|

市場調查報告書

商品編碼

1750590

帕金森氏症治療市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Parkinson's Disease Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

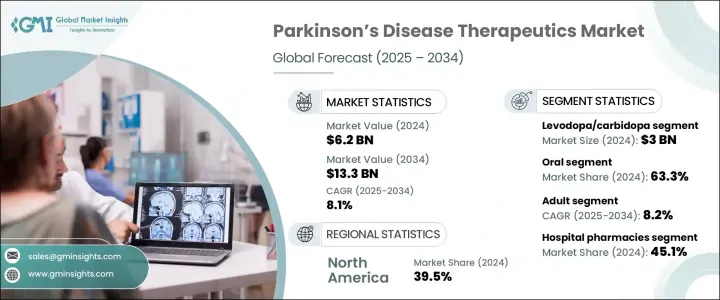

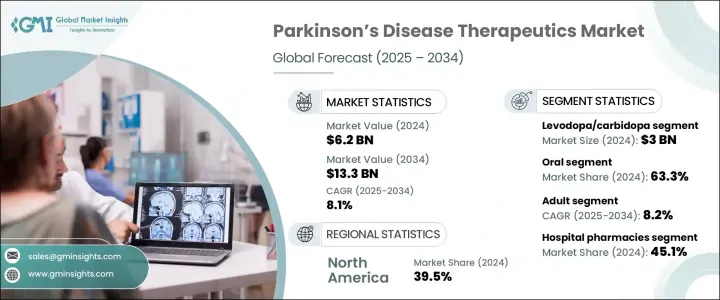

2024年,全球帕金森氏症治療市場規模達62億美元,預計年複合成長率將達8.1%,到2034年將達到133億美元,這主要得益於帕金森氏症發病率的不斷上升,尤其是在全球老齡化人口中。隨著預期壽命的延長,帕金森氏症等與年齡相關的神經退化性疾病的發生率正在迅速上升。北美、歐洲以及亞太部分地區的國家正經歷老齡人口的顯著成長,這推動了對更有效治療方案的需求。醫療保健系統正積極應對這項挑戰,優先發展治療創新,並擴大針對帕金森氏症患者的專科護理覆蓋範圍。

隨著醫藥技術的不斷進步,市場正經歷重大變革。雖然傳統療法仍然被廣泛使用,但人們越來越關注能夠更有針對性地控制症狀的替代療法。針對不同神經通路的藥物類別正在被探索,以更有效地控制疾病進展。創新的給藥平台也正在產生影響。這些平台包括使用者友善的系統,可以提高患者的依從性,尤其是對於需要長期照護的患者。透皮給藥系統、吸入途徑和輸注療法因其能夠穩定、可控地輸送藥物且併發症更少而廣受歡迎。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 62億美元 |

| 預測值 | 133億美元 |

| 複合年成長率 | 8.1% |

左旋多巴/卡比多巴在2024年的銷售額達到30億美元。其持續的主導地位歸功於其能夠治療各種運動症狀。增強型配方可提供緩釋和持續給藥,有助於減少併發症並提供持續的症狀管理。該藥物的廣泛使用、價格實惠以及成熟的臨床療效使其成為高收入和新興經濟體帕金森氏症治療的基石。

2024年,口服藥物佔63.3%。其易用性、成本效益和易獲得性使其成為接受終身治療的患者的首選途徑。許多最常使用的帕金森氏症治療藥物,尤其是用於緩解運動症狀的藥物,都是口服製劑。這不僅提高了依從性,也減少了住院給藥的需求,使口服藥物成為治療領域的主導力量。

2024年,美國帕金森氏症治療市場規模達23億美元。其強大的醫療體系、先進的監管途徑以及早期獲得尖端療法的機會,使其成為帕金森氏症治療領域的領導者。此外,美國也受惠於強大的病患支援網路和合作研發,這些都促進了藥物研發,並加速了新型療法的商業化。

該行業的知名企業包括梯瓦製藥 (Teva Pharmaceutical)、紐倫製藥 (Newron Pharmaceuticals)、優時比 (UCB)、住友製藥 (Sumitomo Dainippon Pharma)、羅氏製藥 (F. Hoffmann-La Roche)、協和麒麟 (Kyowa Kirin)、奧利安林 (Oreo)、Yororkan Pharmaus、Yorimel (Boelinger) Pharmaceuticals、艾伯維 (AbbVie)、Amneal Pharmaceuticals、諾華 (Novartis)、Desitin Arzneimittel、Acorda Therapeutics (Merz Therapeutics) 和阿卡迪亞製藥 (Acadia Pharmaceuticals)。為了鞏固其在帕金森氏症治療市場的地位,各公司強調策略性研發投資,以開發安全性和有效性更高的下一代療法。他們積極爭取監管批准,以加快核准速度並獲得早期市場准入。與學術機構和生物技術公司的合作,使創新管道更加多元化。不斷擴大的全球分銷網路,尤其是在新興經濟體,確保了更廣泛的藥物供應。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 人口老化導致全球帕金森氏症患者病率上升

- 藥物傳輸技術與新配方的進步

- 生物製藥公司不斷增加的研發投資

- 非營利組織和倡導組織的大力支持

- 產業陷阱與挑戰

- 低收入地區先進療法成本高且報銷有限

- 缺乏治癒性治療且現有藥物的副作用持續存在

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 流行病學概況

- 未來市場趨勢

- 管道分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按藥物類別,2021 - 2034 年

- 主要趨勢

- 左旋多巴/卡比多巴

- 多巴胺激動劑

- 腺苷A2A拮抗劑

- COMT抑制劑

- MAO-B抑制劑

- 麩胺酸拮抗劑

- 膽鹼酯酶抑制劑

- 其他藥物類別

第6章:市場估計與預測:按管理路線,2021 - 2034 年

- 主要趨勢

- 口服

- 透皮

- 皮下

- 其他給藥途徑

第7章:市場估計與預測:按患者,2021 - 2034 年

- 主要趨勢

- 成人

- 兒科

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 網路藥局

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- AbbVie

- Acadia Pharmaceuticals

- Acorda Therapeutics (Merz Therapeutics)

- Amneal Pharmaceuticals

- Boehringer Ingelheim

- Desitin Arzneimittel

- F. Hoffmann-La Roche

- Kyowa Kirin

- Newron Pharmaceuticals

- Novartis

- Orion Pharma

- Sumitomo Dainippon Pharma

- Supernus Pharmaceuticals

- Teva Pharmaceutical

- UCB

The Global Parkinson's Disease Therapeutics Market was valued at USD 6.2 billion in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 13.3 billion by 2034, driven by the increasing incidence of Parkinson's disease, particularly among aging populations worldwide. As life expectancy improves, the prevalence of age-related neurodegenerative conditions like Parkinson's is expanding rapidly. Countries across North America, Europe, and parts of the Asia-Pacific region are witnessing a notable rise in the elderly demographic, which is fueling demand for more effective treatments. Healthcare systems are responding by prioritizing therapeutic innovations and expanding access to specialized care tailored to patients with Parkinson's disease.

The market is experiencing significant transformation as pharmaceutical advancements continue to emerge. While traditional therapies remain widely used, there's increasing attention on alternative treatments that provide more targeted symptom control. Drug classes targeting different neural pathways are being explored to manage disease progression more effectively. Innovative delivery platforms are also making an impact. These include user-friendly systems that improve patient adherence, especially for individuals requiring long-term care. Transdermal systems, inhalation routes, and infusion therapies are popular due to their ability to deliver steady, controlled medication with fewer complications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.2 Billion |

| Forecast Value | $13.3 Billion |

| CAGR | 8.1% |

The Levodopa/carbidopa generated USD 3 billion in 2024. Its continued dominance is attributed to its ability to address varied motor symptoms. Enhanced formulations offering extended release and continuous delivery have helped reduce complications and provide consistent symptom management. This drug's widespread use, affordability, and established clinical efficacy make it a cornerstone in Parkinson's treatment across high-income and emerging economies.

Oral medications accounted for a 63.3% share in 2024. Their ease of use, cost-effectiveness, and availability make them the preferred route for patients undergoing lifelong treatment. Many of the most prescribed Parkinson's therapies, particularly those for motor symptom relief, are developed in oral formulations. This not only improves adherence but also limits the need for hospital-based administration, making oral drugs a dominant force in the therapeutic landscape.

U.S. Parkinson's Disease Therapeutics Market generated USD 2.3 billion in 2024. Its robust healthcare system, advanced regulatory pathways, and early access to cutting-edge treatments contribute to its leadership in Parkinson's care. The country also benefits from strong patient support networks and collaborative R&D efforts, which promote drug discovery and accelerate the commercialization of novel therapies.

Prominent players in this industry include Teva Pharmaceutical, Newron Pharmaceuticals, UCB, Sumitomo Dainippon Pharma, F. Hoffmann-La Roche, Kyowa Kirin, Orion Pharma, Boehringer Ingelheim, Supernus Pharmaceuticals, AbbVie, Amneal Pharmaceuticals, Novartis, Desitin Arzneimittel, Acorda Therapeutics (Merz Therapeutics), and Acadia Pharmaceuticals. To strengthen their position in the Parkinson's disease therapeutics market, companies emphasize strategic R&D investments to develop next-generation therapies with better safety and efficacy. They pursue regulatory designations to accelerate approvals and gain early market access. Collaborations with academic institutions and biotech firms allow for diversified innovation pipelines. Expanding global distribution networks, especially in emerging economies, ensures wider medications.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global prevalence of Parkinson’s disease due to an aging population

- 3.2.1.2 Advancements in drug delivery technologies and novel formulations

- 3.2.1.3 Growing research and development investments by biopharmaceutical companies

- 3.2.1.4 Strong support from non-profits and advocacy organizations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced therapies and limited reimbursement in low income regions

- 3.2.2.2 Lack of curative treatments and persistent side effects of current medications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Epidemiology landscape

- 3.7 Future market trends

- 3.8 Pipeline analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Levodopa/carbidopa

- 5.3 Dopamine agonists

- 5.4 Adenosine A2A antagonists

- 5.5 COMT inhibitors

- 5.6 MAO-B inhibitors

- 5.7 Glutamate antagonists

- 5.8 Cholinesterase inhibitors

- 5.9 Other drug classes

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Transdermal

- 6.4 Subcutaneous

- 6.5 Other routes of administration

Chapter 7 Market Estimates and Forecast, By Patient, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Adult

- 7.3 Pediatric

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 Acadia Pharmaceuticals

- 10.3 Acorda Therapeutics (Merz Therapeutics)

- 10.4 Amneal Pharmaceuticals

- 10.5 Boehringer Ingelheim

- 10.6 Desitin Arzneimittel

- 10.7 F. Hoffmann-La Roche

- 10.8 Kyowa Kirin

- 10.9 Newron Pharmaceuticals

- 10.10 Novartis

- 10.11 Orion Pharma

- 10.12 Sumitomo Dainippon Pharma

- 10.13 Supernus Pharmaceuticals

- 10.14 Teva Pharmaceutical

- 10.15 UCB