|

市場調查報告書

商品編碼

1750565

生成式人工智慧市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Generative AI Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

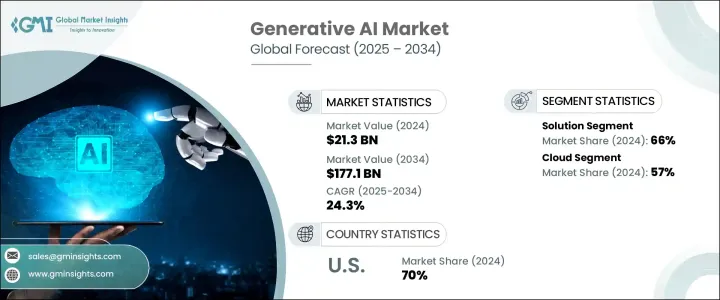

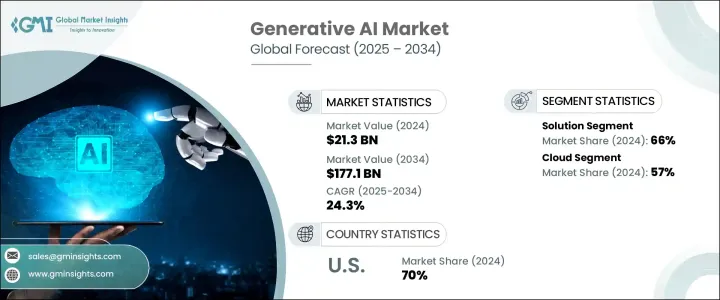

2024年,全球生成式人工智慧市場規模達213億美元,預計到2034年將以24.3%的複合年成長率成長,達到1771億美元。行銷、媒體和電商等行業對自動化內容產生的需求日益成長,是推動這一成長的主要因素。生成式人工智慧使企業能夠有效率、大規模地創建個人化內容,包括文字、圖像、視訊和音頻,同時縮短生產時間和降低成本。在高度依賴數位互動和快速內容分發的行業中,這種興趣的激增尤其明顯。

深度學習演算法、Transformer 架構以及雲端運算資源可用性的技術進步顯著加速了生成式人工智慧的發展。 GPT 和 DALL-E 等人工智慧模型正變得越來越有效率和強大,使企業能夠將這些技術應用於創意和分析性任務。隨著人工智慧處理能力的提升,即時內容產生變得越來越可行,從而幫助企業將生成式人工智慧融入其工作流程。這項技術透過簡化客戶服務、報告產生、程式碼創建和產品設計,支援各行各業的數位轉型。因此,企業可以提高效率、促進創新並降低營運成本,因此,生成式人工智慧已成為具有前瞻性思維的企業的關鍵投資。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 213億美元 |

| 預測值 | 1771億美元 |

| 複合年成長率 | 24.3% |

2024年,解決方案細分市場在生成型人工智慧市場佔據主導地位,約佔66%的市場。這種主導地位得益於各行各業廣泛應用的人工智慧平台和工具,這些平台和工具帶來了切實的、應用驅動的效益。生成型人工智慧解決方案涵蓋用於內容創作、影像生成、虛擬助理、程式碼產生和資料增強的人工智慧軟體。企業越來越需要可擴展、預先訓練且易於整合的端到端解決方案,幾乎不需要內部人工智慧專業知識。隨著醫療、行銷、金融和設計等行業對生成型人工智慧應用的需求不斷成長,可客製化的現成平台越來越受歡迎。

雲端部署也是生成式人工智慧市場的主要貢獻者。由於其可擴展性、經濟實惠和易於部署,雲端市場在 2024 年佔據了 57% 的佔有率。提供高階 GPU 和 TPU 的雲端平台可以有效率地處理生成式人工智慧模型的訓練和推理運算強度。基於雲端的平台提供即時處理、即時更新以及與其他人工智慧工具的整合,使組織無需投入大量基礎設施即可訪問強大的生成式模型,例如大型語言模型和圖像生成器。

美國生成式人工智慧市場佔全球70%的佔有率,2024年產值達47億美元。美國之所以佔據主導地位,得益於強大的人工智慧創新、科技巨頭的高度集中以及大量的風險投資。美國在人工智慧倫理開發和監管框架方面也處於領先地位,使其成為生成式人工智慧發展和商業成功的中心。

生成式人工智慧產業的主要參與者包括 Adobe、NVIDIA、亞馬遜網路服務 (AWS)、微軟、Meta、IBM、Google、Autodesk、百度和 Lighttricks。為了鞏固市場地位,生成式人工智慧領域的公司專注於多項策略措施。這些措施包括擴大與雲端服務供應商的合作夥伴關係以增強可擴展性、投資研發以提高人工智慧模型效率,以及開發行業特定的人工智慧解決方案以滿足多樣化的客戶需求。此外,領先的公司正在探索收購和合作,以整合尖端技術,從而在快速發展的市場中保持競爭力。提供可客製化的人工智慧平台並確保其易於整合到現有企業系統中,是幫助企業鞏固其地位的關鍵策略。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 雲端基礎設施供應商

- 基礎模型開發人員

- 平台提供者

- 軟體供應商

- 利潤率分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 其他國家的報復措施

- 對產業的影響

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 展望與未來考慮

- 對貿易的影響

- 技術與創新格局

- 專利分析

- 用例

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 內容自動化需求不斷成長

- 人工智慧和運算基礎設施的進步

- 企業數位轉型舉措

- 多模式應用的成長

- 產業陷阱與挑戰

- 錯誤訊息和道德濫用的風險

- 數據品質和偏見

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 解決方案

- 服務

第6章:市場估計與預測:依部署模式,2021 - 2034 年

- 主要趨勢

- 雲

- 本地

第7章:市場估計與預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 生成對抗網路(GAN)

- 變形金剛模型

- 變分自編碼器

- 擴散模型

- 其他

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 衛生保健

- 零售與電子商務

- 製造業

- 金融服務業

- 媒體與娛樂

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- Adobe

- Amazon Web Services (AWS)

- Apple

- Autodesk

- Baidu

- DeepMind

- Genie AI

- IBM

- Intel

- Meta

- Microsoft

- MOSTLY AI

- NVIDIA

- OpenAI

- Oracle

- Salesforce

- Siemens

- Synthesia

- Uber AI

- Unity Technologies

The Global Generative AI Market was valued at USD 21.3 billion in 2024 and is estimated to grow at a CAGR of 24.3% to reach USD 177.1 billion by 2034, driven by the increasing demand for automated content generation across sectors such as marketing, media, and e-commerce is driving this growth. Generative AI allows businesses to create personalized content, including text, images, video, and audio, efficiently and at scale, while reducing production time and costs. This surge in interest is particularly pronounced in industries heavily reliant on digital interaction and quick content distribution.

Technological advancements in deep learning algorithms, transformer architectures, and the availability of cloud computing resources have significantly accelerated the development of generative AI. AI models like GPT and DALL-E are becoming more efficient and powerful, enabling companies to use these technologies for creative and analytical tasks. As AI processing capabilities improve, real-time content generation becomes increasingly feasible, helping organizations integrate generative AI into their workflows. This technology supports digital transformation across industries by streamlining customer service, report generation, code creation, and product design. As a result, businesses can improve efficiency, foster innovation, and reduce operational costs, positioning generative AI as a critical investment for forward-thinking companies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21.3 Billion |

| Forecast Value | $177.1 Billion |

| CAGR | 24.3% |

In 2024, the solutions segment dominated the generative AI market, accounting for around 66% of the market share. This dominance is due to the widespread use of AI platforms and tools across industries, which deliver tangible, application-driven benefits. Generative AI solutions encompass AI software for content creation, image generation, virtual assistance, code generation, and data enhancement. Enterprises are increasingly looking for end-to-end solutions that are scalable, pre-trained, and easy to integrate, requiring minimal in-house AI expertise. As the demand for generative AI applications grows across industries like healthcare, marketing, finance, and design, customizable, off-the-shelf platforms have gained popularity.

Cloud deployment is also a major contributor to the generative AI market. The cloud segment accounted for 57% share in 2024 due to its scalability, affordability, and easy deployment. The computational intensity of training and inference for generative AI models is efficiently handled by cloud platforms that offer high-end GPUs and TPUs. Cloud-based platforms provide real-time processing, live updates, and integration with other AI tools, allowing organizations to access powerful generative models like large language models and image generators without heavy infrastructure investments.

United States Generative AI Market held a 70% share and generated USD 4.7 billion in 2024. The country's dominance is driven by strong AI innovation, a high concentration of tech giants, and significant venture capital investment. The U.S. also leads in ethical AI development and regulatory frameworks, making it a hub for generative AI advancement and commercial success.

Key players in the generative AI industry include Adobe, NVIDIA, Amazon Web Services (AWS), Microsoft, Meta, IBM, Google LLC, Autodesk, Baidu, and Lighttricks. To strengthen their market position, companies in the generative AI space focus on several strategic initiatives. These include expanding partnerships with cloud service providers to enhance scalability, investing in R&D to improve AI model efficiency, and developing industry-specific AI solutions to address diverse customer needs. Moreover, leading firms are exploring acquisitions and collaborations to integrate cutting-edge technologies, enabling them to stay competitive in a rapidly evolving market. Offering customizable AI platforms and ensuring easy integration into existing enterprise systems are key strategies helping businesses solidify their presence.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Cloud infrastructure providers

- 3.2.2 Foundational model developers

- 3.2.3 Platform providers

- 3.2.4 Software providers

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Production cost implications

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Use cases

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising demand for content automation

- 3.10.1.2 Advancements in AI and computing infrastructure

- 3.10.1.3 Enterprise digital transformation initiatives

- 3.10.1.4 Growth in multimodal applications

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Risk of misinformation and ethical misuse

- 3.10.2.2 Data quality and bias

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Solution

- 5.3 Service

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Cloud

- 6.3 On-premises

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Generative adversarial networks (GANs)

- 7.3 Transformers model

- 7.4 Variational auto-encoders

- 7.5 Diffusion models

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Healthcare

- 8.3 Retail and e-commerce

- 8.4 Manufacturing

- 8.5 BFSI

- 8.6 Media and entertainment

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Adobe

- 10.2 Amazon Web Services (AWS)

- 10.3 Apple

- 10.4 Autodesk

- 10.5 Baidu

- 10.6 DeepMind

- 10.7 Genie AI

- 10.8 Google

- 10.9 IBM

- 10.10 Intel

- 10.11 Meta

- 10.12 Microsoft

- 10.13 MOSTLY AI

- 10.14 NVIDIA

- 10.15 OpenAI

- 10.16 Oracle

- 10.17 Salesforce

- 10.18 Siemens

- 10.19 Synthesia

- 10.20 Uber AI

- 10.21 Unity Technologies