|

市場調查報告書

商品編碼

1755197

即時脂質測試市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Point of Care Lipid Test Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

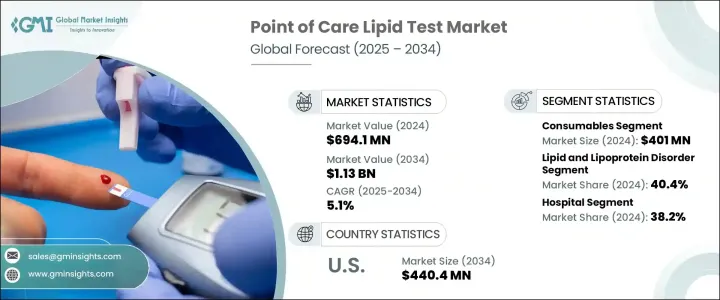

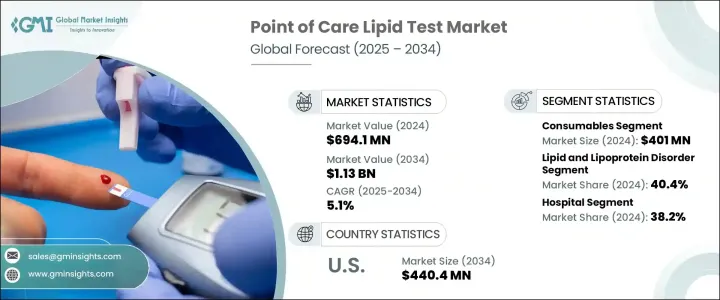

2024年,全球即時血脂檢測市場規模達6.941億美元,預計到2034年將以5.1%的複合年成長率成長,達到11.3億美元。該市場涵蓋攜帶式診斷解決方案,旨在在傳統實驗室環境之外測量血脂水平,例如三酸甘油酯和膽固醇。這些工具能夠提供即時結果,使其成為臨床實踐、一般醫療環境以及家庭個人使用中不可或缺的工具。心血管疾病通常與血脂水平異常相關,全球心血管疾病負擔日益加重,這持續推動對便捷檢測替代方案的需求。

隨著人們越來越重視主動管理健康,快速且方便的檢測方法也越來越受到人們的追捧。隨著預防保健和早期檢測的日益受到重視,人們對操作簡單、快速且準確地檢測結果的可靠設備的需求也日益成長。持續的技術進步使這些設備更加精準、便捷,進一步提升了它們的吸引力。從傳統診斷到按需血脂分析的轉變重塑了醫療保健格局,因為人們渴望在不依賴傳統醫療預約的情況下掌控自己的健康狀況。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 6.941億美元 |

| 預測值 | 11.3億美元 |

| 複合年成長率 | 5.1% |

2024年,耗材市場規模達4.01億美元,預計2034年將以5%的複合年成長率成長。正如國際衛生組織所強調的,全球心血管疾病發生率的上升是血脂檢測產品需求激增的重要促進因素。試劑盒和試紙等耗材是每次血脂檢測的必需品,且一次性使用,因此重複購買頻率較高。隨著即時診斷技術日益融入門診中心、初級保健診所和個人健康機構等各種醫療環境,對可靠的一次性組件的需求也日益成長。人們對快速、衛生、精準的檢測解決方案的日益青睞,也促進了耗材的普及。

由於血脂異常(包括遺傳性和後天性脂質失衡)的盛行率不斷上升,脂質和脂蛋白紊亂領域在2024年佔據了最大的市場佔有率,達到40.4%。這些紊亂在心臟相關疾病的發展中起著核心作用,而心臟相關疾病仍然是全球死亡的主要原因。診斷和管理脂質異常的緊迫性強化了即時脂質檢測的廣泛應用。醫療專業人員,尤其是內科和心臟病學專業人士,都嚴重依賴這些檢測來支持早期介入。定期監測脂質的需求使得這些診斷方法成為專科和普通醫療保健的基本工具。

預計到2034年,美國即時脂質檢測市場規模將達4.404億美元。大眾對心血管風險的日益關注,促使人們普遍認知到脂質檢測的重要性,這推動了便捷易用的診斷試劑盒的普及。隨著越來越多的人致力於主動管理自身健康,人們正在加速向即時居家檢測的轉變。全美脂質疾病發生率的上升,加劇了對可靠、便捷解決方案的需求。隨著人們意識的不斷增強,市場受益於對緊湊型診斷工具的需求激增,這些工具可以進行定期篩檢,無需正式就診實驗室。

推動全球即時脂質檢測產業創新和擴張的主要參與者包括羅氏製藥 (F. Hoffmann-La Roche)、VivaChek Biotech、Kanlife、雅培實驗室 (Abbott Laboratories)、SD Biosensor、三諾生物 (Sinocare)、Callegari、MiCoBio、Nova Biomedical 和美納里尼集團 (Menarini Group)。為了鞏固市場地位,主要參與者正在實施以持續產品創新和技術改進為中心的策略。各公司正在投資開發先進的診斷設備,以提供更快、更準確的結果,同時增強使用者友善性。許多公司正在透過與醫療保健分銷商和診所建立合作夥伴關係和策略合作來擴大其地理覆蓋範圍。這些聯盟有助於提高脂質檢測試劑盒在各市場的可近性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 心血管疾病盛行率不斷上升

- 預防性醫療保健日益受到重視

- POC 脂質檢測設備的技術進步

- 新興經濟體的採用率不斷提高

- 產業陷阱與挑戰

- 嚴格的監管情景

- 農村地區認知有限

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 儀器

- 耗材

第6章:市場估計與預測:按疾病適應症,2021 - 2034 年

- 主要趨勢

- 脂質和脂蛋白紊亂

- 內源性高血脂症

- 丹吉爾病

- 高脂蛋白血症

- 家族性高膽固醇血症

- 其他脂質和脂蛋白疾病

- 動脈粥狀硬化

- 肝臟和腎臟疾病

- 糖尿病

- 其他疾病指徵

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 診所

- 診斷實驗室

- 其他最終用途

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Abbott Laboratories

- Callegari

- F. Hoffmann-La Roche

- Kanlife

- Menarini Group

- MiCoBio

- Nova Biomedical

- SD Biosensor

- Sinocare

- VivaChek Biotech

The Global Point of Care Lipid Test Market was valued at USD 694.1 million in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 1.13 billion by 2034. This market encompasses portable diagnostic solutions designed to measure blood lipid levels, such as triglycerides and cholesterol, outside traditional laboratory settings. These tools provide real-time results, making them essential in clinical practice, general healthcare environments, and for personal use at home. The mounting global burden of cardiovascular conditions, which are often linked with abnormal lipid levels, continues to drive demand for easily accessible testing alternatives.

Rapid and user-friendly testing methods are becoming increasingly sought after as individuals seek to manage health proactively. With a greater emphasis on preventive care and early detection, there's been a noticeable push for reliable devices that are simple to operate and provide fast, accurate outcomes. Ongoing technological improvements are making these devices more precise and user-friendly, reinforcing their growing appeal. The move away from traditional diagnostics and toward on-demand lipid profiling reshape the healthcare landscape, as people demand control over their wellness without depending on conventional healthcare appointments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $694.1 Million |

| Forecast Value | $1.13 Billion |

| CAGR | 5.1% |

In 2024, the consumables segment generated USD 401 million and is projected to grow at a 5% CAGR through 2034. The increasing global incidence of cardiovascular ailments, as highlighted by international health organizations, is a significant driver behind the surge in demand for lipid testing products. Consumables such as reagent cartridges and test strips are essential for every lipid profile test and are intended for single use, resulting in high repurchase frequency. As point-of-care diagnostics become more integrated into various healthcare environments like outpatient centers, primary care offices, and personal health setups, the necessity for reliable, disposable components is rising. The growing preference for fast, hygienic, and accurate testing solutions is enhancing the uptake of consumables.

The lipid and lipoprotein disorder segment accounted for the largest market share in 2024, holding 40.4% due to the rising prevalence of dyslipidemia, including genetic and acquired lipid imbalances. These disorders play a central role in the development of heart-related illnesses, which continue to be the foremost cause of mortality worldwide. The urgency of diagnosing and managing lipid irregularities reinforces the widespread use of point-of-care lipid panels. Medical professionals-particularly those specializing in internal medicine and cardiology-heavily rely on these tests to support early interventions. The demand for regular lipid monitoring has made these diagnostics a fundamental tool in both specialized and general healthcare.

United States Point of Care Lipid Test Market is anticipated to reach USD 440.4 million by 2034. Increasing public concern regarding cardiovascular risk has sparked widespread awareness about the importance of lipid testing, which is pushing the adoption of convenient, easy-to-use diagnostic kits. The shift toward immediate, at-home testing is accelerating as more individuals aim to manage their health proactively. The rising incidence of lipid disorders across the country is intensifying the need for dependable, accessible solutions. As awareness continues to grow, the market is benefiting from a surge in demand for compact diagnostic tools that allow regular screening without the need for formal lab visits.

Major industry participants driving innovation and expansion in the Global Point of Care Lipid Test Industry include F. Hoffmann-La Roche, VivaChek Biotech, Kanlife, Abbott Laboratories, SD Biosensor, Sinocare, Callegari, MiCoBio, Nova Biomedical, and Menarini Group. To strengthen their market positioning, key players are implementing strategies centered around continuous product innovation and technological enhancement. Companies are investing in the development of advanced diagnostic devices that deliver faster and more accurate results while enhancing user-friendliness. Many are expanding their geographic reach through partnerships and strategic collaborations with healthcare distributors and clinics. These alliances help improve accessibility to lipid testing kits across various markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.3 Growth drivers

- 3.3.1 Increasing prevalence of cardiovascular diseases

- 3.3.2 Rising shift towards preventive healthcare

- 3.3.3 Technological advancements in POC lipid testing devices

- 3.3.4 Growing adoption in emerging economies

- 3.4 Industry pitfalls and challenges

- 3.4.1 Stringent regulatory scenario

- 3.4.2 Limited awareness in rural areas

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.7 Technological landscape

- 3.8 Future market trends

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Instruments

- 5.3 Consumables

Chapter 6 Market Estimates and Forecast, By Disease Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Lipid and lipoprotein disorder

- 6.2.1 Endogenous hyperlipemia

- 6.2.2 Tangier disease

- 6.2.3 Hyperlipoproteinemia

- 6.2.4 Familial hypercholesterolemia

- 6.2.5 Other lipid and lipoprotein disorders

- 6.3 Atherosclerosis

- 6.4 Liver and renal diseases

- 6.5 Diabetes mellitus

- 6.6 Other disease indication

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Clinics

- 7.4 Diagnostic laboratories

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Callegari

- 9.3 F. Hoffmann-La Roche

- 9.4 Kanlife

- 9.5 Menarini Group

- 9.6 MiCoBio

- 9.7 Nova Biomedical

- 9.8 SD Biosensor

- 9.9 Sinocare

- 9.10 VivaChek Biotech