|

市場調查報告書

商品編碼

1750609

淚道設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Lacrimal Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

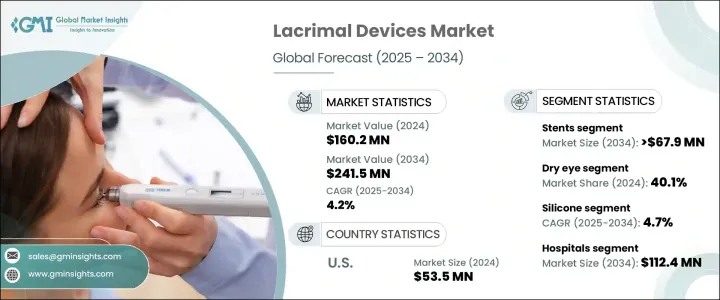

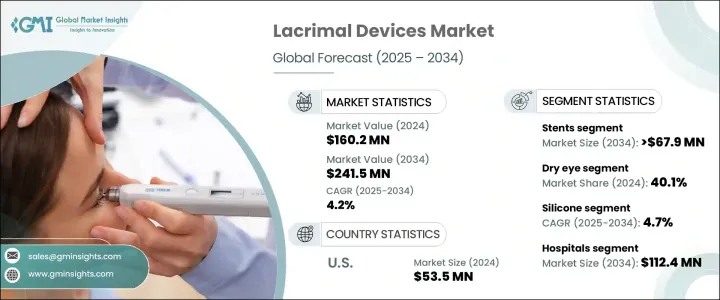

2024 年全球淚道設備市場價值為 1.602 億美元,預計到 2034 年將以 4.2% 的複合年成長率成長,達到 2.415 億美元,這得益於全球眼部健康狀況的日益惡化以及醫療技術的持續進步。隨著人們眼部護理意識的提高和醫療基礎設施的加強,尤其是在新興經濟體,對現代淚道解決方案的需求正在成長。與環境因素、數位螢幕暴露和人口老化相關的乾眼症發病率上升是導致這一趨勢的關鍵因素。隨著人們的注意力轉向高效和微創治療,智慧診斷工具和創新手術方法的應用正在增加。旨在促進眼科研究和創新的政府支持政策也發揮著重要作用。

製造商優先考慮以使用者為中心的產品設計,強調舒適性和生物相容性,以順應日益成長的個人化照護需求。透過客製化淚道裝置以滿足個別患者需求,企業正在提升治療效果,同時提高裝置的耐受性和患者依從性。這種個人化轉變也包括開發不易引發免疫反應、能與眼部組織更自然結合的材料。此外,醫療專業人士、產業參與者和研究機構之間的合作正在加速開發更有效的淚道治療方案和裝置。這些合作促進創新,將臨床洞察與先進的工程技術和數據驅動的設計相結合,從而為乾眼症和鼻淚管阻塞等疾病提供下一代解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1.602億美元 |

| 預測值 | 2.415億美元 |

| 複合年成長率 | 4.2% |

預計支架市場將以4.6%的複合年成長率顯著成長,到2034年將達到6,790萬美元。支架在治療老年和兒童淚道系統疾病的應用日益廣泛,推動了該市場的發展。其卓越的臨床療效、簡單的設計和使用者友善的置入技術,使其成為眼科專家的首選。生物可吸收和自固定支架設計的不斷改進,有助於減少併發症,改善患者體驗,並最大限度地減少後續手術的需求。

2024年,乾眼症治療領域佔40.1%的市場佔有率,並且由於大眾和臨床對乾眼症的認知度不斷提高,該領域市場佔有率將繼續成長。乾眼症與慢性疾病之間的聯繫,使得針對性治療方法的緊迫性日益凸顯。先進的淚液管理和診斷技術提高了治療決策的準確性,從而促進了乾眼症治療的更廣泛應用。人們對早期發現和介入的認知不斷提高,也促進了該領域的發展勢頭。

美國淚道治療設備市場在2024年達到5,350萬美元,未來預計將迎來大幅成長,這主要得益於人口老化,因為老化更容易導致淚道功能障礙。老年人罹患慢性疾病(例如關節炎、糖尿病和自體免疫疾病)的風險更高,而這些疾病中的許多都會導致淚管和眼表併發症,因此對有效且微創的淚道治療的需求持續成長。對創新治療模式的日益關注、優惠的報銷政策以及手術技術的持續改進,正在支持該地區市場的成長。

活躍於市場的主要參與者包括Medennium、FCI、B. Braun、Rumex、Bess Medical、Kaneka Medical Products、Surtex Instruments、JEDMED、OASIS、GWSG、Aurolab、Innovia Medical、Braintree、BVI和Walsh Medical Devices。為了鞏固市場地位,各公司紛紛投資研發生物相容性強、有效率且病患友善的醫療器材。與醫療機構的策略合作有助於提升產品知名度和臨床認可度。拓展全球分銷網路並在新地區尋求監管批准是常見的策略。各公司利用數位行銷和臨床培訓計畫來提升從業人員的參與度和產品利用率。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 眼部疾病盛行率不斷上升

- 淚道治療程序的簡易性

- 淚道裝置的技術進步

- 產業陷阱與挑戰

- 副作用風險高

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 各國應對措施

- 對產業的影響

- 供應方影響(製造成本)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(消費者成本)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(製造成本)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 報銷場景

- 技術格局

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 支架

- 插管套件

- 淚點塞

- 管

- 套管和壓舌板

- 擴張器

- 其他產品

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 乾眼症

- 溢淚症

- 青光眼

- 排水阻塞

- 淚腺發炎

- 其他應用

第7章:市場估計與預測:按材料,2021 - 2034 年

- 主要趨勢

- 矽酮

- 不銹鋼

- 其他材料

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 眼科診所

- 診斷中心

- 其他最終用途

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Aurolab

- B. Braun

- Bess Medical

- Braintree

- BVI

- FCI

- GWSG

- Innovia Medical

- JEDMED

- Kaneka Medical Products

- Medennium

- OASIS

- Rumex

- Surtex Instruments

- Walsh Medical Devices

The Global Lacrimal Devices Market was valued at USD 160.2 million in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 241.5 million by 2034, driven by the increasing prevalence of eye-related health conditions and the continued advancement of healthcare technologies worldwide. As eye care awareness improves and healthcare infrastructure strengthens, particularly in emerging economies, the demand for modern lacrimal solutions is expanding. Rising incidences of dry eye conditions linked to environmental factors, digital screen exposure, and aging demographics are key contributors to this trend. With the focus shifting towards efficient and minimally invasive treatments, the adoption of smart diagnostic tools and innovative surgical methods is rising. Supportive government policies aimed at boosting research and innovation in ophthalmology are also playing a significant role.

Manufacturers prioritize user-centered product design, emphasizing comfort and biocompatibility to align with the growing preference for personalized care. By tailoring lacrimal devices to meet individual patient needs, companies are enhancing treatment outcomes while improving device tolerability and patient adherence. This shift toward personalization also includes developing materials that are less likely to trigger immune responses and can integrate more naturally with ocular tissues. Additionally, the collaborative efforts between healthcare professionals, industry players, and research institutions are fast-tracking the development of more effective lacrimal treatments and devices. These partnerships foster innovation, combining clinical insights with advanced engineering and data-driven design to produce next-generation solutions for conditions like dry eye syndrome and nasolacrimal duct obstruction.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $160.2 Million |

| Forecast Value | $241.5 Million |

| CAGR | 4.2% |

The stents segment is projected to see notable growth with a CAGR of 4.6% and is expected to reach USD 67.9 million by 2034. Their rising use in treating lacrimal system disorders among both elderly and pediatric patients is driving this segment. Enhanced clinical outcomes, simple designs, and user-friendly insertion techniques make stents a preferred choice among eye care specialists. The ongoing refinement of bioresorbable and self-retaining stent designs is helping reduce complications, improving patient experience, and minimizing the need for follow-up procedures.

The dry eye treatments segment held a 40.1% share in 2024 and continues to expand due to growing public and clinical recognition of the condition. The link between dry eye syndrome and chronic conditions has increased the urgency for targeted therapeutic approaches. Advanced technologies in tear management and diagnosis have enhanced accuracy in treatment decisions, prompting wider adoption. Improved awareness of early detection and intervention contributes to the segment's momentum.

United States Lacrimal Devices Market generated USD 53.5 million in 2024 and is set to witness substantial growth ahead, driven by the aging population, which is more prone to lacrimal dysfunctions. As elderly individuals are at a higher risk for chronic illnesses such as arthritis, diabetes, and autoimmune disorders, many of which contribute to tear duct and ocular surface complications, the demand for effective and minimally invasive lacrimal treatments continues to rise. Increased focus on innovative treatment modalities, favorable reimbursement policies, and ongoing improvements in procedural technologies are supporting the market's expansion in the region.

Key players active in this market include Medennium, FCI, B. Braun, Rumex, Bess Medical, Kaneka Medical Products, Surtex Instruments, JEDMED, OASIS, GWSG, Aurolab, Innovia Medical, Braintree, BVI, and Walsh Medical Devices. To solidify their positions, companies invest in R&D to develop biocompatible, efficient, and patient-friendly devices. Strategic collaborations with healthcare institutions help boost product visibility and clinical acceptance. Expanding global distribution networks and seeking regulatory approvals in new regions are common strategies. Firms leverage digital marketing and clinical training programs to enhance practitioner engagement and product utilization.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of eye disease

- 3.2.1.2 Ease of lacrimal treatment procedures

- 3.2.1.3 Technological advancements in lacrimal devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High risk of side effects

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (Cost to consumers)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Reimbursement scenario

- 3.7 Technology landscape

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Stents

- 5.3 Intubation sets

- 5.4 Punctal plugs

- 5.5 Tubes

- 5.6 Cannula and spatula

- 5.7 Dilator

- 5.8 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Dry eye

- 6.3 Epiphora

- 6.4 Glaucoma

- 6.5 Drainage obstruction

- 6.6 Lacrimal gland inflammation

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Silicone

- 7.3 Stainless steel

- 7.4 Other materials

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ophthalmic clinics

- 8.4 Diagnostic centers

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Aurolab

- 10.2 B. Braun

- 10.3 Bess Medical

- 10.4 Braintree

- 10.5 BVI

- 10.6 FCI

- 10.7 GWSG

- 10.8 Innovia Medical

- 10.9 JEDMED

- 10.10 Kaneka Medical Products

- 10.11 Medennium

- 10.12 OASIS

- 10.13 Rumex

- 10.14 Surtex Instruments

- 10.15 Walsh Medical Devices