|

市場調查報告書

商品編碼

1755198

精製乳糖市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Refined Lactose Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

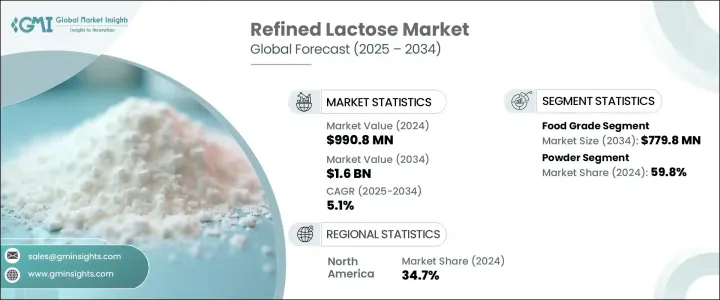

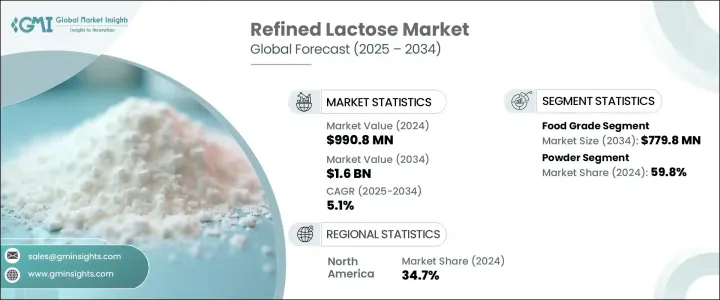

2024年,全球精製乳糖市場規模達9.908億美元,預計到2034年將以5.1%的複合年成長率成長,達到16億美元,這主要得益於食品飲料、製藥和動物飼料等各行各業日益成長的需求。在食品領域,精製乳糖被用作烘焙食品、糖果和乳製品的甜味劑和填充劑。消費者對天然和低加工成分的偏好進一步刺激了對精製乳糖的需求,使其成為比合成甜味劑更健康的替代品。在製藥領域,精製乳糖因其優異的壓縮性和溶解性,可用作片劑和膠囊劑型的賦形劑,從而促進市場擴張。

此外,在動物飼料配方中添加精製乳糖(尤其是針對仔豬和犢牛等幼畜)已被證明能夠有效促進消化系統健康和支持早期能量代謝。這項功能優勢推動了其在畜牧業和乳牛養殖業的應用,因為動物健康和快速生長對於經濟可行性至關重要。由於生產商致力於提高飼料效率並減少合成添加劑的使用,乳糖是一種天然、適口且營養豐富的成分。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 9.908億美元 |

| 預測值 | 16億美元 |

| 複合年成長率 | 5.1% |

預計到2034年,食品級乳糖市場規模將達到7.798億美元,複合年成長率為5.2%,這得益於消費者對加工食品中清潔標籤和天然成分的需求不斷成長。食品級乳糖不僅因其溫和的甜度和質地特性而被廣泛應用,還因其易消化性和在嬰兒營養中的重要作用。乳糖在烘焙、糖果和乳製品中的使用量不斷成長,加上配方和功能性食品開發的創新,預計將在整個預測期內推動該市場持續成長。

在各種形式的精製乳糖中,粉狀乳糖佔據最大的市場佔有率,2024年將佔比59.8%,預計2025年至2034年的複合年成長率為6.8%。粉狀乳糖用途廣泛且易於處理,適用於製藥、食品飲料以及嬰兒營養等各種應用。然而,原料價格波動以及對品質標準的一致性要求等挑戰可能會影響其成長。預計提高純度和性能的加工技術創新將推動精製乳糖市場的持續擴張。

由於北美乳製品行業發達,且製藥業對乳糖的需求日益成長,北美精製乳糖市場在2024年佔據了34.7%的市場佔有率。美國憑藉其先進的生產能力和在乳糖精製研發方面的大量投入,為該地區的市場佔有率做出了巨大貢獻。此外,乳糖基輔料在藥物製劑中的使用日益增多,也將繼續推動該地區市場的成長。

全球精製乳糖市場的主要參與者包括Arla Foods Ingredients Group P/S、恆天然合作Group Limited、Lactalis Ingredients、FrieslandCampina Ingredients、Agropur Cooperative和Hilmar Cheese Company, Inc.。這些公司專注於擴大產品組合、提升產能並投資研發,以滿足各領域對精製乳糖日益成長的需求。為了鞏固市場地位,全球精製乳糖行業的公司正在採取多項關鍵策略,包括擴大產能以滿足日益成長的需求、投資研發以創新和提高產品質量,以及建立戰略合作夥伴關係和合作關係以增強分銷網路和市場覆蓋範圍。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 主要製造商

- 經銷商

- 整個產業的利潤率

- 供應鏈和分銷分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 貿易統計(HS編碼)

- 2021-2024年主要出口國

- 2021-2024年主要出口國

註:以上貿易統計僅針對重點國家

- 衝擊力

- 成長動力

- 食品飲料產業需求不斷成長

- 健康與保健趨勢

- 製藥業需求

- 動物飼料產業的擴張

- 產業陷阱與挑戰

- 乳糖不耐症加劇

- 原物料價格波動

- 市場機會

- 市場挑戰

- 市場機會

- 成長動力

- 原料景觀

- 製造業趨勢

- 技術演進

- 定價分析和成本結構

- 價格趨勢(美元/噸)

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東非洲

- 定價因素(原料、能源、勞力)

- 區域價格差異

- 成本結構細分

- 獲利能力分析

- 價格趨勢(美元/噸)

- 監管框架和標準

- 食品安全法規

- 藥品品質標準

- 嬰兒配方奶粉法規

- 標籤要求

- 進出口法規

- 波特的分析

- Pestel 分析

- 製造流程分析

- 乳清加工

- 結晶技術

- 純化方法

- 乾燥和研磨

- 品質控制程式

- 原料分析與採購策略

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司熱圖分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

- Expansion

- Mergers & acquisition

- Collaborations

- New product launches

- Research & development

- 主要參與者的最新發展和影響分析

- 公司分類

- 參與者概述

- 財務表現

- 產品基準測試

第5章:市場估計與預測:依等級,2021-2034

- 主要趨勢

- 食品級

- 標準食品級

- 高純度食品級

- 其他食品級

- 醫藥級

- USP/EP/JP級

- 無水乳糖

- 噴霧乾燥乳糖

- 一水乳糖

- 其他醫藥級

- 工業級

- 其他等級

第6章:市場估計與預測:依形式,2021-2034

- 主要趨勢

- 粉末

- 細粉

- 粗粉

- 顆粒

- 研磨顆粒

- 團聚顆粒

- 水晶

- 其他形式

第7章:市場估計與預測:依生產方式,2021-2034 年

- 主要趨勢

- 乳清乳糖

- 甜乳清衍生

- 酸性乳清衍生

- 牛奶衍生的乳糖

- 其他生產方法

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 食品和飲料

- 糖果

- 烘焙產品

- 乳製品

- 加工食品

- 飲料

- 其他食品應用

- 製藥

- 片劑製劑(賦形劑)

- 膠囊劑型

- 吸入產品

- 注射劑型

- 其他藥物應用

- 嬰兒配方奶粉

- 標準嬰兒配方奶粉

- 後續配方奶粉

- 特殊配方

- 其他嬰兒營養產品

- 動物飼料

- 化妝品和個人護理

- 其他應用

第9章:市場估計與預測:依最終用途產業,2021-2034 年

- 主要趨勢

- 食品和飲料業

- 大型食品生產商

- 中小型食品加工機

- 手工食品生產商

- 製藥業

- 大型製藥公司

- 學名藥製造商

- 合約製造組織

- 嬰兒配方奶粉製造商

- 動物飼料業

- 化妝品和個人護理行業

- 其他最終用途產業

第 10 章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 直銷/B2B

- 分銷商和批發商

- 線上通路

- 其他分銷管道

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第12章:公司簡介

- Arla Foods Ingredients Group P/S

- Fonterra Co-operative Group Limited

- Lactalis Ingredients

- FrieslandCampina Ingredients

- Agropur Cooperative

- Hilmar Cheese Company, Inc.

- Leprino Foods Company

- Meggle Group GmbH

- DFE Pharma

- Kerry Group plc

- Milei GmbH (Hochdorf Group)

- Molkerei MEGGLE Wasserburg GmbH & Co. KG

- Actus Nutrition

The Global Refined Lactose Market was valued at USD 990.8 million in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 1.6 billion by 2034, driven by increasing demand across various industries, including food and beverage, pharmaceuticals, and animal feed. In the food sector, refined lactose is utilized as a sweetener and filler in bakery items, confectioneries, and dairy products. Consumers' preference for natural and minimally processed ingredients has further fueled the demand for refined lactose, positioning it as a healthier alternative to synthetic sweeteners. In pharmaceuticals, refined lactose serves as an excipient in tablet and capsule formulations due to its excellent compressibility and solubility, contributing to the expansion of the market.

Additionally, incorporating refined lactose into animal feed formulations-especially for young livestock such as piglets and calves-has proven highly effective in promoting digestive health and supporting early-stage energy metabolism. This functional benefit drives its adoption in the livestock and dairy farming sectors, where animal health and rapid growth are critical for economic viability. As producers aim to improve feed efficiency and minimize synthetic additives, lactose is a natural, palatable, and nutrient-rich component.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $990.8 Million |

| Forecast Value | $1.6 Billion |

| CAGR | 5.1% |

The food-grade segment is projected to reach USD 779.8 million by 2034, growing at a CAGR of 5.2% fueled by increasing consumer demand for clean-label, naturally derived ingredients in processed foods. Food-grade lactose is widely used not only for its mild sweetness and textural properties but also due to its digestibility and essential role in infant nutrition. Its rising usage in bakery, confectionery, and dairy products-coupled with innovation in formulation and functional food development-is expected to drive sustained momentum in this segment throughout the forecast period.

Among the various forms of refined lactose, the powder form held the largest market share, accounting for 59.8% in 2024, and is projected to grow at a CAGR of 6.8% from 2025 to 2034. The powder form's versatility and ease of handling make it suitable for various applications in pharmaceuticals, food and beverage industries, and infant nutrition. However, challenges such as fluctuating raw material prices and the requirement for consistent quality standards may impact growth. Innovations in processing techniques to enhance purity and performance are expected to drive the continued expansion of the refined lactose market.

North America Refined Lactose Market held a 34.7% share in 2024 due to the region's developed dairy sector and the growing need for lactose in pharmaceutical applications. The United States significantly contributes to this region's market share, owing to its sophisticated production capabilities and high investment in research and development for refining lactose. Additionally, the increasing use of lactose-based excipients in drug formulations continues to bolster market growth in this region.

Key players in the Global Refined Lactose Market include Arla Foods Ingredients Group P/S, Fonterra Co-operative Group Limited, Lactalis Ingredients, FrieslandCampina Ingredients, Agropur Cooperative, and Hilmar Cheese Company, Inc. These companies are focusing on expanding their product portfolios, enhancing production capacities, and investing in research and development to meet the rising demand for refined lactose across various applications. To strengthen their market presence, companies in the Global Refined Lactose Industry are adopting several key strategies. These include expanding production capacities to meet the growing demand, investing in research and development to innovate and improve product quality, and forming strategic partnerships and collaborations to enhance distribution networks and market reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Key manufacturers

- 3.1.2 Distributors

- 3.1.3 Profit margins across the industry

- 3.1.4 Supply chain and distribution analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code)

- 3.3.1 Major exporting countries, 2021-2024 (Kilo Tons)

- 3.3.2 Major exporting countries, 2021-2024 (Kilo Tons)

Note: the above trade statistics will be provided for key countries only

- 3.4 Impact forces

- 3.4.1 Growth drivers

- 3.4.1.1 Rising demand in food & beverage industry

- 3.4.1.2 Health & wellness trends

- 3.4.1.3 Pharmaceutical industry demand

- 3.4.1.4 Expansion in animal feed industry

- 3.4.2 Industry pitfalls & challenges

- 3.4.2.1 Increasing lactose intolerance

- 3.4.2.2 Raw material price fluctuations

- 3.4.3 Market opportunities

- 3.4.4 Market challenges

- 3.4.5 Market opportunity

- 3.4.1 Growth drivers

- 3.5 Raw material landscape

- 3.5.1 Manufacturing trends

- 3.5.2 Technology evolution

- 3.6 Pricing analysis and cost structure

- 3.6.1 Pricing trends (USD/Ton)

- 3.6.1.1 North America

- 3.6.1.2 Europe

- 3.6.1.3 Asia Pacific

- 3.6.1.4 Latin America

- 3.6.1.5 Middle East Africa

- 3.6.2 Pricing factors (raw materials, energy, labor)

- 3.6.3 Regional price variations

- 3.6.4 Cost structure breakdown

- 3.6.5 Profitability analysis

- 3.6.1 Pricing trends (USD/Ton)

- 3.7 Regulatory framework and standards

- 3.7.1 Food safety regulations

- 3.7.2 Pharmaceutical quality standards

- 3.7.3 Infant formula regulations

- 3.7.4 Labeling requirements

- 3.7.5 Import/Export regulations

- 3.8 Porter's analysis

- 3.9 Pestel analysis

- 3.10 Manufacturing process analysis

- 3.10.1 Whey processing

- 3.10.2 Crystallization techniques

- 3.10.3 Purification methods

- 3.10.4 Drying & milling

- 3.10.5 Quality control procedures

- 3.11 Raw material analysis & procurement strategies

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Company heat map analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.6.1 Expansion

- 4.6.2 Mergers & acquisition

- 4.6.3 Collaborations

- 4.6.4 New product launches

- 4.6.5 Research & development

- 4.7 Recent developments & impact analysis by key players

- 4.7.1 Company categorization

- 4.7.2 Participant’s overview

- 4.7.3 Financial performance

- 4.8 Product benchmarking

Chapter 5 Market Estimates & Forecast, By Grade, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Food grade

- 5.2.1 Standard food grade

- 5.2.2 High purity food grade

- 5.2.3 Other food grades

- 5.3 Pharmaceutical Grade

- 5.3.1 USP/EP/JP grade

- 5.3.2 Anhydrous lactose

- 5.3.3 Spray-dried lactose

- 5.3.4 Monohydrate lactose

- 5.3.5 Other pharmaceutical grades

- 5.4 Technical grade

- 5.5 Other grades

Chapter 6 Market Estimates & Forecast, By Form, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Powder

- 6.2.1 Fine powder

- 6.2.2 Coarse powder

- 6.3 Granules

- 6.3.1 Milled granules

- 6.3.2 Agglomerated granules

- 6.4 Crystals

- 6.5 Other forms

Chapter 7 Market Estimates & Forecast, By Production Method, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Whey-derived lactose

- 7.2.1 Sweet whey-derived

- 7.2.2 Acid whey-derived

- 7.3 Milk-derived lactose

- 7.4 Other production methods

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Food & beverage

- 8.2.1 Confectionery

- 8.2.2 Bakery products

- 8.2.3 Dairy products

- 8.2.4 Processed foods

- 8.2.5 Beverages

- 8.2.6 Other food applications

- 8.3 Pharmaceuticals

- 8.3.1 Tablet formulations (excipient)

- 8.3.2 Capsule formulations

- 8.3.3 Inhalation products

- 8.3.4 Injectable formulations

- 8.3.5 Other pharmaceutical applications

- 8.4 Infant formula

- 8.4.1 Standard infant formula

- 8.4.2 Follow-on formula

- 8.4.3 Specialty formula

- 8.4.4 Other infant nutrition products

- 8.5 Animal feed

- 8.6 Cosmetics & personal care

- 8.7 Other applications

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 Food & beverage industry

- 9.2.1 Large food manufacturers

- 9.2.2 Medium & small food processors

- 9.2.3 Artisanal food producers

- 9.3 Pharmaceutical industry

- 9.3.1 Large pharmaceutical companies

- 9.3.2 Generic drug manufacturers

- 9.3.3 Contract manufacturing organizations

- 9.4 Infant formula manufacturers

- 9.4.1 Animal feed industry

- 9.4.2 Cosmetics & personal care industry

- 9.4.3 Other end-use industries

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 Direct sales/B2B

- 10.3 Distributors & wholesalers

- 10.4 Online channels

- 10.5 Other distribution channels

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Arla Foods Ingredients Group P/S

- 12.2 Fonterra Co-operative Group Limited

- 12.3 Lactalis Ingredients

- 12.4 FrieslandCampina Ingredients

- 12.5 Agropur Cooperative

- 12.6 Hilmar Cheese Company, Inc.

- 12.7 Leprino Foods Company

- 12.8 Meggle Group GmbH

- 12.9 DFE Pharma

- 12.10 Kerry Group plc

- 12.11 Milei GmbH (Hochdorf Group)

- 12.12 Molkerei MEGGLE Wasserburg GmbH & Co. KG

- 12.13 Actus Nutrition