|

市場調查報告書

商品編碼

1750543

磁流變液市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Magnetorheological Fluid Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

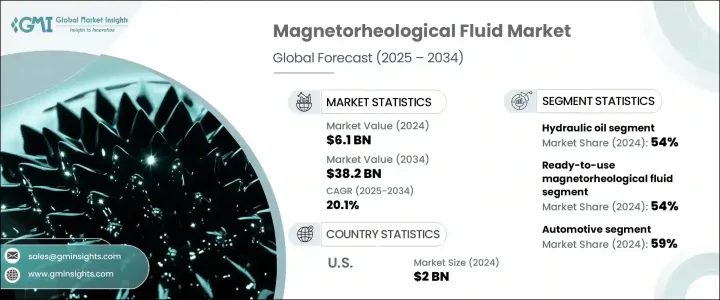

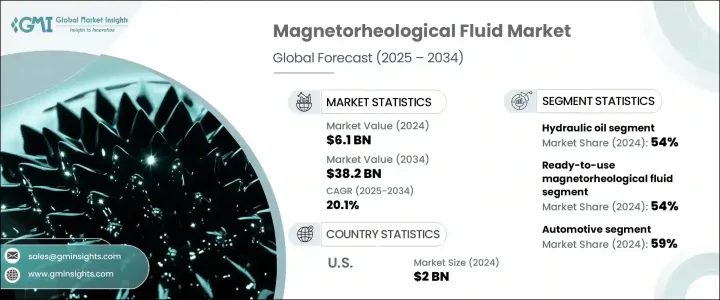

2024 年全球磁流變液市場價值為 61 億美元,預計到 2034 年將以 20.1% 的複合年成長率成長,達到 382 億美元,這得益於各行各業對先進阻尼和控制解決方案日益成長的需求。磁流變液具有在施加磁場的作用下快速且可逆地改變其流變特性的能力,因此在需要精確控制、高速響應和可變阻尼的應用中,其價值日益提升。汽車產業是磁流變液市場成長的重要貢獻者,因為這些液體廣泛用於懸吊系統、避震器和半主動阻尼裝置,以提高車輛的操控性、舒適性和安全性。汽車產業的擴張(尤其是在發展中地區)以及對先進汽車技術的日益關注,推動了對基於磁流變液的解決方案的需求。

此外,工業自動化和控制領域也已成為磁流變流體市場的主要驅動力。流體廣泛應用於工業閥門、離合器、煞車和機器人系統,其對機械系統提供精確且靈敏的控制能力備受推崇。人們日益重視提高製程效率、降低能耗和增強工業設備性能,這進一步促進了市場的擴張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 61億美元 |

| 預測值 | 382億美元 |

| 複合年成長率 | 20.1% |

就基礎油成分而言,液壓油細分市場在2024年創造了33億美元的市場規模,佔54%,這得益於其優異的熱穩定性和氧化穩定性、與添加劑和磁性顆粒的廣泛兼容性、以及廣泛的可用性和成本效益。液壓油在磁場下也表現出良好的流變性能,使其成為工業機械、國防系統和醫療器材等領域磁流變(MR)流體配方的首選。

即用型磁流變液市場在2024年創造了33億美元的收入,這得益於其易於實施且無需內部配製或客製化。這些預混合解決方案旨在提供一致的性能、可靠性和安全性,從而最大限度地減少停機時間並提高營運效率。汽車(用於主動減震器和懸吊系統)、航太(用於振動控制和自適應起落架)以及機器人(用於觸覺反饋和運動控制)等行業正擴大採用即用型磁流變液。

2024年,北美磁流變液市場規模達20億美元,佔38%的市場佔有率,這得益於汽車、航太和建築等產業的強勁需求,以及市場對先進阻尼和振動控制技術的強烈需求。關鍵市場參與者的參與、大量的研發投入以及政府的支持性舉措,進一步鞏固了北美在磁流變液市場的地位。

全球磁流變液市場的主要參與者包括 Ferrofluidics Corporation、巴斯夫 SE、LORD Corporation、日本塗料控股株式會社和曙光煞車工業株式會社。這些公司專注於策略合作夥伴關係、新產品發布和商業化努力,以擴大其市場佔有率。此外,在研發方面的大量投資也使其能夠推出創新磁流變液產品,以滿足各行各業不斷變化的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 戰略產業的回應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 貿易統計(HS編碼)

- 主要出口國

- 主要進口國

註:以上貿易統計僅針對重點國家。

- 供應商格局

- 利潤率分析

- 監管格局

- 衝擊力

- 成長動力

- 汽車乘坐品質提升

- 建築振動控制與抗震防護

- 敏捷而精確的機器人技術

- 產業陷阱與挑戰

- 技術初始成本高

- 實施過程中熟練勞動力短缺

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按基礎流體,2021 - 2034 年

- 主要趨勢

- 油壓

- 礦物油

- 矽油

- 其他

第6章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 即用型磁流變液

- 半濃縮磁流變液

- 濃縮磁流變液

- 其他

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 汽車

- 建築與施工

- 航太

- 其他

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- Ferrofluidics Corporation

- BASF SE

- LORD Corporation

- Nippon Paint Holdings Co., Ltd.

- Akebono Brake Industry Co., Ltd.

- New Energy and Industrial Technology Development Organization (NEDO)

- Boron Rubbers India

- Liquids Research Limited

- TA Instruments

- BASF Agricultural Solutions

- Anton Paar GmbH

- Beijing West Industries Co. Ltd. (BWI Group)

- CK Materials Lab Co., Ltd.

- Industrial Metal Powders (I) Pvt. Ltd.

The Global Magnetorheological Fluid Market was valued at USD 6.1 billion in 2024 and is estimated to grow at a 20.1% CAGR to reach USD 38.2 billion by 2034, driven by the increasing demand for advanced damping and control solutions across various industries. MR fluids have become increasingly valuable with their ability to rapidly and reversibly change their rheological properties in response to an applied magnetic field, in applications where precise control, high-speed response, and variable damping are required. The automotive industry has been a significant contributor to the growth of the MR fluid market, as these fluids are widely used in suspension systems, shock absorbers, and semi-active damping devices to enhance vehicle handling, comfort, and safety. The expansion of the automotive sector, particularly in developing regions, and the increasing focus on advanced vehicle technologies have fueled the demand for MR fluid-based solutions.

Moreover, the industrial automation and control sector has also emerged as a key driver for the MR fluid market. Fluids find applications in industrial valves, clutches, brakes, and robotic systems, where their ability to provide precise and responsive control over mechanical systems is highly valued. The growing emphasis on improving process efficiency, reducing energy consumption, and enhancing the performance of industrial equipment has further contributed to the market's expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.1 Billion |

| Forecast Value | $38.2 Billion |

| CAGR | 20.1% |

In terms of base fluid composition, the hydraulic oil segment generated USD 3.3 billion in 2024, accounting for a 54% share attributed to its excellent thermal and oxidative stability, broad compatibility with additives and magnetic particles, and its widespread availability and cost-effectiveness. Hydraulic oils also exhibit favorable rheological properties under magnetic fields, making them a preferred choice for magnetorheological (MR) fluid formulations across sectors such as industrial machinery, defense systems, and medical devices.

The ready-to-use MR fluid segment generated USD 3.3 billion in 2024, driven by its ease of implementation and reduced need for in-house formulation or customization. These pre-mixed solutions are engineered to offer consistent performance, reliability, and safety, thereby minimizing downtime and enhancing operational efficiency. Industries such as automotive (for active dampers and suspension systems), aerospace (for vibration control and adaptive landing gear), and robotics (for haptic feedback and motion control) are increasingly adopting ready-to-use MR fluids.

North America Magnetorheological Fluid Market was valued at USD 2 billion and held 38% share in 2024, driven by robust demand across sectors like automotive, aerospace, and construction, coupled with a strong inclination towards adopting advanced damping and vibration control technologies. The presence of key market players, substantial research and development investments, and supportive government initiatives further bolsters North America's position in the MR fluid market.

Key players in the Global Magnetorheological Fluid Market include Ferrofluidics Corporation, BASF SE, LORD Corporation, Nippon Paint Holdings Co., Ltd., and Akebono Brake Industry Co., Ltd. These companies are focusing on strategic partnerships, new product launches, and commercialization efforts to expand their market presence. Additionally, significant investments in research and development are enabling the introduction of innovative MR fluid products, catering to the evolving needs of various industries.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.3 Supply-side impact (raw materials)

- 3.2.3.1 Price volatility in key materials

- 3.2.3.2 Supply chain restructuring

- 3.2.3.3 Production cost implications

- 3.2.4 Demand-side impact (selling price)

- 3.2.4.1 Price transmission to end markets

- 3.2.4.2 Market share dynamics

- 3.2.4.3 Consumer response patterns

- 3.2.5 Key companies impacted

- 3.2.6 Strategic Industry responses

- 3.2.6.1 Supply chain reconfiguration

- 3.2.6.2 Pricing and product strategies

- 3.2.6.3 Policy engagement

- 3.2.7 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

Note: the above trade statistics will be provided for key countries only.

- 3.4 Supplier landscape

- 3.5 Profit margin analysis

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Automotive ride quality boost

- 3.7.1.2 Building vibration control & seismic protection

- 3.7.1.3 Agile & precise robotics

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High initial cost of technology

- 3.7.2.2 Skilled labor shortage for implementation

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Base Fluid, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Hydraulic oil

- 5.3 Mineral oil

- 5.4 Silicon oil

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Product, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Ready-to-use magnetorheological fluid

- 6.3 Semi-concentrated magnetorheological fluid

- 6.4 Concentrated magnetorheological fluid

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive

- 7.3 Building & construction

- 7.4 Aerospace

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.3.7 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Ferrofluidics Corporation

- 9.2 BASF SE

- 9.3 LORD Corporation

- 9.4 Nippon Paint Holdings Co., Ltd.

- 9.5 Akebono Brake Industry Co., Ltd.

- 9.6 New Energy and Industrial Technology Development Organization (NEDO)

- 9.7 Boron Rubbers India

- 9.8 Liquids Research Limited

- 9.9 TA Instruments

- 9.10 BASF Agricultural Solutions

- 9.11 Anton Paar GmbH

- 9.12 Beijing West Industries Co. Ltd. (BWI Group)

- 9.13 CK Materials Lab Co., Ltd.

- 9.14 Industrial Metal Powders (I) Pvt. Ltd.