|

市場調查報告書

商品編碼

1750548

汽車攜帶式磷酸鐵鋰 (LFP) 電池市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Portable Lithium Iron Phosphate (LFP) Battery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

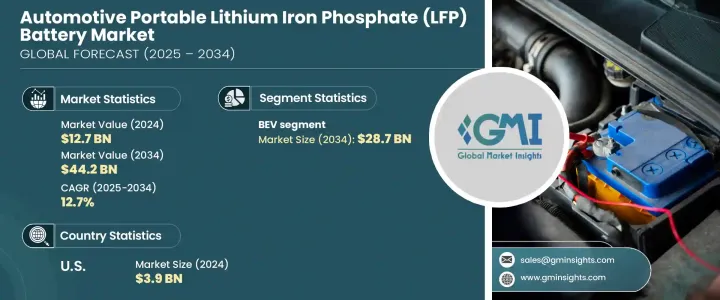

2024年,全球汽車攜帶式磷酸鐵鋰 (LFP) 電池市場規模達127億美元,預計到2034年將以12.7%的複合年成長率成長,達到442億美元。 LFP電池因其安全性、卓越的熱穩定性和抗過熱性能而備受關注,成為電動車的理想選擇。隨著對經濟高效且可靠的電池技術的需求不斷成長,尤其是在入門級和中階電動車領域,LFP電池正成為不可或缺的解決方案。與其他化學電池相比,LFP電池的熱失控風險更低,顯著提高了乘客安全性,而這正是影響消費者決策和OEM策略的關鍵因素。

汽車產業正經歷著向磷酸鐵鋰技術的顯著轉變,因為它比傳統電池類型具有許多優勢。更長的循環壽命、更具競爭力的價格以及更高的安全性,使得磷酸鐵鋰電池對電動車用戶特別有吸引力。因此,越來越多的汽車製造商在其產品線中採用這種電池,尤其是在那些旨在提高可及性和價格承受能力的車型中。對磷酸鐵鋰技術的日益依賴,有助於產業實現永續發展和性能目標,同時又不會增加生產成本。此外,減少碳排放的監管壓力正促使汽車製造商專注於不僅符合安全標準,而且符合綠色能源計劃的電池化學成分。磷酸鐵鋰電池的日益普及也促使製造商探索能量密度和快速充電技術的進步,以提高車輛的整體性能和用戶滿意度。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 127億美元 |

| 預測值 | 442億美元 |

| 複合年成長率 | 12.7% |

從應用角度來看,汽車攜帶式磷酸鐵鋰電池市場分為混合動力電動車 (HEV) 和純電動車 (BEV)。 2024 年,混合動力電動車 (HEV) 佔據了 58.9% 的市場。混合動力電動車在全球轉型為電動化的過程中發揮著至關重要的作用,它在傳統內燃機和純電動系統之間實現了平衡。混合動力電動車日益受到歡迎,是因為它能夠提高燃油效率並降低排放,而無需廣泛的充電基礎設施。磷酸鋰鐵電池以其穩定的性能和長壽命而聞名,非常適合頻繁循環和耐用性至關重要的混合動力系統。

儘管目前混合動力汽車 (HEV) 佔據主導地位,但純電動車 (BEV) 市場預計將實現顯著成長,預計到 2034 年其收入將超過 287 億美元。充電基礎設施的不斷改進和電池成本的下降,使更多消費者能夠輕鬆擁有純電動車。隨著續航里程焦慮的持續下降以及扶持政策的推動,純電動車預計將佔據更大的汽車市場佔有率,而磷酸鐵鋰電池 (LFP) 因其價格實惠且性能可靠,將成為首選動力來源。消費者對低維護解決方案的偏好以及對磷酸鐵鋰電池技術安全性的日益增強的信心,也推動了純電動車市場的發展勢頭。

在美國,汽車攜帶式磷酸鐵鋰電池市場持續成長。 2022年,該產業價值為28億美元,2023年增至33億美元,2024年達39億美元。多項由政府主導的措施正在加速這一成長趨勢,透過提供激勵措施來促進國內電池生產。促進本土電動車供應鏈發展、減少對國際資源依賴的政策正在鼓勵美國製造的汽車使用磷酸鐵鋰電池。此類財政支持有助於降低電動車的價格,提高電動車的普及率,從而間接促進磷酸鐵鋰電池技術在該地區廣泛應用。

在全球範圍內,五大關鍵廠商主導汽車攜帶式磷酸鐵鋰電池領域,合計佔超過55%的市場。這些公司受益於強大的供應鏈整合和規模優勢,使其能夠快速適應不斷變化的監管環境,並獲得政府支持的合約。他們的領先地位也使其能夠加大研發投入,尤其是在能量密度最佳化、充電速度提升和報廢電池回收等領域。這些主導企業推出的創新成果通常會影響更廣泛的市場,無論是透過授權協議或競爭性進步,從而幫助提升整體行業標準,並鼓勵在整個產品生命週期中永續使用電池。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 貿易管理關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 對貿易的影響

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 策略舉措

- 公司市佔率分析

- 競爭基準測試

- 創新與技術格局

第5章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 油電混合車

- 純電動車

第6章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 俄羅斯

- 英國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 日本

- 韓國

- 澳洲

- 印度

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第7章:公司簡介

- A123 Systems

- Clarios

- Contemporary Amperex Technology

- Ding Tai Battery Company

- Duracell

- ENERGON

- Exide Technologies

- General Electric

- Hitachi Energy

- Koninklijke Philips

- LG Energy Solution

- LITHIUMWERKS

- ProLogium Technology

- Saft

- Tesla

The Global Automotive Portable Lithium Iron Phosphate (LFP) Battery Market was valued at USD 12.7 billion in 2024 and is estimated to grow at a CAGR of 12.7% to reach USD 44.2 billion by 2034. LFP batteries are gaining widespread attention due to their safety profile, superior thermal stability, and resistance to overheating-qualities that make them an ideal choice for electric vehicles. As the demand for cost-efficient and reliable battery technologies grows, especially in the entry-level and mid-range EV segment, LFP batteries are becoming an essential solution. Their lower risk of thermal runaway compared to other chemistries significantly enhances passenger safety, a key factor influencing consumer decisions and OEM strategies alike.

The automotive industry is experiencing a noticeable shift toward lithium iron phosphate technology as it offers several advantages over traditional battery types. Extended cycle life, competitive pricing, and enhanced safety make LFP batteries particularly attractive to electric vehicle users. As a result, more automotive manufacturers are adopting these batteries across their product lines, especially in models designed for broader accessibility and affordability. The increasing reliance on LFP technology supports the industry's goals of sustainability and performance without inflating production costs. Furthermore, regulatory pressure to minimize carbon emissions is driving automakers to focus on battery chemistries that not only meet safety standards but also align with green energy initiatives. The growing popularity of LFP batteries is also pushing manufacturers to explore advancements in energy density and fast-charging technologies to boost overall vehicle performance and user satisfaction.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.7 Billion |

| Forecast Value | $44.2 Billion |

| CAGR | 12.7% |

In terms of application, the automotive portable LFP battery market is segmented into hybrid electric vehicles (HEVs) and battery electric vehicles (BEVs). In 2024, the HEV segment accounted for 58.9% of the market share. HEVs are playing a vital role in the global transition toward electrified mobility, offering a balance between traditional combustion engines and fully electric systems. Their increasing acceptance stems from the ability to improve fuel efficiency and lower emissions without the need for widespread charging infrastructure. LFP batteries, known for their stable performance and longevity, are well-suited to hybrid systems where frequent cycling and durability are essential.

Despite the current dominance of HEVs, the BEV segment is poised for significant growth and is projected to surpass USD 28.7 billion in revenue by 2034. The expanding availability of charging infrastructure and declining battery costs are making BEVs more accessible to a wider customer base. As range anxiety continues to decline and supportive policies encourage full electrification, BEVs are expected to take a larger share of the automotive market, with LFP batteries serving as the preferred power source due to their affordability and reliable performance. The market momentum is also being fueled by consumer preference for low-maintenance solutions and increasing confidence in the safety of LFP technology.

In the United States, the automotive portable LFP battery market has shown consistent growth. The industry was valued at USD 2.8 billion in 2022, increased to USD 3.3 billion in 2023, and reached USD 3.9 billion in 2024. Several government-led initiatives are accelerating this upward trend by providing incentives aimed at boosting domestic battery production. Policies promoting the development of local EV supply chains and reducing dependency on international sources are encouraging the use of LFP batteries in American-made vehicles. Such financial support helps make EVs more affordable and accessible, indirectly promoting the widespread use of lithium iron phosphate battery technology in the region.

Globally, five key players dominate the automotive portable LFP battery space, collectively holding over 55% of the market share. These companies benefit from strong supply chain integration and scale, enabling them to adapt quickly to shifting regulatory environments and secure contracts that offer government backing. Their leadership also allows for increased investments in research and development, particularly in areas like energy density optimization, improved charging speeds, and end-of-life battery recycling. Innovations introduced by these dominant firms often influence the broader market, either through licensing deals or competitive advancements, helping elevate overall industry standards and encouraging sustainable battery use throughout the product lifecycle.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trade administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's Analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL Analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Strategic initiatives

- 4.4 Company market share analysis, 2024

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Application, 2021 - 2034, (USD Million)

- 5.1 Key trends

- 5.2 HEV

- 5.3 BEV

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034, (USD Million)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.3 Europe

- 6.3.1 Germany

- 6.3.2 France

- 6.3.3 Russia

- 6.3.4 UK

- 6.3.5 Spain

- 6.3.6 Italy

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 Japan

- 6.4.3 South Korea

- 6.4.4 Australia

- 6.4.5 India

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 South Africa

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Argentina

Chapter 7 Company Profiles

- 7.1 A123 Systems

- 7.2 Clarios

- 7.3 Contemporary Amperex Technology

- 7.4 Ding Tai Battery Company

- 7.5 Duracell

- 7.6 ENERGON

- 7.7 Exide Technologies

- 7.8 General Electric

- 7.9 Hitachi Energy

- 7.10 Koninklijke Philips

- 7.11 LG Energy Solution

- 7.12 LITHIUMWERKS

- 7.13 ProLogium Technology

- 7.14 Saft

- 7.15 Tesla