|

市場調查報告書

商品編碼

1750545

寵物糖尿病護理設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Pet Diabetes Care Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

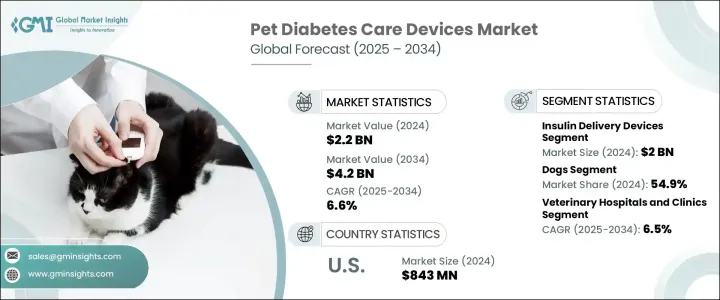

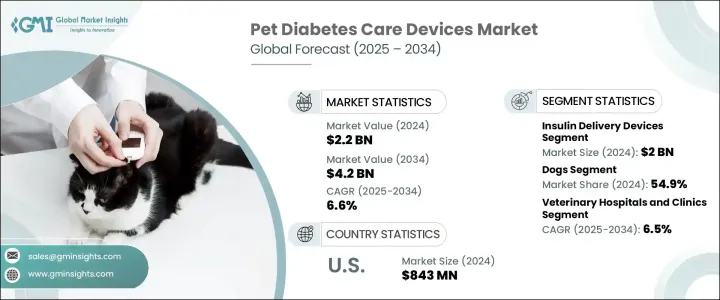

2024年,全球寵物糖尿病護理設備市場規模達22億美元,預計2034年將以6.6%的複合年成長率成長,達到42億美元。這主要得益於寵物飼養數量的成長、獸醫保健技術的進步以及動物保健支出的增加。隨著寵物擁有量的不斷成長,越來越多的寵物主人開始意識到管理寵物糖尿病等慢性疾病的必要性。寵物肥胖症的日益普及、寵物人口的老化以及久坐不動的生活方式導致糖尿病病例激增,從而增加了對監測和治療解決方案的需求。隨著寵物的健康和福祉成為寵物主人的首要任務,對糖尿病等慢性疾病管理的關注預計將持續擴大市場。

技術進步提高了血糖監測儀和胰島素幫浦等設備的普及率,這些設備有助於管理寵物的糖尿病。這些創新產品的開發幫助獸醫和寵物主人提供更好的護理和更有效的治療。隨著寵物糖尿病越來越普遍,尤其是在老齡或肥胖動物中,對有效管理解決方案的需求也日益成長。已開發地區可支配收入的提高也推動了這一趨勢,因為這些地區的寵物主人更有可能投資先進的醫療保健設備。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 22億美元 |

| 預測值 | 42億美元 |

| 複合年成長率 | 6.6% |

市場主要分為兩大板塊:胰島素輸送設備和血糖監測設備。 2024年,胰島素輸送設備佔最大市場佔有率,價值20億美元。該板塊進一步細分為胰島素注射器和胰島素筆,它們對於寵物糖尿病管理至關重要。鑑於寵物糖尿病通常需要終身胰島素治療,胰島素輸送設備對於確保有效治療至關重要。這些設備的普及性和價格實惠鞏固了其在市場上的主導地位,成為成長的關鍵驅動力。

寵物糖尿病照護設備市場進一步按動物類型細分,主要分為狗、貓和馬。 2024年,狗類佔了54.9%的市場。由於肥胖、老化和遺傳因素,狗類糖尿病盛行率較高,這使得它們成為糖尿病管理設備最常見的接受者。寵物主人越來越意識到管理愛犬健康的重要性,導致血糖監測儀和胰島素輸送系統等專用設備的使用率上升。

2024年,北美寵物糖尿病護理設備市場佔據41%的市場佔有率,這歸因於多種因素,包括該地區較高的寵物擁有率以及寵物主人對寵物糖尿病管理重要性的認知不斷提高。隨著越來越多的人認知到主動管理寵物健康的重要性,對血糖監測儀和胰島素輸送系統等專業護理設備的需求激增。此外,北美擁有強大的獸醫基礎設施,許多獸醫診所和醫院提供最先進的技術,用於診斷和治療寵物糖尿病等疾病。

全球寵物糖尿病護理設備市場的主要參與者正積極運用產品創新、策略合作夥伴關係和拓展通路等策略,以增強其影響力。碩騰、默克動物保健和碧迪等公司正在加大研發投入,以推出滿足寵物主人不斷變化的需求的新產品。此外,i-SENS 和 TaiDoc 等公司正致力於提高糖尿病管理設備的可近性和可負擔性,以滿足更廣泛的客戶群。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 寵物糖尿病盛行率上升

- 寵物醫療保健支出增加

- 寵物肥胖發生率不斷上升

- 血糖監測技術進步

- 產業陷阱與挑戰

- 與設備相關的高成本

- 新興國家對此議題的認知與獲取管道有限

- 成長動力

- 成長潛力分析

- 監管格局

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 技術格局

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按設備類型,2021 年至 2034 年

- 主要趨勢

- 胰島素輸送裝置

- 胰島素注射器

- 胰島素注射筆

- 血糖監測設備

- 血糖監測儀(BGM)

- 連續血糖監測儀(CGM)

第6章:市場估計與預測:依動物類型,2021 年至 2034 年

- 主要趨勢

- 狗

- 貓

- 馬匹

第7章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 獸醫醫院和診所

- 居家照護環境

- 其他最終用途

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Allison Medical

- ALR Technologies

- Becton, Dickinson and Company

- Boehringer Ingelheim

- FitBark

- Henry Schein Animal Health

- Merck Animal Health

- TaiDoc

- Ulticare

- Zoetis

The Global Pet Diabetes Care Devices Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 4.2 billion by 2034, driven by the increasing adoption of pets, technological advancements in veterinary healthcare, and rising expenditure on animal healthcare. As pet ownership continues to rise, more owners are becoming aware of the need for managing chronic conditions like diabetes in pets. The growing prevalence of pet obesity, the aging pet population, and sedentary lifestyles contribute to the surge in cases of diabetes, thus increasing demand for monitoring and treatment solutions. As pets' health and well-being become a top priority for owners, the focus on managing chronic conditions such as diabetes is expected to continue to expand the market.

Technological advancements have improved the availability of devices such as glucose monitors and insulin pumps, which help manage diabetes in pets. The development of these innovative products has helped veterinarians and pet owners provide better care and more effective treatments. As diabetes among pets becomes more common, especially in aging or obese animals, the demand for effective management solutions grows. This trend is supported by higher disposable income in developed regions, where pet owners are more likely to invest in advanced healthcare devices.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $4.2 Billion |

| CAGR | 6.6% |

The market is divided into two main segments: insulin delivery devices and glucose monitoring devices. In 2024, insulin delivery devices held the largest market share, valued at USD 2 billion. This segment is further divided into insulin syringes and insulin pens, which are essential for managing diabetes in pets. Given that diabetes in pets often requires lifelong insulin therapy, insulin delivery devices are crucial for ensuring effective treatment. The widespread availability and affordability of these devices have solidified their dominance in the market, providing a key driver for growth.

The pet diabetes care devices market is further segmented by animal type, with dogs, cats, and horses being the primary categories. The dogs segment held a 54.9% share in 2024. The higher prevalence of diabetes in dogs, driven by obesity, aging, and genetic factors, makes them the most common recipients of diabetes management devices. Pet owners are increasingly aware of the importance of managing their dogs' health, leading to an uptick in the adoption of specialized devices like glucose monitors and insulin delivery systems.

North American Pet Diabetes Care Devices Market held a 41% share in 2024, attributed to several factors, including the high rate of pet ownership across the region and a growing awareness among pet owners regarding the importance of diabetes management for their pets. With more individuals recognizing the significance of proactive health management for their animals, demand for specialized care devices such as glucose monitors and insulin delivery systems has surged. Additionally, North America benefits from a robust veterinary infrastructure, with numerous veterinary clinics and hospitals offering state-of-the-art technologies for diagnosing and treating conditions like diabetes in pets.

Key players in the Global Pet Diabetes Care Devices Market are actively employing strategies like product innovation, strategic partnerships, and expanding their distribution channels to strengthen their presence. Companies like Zoetis, Merck Animal Health, and Becton, Dickinson and Company are investing in research and development to introduce new products that cater to the evolving needs of pet owners. In addition, firms such as i-SENS and TaiDoc are focusing on enhancing the accessibility and affordability of diabetes management devices to cater to a broader customer base.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of pet diabetes

- 3.2.1.2 Increasing pet healthcare expenditure

- 3.2.1.3 Growing incidence of obesity in pets

- 3.2.1.4 Technological advancements in glucose monitoring

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with devices

- 3.2.2.2 Limited awareness and access in emerging countries

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Device Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Insulin delivery devices

- 5.2.1 Insulin syringes

- 5.2.2 Insulin delivery pen

- 5.3 Glucose monitoring devices

- 5.3.1 Blood glucose monitors (BGMs)

- 5.3.2 Continuous glucose monitors (CGMs)

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Dogs

- 6.3 Cats

- 6.4 Horses

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Veterinary hospitals and clinics

- 7.3 Homecare settings

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Allison Medical

- 9.2 ALR Technologies

- 9.3 Becton, Dickinson and Company

- 9.4 Boehringer Ingelheim

- 9.5 FitBark

- 9.6 Henry Schein Animal Health

- 9.7 Merck Animal Health

- 9.8 TaiDoc

- 9.9 Ulticare

- 9.10 Zoetis