|

市場調查報告書

商品編碼

1750574

OTC乾眼液市場機會、成長動力、產業趨勢分析及2025-2034年預測OTC Dry Eye Drops Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

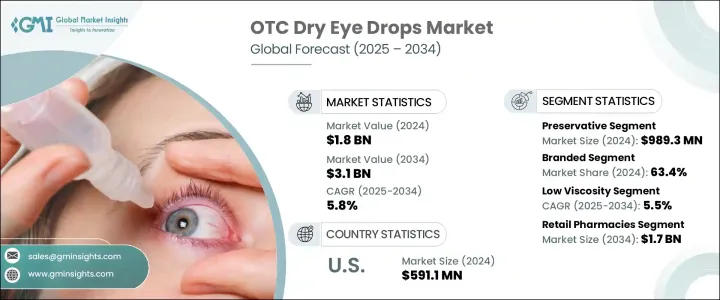

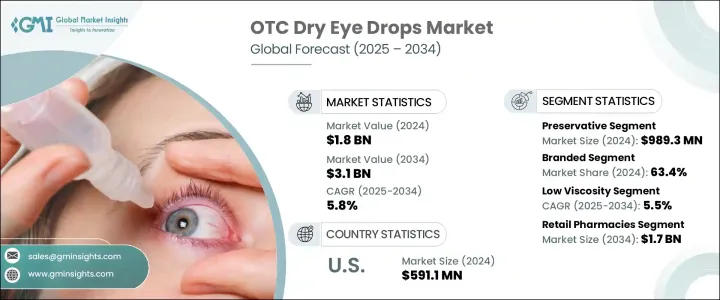

2024年,全球非處方乾眼藥水市場規模達18億美元,預計2034年將以5.8%的複合年成長率成長,達到31億美元。這主要得益於乾眼症盛行率的上升。由於人們使用智慧型手機、電腦和平板電腦的時間增加等因素,乾眼症正變得越來越普遍。此外,空氣污染、灰塵以及長時間暴露在空調環境中等環境因素也會導致乾眼症狀惡化。隨著人們,尤其是年輕人和中年人,眼睛不適的發生頻率越來越高,對非處方乾眼產品的需求也日益成長。

推動市場成長的另一個關鍵因素是消費者轉向自我照護,越來越多的消費者選擇非處方藥 (OTC) 來管理眼部健康。隨著人們越來越注重健康,並意識到自身健康問題,許多人更傾向於使用非處方藥 (OTC) 來緩解乾眼症狀,從而減少就醫需求。非處方眼藥水透過零售連鎖藥局和線上平台的普及,進一步增強了這一趨勢。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 18億美元 |

| 預測值 | 31億美元 |

| 複合年成長率 | 5.8% |

2024年,含防腐劑產品市場價值達9.893億美元,這得益於其價格實惠、供應充足且效果顯著。這些產品使用苯扎氯銨(BAK)等防腐劑來防止多劑量容器中的微生物生長,使其成為許多人的首選。其較長的保存期限、便捷的使用方式和較低的價格使其對消費者特別有吸引力,並推動了其廣泛應用。由於消費者信任度和品牌忠誠度,知名品牌繼續主導這一市場,許多消費者選擇含防腐劑的解決方案,是因為他們熟悉這些產品,並且攜帶式多劑量包裝也十分方便。

依產品類型分類,品牌藥佔最大市場佔有率,2024 年佔 63.4%。領先的製藥公司在非處方乾眼藥水市場保持著強勁的勢頭,得益於數十年來的信任和認可。品牌產品更可靠、更有效的認知極大地提升了其受歡迎程度,尤其受到患有慢性乾眼症的消費者的青睞。這些產品通常能夠滿足特定需求,例如不含防腐劑的方案,從而吸引廣泛的受眾。

2024年,美國非處方乾眼藥水市場佔據37.4%的市場佔有率,這得益於數位設備的廣泛使用,越來越多的人長時間面對螢幕,導致眼疲勞和乾眼症狀加劇。因此,人們對乾眼症的認知不斷提高,促使更多人尋求非處方藥 (OTC) 來緩解不適。美國市場受益於幾家主要製藥公司的存在,這些公司在非處方乾眼產品領域佔據主導地位。這些公司利用完善的分銷網路和零售合作夥伴關係,使產品能夠透過實體店和線上平台廣泛銷售。

全球非處方乾眼液市場的主要參與者包括博士倫健康公司、樂敦製藥、愛爾康、參天製藥、Thea Pharmaceuticals、Prestige Consumer Healthcare、Similasan Corporation、URSAPHARM Arzneimittel、OASIS、NovaBay Pharmaceuticals、Jadran-Galenski Laboratorij、carebbcom、Hanx 或 Healthcare、Scope、ScUm.為了加強市場佔有率,非處方乾眼液市場的公司正專注於擴大產品組合,以滿足多樣化的消費者需求。他們投資研發,以創造更有效的配方,例如不含防腐劑和速效產品。此外,與零售藥局和電子商務平台的策略合作夥伴關係正在幫助公司提高可及性。有效的行銷和品牌建立對於維持客戶忠誠度也至關重要,尤其是在消費者對用於自我照顧的產品越來越挑剔的情況下。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 乾眼症盛行率上升

- 提高意識和自我保健習慣

- 增加螢幕時間和數位裝置的使用時間

- 產品配方的技術進步

- 產業陷阱與挑戰

- 副作用和過敏反應

- 替代療法的可用性

- 成長動力

- 成長潛力分析

- 監管格局

- 美國

- 歐洲

- 亞太地區

- 日本

- 中國

- 印度

- 澳洲

- 技術格局

- 核心技術

- 鄰近技術

- 定價分析

- 未來市場趨勢

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依產品類型,2021 年至 2034 年

- 主要趨勢

- 防腐劑

- 不含防腐劑

第6章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 品牌

- 泛型

第7章:市場估計與預測:按黏度,2021 年至 2034 年

- 主要趨勢

- 低黏度

- 高黏度

第8章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 零售藥局

- 網路藥局

- 其他分銷管道

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- AbbVie

- Alcon

- Bausch Health Companies

- Jadran-Galenski Laboratorij

- Medicom Healthcare

- NovaBay Pharmaceuticals

- OASIS

- Prestige Consumer Healthcare

- Rohto Pharmaceutical

- Santen Pharmaceutical

- Similasan Corporation

- Scope Eyecare

- Thea Pharmaceuticals

- URSAPHARM Arzneim

The Global OTC Dry Eye Drops Market was valued at USD 1.8 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 3.1 billion by 2034, driven by the rising prevalence of dry eye syndrome, which is becoming more common due to factors such as increased screen time from smartphones, computers, and tablets. Additionally, environmental elements like air pollution, dust, and extended exposure to air-conditioned spaces are contributing to the worsening of dry eye symptoms. As people, especially younger and middle-aged groups, experience more frequent eye discomfort, the demand for OTC dry eye products is growing.

Another key factor supporting the market's growth is the shift toward self-care, with more consumers opting for OTC remedies to manage their eye health. As individuals become more health-conscious and aware of their conditions, many prefer to address their dry eye symptoms with OTC solutions, reducing the need for medical consultations. This trend is further amplified by the accessibility of OTC eye drops through retail pharmacy chains and online platforms.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $3.1 Billion |

| CAGR | 5.8% |

The preservative-containing segment was valued at USD 989.3 million in 2024, due to its affordability, availability, and effectiveness. These products use preservatives like benzalkonium chloride (BAK) to prevent microbial growth in multi-dose containers, making them a preferred choice for many. Their extended shelf life, ease of use, and lower price point make them particularly attractive to consumers, driving widespread adoption. Well-established brands continue to dominate this segment due to consumer trust and brand loyalty, with many customers choosing preservative-based solutions because of familiarity and the convenience of portable, multi-dose packaging.

Based on product types, the branded segment holds the largest market share, capturing 63.4% in 2024. Leading pharmaceutical companies maintain a strong presence in the OTC dry eye drops market, benefitting from decades of trust and recognition. The perception of branded products being more reliable and effective contributes significantly to their popularity, especially for consumers suffering from chronic dry eye conditions. These products often cater to specific needs, such as preservative-free solutions, making them appealing to a wide audience.

U.S. OTC Dry Eye Drops Market held 37.4% share in 2024, driven by the widespread use of digital devices, with more people spending prolonged hours on screens, leading to a rise in eye strain and dry eye symptoms. As a result, there is a growing awareness of the condition, prompting more individuals to seek over-the-counter (OTC) solutions to manage the discomfort. U.S. market benefits from the presence of several key pharmaceutical companies, which dominate the OTC dry eye product landscape. These companies leverage well-established distribution networks and retail partnerships, making products widely accessible through brick-and-mortar stores and online platforms.

Key players in the Global OTC Dry Eye Drops Market include Bausch Health Companies, Rohto Pharmaceutical, Alcon, Santen Pharmaceutical, Thea Pharmaceuticals, Prestige Consumer Healthcare, Similasan Corporation, URSAPHARM Arzneimittel, OASIS, NovaBay Pharmaceuticals, Jadran-Galenski Laboratorij, Medicom Healthcare, Scope Eyecare, and AbbVie. To strengthen their market presence, companies in the OTC Dry Eye Drops Market are focusing on expanding product portfolios to address diverse consumer needs. They invest in research and development to create more effective formulations, such as preservative-free and fast-acting products. Furthermore, strategic partnerships with retail pharmacies and e-commerce platforms are helping companies enhance accessibility. Effective marketing and branding efforts are also crucial in maintaining customer loyalty, especially as consumers become more discerning about the products they use for self-care.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of dry eye disease

- 3.2.1.2 Growing awareness and self-care practices

- 3.2.1.3 Increased screen time and digital device usage

- 3.2.1.4 Technological advancements in product formulations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Side effects and allergic reactions

- 3.2.2.2 Availability of alternative treatments

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.3.1 Japan

- 3.4.3.2 China

- 3.4.3.3 India

- 3.4.3.4 Australia

- 3.5 Technology landscape

- 3.5.1 Core technologies

- 3.5.2 Adjacent technologies

- 3.6 Pricing analysis

- 3.7 Future market trends

- 3.8 Trump administration tariffs

- 3.8.1 Impact on trade

- 3.8.1.1 Trade volume disruptions

- 3.8.1.2 Retaliatory measures

- 3.8.2 Impact on the industry

- 3.8.2.1 Supply-side impact

- 3.8.2.1.1 Price volatility in key materials

- 3.8.2.1.2 Supply chain restructuring

- 3.8.2.1.3 Production cost implications

- 3.8.2.2 Demand-side impact (selling price)

- 3.8.2.2.1 Price transmission to end markets

- 3.8.2.2.2 Market share dynamics

- 3.8.2.2.3 Consumer response patterns

- 3.8.2.1 Supply-side impact

- 3.8.3 Key companies impacted

- 3.8.4 Strategic industry responses

- 3.8.4.1 Supply chain reconfiguration

- 3.8.4.2 Pricing and product strategies

- 3.8.4.3 Policy engagement

- 3.8.5 Outlook and future considerations

- 3.8.1 Impact on trade

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Preservative

- 5.3 Preservative-free

Chapter 6 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Branded

- 6.3 Generics

Chapter 7 Market Estimates and Forecast, By Viscosity, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Low viscosity

- 7.3 High viscosity

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Retail pharmacies

- 8.3 Online pharmacies

- 8.4 Other distribution channels

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 Alcon

- 10.3 Bausch Health Companies

- 10.4 Jadran-Galenski Laboratorij

- 10.5 Medicom Healthcare

- 10.6 NovaBay Pharmaceuticals

- 10.7 OASIS

- 10.8 Prestige Consumer Healthcare

- 10.9 Rohto Pharmaceutical

- 10.10 Santen Pharmaceutical

- 10.11 Similasan Corporation

- 10.12 Scope Eyecare

- 10.13 Thea Pharmaceuticals

- 10.14 URSAPHARM Arzneim