|

市場調查報告書

商品編碼

1750599

石墨烯電池市場機會、成長動力、產業趨勢分析及2025-2034年預測Graphene Battery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

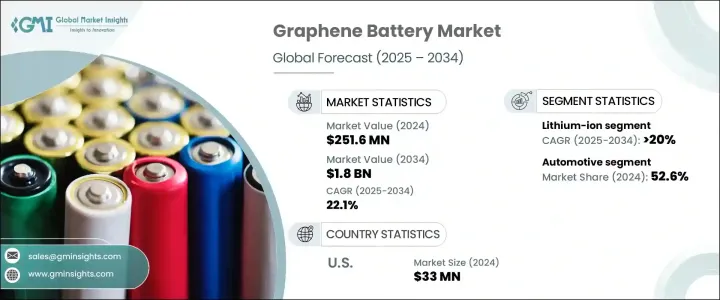

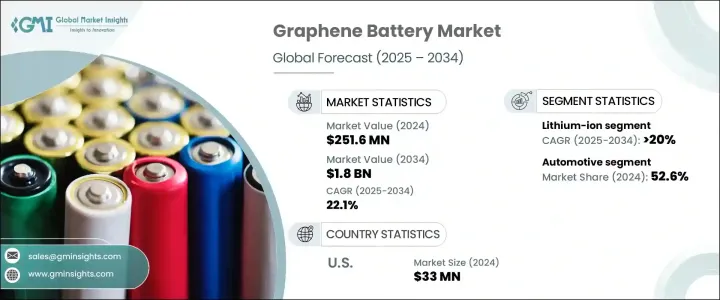

2024 年全球石墨烯電池市場價值為 2.516 億美元,預計到 2034 年將以 22.1% 的複合年成長率成長,達到 18 億美元,這得益於汽車、消費電子、航太和可再生能源等各個行業擴大採用儲能系統。石墨烯電池的主要特性,例如更高的能量密度、增強的安全性、更快的充電時間和更長的使用壽命,正在推動對這些先進儲能解決方案的需求。隨著技術進步不斷提高這些電池的耐用性,它們越來越受到電動車、穿戴式裝置、智慧型手機和筆記型電腦的追捧。它們在這些應用中的卓越性能,加上日益成長的環境問題,促成了石墨烯電池的廣泛接受。

此外,將石墨烯電池整合到再生能源儲存系統中,對基於電網的能源解決方案至關重要。隨著太陽能和風能等再生能源的日益普及,這些電池擴大被用於儲存多餘的能量以備後用,從而提高電網的穩定性和效率。石墨烯電池能夠處理高能量密度,並且比傳統電池技術充電速度更快,因此特別適合大規模儲能系統。隨著各國政府和各行各業推動更綠色、更永續的能源基礎建設,預計這一趨勢將加速發展,進一步鞏固石墨烯電池在能源轉型中的作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2.516億美元 |

| 預測值 | 18億美元 |

| 複合年成長率 | 22.1% |

鋰硫石墨烯電池領域也有望大幅成長,預計到 2034 年其市場規模可達 5 億美元。這些先進電池以其比傳統鋰離子電池更高的能量密度和性能而聞名,在電動車 (EV) 和航太等高需求領域正日益普及。鋰硫石墨烯電池的獨特性能,例如其能夠儲存更多能量和更有效率地運行,使其成為需要持久電力和更高能量輸出的應用的理想替代品。隨著電動車普及率的持續上升以及對航太創新需求的不斷擴大,這些電池正在成為下一代交通和高科技產業的基石。

在消費性電子領域,石墨烯電池的需求也快速成長,預計到2034年市場規模將達到3.5億美元。現今的消費者不僅希望設備續航時間更長,而且充電速度更快。石墨烯電池比傳統鋰離子電池充電時間更快、能源效率更高、使用壽命更長,因此完全能夠滿足這項需求。隨著行動裝置、筆記型電腦和穿戴式裝置的不斷發展,對能夠支援更多功能並提供可靠持久性能的電池的需求正在推動電子產業石墨烯電池市場的成長。

2024年,美國石墨烯電池市場規模達3,300萬美元,預計在政府推廣清潔能源和推動電池產業技術進步的政策推動下,該市場將快速成長。隨著越來越多的產業採用基於石墨烯的儲能解決方案,對此類電池的需求將持續成長。政府對清潔能源計畫的支持預計將加速石墨烯電池的開發和商業化,進一步提升其市場潛力。

石墨烯電池市場的主要參與者包括First Graphene、Nanotech Energy、Graphene Manufacturing Group和Lyten。在關鍵策略方面,石墨烯電池領域的公司正專注於擴大產品組合併提升石墨烯電池的性能。許多公司與研究機構合作,開發具有更高能量密度和更快充電能力的下一代電池。策略合作夥伴關係和併購也有助於擴大石墨烯電池的覆蓋範圍。此外,各公司正在投資提高生產效率,以滿足電動車和再生能源儲存等各個領域日益成長的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 策略舉措

- 公司市佔率分析

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 鋰離子電池

- 鋰硫電池

- 超級電容器電池

- 鉛酸電池

- 其他

第6章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 汽車

- 電子產品

- 航太與國防

- 工業機器人

- 衛生保健

- 其他

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 挪威

- 西班牙

- 亞太地區

- 中國

- 印度

- 澳洲

- 日本

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

第8章:公司簡介

- Ceylon Graphene Technologies

- Chilwee Battery

- Directa Plus

- Enerbond

- First Graphene

- Graphenano Group

- Graphene Batteries

- Graphene Manufacturing Group

- Graphenea

- GTCAP

- Huawei Technologies

- Ipower Batteries

- JYH HSU(JEC) ELECTRONICS

- Lyten

- Maxvolt Energy Industries

- Nanografi Advanced Materials

- Nanotech Energy

- NanoXplore

- SAMSUNG SDI

- Skeleton Technologies

- SUPRO Energy

- Zoxcell

The Global Graphene Battery Market was valued at USD 251.6 million in 2024 and is estimated to grow at a CAGR of 22.1% to reach USD 1.8 billion by 2034, driven by the increasing adoption of energy storage systems across various industries, including automotive, consumer electronics, aerospace, and renewable energy. The key features of graphene batteries, such as higher energy density, enhanced safety, faster charging times, and longer lifespan, are pushing the demand for these advanced storage solutions. As technological advancements continue to improve the durability of these batteries, they are increasingly sought after for use in electric vehicles, wearable devices, smartphones, and laptops. Their superior performance in these applications, coupled with growing environmental concerns, contributes to the widespread acceptance of graphene batteries.

Furthermore, integrating graphene batteries into renewable energy storage systems drives importance in grid-based energy solutions. As renewable energy sources like solar and wind continue to gain prominence, these batteries are increasingly utilized to store excess energy for later use, improving grid stability and efficiency. Their ability to handle high energy densities and charge faster than traditional battery technologies makes them particularly suitable for large-scale energy storage systems. This trend is expected to accelerate as governments and industries push for greener and more sustainable energy infrastructure, further cementing graphene batteries' role in the energy transition.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $251.6 Million |

| Forecast Value | $1.8 Billion |

| CAGR | 22.1% |

The lithium-sulfur graphene battery segment is also poised for significant growth, with forecasts indicating it could generate USD 500 million by 2034. Known for their superior energy density and higher performance than traditional lithium-ion batteries, these advanced batteries are increasingly adopted in high-demand sectors like electric vehicles (EVs) and aerospace. The unique properties of lithium-sulfur graphene batteries, such as their ability to store more energy and operate more efficiently, make them an attractive alternative for applications that require long-lasting power and higher energy output. As EV adoption continues to rise and the demand for aerospace innovations expands, these batteries are becoming a cornerstone for the next generation of transportation and high-tech industries.

In the consumer electronics space, the demand for graphene batteries is also experiencing rapid growth, with the market expected to reach USD 350 million by 2034. Today's consumers are looking for devices that not only last longer but also charge faster. Graphene batteries are well-equipped to meet this demand due to their faster charging times, higher energy efficiency, and longer lifespan than traditional lithium-ion batteries. As mobile devices, laptops, and wearables continue to evolve, the need for batteries that can support increased functionality and deliver reliable, long-lasting performance is driving the growth of the graphene battery market within the electronics sector.

U.S. Graphene Battery Market was valued at USD 33 million in 2024 and is anticipated to grow rapidly, driven by government policies promoting clean energy and advancing technology in the battery sector. As more industries adopt graphene-based energy storage solutions, the demand for these batteries will continue to grow. The government's support for clean energy initiatives is expected to accelerate the development and commercialization of graphene batteries, further enhancing their market potential.

Major players operating in the market include First Graphene, Nanotech Energy, Graphene Manufacturing Group, and Lyten. In terms of key strategies, companies operating in the graphene battery sector are focusing on expanding their product portfolios and improving the performance of graphene-based batteries. Many firms collaborate with research institutions to develop next-generation batteries with higher energy density and faster charging capabilities. Strategic partnerships and mergers are also helpful in boosting the reach of graphene batteries. Moreover, companies are investing in enhancing production efficiency to meet the growing demand across various sectors, including electric vehicles and renewable energy storage.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Strategic initiatives

- 4.4 Company market share analysis, 2024

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Lithium ion battery

- 5.3 Lithium sulphur battery

- 5.4 Supercapacitor battery

- 5.5 Lead acid battery

- 5.6 Others

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Automotive

- 6.3 Electronics

- 6.4 Aerospace & defense

- 6.5 Industrial robotics

- 6.6 Healthcare

- 6.7 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Norway

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Australia

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Mexico

- 7.6.3 Argentina

Chapter 8 Company Profiles

- 8.1 Ceylon Graphene Technologies

- 8.2 Chilwee Battery

- 8.3 Directa Plus

- 8.4 Enerbond

- 8.5 First Graphene

- 8.6 Graphenano Group

- 8.7 Graphene Batteries

- 8.8 Graphene Manufacturing Group

- 8.9 Graphenea

- 8.10 GTCAP

- 8.11 Huawei Technologies

- 8.12 Ipower Batteries

- 8.13 JYH HSU(JEC) ELECTRONICS

- 8.14 Lyten

- 8.15 Maxvolt Energy Industries

- 8.16 Nanografi Advanced Materials

- 8.17 Nanotech Energy

- 8.18 NanoXplore

- 8.19 SAMSUNG SDI

- 8.20 Skeleton Technologies

- 8.21 SUPRO Energy

- 8.22 Zoxcell