|

市場調查報告書

商品編碼

1750595

工業連接器市場機會、成長動力、產業趨勢分析及2025-2034年預測Industrial Connector Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

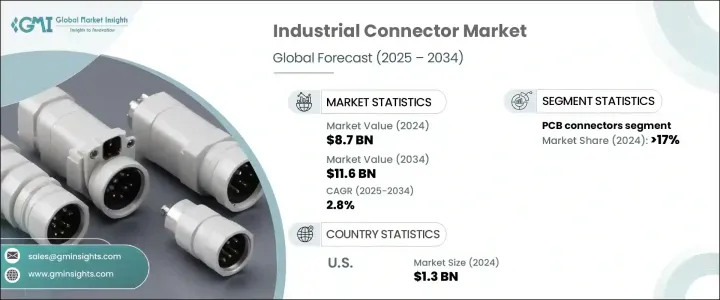

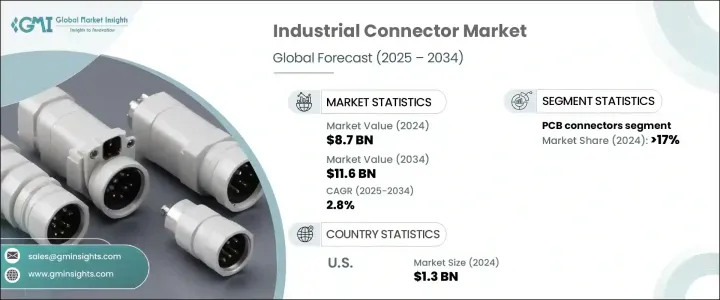

2024年,全球工業連接器市場規模達87億美元,預計到2034年將以2.8%的複合年成長率成長,達到116億美元。這主要得益於工業自動化的發展、技術進步以及工業4.0時代智慧工廠理念的廣泛整合。這些連接器對於確保眾多自動化系統的可靠通訊和功能至關重要,能夠連接感測器、執行器和控制單元等關鍵組件。隨著工廠和製造環境的智慧化程度不斷提高,對支援快速資料交換、高速傳輸和精確自動化的高效能連接器的需求也日益成長。工業連接器不僅在確保系統性能穩健方面發揮關鍵作用,而且還有助於機器高效運行,因為機器越來越依賴持續的資料流。

連接器領域的技術進步拓寬了工業連接器的應用範圍,引入了微型輕量化設計和增強的功能。高速資料傳輸、抗振能力和耐極端溫度等特性增加了各行各業對這些連接器的需求。該行業的一個顯著趨勢是連接器內建感測器,用於測量溫度、壓力和連接性等參數,從而提高整體系統的性能和可靠性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 87億美元 |

| 預測值 | 116億美元 |

| 複合年成長率 | 2.8% |

2024年,PCB(印刷電路板)連接器市場佔據了17%的顯著佔有率,這歸因於製造業、能源業、電信業和汽車業等多個行業對PCB連接器的需求不斷成長。這些連接器對於在電子設備和系統中不可或缺的印刷電路板上提供可靠的電氣連接至關重要。在製造業中,PCB連接器在不同的電路板組件之間建立連接,確保無縫的資料傳輸和電力分配。

2024年,美國工業連接器市場規模達13億美元,這得益於其對自動化、先進製造技術和工業物聯網 (IIoT) 的高度重視,這些技術正在推動高性能連接器的需求。向智慧工廠和互聯製造系統的轉變影響著對可靠且堅固連接器的需求。自動化和數位化系統投資的增加持續擴大了該地區的市場機遇,越來越多的行業需要先進的連接器來確保高效、無縫的營運。

全球工業連接器市場的領導者包括 TE Connectivity、安費諾公司、3M、Molex、Phoenix Contact 和 Aptiv PLC。這些產業巨頭利用其技術專長推動連接器設計的創新,從而提高性能和可靠性。為了鞏固市場地位,工業連接器產業的企業正專注於建立策略合作夥伴關係,以創新和改進其產品。許多公司正在大力投資研發,以開發具有改進功能的連接器,例如高速資料傳輸和抗環境壓力因素的能力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 策略舉措

- 公司市佔率

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:依產品,2021 - 2034

- 主要趨勢

- PCB連接器

- IO連接器

- 圓形連接器

- 光纖連接器

- 射頻同軸連接器

- 其他

第6章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第7章:公司簡介

- 3M

- AMETEK Inc.

- Amphenol Corporation

- Aptiv PLC

- AVX Corporation

- Fischer Connectors

- Foxconn Technology Group

- GTK UK Ltd.

- Hirose Electric Co., Ltd.

- Japan Aviation Electronics Industry, Ltd.

- Lapp Group

- Luxshare Precision Industry Co., Ltd.

- Mencom Corporation

- Molex, Inc.

- Phoenix Contact

- Rosenberger Group

- TE Connectivity

- YAZAKI Corporation

The Global Industrial Connector Market was valued at USD 8.7 billion in 2024 and is estimated to grow at a CAGR of 2.8% to reach USD 11.6 billion by 2034, driven by the growth of industrial automation, technological advancements, and the widespread integration of smart factory concepts under Industry 4.0. These connectors are essential for ensuring reliable communication and functionality across many automation systems, connecting critical components such as sensors, actuators, and control units. As factories and manufacturing environments become smarter, the need for high-performance connectors that support fast data exchange, high-speed transmission, and precise automation is increasing. Industrial connectors are not only pivotal in ensuring robust system performance but also contribute to the efficient operation of machines, which increasingly rely on continuous data flow.

Technology advancements in the connector space have broadened the scope of industrial connectors, introducing miniature and lightweight designs with enhanced functionality. Features like high-speed data transfer, anti-vibration capabilities, and resistance to extreme temperatures have increased the demand for these connectors across multiple industries. A significant trend in the sector is the inclusion of built-in sensors in connectors, which measure parameters like temperature, pressure, and connectivity, improving the overall system performance and reliability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.7 Billion |

| Forecast Value | $11.6 Billion |

| CAGR | 2.8% |

The PCB (Printed Circuit Board) connector segment held a significant share of 17% in 2024, attributed to the growing demand for PCB connectors across multiple industrial sectors, including manufacturing, energy, telecommunications, and automotive industries. These connectors are essential for providing reliable electrical connections on printed circuit boards integral in operating electronic devices and systems. In the manufacturing sector, PCB connectors establish connections between different circuit board components, ensuring seamless data transmission and power distribution.

U.S. Industrial Connector Market was valued at USD 1.3 billion in 2024, driven by its strong focus on automation, advanced manufacturing technologies, and the Industrial Internet of Things (IIoT), which is fueling demand for high-performance connectors. The shift toward smart factories and connected manufacturing systems impacts the need for reliable and robust connectors. Increased investment in automation and digital systems continues to expand opportunities in the region, with more industries requiring sophisticated connectors to ensure efficient and seamless operations.

Leading players in the Global Industrial Connector Market include TE Connectivity, Amphenol Corporation, 3M, Molex, Inc., Phoenix Contact, and Aptiv PLC. These industry giants leverage their technological expertise to drive innovation in connector designs, enhancing performance and reliability. To strengthen their market position, companies in the industrial connector industry are focusing on strategic partnerships and collaborations to innovate and improve their product offerings. Many companies are investing heavily in R&D to develop connectors with improved functionalities, such as high-speed data transfer and resistance to environmental stress factors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1.1 Supply chain reconfiguration

- 3.2.4.1.2 Pricing and product strategies

- 3.2.4.1.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Strategic initiative

- 4.4 Company market share

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (Million Units & USD Billion)

- 5.1 Key trends

- 5.2 PCB connectors

- 5.3 IO connectors

- 5.4 Circular connectors

- 5.5 Fiber optic connectors

- 5.6 RF coaxial connectors

- 5.7 Others

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034 (Million Units & USD Billion)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.2.3 Mexico

- 6.3 Europe

- 6.3.1 Germany

- 6.3.2 France

- 6.3.3 UK

- 6.3.4 Italy

- 6.3.5 Spain

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 South Korea

- 6.4.5 Australia

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 South Africa

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Argentina

Chapter 7 Company Profiles

- 7.1 3M

- 7.2 AMETEK Inc.

- 7.3 Amphenol Corporation

- 7.4 Aptiv PLC

- 7.5 AVX Corporation

- 7.6 Fischer Connectors

- 7.7 Foxconn Technology Group

- 7.8 GTK UK Ltd.

- 7.9 Hirose Electric Co., Ltd.

- 7.10 Japan Aviation Electronics Industry, Ltd.

- 7.11 Lapp Group

- 7.12 Luxshare Precision Industry Co., Ltd.

- 7.13 Mencom Corporation

- 7.14 Molex, Inc.

- 7.15 Phoenix Contact

- 7.16 Rosenberger Group

- 7.17 TE Connectivity

- 7.18 YAZAKI Corporation