|

市場調查報告書

商品編碼

1755192

氣管插管市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Endotracheal Tube Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

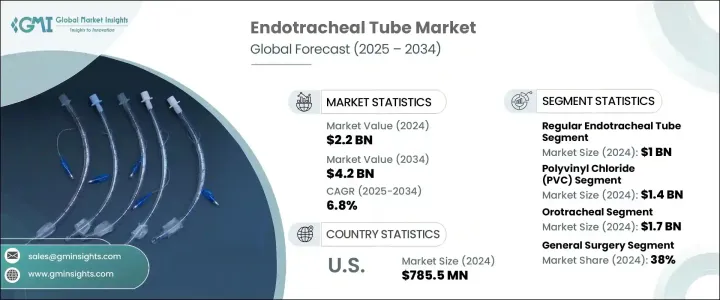

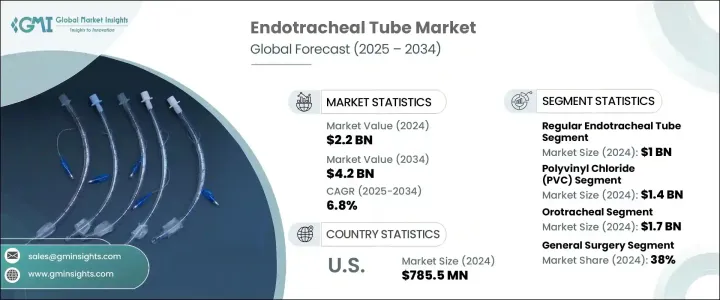

2024年,全球氣管插管市場規模達22億美元,預計2034年將以6.8%的複合年成長率成長,達到42億美元。這一成長可歸因於多種因素,包括需要插管的手術數量不斷增加、ICU入院率和重症監護病例的增加,以及新興地區醫療基礎設施的建設。此外,全球氣喘和慢性阻塞性肺病(COPD)等慢性呼吸系統疾病的發生率不斷上升,尤其是在老年人群中,這也加劇了對氣管插管的需求。

製造商正在透過添加抗菌塗層、新型袖口設計和聲門下吸引等功能來增強這些產品的性能,以減少呼吸器相關性肺炎 (VAP) 等併發症。這些改進不僅惠及患者,也推動了全球醫療中心對這些設備的採用,從而促進了市場成長。氣管插管是一種軟性裝置,用於在手術、麻醉或重症監護期間透過經口或經鼻插入氣管來保護氣道。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 22億美元 |

| 預測值 | 42億美元 |

| 複合年成長率 | 6.8% |

它能夠實現機械通氣,並有助於在手術過程中保護氣道。由於呼吸系統疾病的發生率不斷上升、一次性導管的普及以及視訊喉鏡等先進插管技術的日益普及,氣管導管的需求正在成長。此外,在急診和院外環境中,對帶有抗菌和藥物洗脫塗層的導管的需求也在增加。

2024年,常規氣管插管市場規模達10億美元。這些插管仍然是常規外科手術和急診手術的首選,尤其是在資源匱乏的地區,因為與先進的替代產品相比,它們價格更實惠。它們設計簡單,易於使用,大多數醫療專業人員都接受過高效操作的培訓,確保了它們在臨床環境中的廣泛應用。

2024年,經口氣管插管市場規模達17億美元,預計2034年的複合年成長率將達7%。經口氣管插管因其快速易行,是緊急情況下最常使用的氣道管理方法。它適用於創傷、心臟驟停和重症監護等情況,在這些情況下,幾分鐘內建立氣道至關重要。相較於經鼻氣管插管,經口氣管插管更受青睞,因為它可以避免鼻出血和鼻竇感染等併發症,並被認為對許多成年患者更安全。

2024年,美國氣管插管市場規模達7.855億美元。慢性阻塞性肺病 (COPD)、肺炎和急性呼吸窘迫症候群 (ARDS) 等呼吸系統疾病的盛行率不斷上升,顯著推動了美國對氣管插管的需求。隨著聯邦醫療保險 (Medicare)、醫療補助 (Medicaid) 和私人保險公司訂定的政策涵蓋插管和機械通氣程序,醫院和外科中心更有可能採用氣管插管 (ETT),而無需面臨財務壓力。這些報銷政策在鼓勵最佳實踐和增加氣管插管使用方面發揮關鍵作用,從而推動了市場成長。

全球氣管插管市場的領先公司包括:Flexicare、Ambu、Fuji Systems、Medtronic、Medline、STERIMED、Teleflex、Romed HOLLAND、ANGIPLAST、Mercury Medical、INTERRACIAL、icumedical、VIGGOMEDICAL DEVICES、Wellead 和 TUORen。為了鞏固市場地位,各公司正專注於幾項關鍵策略。他們透過開發抗菌塗層和聲門下吸引等先進功能來投資產品創新,以提高患者安全性並減少併發症。與醫療保健提供者建立合作夥伴關係以及拓展新興市場的分銷管道對於覆蓋更廣泛的受眾也至關重要。此外,公司正在投資教育醫療保健專業人員了解其產品的優勢,以推動其採用。此外,與醫院和醫療保健系統的合作有助於確保更好的產品可近性和知名度。這些策略旨在提高市場滲透率並保持競爭優勢。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 需要插管的手術數量不斷增加

- 氣管插管技術的進步

- ICU入院人數和重症監護病患人數的成長

- 新興市場醫療基礎設施的擴張

- 產業陷阱與挑戰

- 專用氣管插管費用高昂

- 插管後併發症的風險

- 成長動力

- 成長潛力分析

- 監管格局

- 美國

- 歐洲

- 技術格局

- 報銷場景

- 波特的分析

- PESTEL分析

- 差距分析

- 未來市場趨勢

- 價值鏈分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 常規氣管插管

- 加強型氣管插管

- 已進行氣管插管

- 雙腔氣管插管

第6章:市場估計與預測:按材料,2021 - 2034 年

- 主要趨勢

- 聚氯乙烯(PVC)

- 矽

- 聚氨酯

- 其他材料

第7章:市場估計與預測:按插管途徑,2021 - 2034 年

- 主要趨勢

- 口氣管

- 經鼻氣管

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 一般外科

- 緊急治療

- 治療

- 新生兒和兒科護理

- 其他應用

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 其他最終用途

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- ANGIPLAST

- Ambu

- Flexicare

- Fuji Systems

- icumedical

- INTERSURGCIAL

- Medline

- Medtronic

- Mercury Medical

- Romed HOLLAND

- STERIMED

- Teleflex

- TUORen

- VIGGOMEDICAL DEVICES

- Wellead

The Global Endotracheal Tube Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 4.2 billion by 2034. This expansion can be attributed to several factors, including the rising number of surgeries requiring intubation, the increasing incidence of ICU admissions and critical care cases, and the growth of healthcare infrastructure in emerging regions. Additionally, the global rise in chronic respiratory conditions such as asthma and chronic obstructive pulmonary disease (COPD), particularly among older adults, is contributing to the demand for endotracheal tubes.

Manufacturers are enhancing these products by incorporating features like antimicrobial coatings, new cuff designs, and subglottic suction to reduce complications like ventilator-associated pneumonia (VAP). These improvements are not only benefiting patients but are also driving the adoption of these devices in healthcare centers worldwide, contributing to market growth. An endotracheal tube is a flexible device used to secure the airway during surgeries, anesthesia, or critical care by passing through the mouth or nose into the trachea.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $4.2 Billion |

| CAGR | 6.8% |

It enables mechanical ventilation and helps maintain airway protection during procedures. The demand for ETTs is growing due to the rising prevalence of respiratory disorders, the shift toward disposable tubes, and the rising adoption of advanced intubation techniques such as video laryngoscopy. Additionally, there's a growing demand for tubes with antimicrobial and drug-eluting coatings in emergency care and out-of-hospital settings.

In 2024, the regular endotracheal tubes segment generated USD 1 billion. These tubes remain the preferred choice for routine surgical and emergency procedures, especially in resource-limited settings, due to their affordability compared to advanced alternatives. Their simple design makes them easy to use, and most healthcare professionals are trained to operate them efficiently, ensuring their widespread use in clinical settings.

The orotracheal tube segment generated USD 1.7 billion in 2024 and is expected to grow at a CAGR of 7% during 2034. Orotracheal intubation is the most common method for airway management in emergencies due to its speed and ease of execution. It is useful in trauma, cardiac arrest, and critical care situations, where securing the airway within minutes is crucial. The method is preferred over nasotracheal intubation, as it avoids complications like nasal bleeding and sinus infections and is considered safer for many adult patients.

U.S. Endotracheal Tube Market was valued at USD 785.5 million in 2024. The rising prevalence of respiratory diseases such as COPD, pneumonia, and acute respiratory distress syndrome (ARDS) has significantly boosted the demand for endotracheal tubes in the country. With policies from Medicare, Medicaid, and private insurers covering intubation and mechanical ventilation procedures, hospitals and surgery centers are more likely to adopt ETTs without facing financial constraints. These reimbursement policies play a pivotal role in encouraging best practices and increasing the use of endotracheal tubes, driving market growth.

Leading companies in the Global Endotracheal Tube Market include: Flexicare, Ambu, Fuji Systems, Medtronic, Medline, STERIMED, Teleflex, Romed HOLLAND, ANGIPLAST, Mercury Medical, INTERRACIAL, icumedical, VIGGOMEDICAL DEVICES, Wellead, and TUORen. To strengthen their market position, companies are focusing on several key strategies. They invest in product innovation by developing advanced features such as antimicrobial coatings and subglottic suction to improve patient safety and reduce complications. Partnerships with healthcare providers and expanding distribution channels in emerging markets are also critical for reaching a broader audience. Additionally, companies are investing in educating healthcare professionals about the benefits of their products to drive adoption. Furthermore, collaborations with hospitals and healthcare systems help ensure better product accessibility and visibility. These strategies aim to improve market penetration and maintain a competitive edge.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing number of surgeries requiring intubation

- 3.2.1.2 Advancements in endotracheal tube technology

- 3.2.1.3 Growth in ICU admissions and critical care patients

- 3.2.1.4 Expansion of healthcare infrastructure in emerging markets

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with specialized endotracheal tube

- 3.2.2.2 Risk of post-intubation complications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Gap analysis

- 3.10 Future market trends

- 3.11 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Regular endotracheal tube

- 5.3 Reinforced endotracheal tube

- 5.4 Performed endotracheal tube

- 5.5 Double lumen endotracheal tube

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Polyvinyl chloride (PVC)

- 6.3 Silicon

- 6.4 Polyurethane

- 6.5 Other materials

Chapter 7 Market Estimates and Forecast, By Route of Intubation, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Orotracheal

- 7.3 Nasotracheal

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 General surgery

- 8.3 Emergency treatment

- 8.4 Therapy

- 8.5 Neonatal and pediatric care

- 8.6 Other applications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Ambulatory surgical centers

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 ANGIPLAST

- 11.2 Ambu

- 11.3 Flexicare

- 11.4 Fuji Systems

- 11.5 icumedical

- 11.6 INTERSURGCIAL

- 11.7 Medline

- 11.8 Medtronic

- 11.9 Mercury Medical

- 11.10 Romed HOLLAND

- 11.11 STERIMED

- 11.12 Teleflex

- 11.13 TUORen

- 11.14 VIGGOMEDICAL DEVICES

- 11.15 Wellead