|

市場調查報告書

商品編碼

1755202

可堆肥包裝薄膜市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Compostable Packaging Films Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

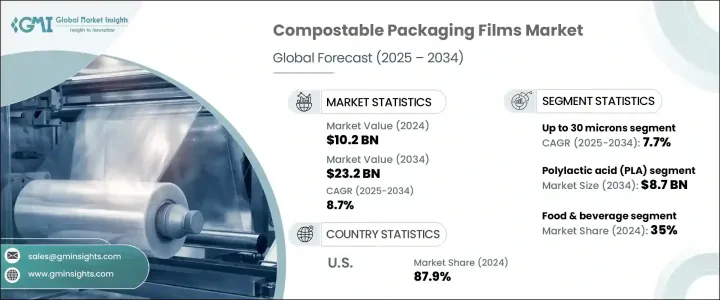

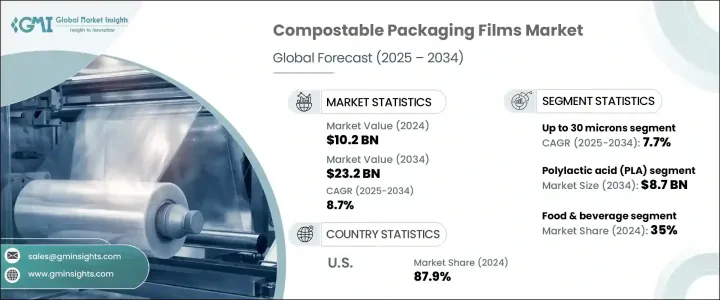

2024 年全球可堆肥包裝薄膜市場價值為 102 億美元,預計在蓬勃發展的電子商務行業和不斷成長的食品飲料行業的推動下,該市場將以 8.7% 的複合年成長率成長,到 2034 年達到 232 億美元。然而,美國上屆政府對生物聚合物和基本加工設備徵收關稅,給當地可堆肥包裝薄膜製造商帶來了成本壓力。這些關稅擾亂了全球供應鏈,推高了投入成本,並為那些投資永續包裝解決方案的企業帶來了不確定性。額外的成本負擔可能會限制可堆肥薄膜的擴張,尤其是對於依賴進口原料或製造技術的小型企業。此外,其他國家的報復性關稅使國際貿易更加困難,損害了出口機會並降低了該行業的整體競爭力。

電子商務的成長顯著影響著對永續包裝的需求,因為線上運輸的產品數量不斷增加,要求包裝既符合消費者偏好,又符合監管標準。可堆肥薄膜因其輕質、柔韌且可生物分解的特點,在電子商務物流領域日益受到青睞。可堆肥包裝薄膜市場的製造商應專注於開發適合電子商務行業的耐用、輕質且可生物分解的薄膜。這將有助於滿足消費者需求,並應對日益成長的永續包裝監管壓力,尤其是在印度等新興市場。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 102億美元 |

| 預測值 | 232億美元 |

| 複合年成長率 | 8.7% |

可堆肥包裝薄膜市場依厚度分為三個部分:厚度不超過30微米、30-60微米和60微米以上。預計到2034年,厚度不超過30微米的薄膜市場將以7.7%的複合年成長率成長。這些薄膜通常用於包裝烘焙產品、零食或茶包等輕質食品,以及標籤和外包裝。其極低的材料用量使其具有成本效益,同時確保符合短保存期限產品的可堆肥標準。

依材料分類,市場分為幾類,包括聚乳酸 (PLA)、竹子、聚羥基脂肪酸酯 (PHA)、澱粉基薄膜、纖維素基薄膜等。預計到 2034 年,PLA 市場規模將達到 87 億美元。 PLA 基薄膜因其優異的印刷適性、透明度和可堆肥性,在食品包裝領域尤其受歡迎。 PLA 薄膜是化石燃料基塑膠的可行替代品,並且與現有加工設備的兼容性使其能夠快速實現商業化應用。

2024年,美國可堆肥包裝薄膜市場佔據87.9%的市場佔有率,這得益於旨在減少塑膠垃圾的強力監管支持以及企業對永續發展日益成長的承諾。市場對可堆肥薄膜的需求日益成長,尤其是來自有機食品產業和注重環保的消費者,這推動了家用可堆肥包裝解決方案的創新。各公司正積極與材料工程師合作,開發具有商業可行性的可生物分解替代品。

全球可堆肥包裝薄膜市場的知名企業包括 BioBag International、巴斯夫、Biome Bioplastics、Amtrex Nature Care 和 Baroda Rapids。為了鞏固市場地位,各公司正在採取建立合作夥伴關係和收購等策略,以提升其在可堆肥包裝領域的技術能力。許多公司正致力於開發高品質的可生物分解薄膜,以滿足消費者對永續包裝日益成長的需求。透過改進生產流程並增加可堆肥材料的供應,企業正在尋求在市場上獲得競爭優勢。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 消費者對永續包裝的需求

- 食品和飲料行業應用的成長

- 加強對一次性塑膠的限制

- 有機和天然產品品牌的需求

- 電子商務和環保運輸需求的成長

- 產業陷阱與挑戰

- 生產和材料成本高

- 工業堆肥基礎設施有限

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 波特的分析

- Pestel 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依材料,2021-2034

- 主要趨勢

- 聚乳酸(PLA)

- 竹子

- 聚羥基脂肪酸酯(PHA)

- 澱粉基薄膜

- 纖維素基薄膜

- 其他

第6章:市場估計與預測:依厚度,2021-2034

- 主要趨勢

- 高達 30 微米

- 30–60微米

- 60微米以上

第7章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 食品和飲料

- 醫療保健和製藥

- 零售與電子商務

- 家庭和個人護理

- 其他

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Amtrex Nature Care

- Baroda Rapids

- BASF

- BI-AX International

- BioBag International

- Biome Bioplastics

- Cortec Corporation

- Easy Flux

- Futamura Group

- Novamont

- Plascon Group

- Polynova Industries

- Polystar Plastics

- Taghleef Industries

- TIPA

The Global Compostable Packaging Films Market was valued at USD 10.2 billion in 2024 and is estimated to grow at a CAGR of 8.7% to reach USD 23.2 billion by 2034 driven by the booming e-commerce sector and the growing food and beverage industry. However, the introduction of tariffs on biopolymers and essential processing equipment under the previous administration in the U.S. has created cost pressures for local manufacturers of compostable packaging films. These tariffs have disrupted global supply chains, inflated input costs, and generated uncertainty for those investing in sustainable packaging solutions. The added cost burden could limit the expansion of compostable films, especially for smaller businesses that rely on imported feedstock or manufacturing technologies. Additionally, retaliation tariffs from other countries have made international trade more difficult, hurting export opportunities and reducing the overall competitiveness of the industry.

E-commerce growth is significantly impacting the demand for sustainable packaging, as the increasing volume of products being shipped online requires packaging that meets both consumer preferences and regulatory standards. Compostable films are gaining traction in e-commerce logistics because they are lightweight, flexible, and biodegradable. Manufacturers in the compostable packaging films market should focus on developing durable, lightweight, and biodegradable films tailored to the e-commerce sector. This will help meet consumer demand and address the growing regulatory pressures for sustainable packaging, particularly in emerging markets like India.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.2 Billion |

| Forecast Value | $23.2 Billion |

| CAGR | 8.7% |

The compostable packaging films market is categorized by thickness into three segments: up to 30 microns, 30-60 microns, and above 60 microns. The market for films up to 30 microns is projected to grow at a CAGR of 7.7% through 2034. These thin films are commonly used for packaging light food items such as bakery products, snacks, or tea bags, as well as for label and overwrap applications. Their minimal material usage makes them cost-effective while ensuring compliance with compostable standards for short-shelf-life products.

By material, the market is divided into several categories, including polylactic acid (PLA), bamboo, polyhydroxyalkanoate (PHA), starch-based films, cellulose-based films, and others. The PLA market is expected to reach USD 8.7 billion by 2034. PLA-based films are particularly popular in the food packaging sector due to their excellent printability, transparency, and compostability. PLA films present a viable alternative to fossil-fuel-based plastics, and their compatibility with existing converting equipment facilitates their rapid commercial adoption.

U.S. Compostable Packaging Films Market held a share of 87.9% in 2024 attributed to strong regulatory support aimed at reducing plastic waste and the growing commitment to sustainability by businesses. There is a rising demand for compostable films, particularly from the organic food industry and environmentally conscious consumers, which is driving innovation in home-compostable packaging solutions. Companies are actively collaborating with material engineers to develop commercially viable biodegradable alternatives.

Notable players in the Global Compostable Packaging Films Market include BioBag International, BASF, Biome Bioplastics, Amtrex Nature Care, and Baroda Rapids. To strengthen their market position, companies are adopting strategies such as forming partnerships and acquisitions to enhance their technical capabilities in the compostable packaging sector. Many companies are focusing on the development of high-quality, biodegradable films that meet the growing consumer demand for sustainable packaging. By improving their manufacturing processes and increasing the availability of compostable materials, businesses are seeking to gain a competitive edge in the market.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1.1 Supply chain reconfiguration

- 3.2.4.1.2 Pricing and product strategies

- 3.2.4.1.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Consumer demand for sustainable packaging

- 3.3.1.2 Growth in food & beverage industry applications

- 3.3.1.3 Increasing restrictions on single-use plastics

- 3.3.1.4 Demand from organic and natural product brands

- 3.3.1.5 Growth of e-commerce and eco-friendly shipping needs

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High production and material costs

- 3.3.2.2 Limited industrial composting infrastructure

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 Pestel analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Material, 2021-2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Polylactic acid (PLA)

- 5.3 Bamboo

- 5.4 Polyhydroxyalkanoate (PHA)

- 5.5 Starch-based films

- 5.6 Cellulose-based films

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Thickness, 2021-2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Up to 30 microns

- 6.3 30–60 microns

- 6.4 Above 60 microns

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverage

- 7.3 Healthcare & pharmaceuticals

- 7.4 Retail & e-commerce

- 7.5 Home & personal care

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Amtrex Nature Care

- 9.2 Baroda Rapids

- 9.3 BASF

- 9.4 BI-AX International

- 9.5 BioBag International

- 9.6 Biome Bioplastics

- 9.7 Cortec Corporation

- 9.8 Easy Flux

- 9.9 Futamura Group

- 9.10 Novamont

- 9.11 Plascon Group

- 9.12 Polynova Industries

- 9.13 Polystar Plastics

- 9.14 Taghleef Industries

- 9.15 TIPA