|

市場調查報告書

商品編碼

1750575

住宅太陽能發電機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Residential Solar Generator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

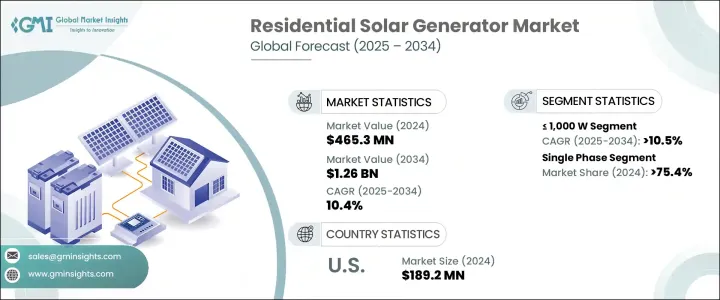

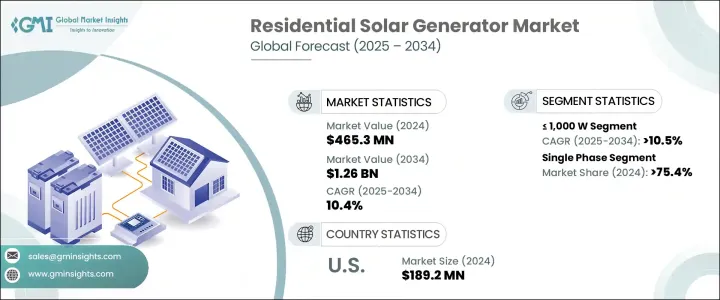

2024年,全球住宅太陽能發電機市場規模達4.653億美元,預計到2034年將以10.4%的複合年成長率成長,達到12.6億美元。這得益於清潔再生能源解決方案需求的不斷成長以及居民環保意識的不斷增強。隨著全球能源結構向永續能源轉型,太陽能發電機正成為住宅應用的首選。能源獨立的推動,加上電網系統頻繁波動和斷電事件的增多,正在加速這一轉變。鋰離子電池和固態電池技術的持續改進,以及能源管理系統在家庭中的整合,正在增強住宅太陽能解決方案的吸引力。這些進步使太陽能發電機更加高效、耐用且方便用戶使用。

政府的減排政策和鼓勵再生能源應用的稅收優惠政策發揮著至關重要的作用。智慧家庭系統的持續普及優先考慮節能,並有助於市場擴張。即使面臨生產成本上升和進口零件關稅等挑戰,由於國內製造業和產業創新日益受到重視,長期前景依然強勁。家用太陽能發電機也因其能夠降低電費和碳足跡而受到重視,對於希望採用更清潔能源的屋主來說,這是一項相當吸引人的投資。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 4.653億美元 |

| 預測值 | 12.6億美元 |

| 複合年成長率 | 10.4% |

額定功率在 1,000 瓦以上至 2,000 瓦之間的發電機在 2024 年創造了 1.5 億美元的收入,反映出它們在住宅環境中日益成長的重要性。這些中檔系統在經常斷電的地區尤其受歡迎,它們為屋主提供了可靠且高效的備用電源,而無需進行大規模的基礎設施升級。它們體積小巧,輸出功率足以滿足基本電器的需求,使其成為中小型住宅的理想選擇。隨著消費者尋求兼顧電力容量和便攜性的經濟高效的能源解決方案,這一細分市場將繼續受到青睞。

三相太陽能發電機市場預計將經歷強勁成長,預計2034年複合年成長率將達到10%。這一趨勢源於對能夠處理更大電力負載並與再生能源框架無縫整合的系統日益成長的需求。隨著越來越多的家庭安裝太陽能板、電動車充電站和能源管理系統,對三相配置的需求也將隨之成長。這些發電機旨在支援高效的能源使用,使其成為智慧家庭和大型住宅環境中不可或缺的能源,因為穩定性和可擴展性至關重要。

2024年,美國住宅太陽能發電機市場規模達1.892億美元,這標誌著全球最發達的能源市場之一——美國——正展現出強勁的發展勢頭。隨著極端天氣事件和電網基礎設施老化導致的停電事件日益增多,屋主比以往任何時候都更加重視能源安全。這種轉變鼓勵人們採用太陽能備用系統,不僅能提供可靠的離網供電,還能實現長期節能。美國政府推出的稅收抵免、退稅和清潔能源計畫資助等措施正在加速市場滲透,尤其是在電費高昂、停電頻繁的州。

EcoFlow、Powerenz、Jackery、GROWATT、Bluetti、Nature's Generator、Inergy、HomeGrid、Aton Solar、PowerOak、Anern、Renogy、Humless、ACOPOWER、Milesolar、Goal Zero、Generac Power Systems、Lion Energy、Anker 和 OUPES 等公司正在鞏固部署策略舉措,以鞏固其市場地位。這些措施包括開發高容量可攜式設備、拓展電商管道、利用智慧電池創新以及增強客戶服務網路。許多品牌專注於擴大分銷合作夥伴關係,並提供針對不同住宅需求的客製化能源解決方案。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 策略舉措

- 公司市佔率分析

- 競爭基準測試

- 創新與永續發展格局

第5章:市場規模及預測:依產能,2021 - 2034 年

- 主要趨勢

- ≤ 1,000 瓦

- > 1,000 瓦 - 2,000 瓦

- > 2,000 瓦 - 3,000 瓦

- > 3,000 瓦

第6章:市場規模及預測:依階段,2021 - 2034

- 主要趨勢

- 單相

- 三相

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 義大利

- 波蘭

- 荷蘭

- 奧地利

- 法國

- 西班牙

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 菲律賓

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 埃及

- 奈及利亞

- 以色列

- 拉丁美洲

- 巴西

- 智利

- 墨西哥

第8章:公司簡介

- ACOPOWER

- Anern

- Anker

- Aton Solar

- Bluetti

- EcoFlow

- Generac Power Systems

- Goal Zero

- GROWATT

- HomeGrid

- Humless

- Inergy

- Jackery

- Lion Energy

- Milesolar

- Nature's Generator

- OUPES

- Powerenz

- PowerOak

- Renogy

The Global Residential Solar Generator Market was valued at USD 465.3 million in 2024 and is estimated to grow at a CAGR of 10.4% to reach USD 1.26 billion by 2034, driven by the rising demand for clean, renewable energy solutions and increasing environmental awareness among homeowners. As the world shifts toward more sustainable energy options, solar generators are becoming a top choice for residential applications. The push for energy independence, along with the frequent instability in grid systems and increasing power disruptions, is accelerating this shift. Ongoing improvements in lithium-ion and solid-state battery technologies, as well as the integration of energy management systems in households, are enhancing the appeal of residential solar solutions. These advancements make solar generators more efficient, durable, and user-friendly.

Government policies focused on emission reductions and tax incentives for renewable adoption play a critical role. The ongoing adoption of smart home systems prioritizes energy savings and contributes to market expansion. Even with challenges like rising production costs and tariffs on imported components, the long-term outlook remains strong due to a growing focus on domestic manufacturing and innovation in the sector. Residential solar generators are also valued for their ability to reduce electricity bills and lower carbon footprints, making them an attractive investment for homeowners aiming to adopt cleaner energy sources.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $465.3 Million |

| Forecast Value | $1.26 Billion |

| CAGR | 10.4% |

Generators with power ratings between >1,000 W and 2,000 W generated USD 150 million in 2024, reflecting their growing importance in residential settings. These mid-range systems are particularly favored in areas facing recurrent power interruptions, offering homeowners a dependable and efficient backup power source without requiring significant infrastructure upgrades. Their compact size, combined with sufficient output for essential appliances, makes them ideal for small to medium-sized homes. This segment continues to gain traction as consumers seek cost-effective energy solutions that balance power capacity and portability.

The three-phase solar generator segment is set to experience robust growth, with projections indicating a CAGR of 10% through 2034. This trend is driven by a rising need for systems capable of handling larger electrical loads and integrating seamlessly with renewable energy frameworks. As more homes incorporate solar panels, electric vehicle charging stations, and energy management systems, the demand for three-phase configurations will grow. These generators are designed to support high-efficiency energy usage, making them essential in smart homes and larger residential setups where stability and scalability are crucial.

United States Residential Solar Generator Market was valued at USD 189.2 million in 2024, signaling strong momentum in one of the world's most advanced energy markets. With increasing power outages caused by extreme weather events and aging grid infrastructure, homeowners prioritize energy security more than ever. This shift encourages the adoption of solar-powered backup systems that provide off-grid reliability and long-term savings. U.S. government initiatives such as tax credits, rebates, and funding for clean energy projects are accelerating market penetration, particularly in states with high electricity costs and frequent outages.

Companies such as EcoFlow, Powerenz, Jackery, GROWATT, Bluetti, Nature's Generator, Inergy, HomeGrid, Aton Solar, PowerOak, Anern, Renogy, Humless, ACOPOWER, Milesolar, Goal Zero, Generac Power Systems, Lion Energy, Anker, and OUPES are deploying strategic initiatives to secure their market position. These include developing high-capacity, portable units, expanding e-commerce channels, leveraging smart battery innovations, and enhancing customer service networks. Many brands focus on expanding distribution partnerships and offering customizable energy solutions tailored to diverse residential needs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Strategic initiatives

- 4.4 Company market share analysis, 2024

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 ≤ 1,000 W

- 5.3 > 1,000 W - 2,000 W

- 5.4 > 2,000 W - 3,000 W

- 5.5 > 3,000 W

Chapter 6 Market Size and Forecast, By Phase, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Single phase

- 6.3 Three phase

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 Italy

- 7.3.3 Poland

- 7.3.4 Netherlands

- 7.3.5 Austria

- 7.3.6 France

- 7.3.7 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.4.6 Philippines

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.5.4 Egypt

- 7.5.5 Nigeria

- 7.5.6 Israel

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Chile

- 7.6.3 Mexico

Chapter 8 Company Profiles

- 8.1 ACOPOWER

- 8.2 Anern

- 8.3 Anker

- 8.4 Aton Solar

- 8.5 Bluetti

- 8.6 EcoFlow

- 8.7 Generac Power Systems

- 8.8 Goal Zero

- 8.9 GROWATT

- 8.10 HomeGrid

- 8.11 Humless

- 8.12 Inergy

- 8.13 Jackery

- 8.14 Lion Energy

- 8.15 Milesolar

- 8.16 Nature's Generator

- 8.17 OUPES

- 8.18 Powerenz

- 8.19 PowerOak

- 8.20 Renogy