|

市場調查報告書

商品編碼

1750555

視網膜疾病治療市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Retinal Disorder Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

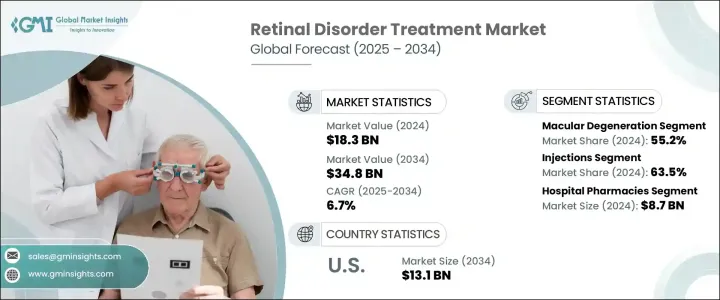

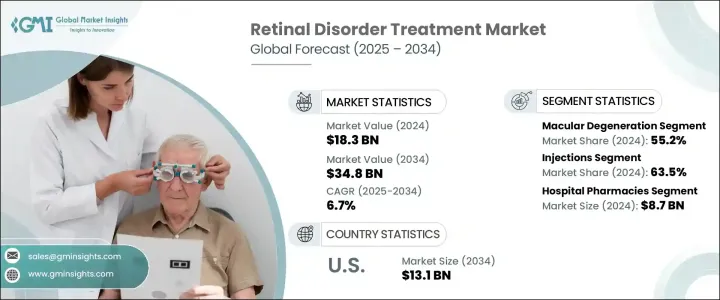

2024 年全球視網膜疾病治療市場價值為 183 億美元,預計到 2034 年將以 6.7% 的複合年成長率成長,達到 348 億美元,這主要得益於糖尿病及其併發症如糖尿病視網膜病變 (DR) 和糖尿病黃斑水腫 (DME) 的日益普及。視網膜疾病治療涵蓋一系列醫療、外科和藥物干預措施,包括抗 VEGF 注射、雷射治療、皮質類固醇治療和玻璃體切除術。這些治療的主要目標是防止進一步的視網膜損傷並保留或恢復視力。治療方法的選擇取決於病情的嚴重程度、疾病的分期以及患者眼睛的整體健康狀況。 DME 是視力喪失的主要原因,尤其是在第 2 型糖尿病患者中,這凸顯了及時介入和專門護理的必要性。

緩釋眼內療法等治療方法的最新進展,透過減少注射頻率提高了患者的依從性。例如,某些注射裝置設計用於持續給藥,從而減輕了頻繁的眼部注射。這些創新有助於最大限度地減輕治療負擔,同時為視網膜疾病提供更有效的解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 183億美元 |

| 預測值 | 348億美元 |

| 複合年成長率 | 6.7% |

黃斑部病變,尤其是老年黃斑部病變 (AMD),在 2024 年佔據了市場主導地位,佔 55%。 AMD 主要影響 60 歲以上的人,是該年齡層視力喪失的主要原因之一。隨著全球人口老化,高血壓和肥胖等合併症進一步加劇了 AMD 的盛行率,推動了對持續研究和治療創新的需求。

注射劑是市場的關鍵驅動力,2024 年佔 63.5%。玻璃體內注射通常用於治療視網膜疾病,例如老年黃斑部病變 (AMD)、視網膜靜脈阻塞和糖尿病黃斑水腫 (DME)。抗 VEGF 療法已在治療這些疾病方面顯示出良好的效果,因為它們能夠快速起效。阿瓦斯汀 (Avastin)、阿柏西普 (Eylea) 和雷珠單抗 (Lucentis) 等藥物已被證明能夠有效減少視網膜水腫和新生血管形成,最終改善患者的視力。

美國視網膜疾病治療市場規模預計將從2024年的71億美元成長至2034年的131億美元,主要得益於老齡化人口對視網膜疾病的易感性,以及先進的玻璃體內注射療法的普及。此外,優惠的健保政策和主要製藥商的強勁影響力將繼續推動市場擴張。

全球視網膜疾病治療市場的主要參與者包括再生元製藥、拜耳、艾伯維、諾華、輝瑞和羅氏。這些公司正在加大研發和新產品開發方面的投入,以在競爭中保持領先地位。為了鞏固其在視網膜疾病治療市場的地位,各公司正致力於擴大產品組合併推廣治療技術。關鍵策略包括建立合作關係,以利用藥物開發和分銷方面互補的專業知識。此外,各公司也透過創新的給藥系統和改進的報銷結構來改善病患治療效果。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 糖尿病盛行率不斷上升

- 老年人口不斷增加

- 技術進步

- 提高認知和篩檢項目

- 產業陷阱與挑戰

- 治療費用高

- 副作用和安全問題

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 各國應對措施

- 對產業的影響

- 供應方影響(製造成本)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(消費者成本)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(製造成本)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 黃斑部病變

- 濕性黃斑部病變

- 乾性黃斑部病變

- 糖尿病視網膜病變

- 遺傳性視網膜疾病(IRD)

- 糖尿病黃斑水腫

- 視網膜靜脈阻塞

- 其他類型

第6章:市場估計與預測:按劑型,2021 - 2034 年

- 主要趨勢

- 膠囊和片劑

- 眼藥水

- 眼部護理

- 凝膠

- 軟膏

- 注射

第7章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 網路藥局

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- AbbVie

- Alimera Sciences

- Amgen

- Apellis Pharmaceuticals

- Astellas Pharma

- Bayer

- Biogen

- Bausch + Lomb

- Celltrion

- F. Hoffmann-La Roche

- Novartis

- Pfizer

- Regeneron Pharmaceutical

- Santen Pharmaceuticals

- Sandoz Group

The Global Retinal Disorder Treatment Market was valued at USD 18.3 billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 34.8 billion by 2034, driven by the increasing prevalence of diabetes, along with its complications such as diabetic retinopathy (DR) and diabetic macular edema (DME). Retinal disorder treatments encompass a range of medical, surgical, and pharmaceutical interventions, including anti-VEGF injections, laser therapy, corticosteroid treatments, and vitrectomy. The primary goal of these treatments is to prevent further retinal damage and preserve or restore vision. The selection of a treatment depends on the severity of the condition, the stage of the disorder, and the overall health of the patient's eye. DME is a leading cause of vision loss, particularly among individuals with type 2 diabetes, highlighting the need for timely interventions and specialized care.

Recent advancements in treatment methods, such as sustained-release intraocular therapies, enhance patient compliance by reducing the frequency of injections. For example, certain injectable devices are designed for continuous drug delivery, offering relief from frequent eye injections. These innovations are helping to minimize the treatment burden while providing more effective solutions for retinal disorders.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18.3 Billion |

| Forecast Value | $34.8 Billion |

| CAGR | 6.7% |

Macular degeneration, particularly age-related macular degeneration (AMD), dominated the market in 2024, accounting for a 55% share. AMD, which primarily affects individuals over 60 years old, is one of the leading causes of vision loss in this age group. As the global population ages, comorbidities such as hypertension and obesity further exacerbate the prevalence of AMD, driving the need for continued research and treatment innovation.

The injection segment is a key driver in the market, accounting for 63.5% share in 2024. Intravitreal injections are commonly used for treating retinal conditions like AMD, retinal vein occlusion, and DME. Anti-VEGF therapies have shown promising results in treating these conditions, as they offer rapid therapeutic responses. Drugs such as Avastin, Eylea, and Lucentis are proving effective in reducing retinal edema and neovascularization, ultimately improving visual acuity for patients.

United States Retinal Disorder Treatment Market is poised to grow from USD 7.1 billion in 2024 to USD 13.1 billion by 2034, driven by the aging population susceptible to retinal conditions and the widespread availability of advanced intravitreal injection therapies. Moreover, favorable reimbursement policies and the strong presence of key pharmaceutical manufacturers continue to fuel market expansion.

Key players in the Global Retinal Disorder Treatment Market include Regeneron Pharmaceuticals, Bayer, AbbVie, Novartis, Pfizer, and F. Hoffmann-La Roche. These companies are investing in R&D and new product development to stay ahead in the competitive landscape. To strengthen their position in the retinal disorder treatment market, companies are focusing on expanding their product portfolios and advancing treatment technologies. Key strategies include forming partnerships to leverage complementary expertise in drug development and distribution. Furthermore, companies are enhancing patient treatment through innovative drug delivery systems and improved reimbursement structures.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of diabetes

- 3.2.1.2 Rising geriatric population

- 3.2.1.3 Technological advancements

- 3.2.1.4 Rising awareness and screening programs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High treatment cost

- 3.2.2.2 Side effects and safety concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (cost of manufacturing)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (cost to consumers)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (cost of manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technological landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Macular degeneration

- 5.2.1 Wet macular degeneration

- 5.2.2 Dry macular degeneration

- 5.3 Diabetic retinopathy

- 5.4 Inherited retinal diseases (IRDs)

- 5.5 Diabetic macular edema

- 5.6 Retinal vein occlusion

- 5.7 Other types

Chapter 6 Market Estimates and Forecast, By Dosage Form, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Capsules and tablets

- 6.3 Eye drops

- 6.4 Eye solutions

- 6.5 Gels

- 6.6 Ointments

- 6.7 Injections

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospital pharmacies

- 7.3 Retail pharmacies

- 7.4 Online pharmacies

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AbbVie

- 9.2 Alimera Sciences

- 9.3 Amgen

- 9.4 Apellis Pharmaceuticals

- 9.5 Astellas Pharma

- 9.6 Bayer

- 9.7 Biogen

- 9.8 Bausch + Lomb

- 9.9 Celltrion

- 9.10 F. Hoffmann-La Roche

- 9.11 Novartis

- 9.12 Pfizer

- 9.13 Regeneron Pharmaceutical

- 9.14 Santen Pharmaceuticals

- 9.15 Sandoz Group