2% 的複合年成長率成長,達到 283 億美元,這得益於技術創新、神經系統疾病發病率上升、醫療保健支出增加以及醫療服務可及性改善等多種因素。人工智慧遠端監控和腦機介面系統的發展顯著改善了患者的照護效果。此外,攜帶式腦電圖監測器和增強刺激系統等新興微創神經技術正在改變神經系統的治療和診斷。這些進步使得更精確、更安全和更有效的治療介入成為可能,促進了神經病學設備產業的全面擴張。神經病學設備包括可植入工具、手術器材和診斷技術,用於治療影響神經系統的疾病,例如大腦、脊椎和周邊神經。

神經病學設備包括用於治療影響神經系統疾病(例如大腦、脊椎和周邊神經)的植入式工具、手術器材和診斷技術。這些設備旨在輔助檢測、監測、治療和復健神經系統疾病,例如癲癇、帕金森氏症、阿茲海默症、多發性硬化症、腦腫瘤和創傷性腦損傷。它們在從常規神經系統評估到複雜的神經外科手術等一系列臨床環境中發揮關鍵作用。腦電圖系統和神經影像技術等診斷工具有助於早期準確地識別神經系統疾病,而神經刺激器等植入式設備則為患有慢性和進行性疾病的患者提供長期治療益處。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 143億美元 |

| 預測值 | 283億美元 |

| 複合年成長率 | 7.2% |

在主要類別中,神經刺激設備領域在2024年創造了70億美元的市場規模。這些設備包括脊髓刺激器和迷走神經刺激器等系統,旨在治療運動障礙、慢性疼痛、精神疾病和癲癇。閉迴路系統、相容MRI的植入物以及微型解決方案等新型設備改善了患者的治療效果,拓寬了治療應用,從而增強了該領域的成長。

按最終用途分類,醫院在2024年以56.1%的市場佔有率佔據市場主導地位,這得益於其完善的基礎設施和處理複雜神經系統病例的能力。醫院承擔大部分診斷和治療程序,使其成為神經影像和神經調節系統應用的關鍵樞紐。醫院在處理癲癇、中風和創傷等緊急神經系統事件方面發揮著重要作用,確保了對尖端設備的持續需求。

2024年,美國神經病學設備市場規模達52億美元,這得益於神經系統疾病盛行率的上升、強大的臨床研究基礎設施以及大量的政府資金投入。主要的聯邦政府措施和研究經費持續支持神經義肢和腦機介面系統的進步。老齡人口的成長以及神經科專業人員的短缺,也促使人們更加依賴先進的設備來滿足日益成長的醫療需求。

積極塑造神經病學設備產業格局的關鍵參與者包括 Synchron、B BRAUN、LivaNova、NeuroPace、ZYLOX TONBRIDGE、雅培實驗室、MicroTransponder、KARL STROZ、美敦力、史賽克、Bioness、奈夫羅、波士頓科學、Enterra Medical 和 Paradromics。為了鞏固其在神經病學設備市場的地位,領先的公司正專注於研究驅動的產品創新和人工智慧整合系統的開發。這些公司正在透過微創設備和針對特定患者的解決方案來擴展其產品組合,以提高安全性和精準度。戰略合作夥伴關係、監管部門的批准以及增加對神經技術研發的投資也是他們的核心策略。企業正在改進設備與成像系統的兼容性,並追求緊湊、便攜的格式,以實現更廣泛的臨床應用。此外,主要參與者正在擴大製造能力並開展全球合作,以贏得合約、提升地理影響力並與旨在提供更智慧的神經病學護理的醫療保健系統保持一致。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 神經系統疾病盛行率上升

- 微創手術的採用日益增多

- 技術進步

- 增加資金和投資

- 產業陷阱與挑戰

- 設備和手術成本高昂

- 設備故障和併發症的風險

- 成長動力

- 成長潛力分析

- 監管格局

- 美國

- 歐洲

- 技術格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 報銷場景

- 波特的分析

- PESTEL分析

- 差距分析

- 未來市場趨勢

- 價值鏈分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按設備,2021 - 2034 年

- 主要趨勢

- 神經刺激裝置

- 脊髓刺激器

- 深部腦部刺激器

- 迷走神經刺激器

- 薦神經刺激器

- 胃電刺激器

- 神經外科設備

- 立體定位系統

- 神經內視鏡

- 超音波吸引器

- 動脈瘤夾

- 介入性神經病學設備

- 動脈瘤栓塞及栓塞治療

- 栓塞線圈

- 導流裝置

- 液態栓塞劑

- 神經血栓切除術

- 血塊取出器

- 吸引裝置

- 響弦裝置

- 神經血管導管

- 微導管

- 微導絲

- 腦球囊血管成形術和支架

- 頸動脈支架

- 過濾裝置

- 球囊封堵裝置

- 腦脊髓液管理設備

- 腦分流術

- 腦外引流

- 動脈瘤栓塞及栓塞治療

- 腦機介面設備

- 非侵入式腦機介面

- 部分侵入式腦機介面

- 完全侵入式腦機介面

- 其他設備

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 慢性疼痛管理

- 帕金森氏症

- 癲癇

- 中風管理與康復

- 阿茲海默症

- 其他應用

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 其他最終用途

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Abbott Laboratories

- B BRAUN

- Bioness

- Boston Scietific

- enterra medical

- KARL STROZ

- LivaNova

- Medtronic

- MicroTransponder

- NeuroPace

- nevro

- Paradromics

- stryker

- synchron

- ZYLOX TONBRIDGE

The Global Neurology Devices Market was valued at USD 14.3 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 28.3 billion by 2034, fueled by a combination of technological innovation, rising rates of neurological conditions, increased healthcare spending, and improved access to medical services. Developments in AI-powered remote monitoring and brain-computer interface systems have significantly improved patient care outcomes. In addition, emerging minimally invasive neurotechnologies-such as portable EEG monitors and enhanced stimulation systems-are transforming neurological treatment and diagnosis. These advances have made it possible to deliver more precise, safer, and efficient therapeutic interventions, contributing to the overall expansion of the neurology devices sector. Neurology devices include implantable tools, surgical instruments, and diagnostic technologies used to manage conditions affecting the nervous system, such as the brain, spine, and peripheral nerves.

Neurology devices include implantable tools, surgical instruments, and diagnostic technologies used to manage conditions affecting the nervous system, such as the brain, spine, and peripheral nerves. These devices are designed to aid in the detection, monitoring, treatment, and rehabilitation of neurological disorders, including epilepsy, Parkinson's disease, Alzheimer's disease, multiple sclerosis, brain tumors, and traumatic brain injuries. They serve a critical role across a range of clinical settings, from routine neurological assessments to complex neurosurgical procedures. Diagnostic tools such as EEG systems and neuroimaging technologies help in the early and accurate identification of neurological conditions, while implantable devices like neurostimulators offer long-term therapeutic benefits for patients suffering from chronic and progressive diseases.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.3 Billion |

| Forecast Value | $28.3 Billion |

| CAGR | 7.2% |

Among the main categories, the neurostimulation devices segment generated USD 7 billion in 2024. These include systems like spinal cord stimulators and vagus nerve stimulators, designed to address movement disorders, chronic pain, psychiatric issues, and epilepsy. Newer models, such as closed-loop systems, MRI-compatible implants, and miniaturized solutions, have improved patient outcomes and broadened therapeutic applications, reinforcing growth in this segment.

By end use, hospitals led the market in 2024 with a dominant share of 56.1%, driven by their comprehensive infrastructure and ability to handle complex neurological cases. Hospitals conduct a majority of diagnostic and therapeutic procedures, making them key hubs for the adoption of neuroimaging and neuromodulation systems. Their role in managing emergency neurological events such as seizures, strokes, and traumatic injuries ensures constant demand for cutting-edge equipment.

United States Neurology Devices Market was valued at USD 5.2 billion in 2024, supported by increasing neurological disease prevalence, robust clinical research infrastructure, and substantial government funding. Major federal initiatives and research grants continue to back advancements in neuroprosthetics and brain-computer interface systems. A growing elderly population and a shortage of specialized neurology professionals are also pushing greater reliance on advanced devices to meet the rising demand for care.

Key players actively shaping The Neurology Devices Industry landscape include Synchron, B BRAUN, LivaNova, NeuroPace, ZYLOX TONBRIDGE, Abbott Laboratories, MicroTransponder, KARL STROZ, Medtronic, stryker, Bioness, nevro, Boston Scientific, Enterra Medical, and Paradromics. To strengthen their position in the neurology devices market, leading companies are focusing on research-driven product innovation and the development of AI-integrated systems. These firms are expanding their portfolios with minimally invasive devices and patient-specific solutions that enhance safety and precision. Strategic partnerships, regulatory approvals, and increased investments in neurotechnology R&D are also central to their approach. Businesses are refining device compatibility with imaging systems and pursuing compact, portable formats for broader clinical use. Additionally, major players are scaling up manufacturing capabilities and entering into global collaborations to secure contracts, boost geographic presence, and align with healthcare systems aiming for smarter neurological care delivery.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of neurological disorders

- 3.2.1.2 Growing adoption of minimally invasive procedure

- 3.2.1.3 Technological advancements

- 3.2.1.4 Increased funding and investments

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of devices and procedures

- 3.2.2.2 Risk of device failure and complications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Trump administration tariffs

- 3.6.1 Impact on trade

- 3.6.1.1 Trade volume disruptions

- 3.6.1.2 Retaliatory measures

- 3.6.2 Impact on the Industry

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.2.1.1 Price volatility in key materials

- 3.6.2.1.2 Supply chain restructuring

- 3.6.2.1.3 Production cost implications

- 3.6.2.2 Demand-side impact (selling price)

- 3.6.2.2.1 Price transmission to end markets

- 3.6.2.2.2 Market share dynamics

- 3.6.2.2.3 Consumer response patterns

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.3 Key companies impacted

- 3.6.4 Strategic industry responses

- 3.6.4.1 Supply chain reconfiguration

- 3.6.4.2 Pricing and product strategies

- 3.6.4.3 Policy engagement

- 3.6.5 Outlook and future considerations

- 3.6.1 Impact on trade

- 3.7 Reimbursement scenario

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Gap analysis

- 3.11 Future market trends

- 3.12 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Device, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Neurostimulation devices

- 5.2.1 Spinal cord stimulators

- 5.2.2 Deep brain stimulators

- 5.2.3 Vagus nerve stimulators

- 5.2.4 Sacral nerve stimulators

- 5.2.5 Gastric electrical stimulators

- 5.3 Neurosurgical devices

- 5.3.1 Stereotactic systems

- 5.3.2 Neuroendoscopes

- 5.3.3 Ultrasonic aspirators

- 5.3.4 Aneurysm clips

- 5.4 Interventional neurology devices

- 5.4.1 Aneurysm coiling and embolisation

- 5.4.1.1 Embolic coils

- 5.4.1.2 Flow diversion devices

- 5.4.1.3 Liquid embolic reagents

- 5.4.2 Neurothromobectomy

- 5.4.2.1 Clot retrievers

- 5.4.2.2 Suction aspiration devices

- 5.4.2.3 Snare devices

- 5.4.3 Neurovascular catheters

- 5.4.3.1 Micro catheters

- 5.4.3.2 Micro guidewires

- 5.4.4 Cerebral balloon angioplasty and stents

- 5.4.4.1 Carotid artery stents

- 5.4.4.2 Filter devices

- 5.4.4.3 Balloon occlusion devices

- 5.4.5 Csf management devices

- 5.4.5.1 Cerebral shunts

- 5.4.5.2 Cerebral external drainage

- 5.4.1 Aneurysm coiling and embolisation

- 5.5 Brain-computer interface devices

- 5.5.1 Non-invasive BCI

- 5.5.2 Partially invasive BCI

- 5.5.3 Fully invasive BCI

- 5.6 Other devices

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Chronic pain management

- 6.3 Parkinson’s disease

- 6.4 Epilepsy

- 6.5 Stroke management and recovery

- 6.6 Alzheimer

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 B BRAUN

- 9.3 Bioness

- 9.4 Boston Scietific

- 9.5 enterra medical

- 9.6 KARL STROZ

- 9.7 LivaNova

- 9.8 Medtronic

- 9.9 MicroTransponder

- 9.10 NeuroPace

- 9.11 nevro

- 9.12 Paradromics

- 9.13 stryker

- 9.14 synchron

- 9.15 ZYLOX TONBRIDGE