|

市場調查報告書

商品編碼

1750603

電子汽油市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測E-Gasoline Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

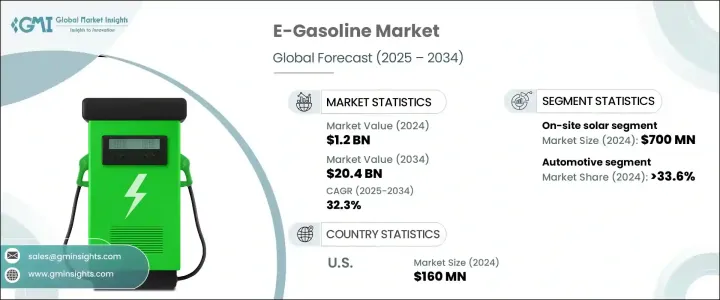

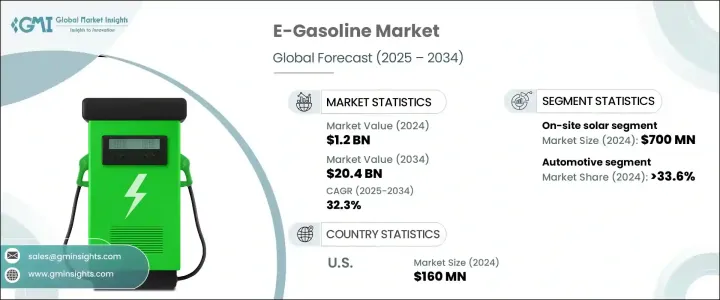

2024年,全球電子汽油市場規模達12億美元,預計到2034年將以32.3%的複合年成長率成長,達到204億美元,這得益於日益嚴格的排放法規和對永續燃料替代品日益成長的需求。隨著各國政府實施更嚴格的環境標準,各行各業紛紛採用更清潔的技術,推動了對電子汽油等環保解決方案的需求。消費者日益增強的氣候變遷意識以及為低碳燃料支付溢價的意願也推動了這一轉變。電子汽油作為合成燃料,作為傳統化石燃料的更清潔替代品,正日益受到青睞,有助於減少各行各業,尤其是交通運輸領域的溫室氣體排放。

新技術進步降低了生產成本並提高了效率,使電子汽油成為旨在降低碳足跡的企業和消費者更實用的選擇。合成燃料生產方法的開發使電子汽油能夠更有效地擴大規模,吸引了能源公司的大量投資。汽車產業與能源產業之間的合作在建立電子汽油生產和分銷基礎設施方面發揮關鍵作用,加速了其在全球燃料網路中的採用和整合。此外,這些合作有助於簡化電子汽油技術的創新,確保燃料的隨時可用,並滿足日益成長的永續能源需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 12億美元 |

| 預測值 | 204億美元 |

| 複合年成長率 | 32.3% |

隨著各國政府和企業加大安裝大型風力渦輪機的力度,對清潔再生能源的需求不斷成長,風能產業有望迎來令人矚目的成長。預計到2034年,該產業的複合年成長率將達到33%。再生能源的應用如今被視為應對氣候變遷的關鍵支柱,而風能是利用自然資源發電最有效的方式之一。渦輪機設計和效率的技術改進使風力發電更加可行且更具成本效益,即使在先前不適合的地區也是如此。

預計到2034年,海運產業的複合年成長率將達到32%。該行業正在積極努力遵守更嚴格的環境法規,並減少其整體溫室氣體排放。這些法規,例如歐盟的《歐盟燃料條例》(FuelEU Maritime Regulation),鼓勵海運業擺脫傳統的高排放燃料,轉向電子汽油、氫氣和氨氣等替代燃料。由於國際航運是全球碳排放的主要貢獻者,低碳燃料的推廣動能正在增強,尤其是在永續發展政策嚴格的歐洲。

預計到2034年,歐洲電子汽油市場將以30%的複合年成長率成長,碳中和指令將推動其快速普及。 《歐洲綠色協議》等關鍵政策和產業合作正在加速各種交通方式(包括汽車和航空)向永續燃料的轉型。歐盟2030年具有約束力的再生能源目標,其中包括大量使用先進生物燃料和非生物來源再生燃料(RFNBO),進一步鞏固了這一成長勢頭。

全球電子汽油市場的領導企業包括Arcadia eFuels、埃克森美孚、巴拉德動力系統和LanzaJet。這些公司專注於策略合作夥伴關係、技術進步和規模化生產,以鞏固其市場地位。許多企業也正在研發方面投入巨資,以提高電子汽油生產流程的效率和可擴展性。此外,他們還與政府和其他行業領導者密切合作,以確保必要的基礎設施到位,從而支持電子汽油的廣泛應用。憑藉永續性和合規性,這些公司正在將自己定位為低碳能源未來的關鍵參與者。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 對貿易的影響

- 展望與未來考慮

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 策略舉措

- 公司市佔率

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:按再生能源,2021 - 2034 年

- 主要趨勢

- 現場太陽能

- 風

第6章:市場規模及預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 費托合成

- 增強型多普勒雷達系統

- 其他

第7章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 汽車

- 海洋

- 航空

- 工業的

- 其他

第8章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第9章:公司簡介

- Arcadia eFuels

- Archer Daniels Midland Co.

- Ballard Power Systems, Inc.

- Ceres Power Holding Plc

- Climeworks AG

- Clean Fuels Alliance America

- Electrochaea GmbH

- eFuel Pacific Limited

- ExxonMobil

- FuelCell Energy, Inc.

- HIF Global

- INFRA Synthetic Fuels, Inc.

- Liquid Wind

- LanzaJet

- MAN Energy Solutions

- Norsk E-Gasoline AS

- Porsche

- Sunfire GmbH

The Global E-Gasoline Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 32.3% to reach USD 20.4 billion by 2034, driven by increasingly stringent emission regulations and a rising demand for sustainable fuel alternatives. As governments enforce stricter environmental standards, industries adopt cleaner technologies, pushing the demand for eco-friendly solutions like e-gasoline. Consumers' growing awareness of climate change and willingness to pay a premium for low-carbon fuels also support this shift. E-gasoline, as a synthetic fuel, is gaining traction as a cleaner alternative to traditional fossil fuels, aiding in reducing greenhouse gas emissions across various sectors, particularly transportation.

New technological advancements have led to lower production costs and improved efficiency, making e-gasoline a more practical choice for businesses and consumers aiming to lower their carbon footprint. The development of synthetic fuel production methods is enabling e-gasoline to scale more effectively, drawing substantial investments from energy companies. Partnerships between the automotive and energy industries play a key role in building infrastructure for e-gasoline production and distribution, accelerating its adoption and integration into global fuel networks. Additionally, these collaborations help streamline innovation in e-gasoline technology, ensuring that the fuel is readily available and meets the growing demand for sustainable energy sources.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $20.4 Billion |

| CAGR | 32.3% |

The wind energy sector is poised for impressive growth, with expectations for a CAGR of 33% by 2034 driven by the accelerating demand for clean, renewable energy, as governments and corporations ramp up efforts to install large-scale wind turbines. Renewable energy adoption is now seen as a key pillar in tackling climate change, and wind energy is one of the most efficient ways to harness natural resources to produce electricity. Technological improvements in turbine design and efficiency make wind power more viable and cost-effective, even in previously unsuitable locations.

The maritime segment, with a projected CAGR of 32% through 2034, is actively working to comply with stricter environmental regulations and reduce its overall greenhouse gas emissions. These regulations, such as the EU's FuelEU Maritime Regulation, encourage the maritime industry to move away from traditional high-emission fuels and shift to alternative options like e-gasoline, hydrogen, and ammonia. As international shipping is a major contributor to global carbon emissions, the push for low-carbon fuels is gaining momentum, particularly in Europe, where sustainability policies are stringent.

Europe E-Gasoline Market is expected to grow at a CAGR of 30% through 2034, with carbon-neutral mandates driving rapid adoption. Key policies like the European Green Deal and industry collaborations are accelerating the transition to sustainable fuels for various transportation modes, including cars and aviation. The EU's binding renewable energy targets for 2030, which include a significant share for advanced biofuels and renewable fuels of non-biological origin (RFNBOs), further reinforce this growth.

Leading players in the Global E-Gasoline Market include Arcadia eFuels, ExxonMobil, Ballard Power Systems, and LanzaJet. These companies are focusing on strategic partnerships, technological advancements, and scaling production to strengthen their position in the market. Many of these players are also investing heavily in R&D to improve the efficiency and scalability of e-gasoline production processes. In addition, they are working closely with governments and other industry leaders to ensure that the necessary infrastructure is in place to support widespread adoption. With sustainability and regulatory compliance, these companies are positioning themselves as key players in a low-carbon energy future.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data source

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.1 Impact on trade

- 3.3 Outlook and future considerations

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Strategic initiative

- 4.4 Company market share

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Renewable Source, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 On-site solar

- 5.3 Wind

Chapter 6 Market Size and Forecast, By Technology, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Fischer-tropsch

- 6.3 eRWGS

- 6.4 Others

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Automotive

- 7.3 Marine

- 7.4 Aviation

- 7.5 Industrial

- 7.6 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 Arcadia eFuels

- 9.2 Archer Daniels Midland Co.

- 9.3 Ballard Power Systems, Inc.

- 9.4 Ceres Power Holding Plc

- 9.5 Climeworks AG

- 9.6 Clean Fuels Alliance America

- 9.7 Electrochaea GmbH

- 9.8 eFuel Pacific Limited

- 9.9 ExxonMobil

- 9.10 FuelCell Energy, Inc.

- 9.11 HIF Global

- 9.12 INFRA Synthetic Fuels, Inc.

- 9.13 Liquid Wind

- 9.14 LanzaJet

- 9.15 MAN Energy Solutions

- 9.16 Norsk E-Gasoline AS

- 9.17 Porsche

- 9.18 Sunfire GmbH