|

市場調查報告書

商品編碼

1750589

葡萄籽萃取物市場機會、成長動力、產業趨勢分析及2025-2034年預測Grape Seed Extracts Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

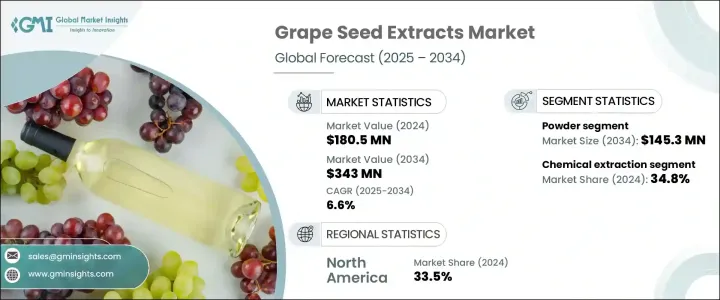

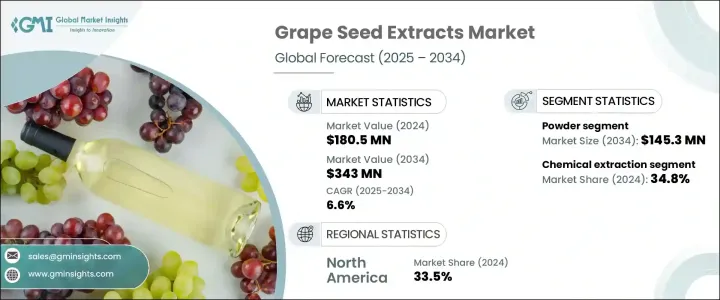

2024年,全球葡萄籽萃取物市場規模達1.805億美元,預計到2034年將以6.6%的複合年成長率成長,達到3.43億美元。這一成長主要源於注重健康的消費群體對天然植物成分日益成長的需求。葡萄籽萃取物源自完整的葡萄籽,以其高濃度的原花青素而聞名。原花青素是一種強大的抗氧化化合物,具有多種健康益處。這些化合物因其抗氧化壓力和抗真菌作用而廣受讚譽,使其成為個人護理、食品飲料和營養保健品等各種應用領域中極具吸引力的成分。

消費者越來越了解抗氧化劑在促進整體健康方面的作用,這對葡萄籽萃取物在多個行業的應用產生了積極影響。其公認的益處,例如支持心血管健康和免疫功能,使其成為功能性食品配方和膳食補充劑中備受歡迎的成分。人們對天然和有機產品日益成長的興趣,加上人們轉向預防性醫療保健,持續推動市場的發展。此外,提取技術和配方技術的創新使製造商能夠滿足最終用戶的多樣化需求,使產品更易於獲取且用途更廣泛。清潔標籤成分的趨勢也提升了葡萄籽萃取物的吸引力,尤其是在注重透明度和簡單性的配方中。隨著消費者越來越傾向於更健康的生活方式和整體健康趨勢,葡萄籽萃取物等植物源成分的重要性可能會進一步加深,從而在預測期內推動市場穩步擴張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1.805億美元 |

| 預測值 | 3.43億美元 |

| 複合年成長率 | 6.6% |

就劑型而言,葡萄籽萃取物市場細分為粉末、液體、膠囊和片劑、軟膠囊以及其他劑型。其中,粉末劑型佔主導地位,預計到2034年將達到1.453億美元,複合年成長率超過6.4%。粉末劑型尤其受歡迎,因為它易於添加到膳食補充劑、功能性食品混合物和健康飲料中。其更長的保存期限和靈活的使用方式,使其成為追求穩定性和便利性的製造商的理想之選。隨著功能性營養需求的成長,尤其是在注重健康的消費者群體中,粉末劑型的市場發展勢頭強勁。它支援多種應用形式,並吸引了廣泛的人群,從而鞏固了其顯著的市場佔有率。

就萃取製程而言,業界將方法分為機械萃取、化學萃取、超臨界流體萃取、熱水萃取等。 2024年,化學萃取佔據市場主導地位,市佔率達34.8%,預計2025年至2034年期間的複合年成長率為6.8%。該方法之所以被廣泛採用,是因為它能夠實現更高的純度和一致的結果,這對於大規模生產和醫藥級應用至關重要。儘管人們正在探索永續性和效率的替代方法,但化學提取仍然保持領先地位,尤其是在注重高效性的領域。

另一方面,機械萃取採用物理方法,不使用化學品,提供了更自然的途徑。這使得它對符合清潔標籤和有機標準的生產商尤其有吸引力。儘管機械萃取是一種環保方法,但它也存在萃取率較低和精煉能力有限的問題。然而,隨著加工設備的不斷進步,機械萃取仍有望獲得更強勁的立足點,預計未來幾年將實現溫和成長。

從區域來看,北美目前引領全球葡萄籽萃取物市場,2024年將佔據33.5%的市場。該地區受益於營養保健食品和功能性食品領域的強勁需求,消費者越來越注重積極的健康管理。對永續實踐的高度重視和對天然健康產品的日益提升,對該地區市場領導地位起到了重要作用。監管架構和膳食補充劑的支持性環境進一步提升了北美市場的潛力。該地區也受益於完善的分銷網路和廣泛的健康零售平台。

全球競爭格局呈現高度競爭態勢,排名前五的公司佔據了相當大的市場佔有率。這些參與者不斷投資於產品開發、供應鏈最佳化和策略合作夥伴關係,以鞏固其市場地位。天然成分採購的創新以及努力滿足不斷變化的消費者期望是主要利害關係人所採取策略的核心。在市場對高品質葡萄籽萃取產品日益成長的需求背景下,各公司正專注於研發、品牌定位和產品多元化,努力保持市場競爭力並搶佔更大的市場佔有率。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 主要製造商

- 經銷商

- 整個產業的利潤率

- 供應鏈和分銷分析

- 原物料採購

- 生產製造

- 冷鏈基礎設施

- 分銷管道

- 供應鏈挑戰與最佳化

- 永續實踐

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 貿易統計(HS編碼)

- 2021-2024年主要出口國

- 2021-2024年主要出口國

- 衝擊力

- 成長動力

- 消費者對健康益處的認知不斷提高

- 對天然補充品的需求不斷增加

- 生活方式疾病盛行率上升

- 擴大化妝品和個人護理領域的應用

- 產業陷阱與挑戰

- 生產成本高

- 替代抗氧化劑來源的可用性

- 市場機會

- 萃取工藝的技術進步

- 新興市場需求不斷成長

- 開發新配方

- 功能性食品和飲料應用的擴展

- 3.6.4 市場挑戰

- 萃取物品質標準化

- 一些健康聲明的臨床證據有限

- 供應鏈中斷

- 來自合成替代品的競爭

- 市場機會

- 成長動力

- 原料景觀

- 製造業趨勢

- 技術演進

- 定價分析和成本結構

- 價格趨勢(美元/噸)

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東非洲

- 定價因素(原料、能源、勞力)

- 區域價格差異

- 成本結構明細

- 獲利能力分析

- 價格趨勢(美元/噸)

- 監管框架和標準

- FDA 法規和 GRAS 狀態

- 歐洲食品安全局(EFSA)指南

- 亞太地區監管格局

- 監管變化對市場成長的影響

- 波特的分析

- Pestel 分析

- 永續發展趨勢對生產和消費的影響

- 新參與者的市場進入策略

- 原料分析與採購策略

- 葡萄品種及其對萃取物品質的影響

- 釀酒副產品的利用

- 永續採購實踐

- 植物化學成分分析

- 原花青素

- 黃酮類化合物

- 酚酸

- 其他生物活性化合物

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司熱圖分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

- Expansion

- Mergers & acquisition

- Collaborations

- New product launches

- Research & development

- 主要參與者的最新發展和影響分析

- 公司分類

- 參與者概述

- 財務表現

- 產品基準測試

第5章:市場估計與預測:依形式,2021-2034

- 主要趨勢

- 粉末

- 液體

- 軟膠囊

- 膠囊和片劑

- 其他

第6章:市場估計與預測:按提取方法,2021-2034 年

- 主要趨勢

- 機械萃取

- 化學萃取

- 超臨界流體萃取

- 熱水萃取

- 其他

第7章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 膳食補充劑

- 食品和飲料

- 功能性食品

- 功能性飲料

- 其他

- 製藥

- 動物

- 化妝品和個人護理

- 皮膚護理

- 頭髮護理

- 其他

- 其他

第 8 章:市場估計與預測:按治療適應症,2021-2034 年

- 主要趨勢

- 心血管健康

- 抗衰老和皮膚健康

- 糖尿病管理

- 癌症預防

- 認知健康

- 其他

第9章:市場估計與預測:按配銷通路,2021-2034

- 主要趨勢

- B2B

- B2C

- 超市和大賣場

- 專賣店

- 網路零售

- 藥局和藥局

- 其他

第10章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Indena SpA

- Botanic Healthcare

- Polyphenolics (Division of Constellation Brands)

- Naturex (Part of Givaudan)

- Nexira

- Dohler Group

- Keller Juices SRL

- NOW Foods

- Solgar Inc. (Part of The Nature's Bounty Co.)

- JF Natural (Zhejiang Jianfeng Group)

- Undersun Biomedtech Corp.

- Grap'Sud

- Nutra Green Biotechnology Co., Ltd.

- Ethical Naturals, Inc.

- Hunan Sunfull Bio-tech Co., Ltd.

The Global Grape Seed Extracts Market was valued at USD 180.5 million in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 343 million by 2034. This growth is largely driven by the increasing demand for natural, plant-based ingredients across health-conscious consumer segments. Grape seed extract, sourced from whole grape seeds, is known for its high concentration of procyanidins-powerful antioxidant compounds that support various health benefits. These compounds are widely appreciated for their ability to combat oxidative stress and provide antifungal effects, making grape seed extract an attractive ingredient in various applications, including personal care, food and beverage, and nutraceuticals.

Consumers are becoming more informed about the role of antioxidants in promoting overall wellness, which has positively impacted the adoption of grape seed extract across multiple industries. Its perceived benefits, such as supporting cardiovascular health and immune function, have made it a popular inclusion in functional food formulations and dietary supplements. The expanding interest in natural and organic products, combined with the shift toward preventive healthcare, continues to push the market forward. Furthermore, innovation in extraction techniques and formulation technologies is allowing manufacturers to cater to the diverse demands of end-users, making the product more accessible and versatile. The move toward clean-label ingredients also boosts the appeal of grape seed extract, especially in formulations that prioritize transparency and simplicity. As consumers gravitate toward healthier lifestyles and holistic wellness trends, the importance of plant-derived ingredients like grape seed extract is likely to deepen, contributing to steady market expansion through the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $180.5 Million |

| Forecast Value | $343 Million |

| CAGR | 6.6% |

In terms of form, the grape seed extracts market is segmented into powder, liquid, capsules and tablets, soft gels, and other variants. Among these, the powder segment stands out as a dominant contributor and is projected to reach USD 145.3 million by 2034, expanding at a CAGR of over 6.4%. The powdered form is especially popular due to its easy incorporation into dietary supplements, functional food blends, and wellness beverages. Its longer shelf life and flexibility in usage make it highly favorable for manufacturers seeking stability and convenience. As demand rises for functional nutrition, particularly among health-focused consumers, the powder form continues to gain momentum. It supports various application formats and appeals to a broad demographic base, reinforcing its significant market share.

When it comes to extraction processes, the industry categorizes methods into mechanical extraction, chemical extraction, supercritical fluid extraction, hot water extraction, and others. In 2024, chemical extraction led the market with a 34.8% share and is forecast to grow at a CAGR of 6.8% between 2025 and 2034. The widespread adoption of this method is due to its ability to achieve higher purity levels and consistent results, which is crucial for large-scale production and pharmaceutical-grade applications. While alternative methods are being explored for their sustainability and efficiency, chemical extraction continues to maintain its lead, especially where high efficacy is a priority.

Mechanical extraction, on the other hand, offers a more natural route by utilizing physical means without the use of chemicals. This makes it particularly attractive to producers who align with clean-label and organic standards. Despite its eco-friendly approach, this method struggles with lower extraction yields and limited refinement capabilities. However, with ongoing advancements in processing equipment, the potential for mechanical extraction to gain a stronger foothold remains promising, and moderate growth is expected for this segment in the coming years.

Regionally, North America currently leads the global grape seed extracts market, accounting for 33.5% of the total market share in 2024. The region benefits from robust demand in the nutraceutical and functional foods sector, where consumers are increasingly focused on proactive health management. A strong emphasis on sustainable practices and heightened awareness of natural health products have played a major role in the region's market leadership. Regulatory frameworks and a supportive environment for dietary supplements further enhance the market's potential in North America. The region also benefits from a well-established distribution network and widespread availability of health-focused retail platforms.

The global competitive landscape is characterized by high rivalry, with the top five companies holding a considerable share of the market. These players are continuously investing in product development, supply chain optimization, and strategic partnerships to strengthen their foothold. Innovation in natural ingredient sourcing and efforts to align with evolving consumer expectations are central to the strategies adopted by key stakeholders. With a focus on research, brand positioning, and product diversification, companies are working to maintain relevance and capture greater market share amid rising demand for high-quality grape seed extract offerings.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Key manufacturers

- 3.1.2 Distributors

- 3.1.3 Profit margins across the industry

- 3.1.4 Supply chain and distribution analysis

- 3.1.4.1 Raw material sourcing

- 3.1.4.2 Production and manufacturing

- 3.1.4.3 Cold chain infrastructure

- 3.1.4.4 Distribution channels

- 3.1.4.5 Supply chain challenges and optimization

- 3.1.4.6 Sustainable practices

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code)

- 3.3.1 Major exporting countries, 2021-2024 (Kilo Tons)

- 3.3.2 Major exporting countries, 2021-2024 (Kilo Tons)

- 3.4 Impact forces

- 3.4.1 Growth drivers

- 3.4.1.1 Growing consumer awareness about health benefits

- 3.4.1.2 Increasing demand for natural supplements

- 3.4.1.3 Rising prevalence of lifestyle diseases

- 3.4.1.4 Expanding applications in cosmetics and personal care

- 3.4.2 Industry pitfalls & challenges

- 3.4.2.1 High production costs

- 3.4.2.2 Availability of alternative antioxidant sources

- 3.4.3 Market opportunities

- 3.4.3.1 Technological advancements in extraction processes

- 3.4.3.2 Growing demand in emerging markets

- 3.4.3.3 Development of novel formulations

- 3.4.3.4 Expansion in functional food and beverage applications

- 3.4.4 market challenges

- 3.4.4.1 Standardization of extract quality

- 3.4.4.2 Limited clinical evidence for some health claims

- 3.4.4.3 Supply chain disruptions

- 3.4.4.4 Competition from synthetic alternatives

- 3.4.5 Market opportunity

- 3.4.1 Growth drivers

- 3.5 Raw material landscape

- 3.5.1 Manufacturing trends

- 3.5.2 Technology evolution

- 3.6 Pricing analysis and cost structure

- 3.6.1 Pricing trends

- 3.6.1.1 North America

- 3.6.1.2 Europe

- 3.6.1.3 Asia Pacific

- 3.6.1.4 Latin America

- 3.6.1.5 Middle East Africa

- 3.6.2 Pricing factors (raw materials, energy, labor)

- 3.6.3 Regional price variations

- 3.6.4 Cost structure breakdown

- 3.6.5 Profitability analysis

- 3.6.1 Pricing trends

- 3.7 Regulatory framework and standards

- 3.7.1 FDA regulations and GRAS Status

- 3.7.2 European food safety authority (EFSA) guidelines

- 3.7.3 Asia-pacific regulatory landscape

- 3.7.4 Impact of regulatory changes on market growth

- 3.8 Porter's analysis

- 3.9 Pestel analysis

- 3.10 Impact of sustainability trends on production and consumption

- 3.11 Market entry strategies for new players

- 3.12 Raw material analysis and sourcing strategies

- 3.12.1 Grape varieties and their impact on extract quality

- 3.12.2 Winemaking by-products utilization

- 3.12.3 Sustainable sourcing practices

- 3.13 Phytochemical composition analysis

- 3.13.1 Proanthocyanidins

- 3.13.2 Flavonoids

- 3.13.3 Phenolic acids

- 3.13.4 Other bioactive compounds

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Company heat map analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Recent developments & impact analysis by key players

- 4.7.1 Company categorization

- 4.7.2 Participant’s overview

- 4.7.3 Financial performance

- 4.8 Product benchmarking

Chapter 5 Market Estimates & Forecast, By Form, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Powder

- 5.3 Liquid

- 5.4 Soft gels

- 5.5 Capsules and tablets

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Extraction Method, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Mechanical extraction

- 6.3 Chemical extraction

- 6.4 Supercritical fluid extraction

- 6.5 Hot water extraction

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Dietary supplements

- 7.3 Food and beverages

- 7.3.1 Functional foods

- 7.3.2 Functional beverages

- 7.3.3 Others

- 7.4 Pharmaceuticals

- 7.5 Animal

- 7.6 Cosmetics and personal care

- 7.6.1 Skin care

- 7.6.2 Hair care

- 7.6.3 Other

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Therapeutic Indication, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Cardiovascular health

- 8.3 Anti-aging and skin health

- 8.4 Diabetes management

- 8.5 Cancer prevention

- 8.6 Cognitive health

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 B2B

- 9.3 B2C

- 9.3.1 Supermarkets and hypermarkets

- 9.3.2 Specialty stores

- 9.3.3 Online retail

- 9.3.4 Pharmacy and drug stores

- 9.3.5 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Indena S.p.A.

- 11.2 Botanic Healthcare

- 11.3 Polyphenolics (Division of Constellation Brands)

- 11.4 Naturex (Part of Givaudan)

- 11.5 Nexira

- 11.6 Dohler Group

- 11.7 Keller Juices S.R.L

- 11.8 NOW Foods

- 11.9 Solgar Inc. (Part of The Nature's Bounty Co.)

- 11.10 JF Natural (Zhejiang Jianfeng Group)

- 11.11 Undersun Biomedtech Corp.

- 11.12 Grap'Sud

- 11.13 Nutra Green Biotechnology Co., Ltd.

- 11.14 Ethical Naturals, Inc.

- 11.15 Hunan Sunfull Bio-tech Co., Ltd.