|

市場調查報告書

商品編碼

1750613

經橈動脈接取設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Transradial Access Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

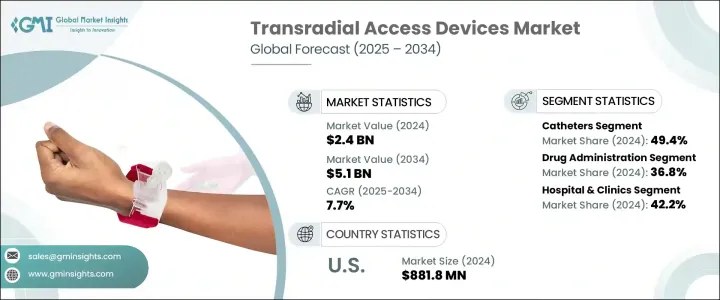

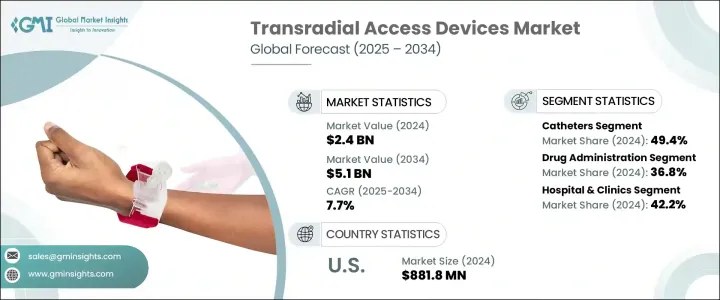

2024年,全球經橈動脈介入器械市場價值為24億美元,預計到2034年將以7.7%的複合年成長率成長,達到51億美元,這主要得益於心血管疾病(CVD)患病率的不斷上升以及人們對微創介入手術日益成長的偏好。與傳統方法相比,經橈動脈介入能夠加快患者康復速度、降低出血風險並縮短住院時間,因此正日益受到青睞。隨著醫療保健提供者更加重視安全性、舒適性和效率,向橈動脈介入的轉變重塑了臨床實踐。經橈動脈介入已得到證實的臨床可靠性和操作優勢,進一步推動了導管室採用橈動脈優先介入的趨勢。

對橈動脈技術的日益依賴推動了全球對經橈動脈介入器械(包括鞘管、導引線、止血帶和導管等組件)的強勁需求。橈動脈入路的臨床優勢——例如更低的出血風險、更快的患者活動和更短的住院時間——持續影響介入性心臟病學的手術方案。隨著醫療服務提供者致力於最佳化效率和患者滿意度,採用橈動脈優先策略不僅在已開發市場日益普及,而且在心血管基礎設施不斷改善的新興經濟體中也日益流行。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 24億美元 |

| 預測值 | 51億美元 |

| 複合年成長率 | 7.7% |

導管目前在該產品領域佔據領先地位,2024 年的市佔率高達 49.4%。導管在複雜的血管網路中導航的有效性以及精準的器械輸送能力使其成為心臟診斷和治療手術的關鍵。導管設計的創新,例如扭矩響應的提升、柔韌性的增強以及親水塗層,顯著提高了手術成功率和患者的整體預後。此外,專為經橈動脈介入設計的新一代導管有助於減少穿刺部位併發症,並提高手術效率。

此外,藥物管理領域在2024年佔據36.8%的市場佔有率,預計到2034年將達到18億美元。這些設備能夠將標靶藥物直接輸送至患處,不僅可以提高治療效果,還能縮短復原時間。這種能力在急性心血管事件中至關重要,因為快速給藥可以挽救生命。由於其精準性和微創性,經橈動脈入路正被擴大探索更廣泛的應用。它在心臟和非心臟疾病藥物傳遞方面的作用日益增強,反映了經橈動脈解決方案的適應性及其不斷擴展的應用範圍。

2024年,美國經橈動脈介入器械市場規模達8.818億美元,這得益於心血管介入手術數量的成長、支持性報銷政策以及術者對橈動脈介入的偏好,這些因素正在加速其應用。隨著人們對經橈動脈介入手術益處的認知不斷提高,醫療體系的整合程度也不斷提升。醫院正迅速轉向門診PCI模式,充分利用橈動脈介入手術縮短病患恢復時間和簡化手術的優勢。監管支援、臨床培訓項目以及對先進導管室基礎設施的投資,進一步鞏固了這些器械的廣泛應用。這種不斷發展的環境確保了經橈動脈介入手術始終處於該地區介入性心臟病學創新的前沿。

該領域的主要參與者包括波士頓科學公司 (Boston Scientific)、Alvimedica、碧迪醫療 (Becton Dickinson and Company)、泰爾茂 (Terumo)、美敦力 (Medtronic)、泰利福 (Teleflex)、Palex Medical、ICU Medical、InnoMedica、康德Industries、AngioDynamics 和 Oscor。為了確保競爭優勢,領先的公司專注於產品創新和技術升級。他們投資先進材料、人體工學設計和改進功能,以提高臨床醫生的可用性和患者的舒適度。許多公司透過策略合作夥伴關係、併購來擴大其地域覆蓋範圍。與醫院和醫療保健網路的合作有助於早期採用和市場滲透。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 已開發經濟體和發展中經濟體心血管疾病盛行率不斷上升

- 老年人口的成長

- 採用橈動脈入路進行介入手術的偏好日益增加

- 橈動脈通路裝置在兒科患者的應用日益增多

- 產業陷阱與挑戰

- 嚴格的監管框架

- 血管通路裝置成本高且維護成本高

- 發展中國家缺乏心胸外科醫師

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮川普政府關稅

- 對貿易的影響

- 未來市場趨勢

- 差距分析

- 專利分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 導管

- 導絲

- 鞘管和鞘管導入器

- 配件

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 藥物管理

- 液體和營養管理

- 輸血

- 診斷和測試

- 其他應用

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院和診所

- 門診手術中心

- 其他最終用途

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Alvimedica

- Ameco Medical Industries

- AngioDynamics

- Becton Dickinson and Company

- Boston Scientific

- Cardinal Health

- Edward Lifesciences

- ICU Medical

- InnoMedica

- Medtronic

- Merit Medical System

- NIPRO Medical

- Oscor

- Palex Medical

- Teleflex

- Terumo

The Global Transradial Access Devices Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 7.7% to reach USD 5.1 billion by 2034, driven by the increasing prevalence of cardiovascular diseases (CVDs) and the rising preference for minimally invasive interventional procedures. Transradial access is gaining traction due to its ability to offer faster patient recovery, reduced risk of bleeding, and shorter hospital stays compared to traditional methods. The shift toward radial artery access has reshaped clinical practice, as healthcare providers prioritize safety, comfort, and efficiency. The trend toward using radial-first approaches in catheterization laboratories has been further fueled by its demonstrated clinical reliability and operational benefits.

This increasing reliance on radial techniques drives strong demand for transradial access devices worldwide, including components such as sheaths, guidewires, hemostasis bands, and catheters. The clinical advantages of the radial approach-such as lower bleeding risk, faster patient mobilization, and shorter hospital stays-continue to shape procedural protocols in interventional cardiology. As healthcare providers aim to optimize efficiency and patient satisfaction, adopting radial-first strategies is expanding not only in developed markets but also gaining momentum in emerging economies with improving cardiovascular infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $5.1 Billion |

| CAGR | 7.7% |

Catheters currently lead the product segment with a commanding market share of 49.4% in 2024. Their effectiveness in navigating complex vascular networks and facilitating accurate device delivery makes them vital in diagnostic and therapeutic cardiac procedures. Innovation in catheter designs, such as improved torque response, enhanced flexibility, and hydrophilic coatings, has significantly boosted procedural success rates and overall patient outcomes. Furthermore, next-generation catheters designed specifically for transradial interventions contribute to reduced access site complications and increased procedural efficiency.

Additionally, the drug administration segment holds a 36.8% market share in 2024 and is forecasted to reach USD 1.8 billion by 2034. The ability of these devices to deliver targeted medications directly to affected areas not only enhances therapeutic results but also shortens recovery times. This capability is important in acute cardiovascular events, where rapid drug delivery can be life-saving. Transradial access is now being increasingly explored for broader applications, thanks to its precision and minimally invasive nature. Its growing role in delivering pharmacological agents for cardiac and non-cardiac conditions reflects the adaptability and expanding scope of transradial solutions.

U.S. Transradial Access Devices Market generated USD 881.8 million in 2024, driven by the number of cardiovascular interventions, supportive reimbursement policies, and operator preference for radial access, which is accelerating adoption. Increased awareness of the benefits of transradial procedures is leading to greater integration across healthcare systems. Hospitals are rapidly transitioning to outpatient-based PCI models, taking advantage of the reduced recovery time and procedural simplicity of radial access. Regulatory support, clinical training programs, and investment in advanced cath lab infrastructure further reinforce the widespread use of these devices. This progressive environment ensures that transradial access remains at the forefront of interventional cardiology innovation in the region.

Key players operating in this space include Boston Scientific, Alvimedica, Becton Dickinson and Company, Terumo, Medtronic, Teleflex, Palex Medical, ICU Medical, InnoMedica, Cardinal Health, Merit Medical System, Edward Lifesciences, NIPRO Medical, Ameco Medical Industries, AngioDynamics, and Oscor. To secure a competitive edge, leading companies are focusing on product innovation and technological upgrades. They invest in advanced materials, ergonomic designs, and improved functionality to boost clinician usability and patient comfort. Many firms expand their geographic footprint through strategic partnerships, mergers, and acquisitions. Collaborations with hospitals and healthcare networks help in early adoption and market penetration.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of cardiovascular disease in developed and developing economies

- 3.2.1.2 Growth in elderly age group

- 3.2.1.3 Rising preference for interventional procedures using radial artery access

- 3.2.1.4 Growing use of radial access devices in pediatric patients

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory framework

- 3.2.2.2 High cost and maintenance of vascular access devices

- 3.2.2.3 Dearth of cardiothoracic surgeons in developing nations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Trump administration tariffs

- 3.6.1 Impact on trade

- 3.6.1.1 Trade volume disruptions

- 3.6.1.2 Retaliatory measures

- 3.6.2 Impact on the Industry

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.2.1.1 Price volatility in key materials

- 3.6.2.1.2 Supply chain restructuring

- 3.6.2.1.3 Production cost implications

- 3.6.2.2 Demand-side impact (selling price)

- 3.6.2.2.1 Price transmission to end markets

- 3.6.2.2.2 Market share dynamics

- 3.6.2.2.3 Consumer response patterns

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.3 Key companies impacted

- 3.6.4 Strategic industry responses

- 3.6.4.1 Supply chain reconfiguration

- 3.6.4.2 Pricing and product strategies

- 3.6.4.3 Policy engagement

- 3.6.5 Outlook and future considerationsTrump administration tariffs

- 3.6.1 Impact on trade

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Patent analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive analysis of major market players

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Catheters

- 5.3 Guidewires

- 5.4 Sheath and sheath introducers

- 5.5 Accessories

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Drug administration

- 6.3 Fluid and nutrition administration

- 6.4 Blood transfusion

- 6.5 Diagnostics and testing

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals and clinics

- 7.3 Ambulatory surgical centers

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Alvimedica

- 9.2 Ameco Medical Industries

- 9.3 AngioDynamics

- 9.4 Becton Dickinson and Company

- 9.5 Boston Scientific

- 9.6 Cardinal Health

- 9.7 Edward Lifesciences

- 9.8 ICU Medical

- 9.9 InnoMedica

- 9.10 Medtronic

- 9.11 Merit Medical System

- 9.12 NIPRO Medical

- 9.13 Oscor

- 9.14 Palex Medical

- 9.15 Teleflex

- 9.16 Terumo